The latest in blockchain tech upgrades, funding announcements and deals. For the period of Feb. 29-March 6.

Renowned Economist Says Bitcoin Isn’t Digital Gold, Then What Is It?

Chief Economist and Bitcoin antagonist, Peter Schiff has made another controversial statement about BTC, comparing the world’s largest cryptocurrency to gold, while expressing skepticism about BTC being lauded as the “digital gold.”

Bitcoin Is “Digital Anti-Gold”

In a February 27 post on X (formerly Twitter), Schiff publicly criticized Bitcoin’s title as the digital gold, asserting that the cryptocurrency should be seen as a bet against gold instead of a digital counterpart of the precious metal. While the renowned economist has stated that “Bitcoin is not digital gold,” he has also provided his version of a more accurate description of Bitcoin, characterizing the cryptocurrency as a “digital anti-gold.”

Earlier in November 2023, ARK Invest CEO, Cathie Woods declared Bitcoin to be a digital gold, confidently stating that she would rather wager on Bitcoin than gold. Similarly, Chief Executive Officer (CEO) of MicroStrategy, Michael Saylor and CEO of VanEck, Jan van Eck, have confirmed BTC to be the ultimate store of value.

These sentiments and statements from renowned BTC investors and leading cryptocurrency supporters clearly contrast Schiff’s perspective on BTC. The global strategist is well known for his opposing views against BTC and other cryptocurrencies, often criticizing the value of these digital assets and informing the broader crypto community of the risks associated with cryptocurrencies while glorifying gold’s value.

The economist has remained critical of Bitcoin’s perceived role as a digital store of value, highlighting that BTC buyers should hope for the sustained control of inflationary pressures and the ongoing strength of the United States dollar (USD) against other fiat currencies.

Crypto Community In Opposition

The crypto community has swiftly offered their personal opinions on Schiff’s statement about Bitcoin, opposing the Bitcoin antagonist’s views and showcasing their relentless support for the cryptocurrency.

One crypto community member has asserted that Schiff’s Bitcoin remarks lack theoretical validity, stemming from a fundamental misunderstanding and fear of BTC’s value and potential. Another member has highlighted the differences between gold and Bitcoin, describing the cryptocurrency as a “tech innovation” which has nothing to do with precious metals like gold.

The majority of crypto members have shown unwavering support for BTC, with some even stating that Bitcoin could potentially surpass the value of gold in the future.

“Bitcoin is going to consume gold. It’s not a matter of if, it’s a matter of when,” a community member stated.

Altcoin Market Cap Break From “Wyckoff Accumulation Phase”: Will Ethereum, XRP Fly?

In a post on X, one analyst observes that the altcoin market capitalization has broken from the Wyckoff accumulation phase. With this upswing, the trader expects altcoin prices to move higher.

This refreshing breakout coincides with Bitcoin’s (BTC) stellar performance when writing on February 28. At spot rates, the coin is trading above $60,000, a psychological round number- now supported- and is closely approaching $70,000.

The Altcoin Breakout From Accumulation

The “Wyckoff accumulation pattern” is a concept developed by technical analysts to pick out potential buying opportunities, in this case, altcoins. Whenever prices are in this phase, it is widely believed that the so-called “smart money” or large institutional players are accumulating at low prices.

Currently, prices consolidate at tight ranges and with low trading volumes. A signal marking the end of this accumulation is a sharp breakout, lifting prices above the defined range. Often, this upswing is with rising trading volume.

Looking at the chart, the altcoin market cap has broken above the accumulation phase. With previous resistance and support, the altcoin market cap will likely continue floating higher. As such, top altcoins, including Ethereum (ETH), Solana (SOL), and XRP, will follow suit, posting fresh 2024 highs.

Why Spot Bitcoin ETFs Give BTC Edge In This Bull Run

So far, Bitcoin is leading the way, posting over $10,000 in less than a week. However, with the coin trading above $60,000, its demand-side drivers differ entirely from what’s influencing altcoins. The approval of spot Bitcoin exchange-traded funds (ETFs) by the United States Securities and Exchange Commission (SEC) has seen billions of dollars flow to the world’s first cryptocurrency.

Therefore, while altcoins have historically outperformed BTC when crypto prices rally, there is an edge with spot Bitcoin ETFs. As such, this bull run will likely differ from 2017 and 2021. This forecast is because institutions will likely favor a regulated asset over altcoins whose status remains undefined.

As of late February 2024, the United States SEC has not approved spot ETFs of any altcoin, including that of Ethereum. Additionally, the agency has labeled several top altcoins, including Cardano (ADA), unregistered securities. The agency even filed lawsuits against major exchanges like Binance and Coinbase, accusing them of facilitating the trading of what the commission described as “unregistered securities.”

It is not immediately clear whether the United States SEC will change their preview of leading altcoins, especially Ethereum (ETH), which has a market of over $400 billion. Wall Street heavyweights like BlackRock and Fidelity remain interested in launching spot Ethereum ETFs.

Analyst Labels Bitcoin Rally Strongest Pre-Bull Cycle Yet

The entire cryptocurrency space is fueled with excitement as the price of Bitcoin rallied today, demonstrating immense resilience, reaching the $59,000 threshold and even further in the past 26 months.

Bitcoin Rally Kicks Off The Strongest Pre-Bull Cycle So Far

Bitcoin is currently in the limelight as the crypto asset continues to rally, leading to several analysts identifying the surge as the start of the “biggest bull cycle ever.”

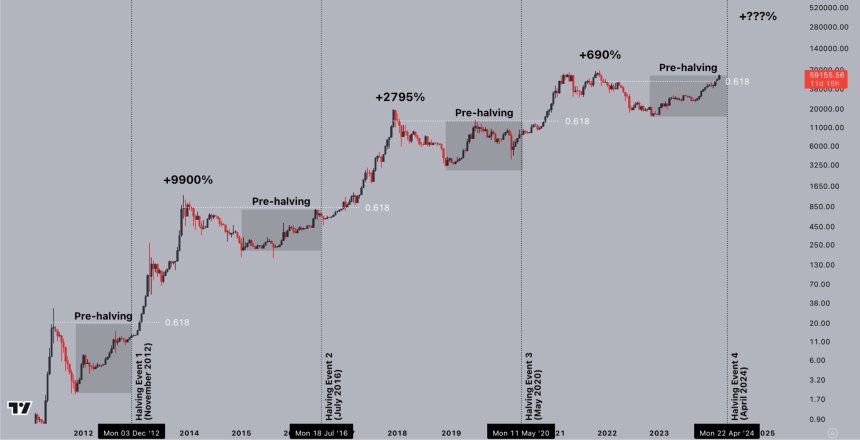

Analyst and trader Crypto Jelle has labeled the recent uptick as the “strongest start to a new cycle” as his analysis examines the strength of BTC‘s surge.

Jelle claims this resulted from Bitcoin’s latest “break out from the 0.618 Fibonacci retracement.” According to the analyst, “this marks the first time” the asset has made this kind of move “before the Bitcoin Halving event happens.”

He also claims that with the ongoing rally, it seems like the market is “in for a new regime,” he believes things will play out “differently” in the market from how they usually do.

The post read:

This is the first time Bitcoin breaks that 0.618 Fibonacci retracements before the halving event even takes place. By far the strongest start to a new cycle, ever. Looks like we are in for a new regime, where things work a little different than how they used to.

The analyst claims that a shift in the narrative is ushering in a “new era of dynamics in the cryptocurrency landscape.” As a result, “exciting moments await” the space in the future.

Crypto Jelle declared that nothing can stop Bitcoin at the moment. “With BTC rising by another 2% in the past few hours, there seems to be no stopping it right now,” he stated.

Additionally, most of yesterday’s gains occurred outside the Exchange-Traded Funds’ trading hours. However, the analyst is waiting to see if they will “force boomers to pursue price.”

BTC ETFs See Massive Inflow

Research company BitMEX reported that Bitcoin Spot ETFs have seen increased adoption, witnessing a massive surge in daily inflow. Data from the platform shows that ETFs have witnessed a significant inflow of 10,167 BTC valued at $576.8 million.

BitMEX underscored that Blackrock’s iShares BTC ETF (IBIT) made up $520 million of the total inflow. Consequently, this marks the highest inflow the company has seen since the products were approved.

So far, Blackrock’s asset holdings have risen to over 141,000 BTC, and its net inflow sits above $6.5 billion. Currently, Bitcoin is trading at $59,254, indicating a rise of over 4% in the past 24 hours.

BlackRock Bitcoin ETF Breaks Volume Record as Bitcoin Rallies to $64K Before Plunging

U.S. spot bitcoin {{BTC}} exchange-traded funds (ETF) experienced another massive trading session Wednesday with BlackRock’s bitcoin ETF (IBIT) breaking its volume record for the third consecutive day.

U.S. Government Crypto Wallets Transfer Nearly $1B of Bitcoin Seized From Bitfinex Hacker

Wallets containing bitcoin seized by the U.S. government in the notorious Bitfinex hack – later leading to guilty pleas for Ilya Lichtenstein and Heather “Razzlekhan” Morgan – have suddenly become active.

Morgan Stanley Evaluating Spot Bitcoin ETFs for Its Giant Brokerage Platform: Sources

Since spot bitcoin ETFs went live in January, chatter has increased about the imminent arrival of the big registered investment advisor (RIA) networks and broker-dealer platforms.

Retail Investors Are Sleeping on Bitcoin’s March Towards All-Time Highs: IntoTheBlock

Metrics that previously signaled retail froth are still at low levels, suggesting that this phase of bitcoin’s rally is driven by institutional investors, IntoTheBlock analysts said.

Bitcoin Suddenly Plummets 7% After Hitting $64K, Triggering Over $600M Crypto Liquidations

Bitcoin rose to $64,000 Wednesday before quickly reversed to $59,000, CoinDesk data shows.

El Salvador’s Bukele Says Value of Country’s Bitcoin Holdings Up Over 40%

The country’s bonds have also surged to over 80 cents on the dollar.

Craig Wright to Face New Allegations of Forgery in COPA Trial Over Ontier Emails

He’s set to retake the stand on Friday to defend allegations initially made by his former lawyers that their correspondence submitted to court had been doctored.

MicroStrategy’s Bitcoin Holdings Balloons Above $10 Billion, Here’s How Much Profit It Has Made

MicroStrategy recently revealed that they had acquired an additional 3,000 BTC this month, bringing its Bitcoin holdings to 193,000 BTC. Interestingly, BTC’s recent price surge caused these holdings to cross the $10 billion mark, with the software company currently sitting on a tremendous amount of unrealized profits.

MicroStrategy’s Unrealized Profit Reaches $5 Billion

As disclosed in the company’s filing with the Securities and Exchange Commission (SEC), its BTC holdings have now been purchased for an average price of $31,544. That means that MicroStrategy’s Bitcoin investment is now at an unrealized profit of almost $5 billion, considering Bitcoin is trading just above $57,000.

MicroStrategy’s ‘Bitcoin strategy,’ spearheaded by its co-founder Michael Saylor, began as far back as 2020 when the company started investing in the flagship crypto token. Saylor saw this as a way to hedge against inflation and diversify the company’s cash reserves. Since then, Saylor and his company have continued to accumulate Bitcoin aggressively.

Saylor’s faith in Bitcoin was tested when the company’s investment was at an unrealized loss during the height of the crypto winter when BTC traded below the $30,000 price level. Despite that, Saylor and MicroStrategy stayed true to their Bitcoin Strategy. Instead of selling, they saw it as an opportunity to accumulate more BTC.

Saylor also recently made it clear that he and his company have no intention of liquidating their BTC holdings anytime soon, stating that “Bitcoin is the exit strategy.” This sentiment undoubtedly provides a bullish narrative for the flagship crypto, especially considering what could happen to the market if the company offloads its Bitcoin.

MicroStrategy is currently the largest corporate holder of BTC and is leading the charge as institutional demand for BTC continues to increase. This demand has mainly come from the Spot Bitcoin ETFs, which together hold more BTC than MicroStrategy combined.

Spot Bitcoin ETFs Trading Volume Surpass $2 Billion Again

Bloomberg analyst Eric Balchunas revealed that the newly listed Bitcoin ETFs once again surpassed the $2 billion mark on February 27. This was the second consecutive day they achieved this, having recorded an all-time high of $2.4 billion in trading volume on February 26. Specifically, the world’s largest asset manager, BlackRock, seems to be having a run of its own.

Balchunas noted that BlackRock had broken its record again, with the iShares Bitcoin ETF (IBIT) recording a trading volume of $1.3 billion on February 27. The impressive demand for these funds is believed to be another reason why BTC’s price has continued to rally.

At the time of writing, Bitcoin is trading at around $57,100, up in the last 24 hours, according to data from CoinMarketCap.

Mt. Gox: What We Still Don’t Know 10 Years After the Collapse

To commemorate the 10th anniversary of the collapse of bitcoin exchange MtGox, Mark Hunter, author of “Ultimate Catastrophe: How MtGox Lost Half a Billion Dollars and Nearly Killed Bitcoin,” tackles the questions that still remain unanswered ten years later.

BREAKING: Bitcoin Price Smashes Above $60,000: Are New ATHs Ahead?

Bitcoin price action continues to pick up steam following unprecedented institutional demand amidst an asset supply that’s on the brink of being slashed by 50%. Today, the BTCUSD trading pair has broken cleanly above $60,000. What does this mean for the top cryptocurrency by market cap? Are new all-time highs just ahead?

Bitcoin Trades Above $60,000 For First Time Since 2021

Just one month ago, Bitcoin was still stuck below $50,000 and the launch of the first ever US spot BTC ETFs were considered a sell the news event. Now, with only a day left in February, Bitcoin price is showing serious strength with a more than 40% single month increase. Bullish momentum has pushed BTCUSD above $60,000 where it is trading currently.

The bullish price action is due to the market front-running the halving now that the the impact of the introduction of the first meaningful Bitcoin ETFs are understood. ETF providers yesterday added as much as 9,000 BTC to holdings, while miners only managed to produce 900 BTC in the same timeframe. This amount is slashed by 50% at the halving in less than two months, potentially prompting institutional FOMO (fear of missing out).

With Bitcoin now above $60,000 and around 13% away from all-time highs, new price records are within striking distance. After any cryptocurrency price takes out a current peak, price action moves into discovery due to a lack of sell orders in the order book. With no historical resistance to consider, Fibonacci ratios often help pinpoint there rallies will come to a conclusion.

According to the 1.272 Fibonacci, BTCUSD could begin finding psychological resistance around $94,000 per coin. The ultimate “top” of this rally could extend to the 1.618 Fibonacci, located at around $155,000 per BTC.

To hit $155,000 per coin, Bitcoin only needs a 161% advance from current levels. To put this into perspective, the top brass crypto asset is up more than 300% from the bottom set in 2022, and there wasn’t a bull market to speak of yet. With the bull market now undeniable, it isn’t unreasonable to assume BTCUSD could climb by 161% over the remainder of 2024.

Bitcoin Pushes Through $60K for First Time Since November 2021

First Mover Americas: PEPE, Not BTC, Is The Top Trending Token

The latest price moves in bitcoin (BTC) and crypto markets in context for Feb. 28, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Bitcoin Crosses $59,000 In Surprise Pre-Halving Rally

The Bitcoin price has now successfully crossed the $59,000 level after an incredibly bullish month of February. The market leader has also barreled ahead of all expectations during this time as well, continuing to rally at a time when prices are expected to crash ahead of the next halving.

Institutional Investors Drive Bitcoin Price Higher

One of the major drivers behind the Bitcoin performance over the last day has been institutional investors. These investors have continued to take advantage of the opportunities provided by the Bitcoin Spot ETFs approved by the Securities and Exchange Commission (SEC) in January.

While there have been outflows from the Grayscale Bitcoin Trust due to concerns about high fees, the inflows have not slowed. On Tuesday, Bloomberg Analyst James Seyffart revealed that Spot ETF inflows rose once again, to cross $400 million in a single day.

In the same vein, the trading volumes have been on the rise. With demand soaring, volumes crossed $2 billion on Tuesday and it is the second time in a month that it has crossed this figure. This rise in both inflows and trading volumes shows a willingness among institutional investors to take positions in Bitcoin.

Fidelity Investments, one of the issues of the many Spot Bitcoin ETFs available for trading in the market, also recently encouraged investors to put a small portion of their portfolios in Bitcoin. According to the asset manager, a portfolio allocation of 1-3% in Bitcoin is ideal at this point.

Now, while a 1-3% allocation may seem small to the average investor, it is quite large when it comes to institutional investing. These portfolios are often made up of billions of dollars, and even a 1-3% allocation could work out to hundreds of millions of dollars being funneled into Bitcoin.

BTC Dominance Not Budging

While the price of Bitcoin has rallied in the last week, expectations are that Bitcoin will begin to consolidate and then give way to altcoins. However, the BTC dominance over the crypto market remains quite high, suggesting that the time for altcoins may not be here yet.

Presently, the BTC dominance is sitting at 54.1% after seeing a local peak of 54.4%. This shows that Bitcoin is still leading the entire market by a large margin, and until this dominance subsides, Bitcoin will continue to lead the rally while altcoins lag behind.

For now, the bulls are focusing on maintaining support at $59,000, giving it a bounce point toward $60,000. With the previous all-time high at $69,000, the BTC price needs a less than 20% move from here to reach a new all-time high.

Stacks Creator Ali Calls Bitcoin ‘Apex Predator’ as Development Flourishes on OG Blockchain

Muneeb Ali, the co-creator of Stacks and Princeton-educated computer scientist who’s now CEO of the Bitcoin-focused development firm Trust Machines, spoke with CoinDesk’s Jenn Sanasie on the flurry of development and layer-2 building now taking place on the original blockchain.

Bitcoin Fast Approaching $60,000 As BTC F&G Index Hits ‘Extreme Greed’ – Details

After rising 5% in the last day, Bitcoin (BTC) is now rapidly nearing the coveted $60,000 mark. This is because investor interest in the largest cryptocurrency in the world has reached levels last seen during a 2021 boom, bringing it very close to its all-time high.

Pre-Halving Rally? Bitcoin Nears $60K

The increase in price coincided with a surge in demand as spot bitcoin exchange-traded funds (ETFs) achieved trading volumes of over $3 billion cumulatively on Tuesday. Additionally, other traders cited the anticipated April bitcoin halving as the source of a fresh narrative that spurs a pre-halving increase.

The world’s most sought-after digital asset’s market cap has now reached $1.2 trillion, Coingecko data shows.

Joel Kruger, a market strategist at LMAX Group, stated that the market is “that much more determined to see the level retested and shattered” now that bitcoin is that much closer to retesting its record high.

Due mostly to the euphoria surrounding a number of spot bitcoin exchange-traded funds that began trading in January, bitcoin has increased by as much as 16% this week and 35% so far this year.

Bitcoin reached its highest level since November 2021 when it surpassed $59,000. The objective of the present surge is to see if the price can rise to $68,790, its all-time high. Six months before a stunning crash in 2022, that peak occurred.

According to Coinglass data, futures bets on lower bitcoin prices have taken on $25 million in liquidations since Asian morning hours, which could have contributed to the price rise.

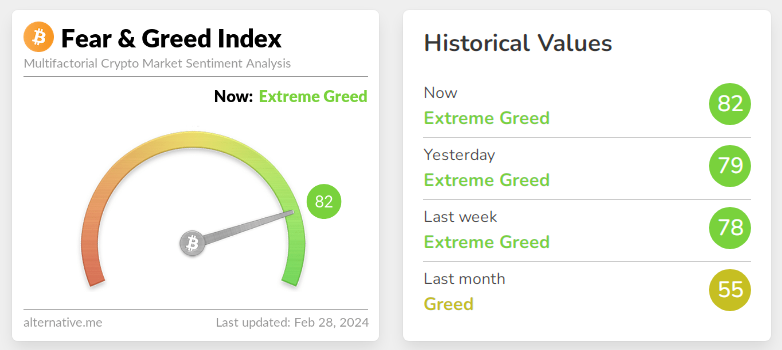

‘Extreme Greed’ For BTC

In the meantime, on Wednesday, the Fear and Greed Index—a sentiment indicator that measures how quickly asset movement deviates from underlying fundamentals—flashed 82, signaling “extreme greed” and hitting its highest level in more than a year.

A scale of 0 to 100 represents the most anxious and 100 is the most greedy on the index. According to the index’s creators, an environment that is hungry is indicative of exuberance and shows the market is due for a correction.

Since the ETFs started trading on January 11, Bitcoin has increased by 24%. The current upward trend in pricing, according to Bitwise Asset Management analyst Ryan Rasmussen, is merely the beginning.

“The demand that ETFs are generating for the spot bitcoin market is substantially greater than the daily production of fresh supply,” he stated.

In the end, Rasmussen stated:

“What we’re witnessing is cryptocurrency kind of rising from the ashes of the 2022 market.”

The volume of bitcoin trades made thus far this quarter has exceeded the totals for each quarter of 2023 for the same period. Major cryptocurrency trading platforms like Coinbase Global (COIN) and Robinhood (HOOD) have benefited greatly from this activity. Between the start of January and now, those stocks have increased by 27% and 31%, respectively.

Featured image from Pexels, chart from TradingView

Crypto Traders Hedge Bitcoin Rally After 40% Rise in 4 Weeks, Options Data Show

Some traders have started buying puts to protect against a potential sharp decline, according to Greeks.Live.