Bitcoin miners’ reserves slid to the lowest since May following a spate of withdrawals to exchanges this week, data from CryptoQuant shows.

First Mover Americas: Bitcoin Set to Ring in the New Year Up Nearly 160%

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 29, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Bitcoin Worth $1B Leaves Exchanges in Largest Single-Day Outflow in 12 Months

Net outflows from exchanges are often taken to represent investors’ intention to hold coins for long-term.

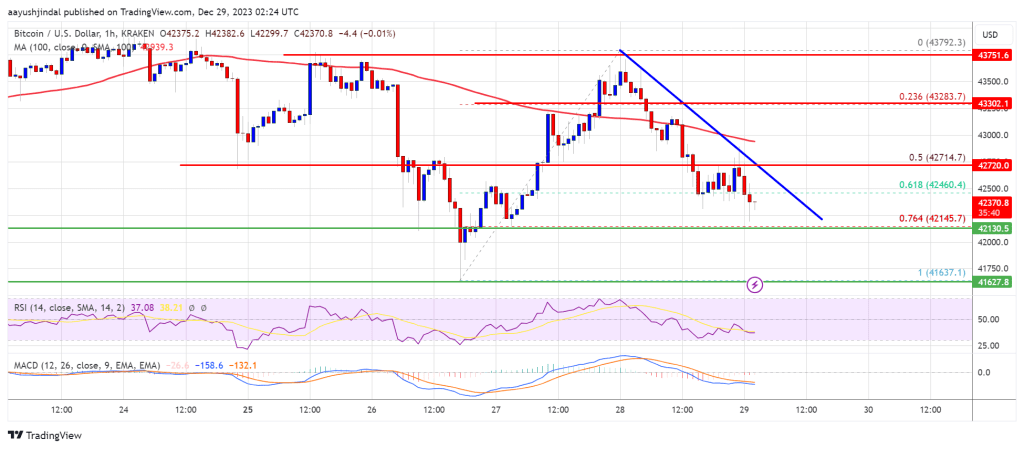

Bitcoin Price Faces Another Rejection, Why BTC Is At Risk Before The New Year

Bitcoin price failed again to clear the $44,000 resistance zone. BTC is declining and might be at risk of a downside break below the $41,500 level.

- Bitcoin is slowly moving lower from the $43,800 resistance zone.

- The price is trading below $43,000 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance near $42,550 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to decline if it stays below the $43,000 level.

Bitcoin Price Takes Hit

Bitcoin price made a fresh attempt to gain pace above the $43,200 level. BTC climbed above the $43,500 level, but it struggled to reach the $44,000 resistance zone.

A high was formed near $43,792 and the price started a fresh decline. There was a clear inverted V pattern formed and the price declined below the $43,200 level. The bears were able to push the price below the 50% Fib retracement level of the upward move from the $41,637 swing low to the $43,792 low.

Bitcoin is now trading below $43,000 and the 100 hourly Simple moving average. It is also consolidating below the 61.8% Fib retracement level of the upward move from the $41,637 swing low to the $43,792 low.

On the upside, immediate resistance is near the $42,500 level. There is also a key bearish trend line forming with resistance near $42,550 on the hourly chart of the BTC/USD pair. The first major resistance is $43,000. A close above the $43,000 level could send the price further higher.

Source: BTCUSD on TradingView.com

The main hurdle sits at $43,250. A close above the $43,250 resistance could start a decent move toward the $43,800 level. The next key resistance could be near $44,000, above which BTC could rise toward the $45,000 level.

More Losses In BTC?

If Bitcoin fails to rise above the $43,000 resistance zone, it could continue to move down. Immediate support on the downside is near the $42,150 level.

The next major support is near $41,650. If there is a move below $41,650, there is a risk of more losses. In the stated case, the price could drop toward the $40,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $42,150, followed by $41,650.

Major Resistance Levels – $42,550, $43,000, and $43,800.

CryptoQuant Sound Alarm: Spot Bitcoin ETF Approval May Trigger Drop To $32,000, Here’s Why

A recent report from CryptoQuant has sparked discussions, suggesting that a Bitcoin spot exchange-traded fund (ETF) approval by the US Securities and Exchange Commission (SEC) could lead to a significant market event.

This possibility arises amid the Bitcoin (BTC) price stabilizing above $40,000, leaving many market participants sitting on substantial unrealized profits.

The report by CryptoQuant particularly posits that this scenario could trigger a “sell the news” event, historically linked to market corrections.

Bitcoin Possible Drop To $32,000

CryptoQuant’s analysis points to the current state of Bitcoin holders as a reason for the possible drop in BTC price when the approval of spot Bitcoin ETF happens.

Particularly the short-term ones, experiencing unrealized profit margins of around 30%. According to CryptoQuant, such high-profit levels have often preceded price drops.

Additionally, the report notes an uptick in selling activity from Bitcoin miners, adding to the potential sell pressure on BTC. This, combined with the market’s anticipation of a spot Bitcoin ETF approval, could create a volatile environment, as highlighted by CryptoQuant.

Based on CryptoQuant’s analysis, during downturns within bullish markets, Bitcoin’s value often falls back to the level where short-term investors have historically realized their prices.

Considering this, the report suggests that in a scenario where “sell the news” occurs, Bitcoin’s value might see a downturn, with a possible dip to around “$32,000.”

Contrasting Views And Support Levels Amid ETF Speculations

The conversation around a Bitcoin spot ETF’s potential approval is not one-sided. Several analysts predict a positive outcome, with firms like Matrixport and prominent analysts like Michael van de Poppe suggesting that the approval could catapult Bitcoin’s price to new highs.

Matrixport anticipates that the approval of Bitcoin spot ETFs by the US SEC could drive BTC’s value to around $50,000 in early 2024. Van de Poppe echoes this sentiment, foreseeing a potential rise to the $47,000-$50,000 range.

#Bitcoin did test the lows, didn’t take the liquidity beneath the lows.

Anyway, correction seems over and pre-ETF we’re likely to test $47-50K.

Buy the dips. pic.twitter.com/Ar4mqvYRjJ

— Michaël van de Poppe (@CryptoMichNL) December 19, 2023

Additionally, while CryptoQuant predicts a possible drop to $32,000, other analysts’ prediction of BTC bottom doesn’t go that low. Analyst Ali, for instance, has highlighted a robust support zone between $37,150 and $38,360.

In case of a deeper correction, #Bitcoin finds solid support between $37,150 and $38,360. This zone is backed by 1.52 million addresses holding 534,000 $BTC.

Also, watch out for two resistance walls that could keep the #BTC uptrend at bay: one at $43,850 and another at $46,400. pic.twitter.com/NGm1XpMOLf

— Ali (@ali_charts) December 11, 2023

This range is reinforced by the activities of approximately 1.52 million addresses holding about 534,000 BTC. Notably, such a strong foundation of support might mitigate the risks of a drastic price fall even if a “sell the news” event were to occur following the spot ETF approval.

Featured image from Unsplash, Chart from TradingView

Cathie Wood’s ARK ETF Overhauls Bitcoin Portfolio: ProShares In, Grayscale Out – What’s The Strategy?

In a significant shake-up of its Bitcoin (BTC)-related holdings, Cathie Wood’s ARK Next Generation Internet exchange-traded fund (ETF) has made strategic changes as BTC ends the year with a significant 156% surge.

According to a Bloomberg report, the ETF sold all its remaining 2.25 million shares of the Grayscale Bitcoin Trust (GBTC) while acquiring 4.32 million shares of the ProShares Bitcoin Strategy ETF.

Caution As Reason For Exiting Grayscale Bitcoin Trust

According to Bloomberg, Wood cited caution as the reason behind the sale of the Grayscale Bitcoin Trust. The move was prompted by concerns that the anticipated conversion of the trust to a spot Bitcoin ETF might not receive approval from US regulators in early January.

Additionally, Wood highlighted the substantial reduction in the trust’s discount to its net asset value, which, combined with its price increase, influenced the decision.

Wood emphasized the unpredictability surrounding which Bitcoin-related offerings would gain regulatory approval, expressing optimism about Bitcoin while acknowledging the uncertainty ahead.

In this regard, Bloomberg ETF expert Erich Balchunas highlights that approximately $100 million of the proceeds were used to purchase the ProShares Bitcoin Strategy ETF (BITO), likely as a liquid transition vehicle to maintain exposure to Bitcoin while gradually transitioning into either ARKW or ARKB.

Interestingly, ARK has now become the second-largest holder of BITO, although Balchunas clarifies that this is a temporary parking spot. Blachunas emphasizes that institutions, including ARK, often employ highly liquid ETFs for transitions of this nature.

Balchunas also points out that this move aligns with the prediction made by Bloomberg a month ago, reflecting strategic foresight on ARK’s part.

According to Balchunas, this decision is smart as it allows ARK to boost its own ETF’s assets under management (AUM) while saving investors from incurring a significant expense ratio in the process.

Wood’s Long-Term Vision

Per the report, the reduction in holdings of the Grayscale Bitcoin Trust has been a gradual process for Cathie Wood, even as the price of Bitcoin surged to its highest level since April 2022.

Throughout 2023, Bitcoin more than doubled in value, with significant gains occurring towards the end of the year amid speculation that the Securities and Exchange Commission (SEC) would approve spot Bitcoin ETFs in the first days of January 2024.

During the Sohn Australia conference last month, Wood touted the Grayscale Bitcoin Trust as her top pick. However, recent developments have led to a shift in the ETF’s portfolio composition.

In addition to the changes involving Grayscale and ProShares, the ARK ETF also purchased 20,000 shares of the ARK 21Shares Active Bitcoin Futures Strategy ETF and sold 148,885 shares of the cryptocurrency exchange Coinbase Global, according to the fund’s report.

The ARK Next Generation Internet ETF has achieved an impressive 103% gain for the year, surpassing the 55% advance of the Nasdaq 100 Index.

It is worth noting that the fund’s performance has been characterized by significant volatility, experiencing declines of 19% and 67% in 2021 and 2022, respectively.

The leading cryptocurrency in the market is trading at $42,800, exhibiting a sideways price movement over the past 24 hours. During this timeframe, there has been a marginal decrease of 0.3% in its value.

Featured image from Shutterstock, chart from TradingView.com

Bitcoin Whales Bought The Recent Dip While Market Panicked

On-chain data suggests the Bitcoin whales may have participated in a significant amount of buying while the market was panicking about the recent lows.

Bitcoin Exchange Netflow Has Been Quite Negative Recently

An analyst in a CryptoQuant Quicktake post pointed out that the exchanges have recently seen outflows. The indicator of interest here is the “exchange netflow,” which keeps track of the net amount of Bitcoin entering or exiting out of the wallets of all centralized exchanges. The metric’s value is calculated by subtracting the outflows from the inflows.

When the indicator has a positive value, the inflows overwhelm the outflows, and a net number of coins moves into these platforms.

As one of the main reasons investors may want to deposit their BTC to the exchanges is for selling purposes, this trend can have bearish implications for the cryptocurrency.

On the other hand, the negative metric implies withdrawals are taking place, which can be a sign that the holders are accumulating right now. Such a trend could naturally turn out to be bullish for the asset’s price.

Now, here is a chart that shows the trend in the Bitcoin exchange netflow over the past year:

The above graph shows that the Bitcoin exchange netflow has observed some deep negative spikes recently. This suggests that some large outflows have been occurring from these platforms.

Interestingly, these withdrawals came as BTC slipped towards the $41,600 level, implying that some investors were potentially buying while the rest of the market was panicking about the drawdown.

Given the large scale of the deposits, it’s likely that whale entities were behind them. The fact that these humongous holders were willing to risk accumulating at these recent prices could be a positive sign for the continuation of the rally.

Microstrategy has also just announced its massive $615 million BTC acquisition, which can naturally be another optimistic sign for the coin. The exchange netflows occurring ahead of the announcement are interesting, though.

It’s hard to be sure if there is any connection between the two, but one possibility is that the whales who bought at these recent lows knew about the acquisitions ahead of time.

Another, and perhaps the more likely explanation, is that these large investors were looking for an entry point into the asset ahead of the potential ETF approvals, and the dip presented as good an opportunity as any to achieve so.

Whatever the case, it would seem like the moves made by the whales might have paid off so far, as the Bitcoin price has rebounded since its lows (although its recovery hasn’t been too strong yet).

BTC Price

Bitcoin had recovered to as high as $43,800 during the past day, but the asset has since slumped back down as it’s now floating around the $42,800 mark.

A Crypto Christmas Special With Sheraz Ahmed: Past, Present, And Future

Another year, another Crypto Christmas special for our team at NewsBTC. In the coming week, we’ll be unpacking 2023, its downs and ups, to reveal what the next months could bring for crypto and DeFi investors.

Related Reading: A Crypto Christmas Special With Jlabs Digital: Past, Present, And Future

Like last year, we paid homage to Charles Dicke’s classic “A Christmas Carol” and gathered a group of experts to discuss the crypto market’s past, present, and future. In that way, our readers might discover clues that will allow them to transverse 2024 and its potential trends.

Crypto Christmas With STORM: Bitcoin ETF Should Be Out Of Your Wishlist?

For today’s issue, our team got to chat with Sheraz Ahmed, Managing Partner at blockchain solutions provider STORM and founder of Decentral House. Ahmed has been present at some of the most important crypto events in 2023 and is constantly speaking with founders, organizations, and relevant actors within and outside the nascent sector.

Thus, Ahmed has a unique perspective on the industry, its blindspots, and possible catalyzers. During the interview, we talked about the downside of approving a Bitcoin spot Exchange Traded Fund (ETF) in the United States and why the space might be unprepared for a new bull cycle. This is what he told us.

Q: Our team has coincided with you in several crypto events this year; where do you think most of these events coincide? And what do you believe has been overlooked during 2023, a narrative, a project, something people missed as the industry enters another cycle?

Switzerland, Europe, Dubai, Singapore, and Rio (de Janeiro). I do believe that we are too early for the next cycle. The broken models of the last bull run are yet to be rebuilt. Infrastructure has improved, custody, wallets, exchanges, and stablecoins, but the business models for Dapps (Decentralized Applications) have not evolved.

I fear that we enter into another vaporware cycle and, at best have to wait 4 more years for real use cases/adoption or risk burning ourselves completely with shitcoins and scams.

Q: As Crypto enters a new cycle, what’s different about the industry when you compare it to early 2021 and 2017? Where can investors see the growth? Is it in the players joining the industry, the financial products, or in its community?

There is a bit more maturity, although that sometimes just feels like the veterans are just numb to the pain this industry can self-inflict. We do see genuine interest from large institutional players in the financial, consumer, and impact fields. But can we convert those ideas into adoption?

Investment in utility and payment tokens is an oxymoron. They are not meant to be investment products and are not regulated as such. An investor could look into an infrastructure play, although I believe that is quite saturated today at approx. $700M. My bet would be early-stage protocol ecosystem funds (equity-based), with a portion of that taken in tokens for the utility of governance, etc., that might be attached.

Q: The upcoming approval of a spot Bitcoin ETF in the US seems like the perfect indicator that crypto has made it to the mainstream, but what’s the next frontier? Where does the industry go from here?

I don’t agree. For me, it just sounds like the bankers finally believe they can make money off our industry. Now, does that mean it’ll be good for prices in the short term and more eyeballs? Yes. But be careful what you wish for, as when the heavy artillery comes in, they crush everything/everyone in their path.

In 2023, we founded Decentral House. An innovation centre focused on blockchain-based application that provide the infrastructure to spark ideas to life. I believe that by having the right tools in your arsenal, you can navigate the Web3 space to find the light at the end of the tunnel. Without the right guidance, WANGMI (We Are Not Gonna Make It). Let’s work together to create an industry of trust we can all be proud of!

Cover image from Unsplash, chart from Tradingview

Bitcoin ETF Approval Tipped to Be ‘Sell The News’ Event: CryptoQuant

Bitcoin [BTC] is expected to experience a period of downside following a potential ETF approval over the coming weeks as trader’s unrealized profits linger at a level that historically precedes a correction, according to data provider CryptoQuant.

Crypto Analyst Predicts Major Price Shift For Cardano (ADA)

LuckSide, a crypto analyst, has weighed in on the price action of Cardano (ADA), giving an analysis of the near-term price performance of the crypto asset.

Cardano (ADA) Poised For Bullish Or Bearish Trajectory

The crypto analyst recently shared his predictions for Cardano (ADA) with the crypto community during one of his YouTube videos. In the YouTube video – “CARDANO ADA – MOMENT OF TRUTH!,” LuckSide asserted that ADA is at a critical crossroads.

The analyst revealed a technical projection that indicates ADA is about to undergo a major price shift. According to him, this is either a bullish or a bearish trajectory in the near future.

LuckSide finds signals that are pointing in the direction of a significant price shift, after analyzing ADA’s price charts. This analysis is centered on the significant price gap in the Cardano native token.

LuckSide asserted that the gap is “where the highest concentration of liquidity is located for ADA.” This is marked by ongoing selling pressure at the resistance level between “$0.60 and $0.67,” in sharp contrast to a $0.40 level.

This gap denotes an unexplored area and suggests a potential strong move, given ADA’s price history. He noted that Cardano could either rise to test the resistance level around $0.70 or drop to the $0.40 support level.

The crypto expert also pointed out signs of robustness and strength of ADA in his video. The stability of pivotal support levels and moving averages underscores the strength of the crypto asset.

The larger market indicators, such as the volatility and price stability of Bitcoin (BTC), further support this resiliency. The analyst also attributed the market’s movement to the impending Bitcoin Halving event in Mid-2024, due to its market impact.

However, LuckSide notes that unforeseen circumstances have the potential to change ADA’s direction while conceding the unpredictability of the market. He further added that although, a decline to $0.40 “might create opportunities to buy the token at a lesser price.”

The Network’s Growth Is Similar To Bitcoin

Charles Hoskinson, the founder of Cardano recently underscored the network’s growth, acknowledging that it mimics the natural growth of Bitcoin. The founder took to X (formerly Twitter) to celebrate the network’s performance with the community.

In the X post, Hoskinson stated that he has been observing with “glee as some people worry about Cardano’s blocks filling up.” He further reminded the community about the criticism of the network being a useless “ghost chain,” with no liquidity.

Hoskinson has assured the community that “Cardano is designed to handle these loads.” He noted a “huge design space” that optimizes the network and DApps for greater scalability in the short and long term.

In addition, he has highlighted the network’s victories without Venture Capital (VCs), the media, or influencers.

First Mover Americas: MicroStrategy Buys More BTC and ARK Invest Buys BITO

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 28, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

A Record $11B Crypto Options Expiry Looms as BTC Shows Little Volatility

The expiry is Deribit’s largest so far and a record of almost $5 billion of options will expire in the money.

MicroStrategy Spends Another $615 Million On Bitcoin, Do They Know Something You Don’t?

In a strategic move that has effectively caught the attention of the crypto space, Microstrategy has once more fortified its Bitcoin portfolio, strengthening its position as the largest corporate holder of BTC globally.

MicroStrategy Boost BTC Holdings

In a recent filing on December 27, the United States Securities and Exchange Commission (SEC) announced that business intelligence software company, Microstrategy has increased its Bitcoin holdings by 14,620 BTC valued approximately at $615.7 million.

“On December 27, 2023, MicroStrategy Incorporated (“MicroStrategy”) announced that, during the period between November 30, 2023, and December 26, 2023, MicroStrategy, together with its subsidiaries, acquired approximately 14,620 bitcoins for approximately $615.7 million in cash, at an average price of approximately $42,110 per bitcoin, inclusive of fees and expenses,” the report stated.

It added:

As of December 26, 2023, MicroStrategy, together with its subsidiaries, held an aggregate of approximately 189,150 bitcoins, which were acquired at an aggregate purchase price of approximately $5.895 billion and an average purchase price of approximately $31,168 per bitcoin, inclusive of fees and expenses.

The founder and Chairman of Microstrategy, Michael Saylor also announced the company’s substantial BTC purchase via his X (formerly Twitter) handle. This move has sparked curiosity among crypto enthusiasts and investors, prompting questions about the crypto investor’s ultimate strategy and motivations behind the company’s accumulation of substantial amounts of Bitcoin.

Microstrategy’s strategic BTC investment also stealthily comes as the anticipation of Spot Bitcoin ETF grows. The significant BTC purchase raises the possibility of the company having information that could place it in a strong position to potentially profit from the Spot Bitcoin ETF craze while simultaneously leading the 2024 Bitcoin bull run cycle.

MSTR Stocks Surge Amidst Bitcoin ETF Frenzy

As Microstrategy ramps up its BTC portfolio on one front, concurrently, the company witnesses a surge in its stock value. The business intelligence software company has seen its MSTR stock performance skyrocket by over 300% in 2023. At the time of writing, the price of MSTR is trading at $613.80 with a 15.25% increase in the past five days according to Market Watch.

This price surge can be largely attributed to the expectations surrounding the Bitcoin Spot ETF in the United States. The crypto industry is presently watching as the SEC approaches the crucial deadline to either deny or approve Spot Bitcoin ETFs. The final date of the SEC’s Bitcoin ETF decision has already been scheduled for January 10, 2024.

Stock of Bitcoin’s Biggest Public Holder is Overvalued by 26%, Analyst Who Predicted BTC Rally Says

Early investors in MSTR can consider taking profit as shares appear overvalued and could fall by 20%, according to 10x Research.

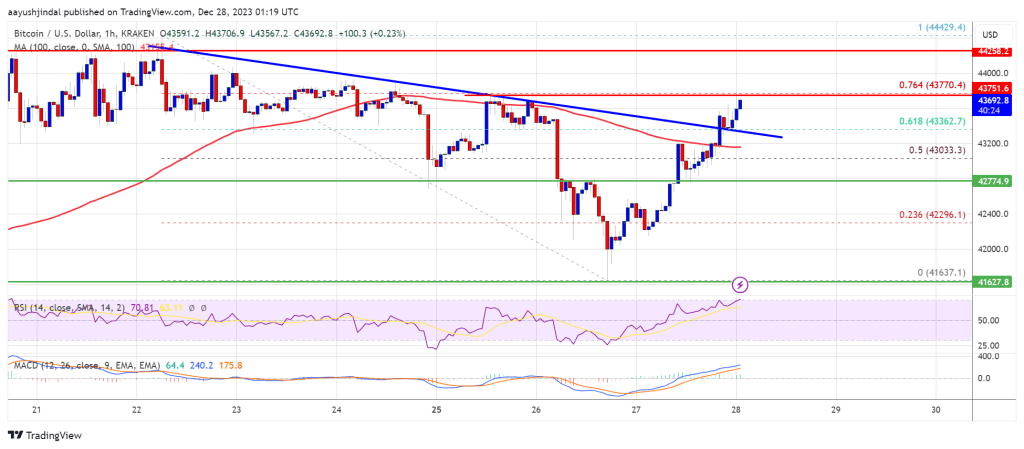

Bitcoin Price Regains Strength – Why BTC Could Still Remain In Range Before 2024

Bitcoin price found support and started a decent increase above $43,000. BTC is rising, but it might struggle to clear the $44,300 and $44,500 resistance levels.

- Bitcoin tested the $41,650 zone an started a fresh increase.

- The price is trading above $43,000 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance near $43,350 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to move surge toward the main resistance at $44,300.

Bitcoin Price Restarts Increase

Bitcoin price was able to find bids above the $41,500 level. BTC formed a base and recently started a fresh increase from the $41,637 low. There was a steady increase above the $42,500 resistance zone.

There was a break above a connecting bearish trend line with resistance near $43,350 on the hourly chart of the BTC/USD pair. The pair even climbed above the 61.8% Fib retracement level of the downward move from the $44,429 swing high to the $41,636 low.

Bitcoin is now trading above $43,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $43,780 level. It is close to the 76.4% Fib retracement level of the downward move from the $44,429 swing high to the $41,636 low.

Source: BTCUSD on TradingView.com

The first major resistance is $44,000. The main hurdle sits at $44,300. A close above the $44,300 resistance could start a decent move toward the $45,000 level. The next key resistance could be near $45,500, above which BTC could rise toward the $46,500 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $44,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $43,350 level.

The next major support is near $42,750. If there is a move below $42,750, there is a risk of more losses. In the stated case, the price could drop toward the $42,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $43,350, followed by $42,750.

Major Resistance Levels – $43,750, $44,000, and $44,300.

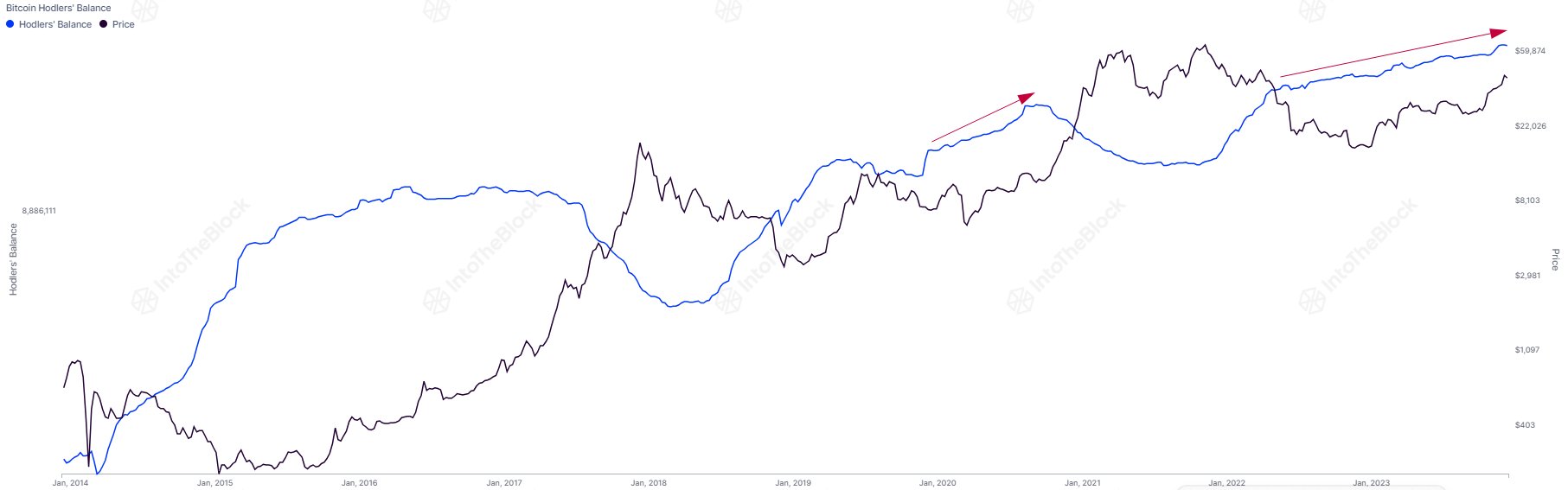

When Will Bitcoin Bull Run Begin? This Could Be The Metric To Watch

A pattern in the supply of the Bitcoin long-term holders could provide some hints about when the next bull run might begin in earnest.

Bitcoin HODLer Balance Has Followed A Specific Pattern In Previous Cycles

According to the market intelligence platform IntoTheBlock, the supply of the BTC HODLers is “an excellent indicator for measuring market cycles.” The “HODLers” or long-term holders (LTHs) refer to the Bitcoin investors who have held onto their coins since at least a year ago without having sold or transferred them on the blockchain.

The LTHs are the resolute hands in the market, which rarely sell their coins even when a profitable opportunity has presented itself or a deep price crash has occurred.

One way to track the behavior of these diamond hands is through the combined amount of balance they carry in their wallets. The chart below shows this Bitcoin metric trend over the past few years.

As displayed in the above graph, the Bitcoin supply held by the HODLers has been showing some growth over the past couple of years, suggesting that the LTHs have been accumulating.

This rise in the indicator has also continued through the latest rally, implying that the LTHs aren’t yet ready to start taking their profits. Something to note is that when the metric goes up, it doesn’t mean buying is happening in the present.

The indicator naturally has a 1-year lag associated with it, as coins must mature for that long before they can be included in the cohort. However, this only applies to buying as the holders moving their coins to sell instantly reset the age back to zero and, hence, remove them from the group.

In the chart, the analytics firm has highlighted a pattern that the Bitcoin LTH supply has observed during the leadup to past bull runs. It would appear that the HODLers have shown accumulation in such periods.

On the other hand, the start of selling from this cohort coincided with the beginning of the bull rally in proper. So far, the HODLers have only been accumulating recently, implying that the market may be in the pre-bull run phase.

If the historical pattern indeed holds for the current cycle as well, then the HODLer supply could be one to watch, as a significant downtrend in it could turn out to be a signal that the bull run has begun once more.

BTC Price

Bitcoin had plunged towards the $41,700 mark yesterday, but the asset has already seen some sharp recovery as its price is now trading around the $43,000 level.

Major Acquisition: MicroStrategy Grows Bitcoin Reserves By 14K BTC Ahead Of ETF Approval

MicroStrategy (MSTR), a prominent Bitcoin holding company, has once again expanded its BTC holdings with a substantial purchase of 14,620 Bitcoin, amounting to a staggering $615.7 million.

The former CEO of the American business intelligence (BI) firm announced the acquisition, highlighting the company’s continued confidence in Bitcoin’s long-term potential.

With the potential approval of Bitcoin spot exchange-traded funds (ETFs) on the horizon, MicroStrategy aims to capitalize on the positive impact on BTC’s price and the company’s profitability in the leading cryptocurrency market.

MicroStrategy Stock Skyrockets 337%

According to a CNBC report, MicroStrategy’s stock has experienced a remarkable 337% surge in 2023, making it one of the top gainers among US companies valued at $5 billion or more.

This success surpasses the rallies of industry giants like Nvidia and Meta. Unlike its tech peers, MicroStrategy’s appeal to investors stems primarily from its Bitcoin holdings.

MicroStrategy’s market capitalization currently stands at $8.5 billion, with a staggering 90% directly tied to its Bitcoin holdings. The company’s stock price closely mirrors the performance of Bitcoin, with significant fluctuations in response to the cryptocurrency’s price movements.

Per the report, in 2022, when Bitcoin experienced a 64% decline, MicroStrategy’s stock plummeted by 74%. Despite the substantial gains achieved this year, MicroStrategy shares are still below their peak levels in 2021, during the cryptocurrency’s peak.

Michael Saylor’s Vision

MicroStrategy’s decision to invest in Bitcoin dates back to July 2020, when the company recognized the potential of alternative assets, including digital currencies.

At that time, MicroStrategy had a market capitalization of around $1.1 billion, primarily driven by its software business, which has been shrinking since 2015. Co-founder Michael Saylor, who was CEO then, saw an opportunity to put the company’s idle cash reserves to work, considering low interest rates and the need for diversification.

Saylor’s conviction in Bitcoin as a digital form of gold led MicroStrategy to prioritize Bitcoin purchases over equities and precious metals. This strategic move exposed investors to Bitcoin indirectly through MicroStrategy’s stock.

Saylor, who transitioned to executive chairman, remains optimistic about Bitcoin’s future, expecting the bull market to continue into the next year. Despite its growing popularity, Saylor emphasized that Bitcoin still represents only a fraction of global capital allocation, with ample room for further growth.

As of December 27, 2023, MicroStrategy’s latest purchase adds to its already impressive Bitcoin portfolio, bringing the total holdings to 189,150 BTC.

The company has invested approximately $5.9 billion, with an average purchase price of $31,168 per Bitcoin. These strategic acquisitions position MicroStrategy as a major player in the crypto space, aligning its interests with the anticipated growth and adoption of Bitcoin.

The current market data shows that Bitcoin is trading at $42,900, reflecting a marginal 0.5% increase over the past 24 hours. The cryptocurrency briefly dipped below its critical support level of $42,000 but has since regained its position.

The market is anticipating the potential approval of the Bitcoin Spot ETF applications between January 5 and 10, 2024.

This development holds significant promise for Bitcoin, as it could drive the cryptocurrency’s price well beyond $50,000, establishing a new yearly high and edging closer to its historical peak.

Featured image from Shutterstock, chart from TradingView.com

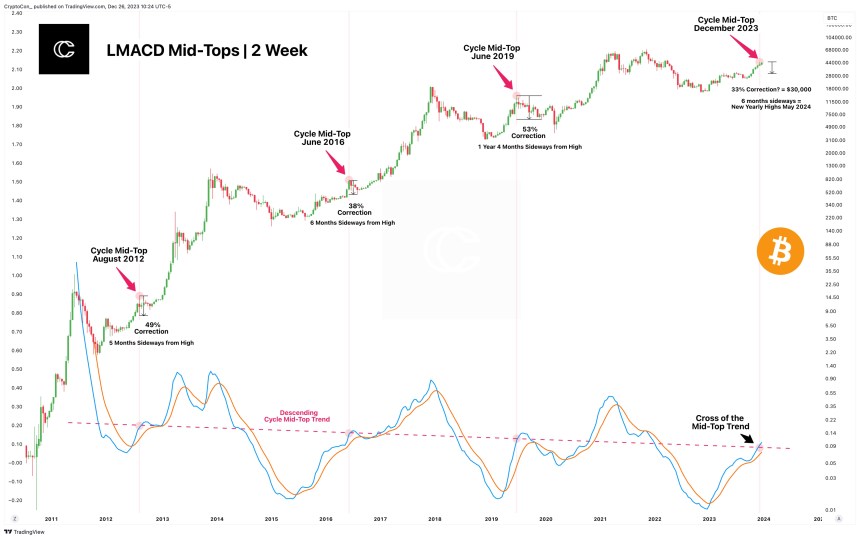

Crypto Analyst Predicts Bitcoin To Reach $130,000, Here’s When

Amid the recent Bitcoin (BTC) price rally, cryptocurrency analyst CryptoCon has shed his optimism about the price action of the crypto asset while highlighting a bold prediction.

Bitcoin To Experience Pullback Beforehand

On Tuesday, December 26, CryptoCon took to X (formerly Twitter) to share his latest projections on Bitcoin. According to the analyst, the price of BTC will reach the $130,000 mark, but it might undergo a correction beforehand.

In the X post, CryptoCon reiterated his opinion that, many weeks ago, Bitcoin peaked at roughly $45,000. He further highlighted that the LMACD includes another layer with a cross of the “Descending Cycle Mid-Top Trend.”

He suggests that Bitcoin is about to experience a “significant pullback.” The analyst highlighted that the “correction ranges from 38% to 52%” from its peak of around $45,000.

In addition, CryptoCon predicts that a period of correction lasting “up to five to six months” will follow the correction. He added that these declines would cease in May 2024, as he sees an upward trajectory despite his correction projections.

The crypto analyst highlighted the “Green Year Accumulation” phase in his projections. He then underscored the opportunity this correction offers investors who couldn’t take advantage of favorable entry during this phase.

He sees an opportunity for investors to enter the Bitcoin market at a “more reasonable” price during this possible correction. However, overleveraged long may suffer due to the potential correction from the recent highs.

Furthermore, the analyst continued by pointing out the advantages of Bitcoin’s future performance. He expects Bitcoin to reach a fresh peak in November or December 2025.

CryptoCon’s predictions for BTC to reach an all-time high by the time above were based on the “Halving Cycles Theory.” He then asserted that after careful price experiments, he expects BTC to be around “$130,000 by the end of 2025.”

Rise In BTC’s Addresses Holding Millions Of Dollars

A recent report has revealed an uptick in the total number of Bitcoin millionaires in 2023. Data from BitInfoCharts shows the number of BTC millionaires has increased by 246% in 2023.

Currently, Bitcoin millionaires are around 97,497, according to the data provided by the platform. This indicates a notable growth compared to this year, with 23,795 addresses worth at least $1 million.

Furthermore, BitinfoCharts has divided these 97,497 millionaires into two distinct parts. Addresses that contain at least $1 million are 90,040, while those containing more than $10 million make up for the rest.

This uptick can be traced back to the rise in BTC’s price this year, which has seen a year-to-date gain of nearly 158%. Earlier this year, the price of BTC was around $16,000.

MicroStrategy Buys $615M Worth Additional BTC, Pushing Holdings to $5.9B

Microstrategy’s CEO Michael Saylor tweeted on Wednesday that the company had acquired an additional 14,620 bitcoin.

First Mover Americas: Barry Silbert Resigns as Grayscale Chairman

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 27, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.