Users who lose their Bitkey wallet don’t need to input a seed phrase to recover funds, the company said.

Cryptocurrency Financial News

Users who lose their Bitkey wallet don’t need to input a seed phrase to recover funds, the company said.

Bitcoin is lining up a never-before-seen bull signal which could print on the Bitcoin chart by the start of 2024.

The hearing, scheduled to take 15 days, will also seek to determine whether the hack occurred.

A recent dovish shift in the outlook for monetary policy has played a sizable role in big gains for both crypto and traditional markets.

Trading firm QCP Capital has shared its thoughts on what could drive the flagship cryptocurrency, Bitcoin, to its all-time high (ATH) of $69,000. From their analysis, Spot Bitcoin ETFs have a huge role to play in all of this.

QCP Capital stated that revisiting its ATH of $69,000 will depend on the “genuine flows the actual ETF will bring in the first few weeks of trading.” If the inflows are below par, the trading firm noted that it could set things up for the classic ‘sell-the-news’ moment.

This assumption seems to stem from their belief that the news could already be priced in. They highlighted how Bitcoin has so far enjoyed incredible gains on the back of optimism that the SEC is going to approve these Spot Bitcoin ETFs. Bitcoin has already risen to as high as $45,000 this month and is said to be up 15% MTD in the first week.

With this in mind, QCP Capital is conscious of the fact that investors are most likely already positioned for an approval order by the SEC. If that is the case, Bitcoin and the broader crypto market will need something else to sustain this bullish momentum. That is why the trading firm has singled out liquidity flowing into these Spot Bitcoin ETFs as being key.

Renowned Economist Peter Schiff had previously warned of a possible sell-the-news event when he mentioned that Bitcoin is unlikely to rally again once a Spot BTC ETF is approved. That is because he believes that the current Bitcoin rally is a result of many already ‘buying the rumor.’ As such, once approval comes, the next thing could be these ‘investors selling the news.’

There is reason to believe that enough liquidity will flow into these Spot Bitcoin ETFs and the Bitcoin ecosystem to sustain the current market rally. Crypto research firm Galaxy Digital once published a report that stated that these funds could see $14 billion of inflows in the first year of launch.

Specifically, Galaxy Digital estimates that these funds will see an adjusted inflow of over $10 billion in their first month. These inflows should be enough to sustain Bitcoin’s rally as the research firm projects that Bitcoin’s price could see a 74.1% increase in the first year of these funds launching.

Meanwhile, Blockchain analytics firm Glassnode is of the opinion that an approval order by the SEC will bring in a substantial influx of investors. They predict that about $70.5 billion could flow into Bitcoin due to increased demand from institutional investors.

The fundraise was led by Polychain Capital and Hack VC and included contributions from Framework Ventures, Polygon Ventures, Castle Island Ventures and OKX Ventures.

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 7, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Apollo Crypto, a renowned name in the field of cryptocurrency analysis, has recently released a comprehensive report predicting a significant surge in the Bitcoin price, potentially reaching as high as $200,000 in the current cycle. Authored by Henrik Andersson, the report delves into various factors that could contribute to this remarkable growth.

A pivotal aspect of the report is the anticipated approval of the first spot Bitcoin Exchange-Traded Fund (ETF) in the United States. Eric Balchunas, the senior Bloomberg ETF analyst, is quoted saying, “There is a 90% chance of an approval by January 10, 2024.” This development is seen as a significant driver for Bitcoin’s price increase.

The report elaborates on the interest from prominent asset managers in Bitcoin spot ETFs, asserting, “In our view, it is likely that the SEC won’t give preferential treatment to a single ETF issuer; therefore several of them are likely to get approval at the same time.”

A key element in Apollo Crypto’s analysis is the potential new money inflow into Bitcoin ETFs. The report estimates this by considering the total size of US holdings of equities at $64.7 trillion.

It assumes that 10% of these investors would allocate 1% to Bitcoin ETFs, leading to an estimated inflow of $65 billion. This number is cross-referenced with the total US ETF market size of $6.5 trillion, where Bitcoin ETFs are expected to capture 1%, aligning with the $65 billion inflow estimate.

The concept of the ‘Bitcoin multiplier’ is also central to the report’s analysis. This refers to the effect of each dollar inflow on Bitcoin’s market cap. The report cites the next BTC halving in April 2024, which will reduce the new supply of BTC, as a factor that could increase the multiplier effect.

Referring to a Bank of America report titled “Bitcoin’s dirty little secrets,” Apollo Crypto notes, “For example, we estimate that a net inflow of just $93 million would result in price appreciation of 1%.” From this, they deduce a 114x multiplier effect as an upper bound but apply a more conservative estimate of 50x for their scenario.

Combining the inflow estimate and the multiplier effect, the report concludes that Bitcoin could reach $200,000 per coin in this cycle:

Putting it all together leads us to believe that we could see $65 billion in inflow to Bitcoin ETFs in the coming cycle. Applying a 50x multiplier effect leads to an increased market cap of $3.25 trillion in which case we would see Bitcoin trading at $200,000 per coin. We realize this is a bold estimate with a lot of uncertainty.

The report doesn’t stop at Bitcoin. It also analyzes the performance relationship between Bitcoin and Ethereum during the last bull market, using a specified period from September 2020 to November 2021.

During this phase, the report notes, “Bitcoin increased 4.8x while Ethereum increased 9.8x; Ethereum increased twice as much as Bitcoin during this time.” This historical data is crucial as it indicates that Ethereum tends to have a higher beta, or sensitivity, to Bitcoin’s market movements.

Building on this relationship, the report projects that if Bitcoin’s price were to quintuple – as suggested in their forecast from $40,000 to $200,000 – then based on the past market behavior, Ethereum could potentially experience a parallel and more pronounced surge.

The report estimates, “If the relationship holds for the coming cycle and Bitcoin increases 5x, then Ethereum would reach $22,000.”

At press time, BTC traded at $43,371.

Bitcoin has seen a pullback but not to the extent that bears have been expecting. Nevertheless, as a result of this, a lot of traders have incurred massive losses due to Bitcoin staging another unexpected recovery. The loss volumes have quickly risen to $190 million in one day as uncertainty remains the order of the day.

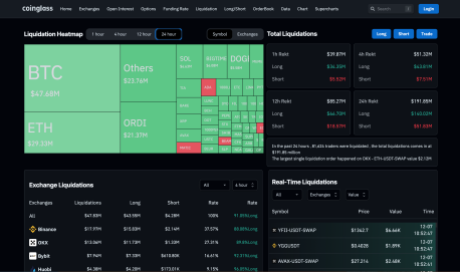

According to data from Coinglass, the 24-hour crypto liquidation volumes quickly rose above $190 million as Bitcoin completed a shakeout. This began with the price pullback to the $43,600 territory. And then a rapid rise back toward $44,000 completed the move.

Following this, traders on both sides quickly found themselves holding loss positions, and the liquidations pilled up. In total, over 81,000 traders were caught in the red, leading to more than $190 million in losses. Interestingly, the majority of these were from long trades who were betting on the price to continue to rise.

Coinglass puts 73.74% of the total liquidations in the past day to be from long traders, meaning that around 45,000 traders were long this time around. The single largest liquidation event was recorded on the OKX crypto exchange across the ETH-USDT-SWAP pair which was valued at $2.12 million at the time of the liquidation.

There was also a new entrant into the top 3 in terms of liquidation volumes. Naturally, Bitcoin and Ethereum led the pack with liquidation volumes of $47.12 million and $29.16 million. However, ORDI came in third position with $21.64 million in liquidations in 24 hours.

Long traders have continued to suffer the brunt of the liquidations in the last day, and the tides are still yet to turn against the bears. As Bitcoin’s price has briefly plunged below $43,000 and recovered back up toward $43,400 once more, the long liquidations are still piling up.

At the time of this writing, short liquidations made up 91.05% of the approximately $47.83 million in liquidations that have been recorded in the last four hours. This 4-hour liquidation trend is also being led by the same top three including Bitcoin, Ethereum, and ORDI, all of which have seen a lot of volatility in the last week. If Bitcoin’s recovery continues to show high volatility, these liquidation volumes will continue to rise.

The majority of the liquidations have taken place on both the Binance and OKX exchanges with $82.56 million and $60.51 million, respectively. ByBit exchange snags third position with $27.05 million in liquidations in the last day.

Bitcoin is currently struggling to maintain support above $43,000, which explains why there has been an uptick in the liquidation trend in the last few hours. However, bulls are still ahead and continue to dominate as sentiment remains firmly in greed.

The bull market has been clearly spot-driven, with all major derivatives data relatively flat, one observer said, adding the rally has limited downside.

Bitcoin buyers from the past cycle are more stubborn than ever before, data shows, even after 165% year-to-date BTC price gains.

These bitcoin were mined at the very early stages of the network for an estimated $100, as per CryptoQuant.

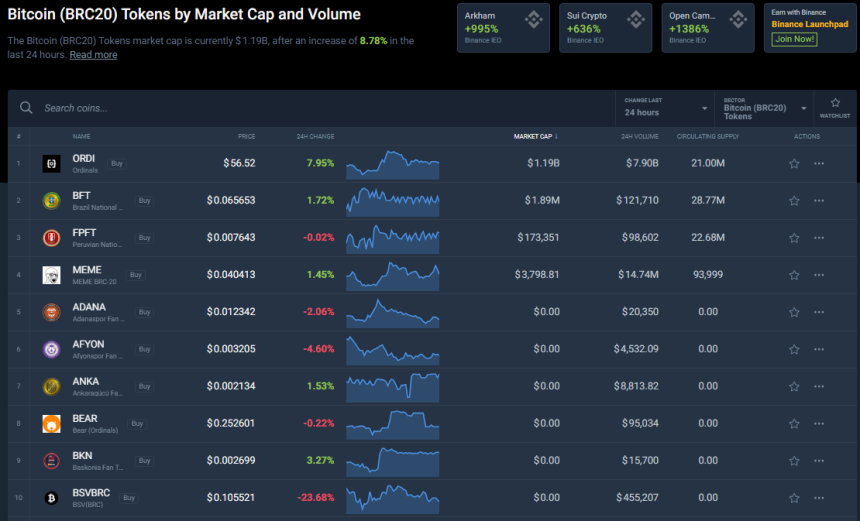

The BRC-20 token ORDI, which is based on Bitcoin, surged by 181% today amid a wider cryptocurrency upswing and a recent rise in activity surrounding the Ordinals protocol.

According to the most recent data, the token’s trade volume has increased by more than 900% during the last 30 days.

The ORDI coin has experienced a downward trend since its entry onto the market. It began trading at around $10 in June of this year and gradually dropped back to slightly less than $3 by mid-September.

The token’s decline marked the bottom and the beginning of the subsequent bull market, which drove the price up to its all-time high of $66 on November 5.

The previous few days have seen a phenomenal increase in the price of ORDI, and since Bitcoin has recently performed well and crossed $44,000, ORDI is also rising quickly.

The ORDI token, which is based on Bitcoin Ordinals, has achieved triple-digit monthly and weekly percentage growth, making it the first BRC-20 token to surpass a $1 billion market valuation.

Tokens based on Bitcoin are comparatively new in the digital currency space. These tokens leverage the Bitcoin network to produce a variety of digital assets, in contrast to Bitcoin, which is mostly used as electronic money. This change broadens the use of blockchain applications beyond the initial intent of Bitcoin.

Casey Rodarmor introduced the initial version of Bitcoin Ordinals in January. The protocol made it possible to add content to the blockchain of Bitcoin.

An important factor in the development of the two different types of tokens—fungible and non-fungible—was the introduction of the Ordinals mechanism.

In particular, this creative process has played a significant role in the development of BRC-20 tokens, which are a class of fungible token with characteristics similar to those of Ethereum’s ERC-20 standard.

Like BRC-20s, fungible tokens are interchangeable and frequently linked to simpler use cases, such as enabling different decentralized applications and transaction processing.

Trading in Ordinals decreased significantly in October after reaching a peak in the preceding month, but it increased again once Binance declared it will list ORDI.

The Ordinals Inscription Service, which Binance Pool introduced in August, makes it simpler for users to engrave extra data on the Bitcoin blockchain.

Meanwhile, in the event that investors perceive the saturation and sell in order to book profits, the price of ORDI is expected to find some support at $60.

Since the meme coin is now tracking the price movement of Bitcoin, eventually the rise in BTC will halt, which would prompt additional selling by investors seeking to validate their gains.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

In a fiery declaration that reverberated through the financial landscape, JPMorgan Chase’s formidable CEO, Jamie Dimon, once again launched a verbal assault on crypto.

Dimon, well-known for speaking his mind, straightforwardly called for a complete ban on digital currencies, linking them to criminal activities without holding back.

The CEO didn’t mince words at a Senate hearing alongside seven other big bank bosses:

“If I was the government, I’d close it down.”

In response to a question from Senator Elizabeth Warren, he stated that he was adamantly against all forms of crypto, including bitcoin.

Dimon expressed worries that terrorists, drug dealers, and rogue states would use them as a means of finance and declared he would shut it down if he were in charge.

Even though Dimon’s bank is deeply engaged in blockchain—the technology that powers the $1.6 trillion cryptocurrency industry—his comments are the most recent assault against the industry.

In earlier remarks, Dimon referred to bitcoin as “a hyped-up scam,” a term he subsequently withdrew. In addition, he had compared it to a “pet rock.”

In spite of his subsequent admissions of remorse, he continued to use the term “decentralized Ponzi scheme” to describe bitcoin and other digital currencies following his previous tirades.

Dimon and other banking leaders, including Brian Moynihan of Bank of America Corp., have asserted that their institutions have measures to stop terrorists and other criminals from utilizing them.

In contrast, Warren advocated for the extension of anti-money-laundering regulations that banks presently enforce to digital assets, specifically the cryptocurrency market. Every single CEO expressed agreement.

According to sources, JPMorgan completed its first blockchain-based collateral resolution as recently as October in a deal with BlackRock and Barclays.

With its JPM Coin, a proprietary stablecoin that enables users to execute blockchain-based payments, JPMorgan was a pioneer in this space.

JPMorgan said in the next two years, the token may handle up to $10 billion in daily transactions, up from its current level of about $1 billion.

The price of bitcoin, the biggest cryptocurrency in the world in terms of market valuation, has increased by more than 150% this year to about $44,000-plus, according to market tracker CoinMarketCap, despite calls for a government clampdown.

Warren took advantage of the session to criticize the cryptocurrency sector by collaborating with Republicans and prominent bankers.

Naturally, Dimon does not have the power of a government and cannot independently initiate the ban of cryptocurrencies.

Being the leader of a private financial company, he may only make suggestions and voice opinions; he cannot implement significant policy changes.

Nevertheless, it demonstrated an unusual convergence of interests between the crypto industry and the senator from Massachusetts, a long-time enemy of banks, who claimed that cryptocurrency was supporting illegal transactions.

The price of bitcoin, the biggest and most popular cryptocurrency in the world, has increased by more than 150% this year and crossed the $44,000 barrier on Wednesday, according to the most recent market data, despite calls for a government shut down.

Featured image from Ting Shen/Bloomberg via Getty Images

Short sellers have lost more than $6 billion trying to bet against crypto stocks in 2023.

Bitcoin price started a strong increase above the $42,000 zone. BTC is now consolidating gains and might rally further toward the $45,000 zone.

Bitcoin price started a major increase above the $42,000 resistance zone. BTC surged and even broke the $43,200 resistance zone. A new multi-month high was formed near $44,465 before the price started a minor downside correction.

There was a move below the $44,000 level. The price tested the 23.6% Fib retracement level of the upward move from the $39,475 swing low to the $44,465 high. However, the bulls remained active above the $43,200 support zone.

Bitcoin also trades above $43,500 and the 100 hourly Simple moving average. Besides, there are two bullish trend lines forming with support near $43,900 and $42,000 on the hourly chart of the BTC/USD pair. The second trend line is close to the 61.8% Fib retracement level of the upward move from the $39,475 swing low to the $44,465 high.

On the upside, immediate resistance is near the $44,250 level. The first major resistance is forming near $44,450, above which the price might rally toward the $45,000 level.

Source: BTCUSD on TradingView.com

A close above the $45,000 resistance might send the price further higher. The next key resistance could be near $46,200, above which BTC could rise toward the $47,500 level.

If Bitcoin fails to rise above the $44,250 resistance zone, it could start a downside correction. Immediate support on the downside is near the $43,900 level and the trend line.

The next major support is near $42,550, below which the price might test the second trend line. If there is a move below $42,000, there is a risk of more downsides. In the stated case, the price could drop toward the $41,200 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $43,900, followed by $42,000.

Major Resistance Levels – $44,250, $44,450, and $45,000.

As the eagerly awaited Bitcoin (BTC) exchange-traded fund (ETF) verdict approaches, excitement and anticipation continue to grow in the cryptocurrency market.

According to a report by K33 Research, the upcoming decision, expected between January 8 and January 10, has been a significant factor behind Bitcoin’s positive momentum since October. Institutional demand remains robust, with traditional investors strongly interested in adding long BTC exposure.

Bitcoin has displayed a notable tendency to surge higher in the lead-up to major events, creating a sense of enthusiasm and driving prices upward. This phenomenon has been observed across various significant milestones in the cryptocurrency’s history.

According to the report, examples include Bitcoin’s peak coinciding with the launch of the Chicago Mercantile Exchange’s (CME) BTC futures in 2017, its spike coinciding with Coinbase’s public listing in April 2021, and its peak on the day El Salvador declared Bitcoin legal tender in September 2021.

Similarly, Bitcoin reached its peak on the date of VanEck’s spot ETF deadline in November 2021. These instances highlight the potential for Bitcoin to experience significant price movements as the ETF verdict draws near.

The report emphasizes the substantial demand from institutional investors seeking exposure to Bitcoin. BTC exchange-traded products (ETPs) witnessed inflows of nearly 40,000 BTC in November, while CME open interest reached and maintained all-time highs. Futures premiums have also surged to 20%, indicating the strong interest from institutional players.

In contrast, retail participation has shown signs of stagnation. Offshore flows have remained shallow, and Bitcoin-denominated open interest in BTC perpetual contracts is currently at yearly lows. These factors suggest that institutional flows continue to be the driving force behind Bitcoin’s solid market strength.

Based on the historical pattern of event-driven price movements and the sustained institutional demand, the report maintains a positive outlook for Bitcoin in December.

As the ETF verdict approaches, K33 Research’s report suggests that the narrowing time window is expected to fuel enthusiasm and drive prices higher. However, it is worth noting that once the event occurs, prices may experience a temporary surge before potentially stabilizing, according to the report.

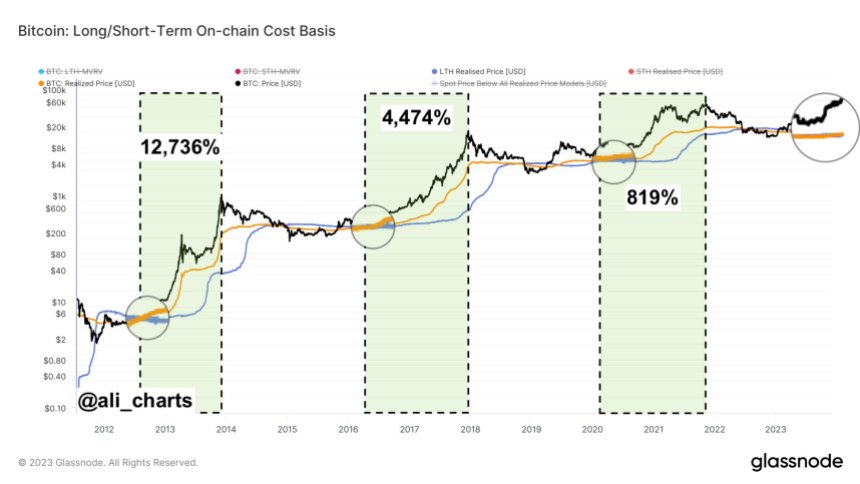

Renowned crypto analyst Ali Martinez has identified a significant development in the Bitcoin market that suggests a bullish outlook for the cryptocurrency.

According to Martinez, the Realized Price of Bitcoin has surpassed the Long-Term Holder Realized Price, signaling an increase in market momentum and attracting new investors willing to purchase Bitcoin at higher prices.

Martinez’s analysis highlights that similar occurrences in the past have preceded substantial price surges, further fueling optimism regarding Bitcoin’s future performance.

The Realized Price of Bitcoin refers to the average price at which all previously transacted coins were acquired. It considers the price at which each Bitcoin unit was last moved on the blockchain.

On the other hand, the Long-Term Holder Realized Price focuses specifically on coins held by long-term investors, providing insights into their average acquisition price. When the Realized Price surpasses the Long-Term Holder’s Realized Price, it suggests that newer investors are entering the market and are willing to buy Bitcoin at higher valuations.

As seen in the above chart, Bitcoin experienced significant gains following this bullish signal on three separate occasions in the past. Specifically, the cryptocurrency surged 12,736%, 4,474%, and 819%, respectively, following similar events.

In addition to Martinez’s bullish outlook for BTC, the largest cryptocurrency on the market has demonstrated relatively stable price action above $44,000 in the past hour.

This stability increases the potential for continued upside and consolidation above key levels, positioning Bitcoin for further gains and surges in the future. It remains to be seen if the cryptocurrency will see any corrections following its impressive 16% surge over the past few days.

Featured image from Shutterstock, chart from TradingView.com

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Dec 7-Dec. 13, with live updates throughout.

The recent Bitcoin rally has brought a number of things to the forefront and one of those is a bullish Bitcoin fractal that has not returned in two years. Crypto analyst FieryTrading was the one to point this out in a recent analysis of the leading cryptocurrency as something that could serve as evidence that the rally will continue.

The crypto analyst pointed to a previously identified channel in the Bitcoin price that could suggest a bullish continuation. This channel often results after a big pump and given that BTC has added around $15,000 to its price in the space of a month, it doesn’t get bigger than this. As a result of this, the channel has returned, suggesting that the BTC price could stick to this historical fractal.

FieryTrading identified that the fractal had appeared back in 2019 when the price jumped from around $4,100 to $5,800. After this, the fractal had completed the move, causing the BTC price to rise above the $6,800 level.

Then again in 2020, the fractal would reappear after the BTC price rose from around $11,000 and ended around $14,200. And just like in 2019, when the fractal was confirmed, it saw a continuation of the bullish rally which pushed the Bitcoin price above $16,000.

Most recently, after Bitcoin’s price rose from $28,000 to $41,000, the fractal has reappeared once more. “The pattern that I’m talking about is a bullish channel after a big pump that results in another big pump,” FieryTrading explains.

Following the previous performances of the Bitcoin price whenever this fractal has appeared, it suggests that there is still a lot of runway for the current rally. The crypto analyst used this historical performance to map out a likely path for the crypto’s price, putting the top of the fractal at $48,000.

“Seeing how the market historically behaved, I made the assumption that BTC would follow this fractal and break out of the channel in the near future. One week later, and BTC has successfully broken out of the channel, as predicted by this fractal analysis,” FieryTrading stated. “As described in my analysis below, I’m currently looking at 48k as the next target. Seeing how these fractals historically behaved, 48k should be fairly easily reached?”

If this fractal does play out the way the analyst expects, then the BTC price can be expected to add another $6,000 to its value from here before the recovery trend ends. This means that the leading crypto might see another 10% jump from its current price.

According to @RiggsBTC on X, Bitcoin (BTC) is poised for an “unprecedented” surge that could lift it to above $9 million in the next two years. Taking to X on December 6, @RiggsBTC asserted that the current Bitcoin bull run, which began in late 2022 when prices dumped to as low as $15,000, marks the start of a “supercycle,” a period where BTC will aggressively rally, extending gains.

The asset manager attributes this potential upsurge to multiple factors. Top of the list is the looming supply shock, considering the expected Bitcoin halving scheduled for early April 2021. @RiggsBTC noted that with less than 21 million BTC in circulation, reducing supply and sustained demand could support Bitcoin, feeding aggressive bulls.

To contextualize the potential magnitude of this expected growth, @RiggsBTC estimates that only if 5% of global wealth, conservatively estimated at over $1 quadrillion, translating to $50 trillion, get exposure to the limited BTC in circulation, there will be more upsides.

From the analyst’s view, there will only be around 5 million BTC, most of which are from “weak hands” selling to “nation-states and institutions.” This shift will be the basis for a leg up that will see Bitcoin reach $9 million “in 24 months.”

Pierre Rochard, the VP of Research at Riot Platforms, echoed @RiggsBTC’s sentiment, highlighting the favorable macroeconomic conditions likely to propel Bitcoin even higher. Rochard notes that the U.S. government spends $6 trillion, encompassing $4 trillion in taxes, $2 trillion in borrowing, and $1 trillion in interest payments on its $33 trillion debt.

While the government spends huge sums of money on interest payments alone, Bitcoin’s market capitalization remains under $1 trillion. According to CoinMarketCap, BTC had a market cap of $860 billion when writing on December 6.

Beyond the Bitcoin halving event and supportive macroeconomic factors, the community is also looking at regulators. In early December 2023, the crypto community expects the United States Securities and Exchange Commission (SEC) to approve the first batch of spot Bitcoin ETFs.

This product will provide institutional investors an avenue to get exposure to Bitcoin in a regulated environment, potentially unleashing a wave of capital. Since October, the expectations of a spot Bitcoin ETF in the United States have propped prices.

Even so, how the market will react once the SEC authorizes this derivative is yet to be seen. In the past, the approval of key crypto derivatives products, for instance, the first Bitcoin Futures product in the United States in December 2018, marked cyclic peaks. Afterward, prices tanked, dropping from $20,000.