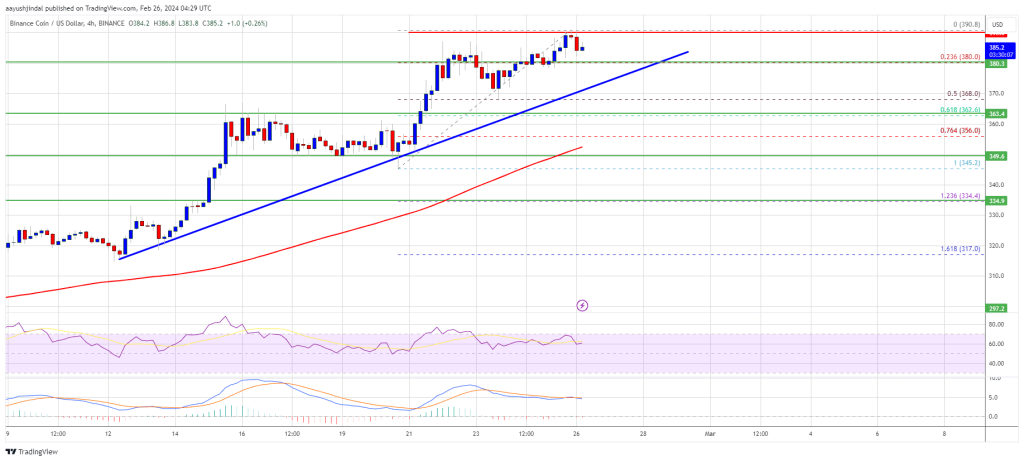

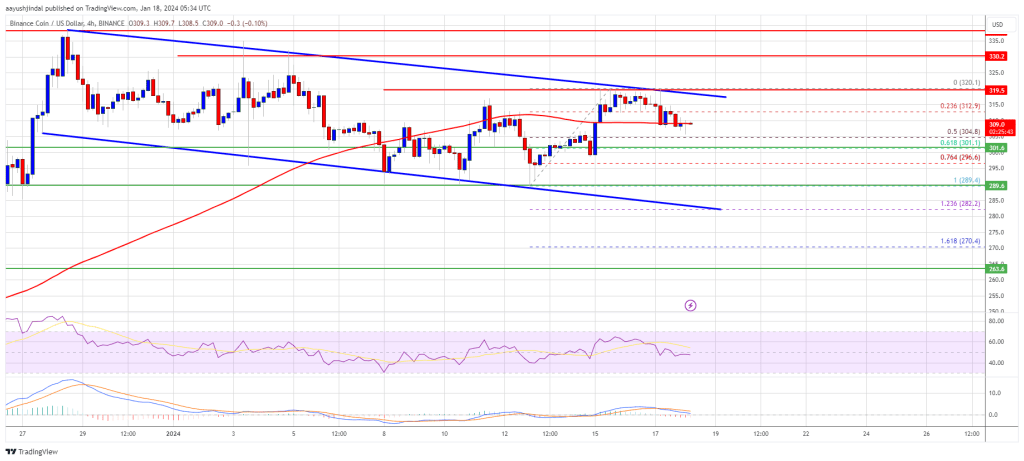

BNB price is gaining bullish momentum above the $350 resistance. The price looks set for more gains above the $400 resistance in the near term.

- BNB price is showing bullish signs above the $365 resistance level.

- The price is now trading above $375 and the 100 simple moving average (4 hours).

- There is a key bullish trend line forming with support at $380 on the 4-hour chart of the BNB/USD pair (data source from Binance).

- The pair could continue to rise toward the $400 resistance zone or even $422.

BNB Price Extends Increase

In the last BNB price prediction, we discussed the chances of more gains above the $365 resistance zone. The bulls did remain active and were able to push the price above the $375 level.

BNB outperformed Bitcoin and Ethereum with a move above the $380 resistance. A high was formed near $390 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $345 swing low to the $390 high.

The price is now trading above $375 and the 100 simple moving average (4 hours). There is also a key bullish trend line forming with support at $380 on the 4-hour chart of the BNB/USD pair.

Source: BNBUSD on TradingView.com

Immediate resistance is near the $390 level. The next resistance sits near the $392 level. A clear move above the $392 zone could send the price further higher. In the stated case, BNB price could test $400. A close above the $400 resistance might set the pace for a larger increase toward the $422 resistance. Any more gains might call for a test of the $500 level in the coming weeks.

Dips Supported?

If BNB fails to clear the $390 resistance, it could start a downside correction. Initial support on the downside is near the $380 level and the trend line.

The next major support is near the $362 level or the 61.8% Fib retracement level of the upward move from the $345 swing low to the $390 high. The main support sits at $350. If there is a downside break below the $350 support, the price could drop toward the $335 support. Any more losses could initiate a larger decline toward the $315 level.

Technical Indicators

4-Hours MACD – The MACD for BNB/USD is gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major Support Levels – $380, $362, and $350.

Major Resistance Levels – $390, $400, and $422.