In a recent report by Messari, the analysis sheds light on the developments and challenges faced by Binance Chain (BNB), the blockchain created by Binance, the world’s largest cryptocurrency exchange regarding trading volume.

The report highlights the separation of BNB Chain from Binance and various events and allegations that have impacted Binance and its associated entities throughout the third quarter of 2023.

Binance Chain Separation And Challenges

The Messari report emphasizes that BNB Chain has distinguished itself as an independent entity separate from Binance despite its origins as a product of the largest centralized cryptocurrency exchange. However, the market has not fully recognized this separation, leading to a lack of distinction between BNB Chain and Binance.

During the third quarter, Binance encountered numerous challenges, including losing partnerships, shutting down lines of business, conducting layoffs, and facing accusations of violating sanctions.

These events coincided with a downward pressure on the value of BNB, which experienced a 25% decline compared to the previous quarter. In contrast, the cryptocurrency market dropped by 9% during the same period.

The Messari report mentions that Binance, including its subsidiary Binance.US, was accused by the Securities and Exchange Commission (SEC) of engaging in unregistered offers and sales of “crypto securities”, including BNB.

These allegations further added to the challenges faced by Binance and its associated entities during the third quarter.

BNB Chain Performance And On-chain Activity

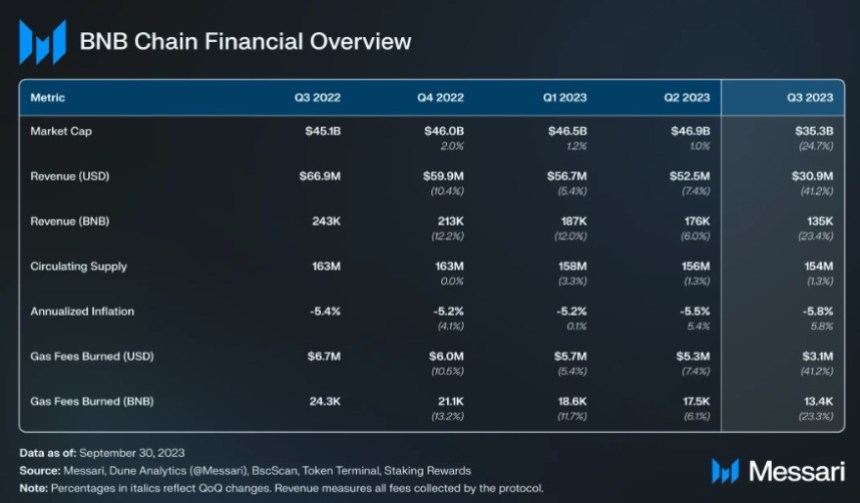

Despite the challenges, BNB maintained its position as the fourth-largest cryptocurrency by market capitalization, with a market cap of $35.3 billion. The circulating supply of BNB decreased by 1.3% in the third quarter due to the token-burning mechanism employed by BNB Chain.

The report also highlights the impact of adverse events on BNB Chain’s on-chain activity. BNB Smart Chain’s revenue, measured in BNB, fell in line with the decline in BNB’s market cap, indicating a decrease in activity on the Binance Smart Chain (BSC). Daily transactions (-14%) and average fees (-12) in BNB also experienced declines during this period.

BNB Chain offers staking opportunities for cryptocurrencies such as Ethereum (ETH), BNB, Cardano (ADA), and others. The report notes that the total stake and eligible supply declined by 3% and 2%, respectively, while the average annualized staking yield decreased from 2.6% to 2.1% during the third quarter.

The DeFi sector on the BNB Chain demonstrated strength compared to other sectors. The NFT space experienced increased secondary sales volume, unique buyers, and sellers.

However, stablecoin transfers and GameFi experienced declines in volume. The report suggests that newer applications on BSC may have influenced the growth of unique buyers and sellers in the NFT sector.

Ultimately, the Messari report provides insights into the separation of BNB Chain from Binance and the challenges faced by Binance and its associated entities during the third quarter of 2023.

Despite these challenges, BNB Chain maintained its market capitalization and continued to launch new products and implement technical upgrades. The report highlights the need for market recognition of the separation between BNB Chain and Binance and the impact of adverse events on BNB Chain’s on-chain activity.

On the other hand, BNB has experienced a prolonged downtrend since reaching its annual peak of $350 in April. Subsequently, the token plummeted to $202 on October 9.

However, recent developments have resulted in a positive trend, with BNB recording a profit of 5.2% in the past 14 days and 1.8% in the last 30 days. As a result, the current trading price of BNB stands at $223.

Featured image from Shutterstock, chart from TradingView.com