Binance’s BNB token has struggled to keep gains amidst a bearish-looking crypto market. The 4th largest crypto by market cap has kept over 15% profit in the last 7 days. This comes when other top tokens, including Bitcoin, struggle to trade in the green zone.

As of writing, BNB has also recorded quite a fair amount of gains against Bitcoin and Ethereum. Specifically, the token has garnered around 5.02% over BTC and 5.71% over Ethereum. The coin is also on its way to retouching its 24-hour high of $340 as it trades at $336, press time.

BNB has all the ingredients to start a bullish run this November. The 7-day surge resulted from Binance’s involvement in the acquisition of Twitter by Elon Musk. CZ, the founder of Binance, has now hinted at BNB as a payment method on the social media platform.

Binance Launches Blue Bird Index, Potentially Hinting At Twitter Payment Options

On November 2nd, a blog post announced that Binance Futures would begin trading USDS-M Binance Bluebird Index perpetual contracts (BLUEBIRDUSDT Perpetual Contracts). Binance intends to provide leverage of up to 25x on perpetual contracts. The new price index monitors BNB, DOGE, and MASK. Binance generates the index using weighted averages of the component tokens’ real-time values on the Binance Spot, denominated in USDT.

Miles Deutscher, a crypto expert, wonders if Binance CEO “CZ” hinted at the crypto assets that could be used to pay on Twitter. If Elon Musk implements Dogecoin as a payment option on Twitter, then Binance may look at adding BNB support there. He said,

CZ invests $500m to help Elon Musk buy Twitter. Then Binance launches a “Bluebird Index” comprising of BNB, DOGE, and MASK. Is CZ hinting at these assets being used for Twitter payments (blue bird)?

When asked about just supporting one cryptocurrency on Twitter, Binance CEO “CZ” said it wasn’t a good idea in yesterday’s AMA. Besides DOGE and BNB, CZ believes Elon Musk could endorse other cryptocurrencies on Twitter. More than that, he thinks Musk is studying Twitter following the purchase. It’s also possible that Twitter’s support for cryptocurrencies as payment may be rolled out gradually.

BNB Making Bullish Moves

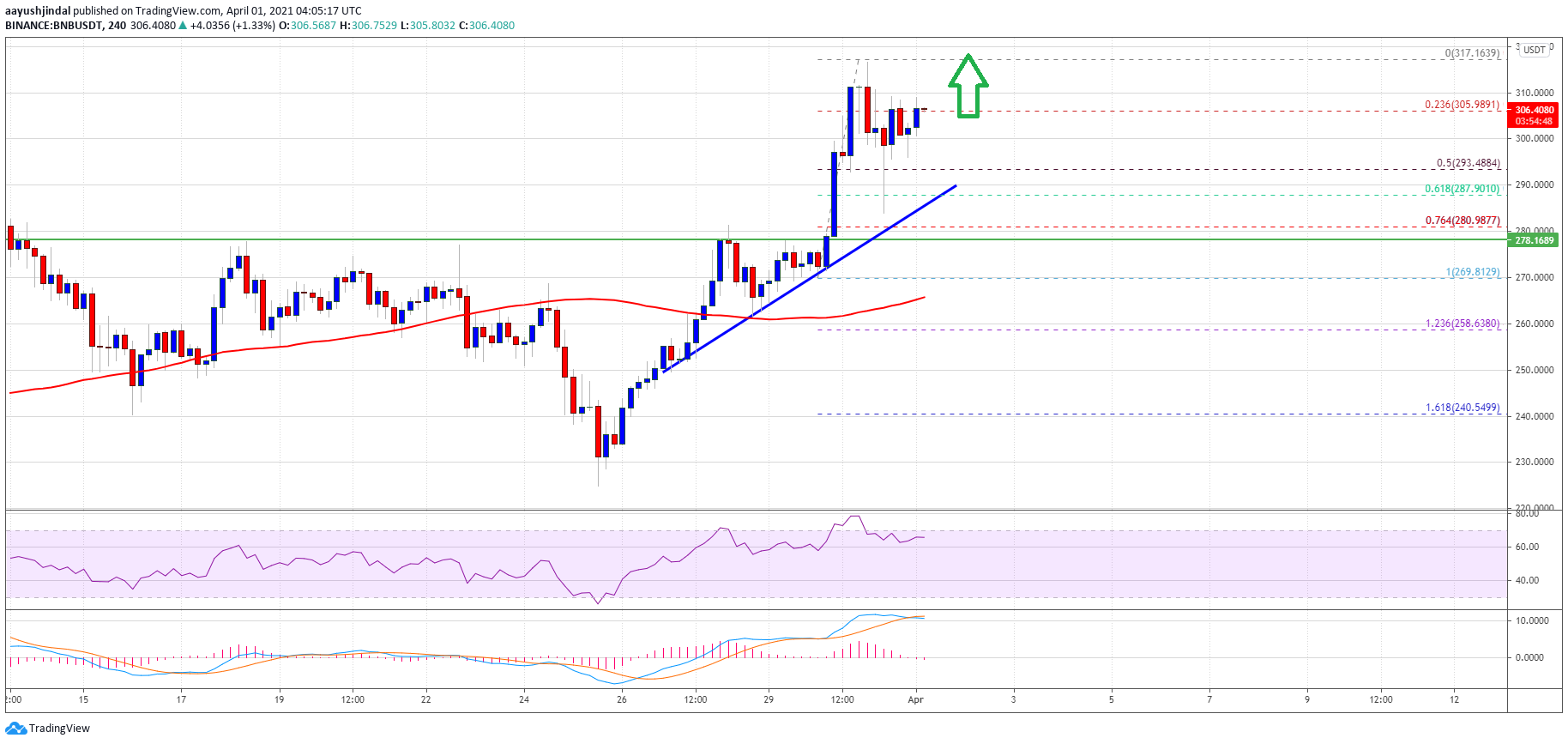

The price of BNB has remained bullish since June. However, it broke down in September after being rejected by the crucial resistance level of $332. For the past six months, this price threshold has remained unbroken—until this October.

Last week’s last-minute crypto market surge pushed the token past the resistance before settling at today’s price of $325. Investors could sell their shares if the price exceeds $332 again since the multi-month breakthrough would form a new local top.

BNB might find it challenging to advance higher if it encounters resistance in the $335 to $357 zone. If the alternative currency fails to break through, it will likely drop to a level of support, around $299. And with any additional decline, BNB would be forced to retest $259, a crucial support level. Scalpers can make a few dollars here. However, long-term investors should sit tight until the resistance level is broken.

Featured image from Pixabay and chart from TradingView.com