In a significant development for the crypto industry, Changpeng Zhao, commonly known as CZ, the founder of Binance, the world’s largest cryptocurrency exchange, has been imprisoned for four months.

The sentencing follows his guilty plea to charges related to enabling money laundering activities within his crypto exchange. The verdict was delivered in Seattle federal court and marks the culmination of US authorities’ multiyear investigation into Binance.

Lighter Sentence For Binance Founder

The sentence handed down to Zhao was notably less severe than the three-year prison term sought by federal prosecutors. In contrast, the defense had requested five months of probation, ultimately given the outcome wanted.

Under the terms of a settlement reached in November of 2023, Zhao agreed to step down as CEO of Binance, as part of an agreement to resolve the investigation.

The probe primarily focused on allegations that Binance failed to implement an effective anti-money laundering program, as the Bank Secrecy Act required.

Regulatory Pressure Mounts

Zhao was also accused of knowingly allowing Binance to process transactions involving funds derived from unlawful activities, including transactions between US citizens and individuals residing in sanctioned jurisdictions.

As part of the resolution, Binance was ordered to pay an imposing $4.3 billion fines and forfeiture. Additionally, Changpeng Zhao personally agreed to pay a substantial $50 million fine, underscoring the severity of the charges and the commitment to accountability.

The legal challenges for Binance do not end there. The company faces separate lawsuits from the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) for alleged mishandling of customer assets and operating an illegal, unregistered exchange within the United States.

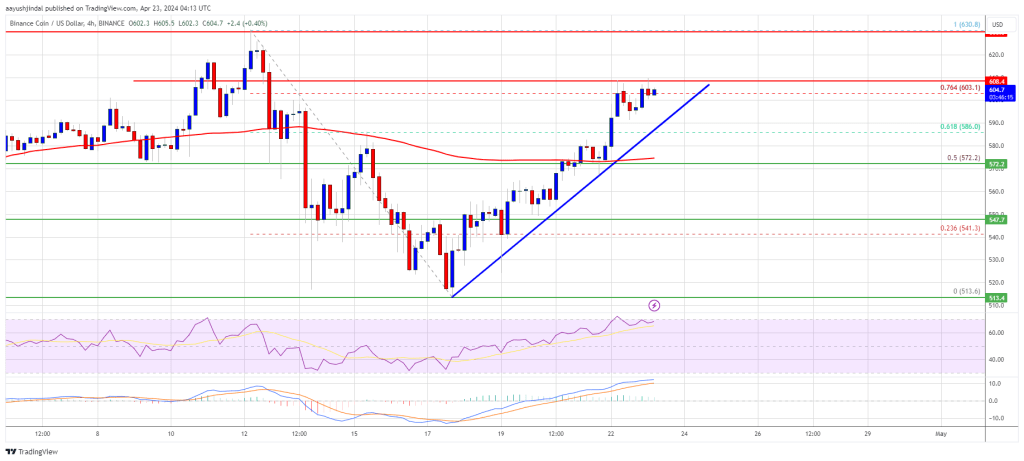

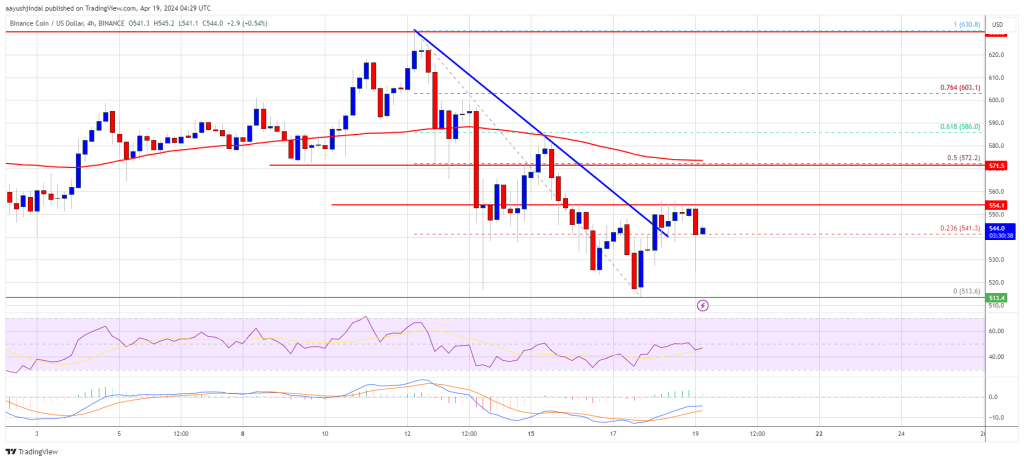

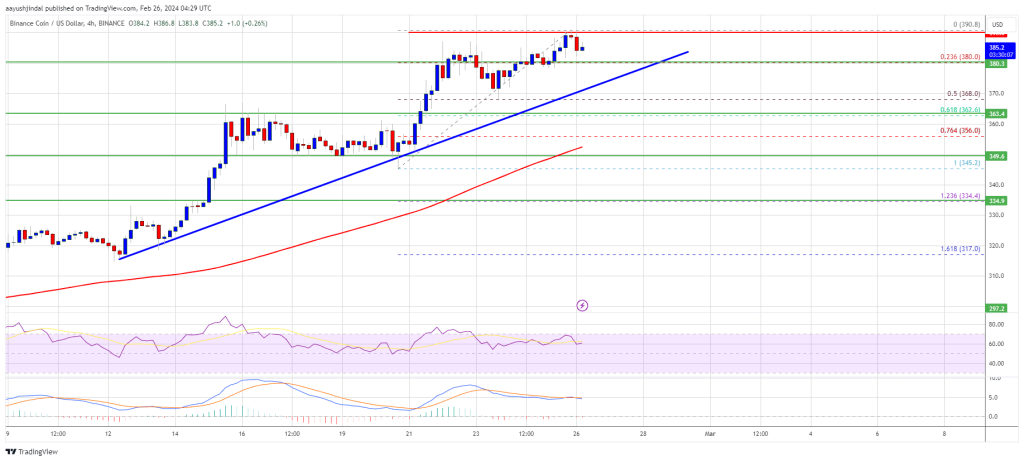

As of this writing, the exchange’s native token, Binance Coin (BNB), is trading at $573, down over 3% in the last 24 hours and 7% in the last seven days.

Featured image from Bloomberg, chart from TradingView.com