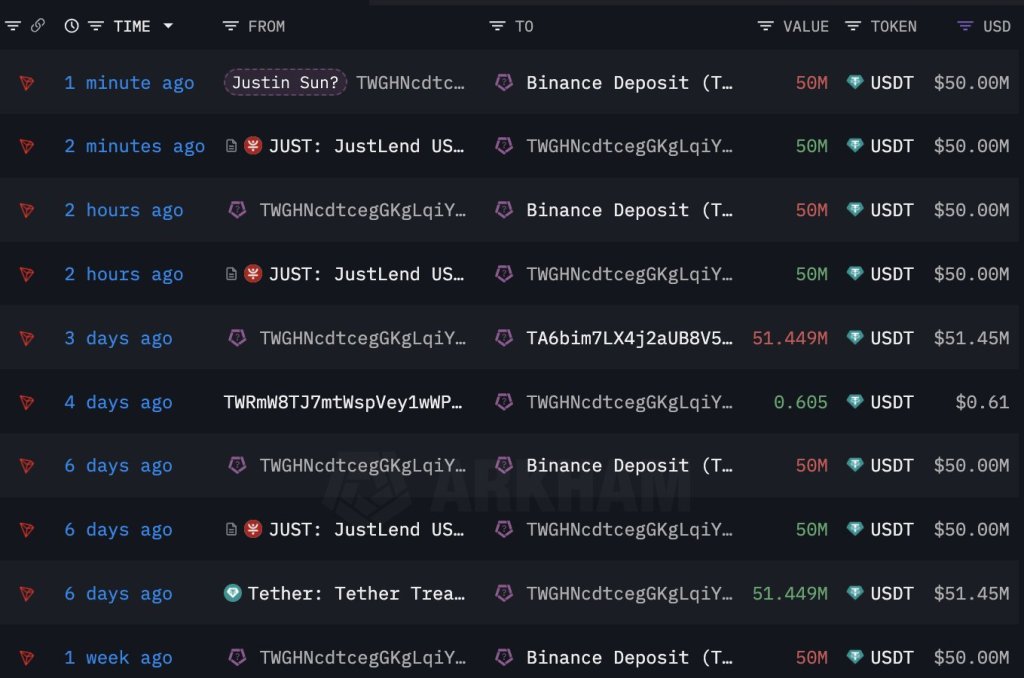

The demand for spot Bitcoin exchange-traded funds (ETFs) has surged since their recent approval on January 10, with BlackRock’s IBIT Bitcoin ETF leading the way. This ETF has reached impressive milestones in less than two months, attracting significant investor interest and opening doors for various market participants to invest in the largest cryptocurrency directly.

As institutional and retail investors flock to these new investment vehicles, market experts predict a bullish trend and anticipate a potential price surge.

Bitcoin ETF Frenzy

According to Bloomberg ETF expert Eric Balchunas, BlackRock’s IBIT Bitcoin ETF has quickly joined the esteemed “$10 billion club,” reaching the milestone faster than any other ETF, including Grayscale’s Bitcoin Trust (GBTC), noting that only 152 ETFs out of 3,400 have crossed the threshold.

Balchunas notes that IBIT’s ascent to this club was primarily driven by significant inflows, which accounted for 78% of its assets under management (AUM). This reflects the growing appetite for Bitcoin exposure among investors seeking diversified and regulated investment options.

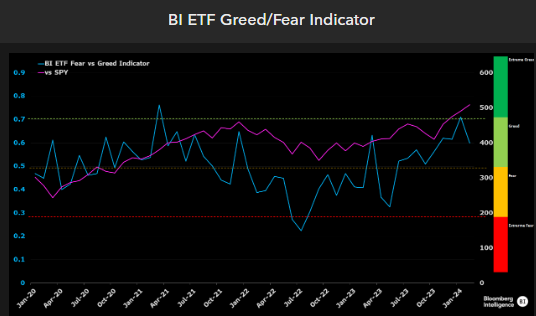

In particular, the current trajectory of the ETF market paints a picture of resilience and bullish sentiment in the market. Equity ETF flows, and leveraged trading levels are positive indicators, although they have not yet reached the euphoria seen in 2021, Balchunas notes.

However, Bloomberg’s new BI ETF Greed/Fear Indicator, which incorporates various inputs, highlights the optimistic outlook shared by ETF investors, as seen in the chart below.

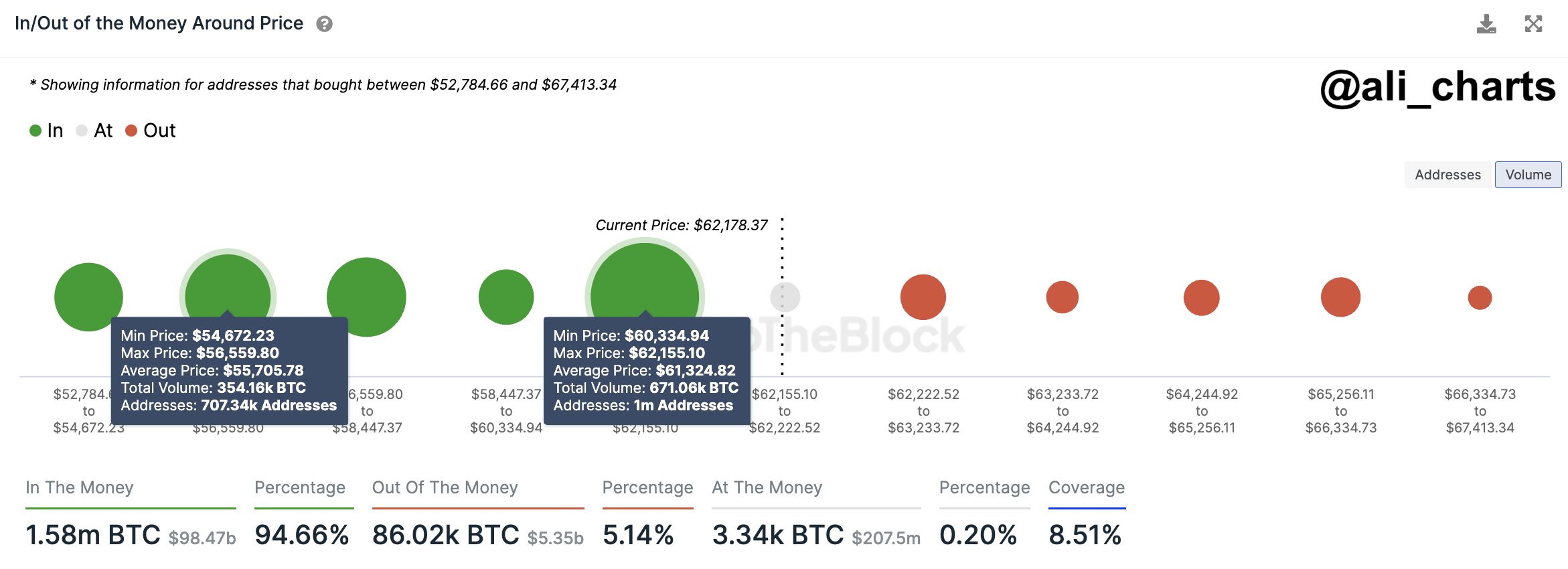

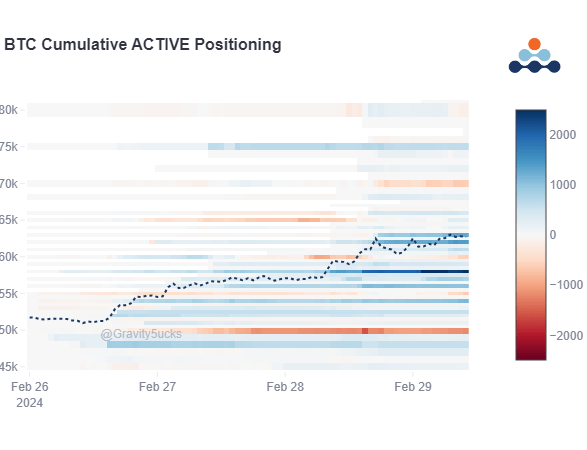

On this matter, crypto analyst “On-Chain College” went to social media X (formerly Twitter) to emphasize the significant demand for Bitcoin as evidenced by its rapid departure from exchanges.

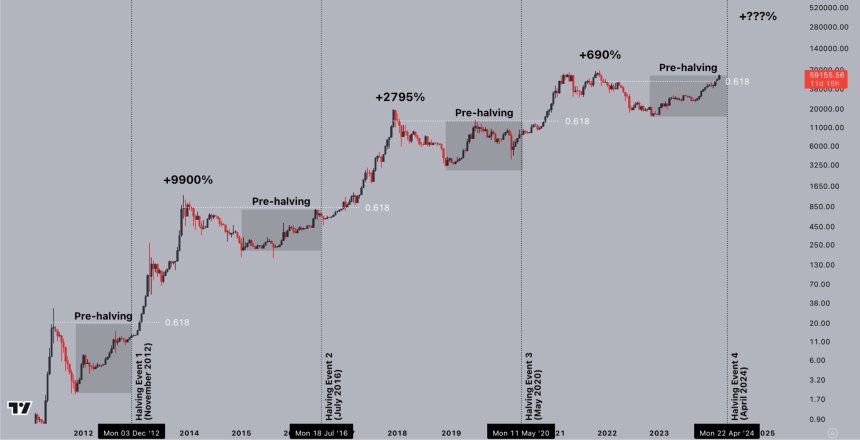

In its analysis, On-Chain College highlights that Bitcoin ETFs buy approximately ten times the daily amount of BTC mined. At the same time, the upcoming halving event will further reduce the mining supply. The analyst predicts when demand will exceed available supply, leading to potential upward price pressure.

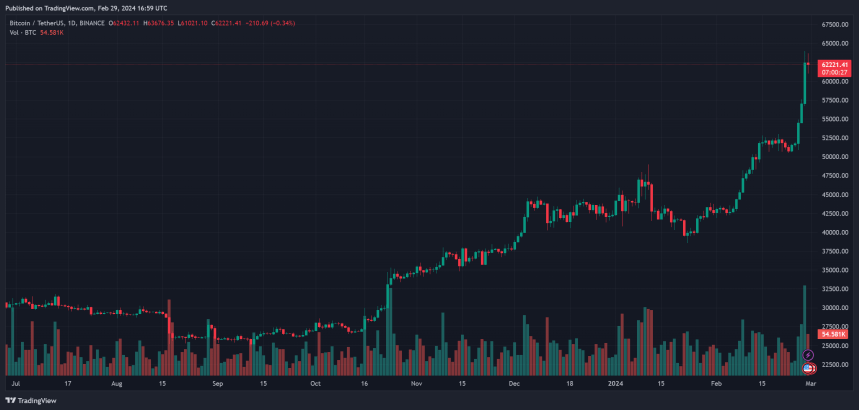

Highest Monthly Close Since 2021

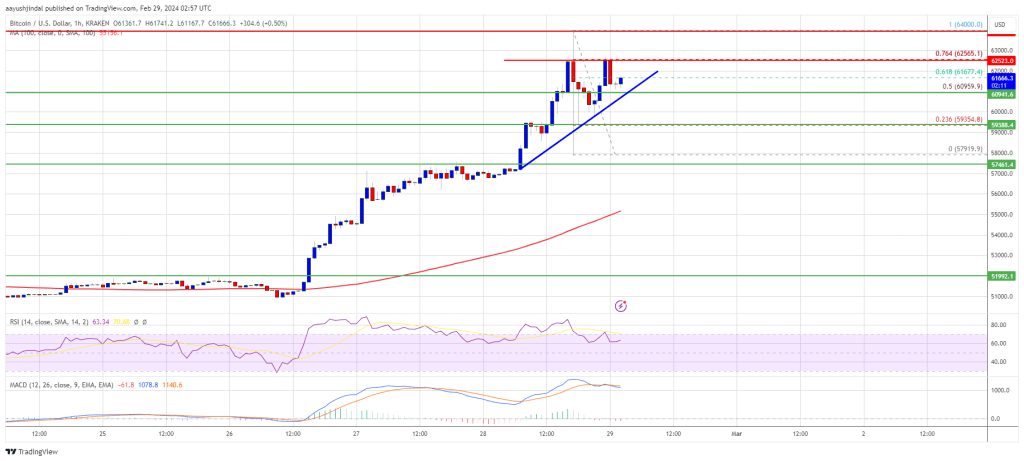

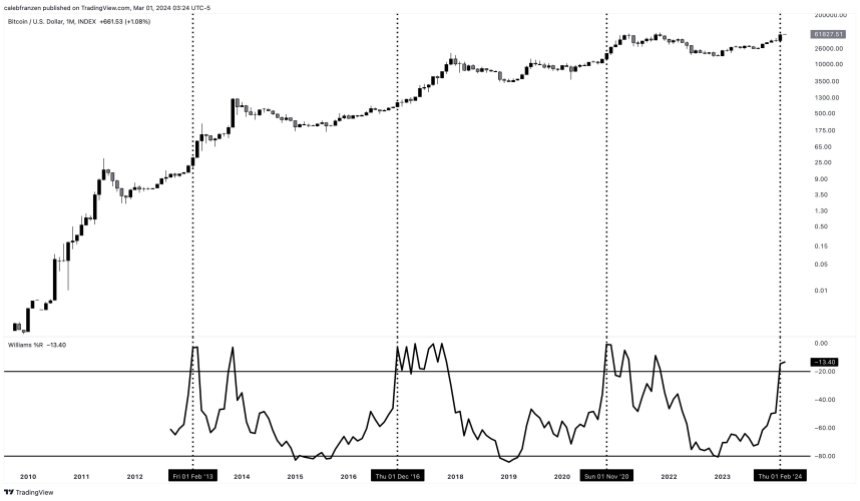

Bitcoin’s recent market performance has caught the attention of wealth manager Caleb Franzen, who highlights the significance of the highest monthly close since October 2021.

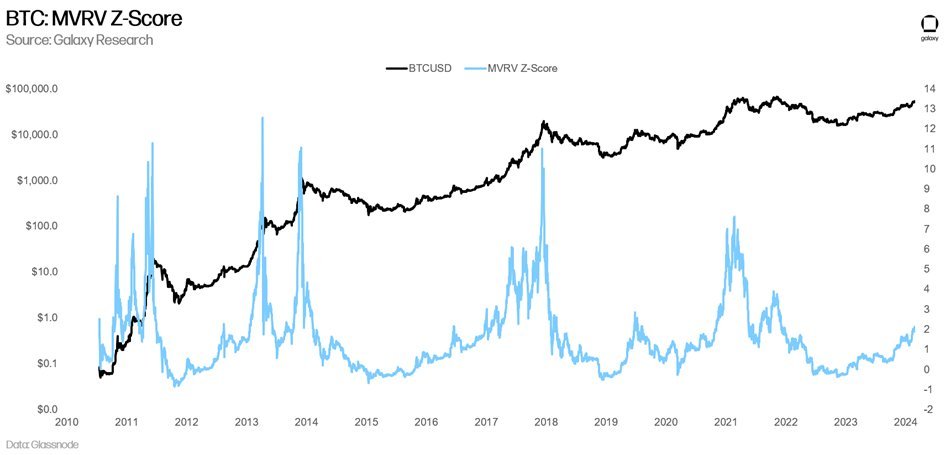

Franzen further emphasizes the bullish momentum by pointing out that the 36-month Williams%R Oscillator has closed above the overbought level for only the fourth time in history. Historical data reveals impressive returns following such signals, indicating the potential for substantial gains in the coming months.

Additionally, Franzen notes the changing dynamics of the market, with increased institutional participation and the ease of retail onboarding through ETFs.

Franzen presents a compelling case for the bullish nature of overbought signals, urging market participants to view them as momentum indicators rather than signals to fade. Previous instances of overbought signals have resulted in significant Bitcoin price appreciation:

- February 2013: +3,900% in 9 months

- December 2016: +1,900% in 12 months

- November 2020: +260% in 12 months

While acknowledging diminishing returns in each cycle, Franzen highlights the unprecedented level of institutional participation and the ease of retail access through ETFs.

Even if Bitcoin were to match the +260% gain from the November 2020 signal, it would reach a price of $180,000, surpassing Franzen’s minimum cycle target of $175,000.

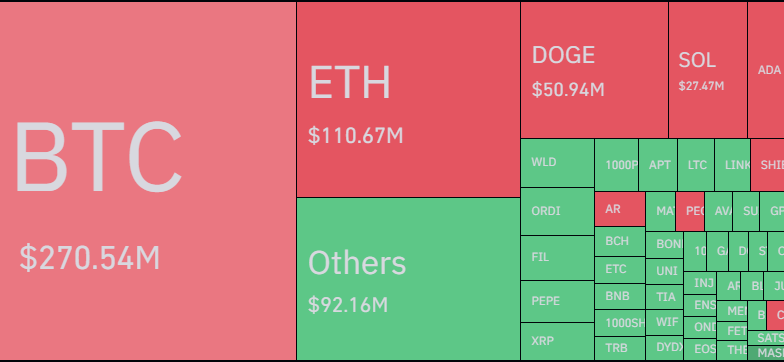

Ultimately, Franzen notes that bull markets are typically characterized by a rising ETHBTC ratio and a falling BTC.D (Bitcoin dominance). While these characteristics have yet to manifest fully, Franzen suggests that a multi-quarter rally in the broader cryptocurrency market may be on the horizon.

Featured image from Shutterstock, chart from TradingView.com