Bitcoin’s recovery from its recent lows and the stellar performance from altcoins signal that bulls are confident BTC will retest its all-time high.

Cryptocurrency Financial News

Bitcoin’s recovery from its recent lows and the stellar performance from altcoins signal that bulls are confident BTC will retest its all-time high.

Cardano Founder Charles Hoskinson has announced the formation of an internal action force aimed at countering scammers. This comes as a report from fraud prevention firm Bolster showed cryptocurrency scams almost doubled in 2020.

“One of the things we’ve been thinking about is setting up some sort of dedicated body in the Cardano ecosystem that does nothing but builds tools to help people report scams and propagate the knowledge that a scam has occurred.”

Last month, a frustrated Hoskinson hosted a live stream in which he warned the Cardano community of giveaway scams. He reiterated the point, one made many times before, that he nor Cardano will ever giveaway ADA.

“If you fall for this, you will lose your ADA, these are criminals, these are scammers, these are people who are trying to steal from you. Use common f*cking sense. You don’t get something for free. You don’t get something for nothing.”

Cardano is now taking an active role in combating the fraudsters with the newly formed anti-scam task force. Not only is it tasked with reporting and spreading awareness of scams, but Hoskinson also spoke about an investigative element to their operations as well.

“… do some targetted investigations into ventures that have entered into the Cardano space, that we feel may be fraudulent.”

Without going into specifics, Hoskinson said, following complaints raised by community members, the task force has investigated a fund suspected of fraud. Initial results indicate the fund in question may be a scam. However, he did not disclose the name of the fund at this time.

“We started conducting an investigation and the preliminary results indicate that that fund may actually be a scam. So in two weeks time, we’re going to release our first output of this internal working group.”

Fraudsters are flocking to crypto as markets continue booming. Research conducted by Bolster confirms that cryptocurrency fraud is on the rise. The firm points out that this is one of the most significant barriers to mainstream success.

Co-Founder and CTO of Bolster Shashi Prakash said crypto scams are the fastest-growing category of scams. He warned that this is just the start of a “new wave of digital theft campaigns.”

We continue to see scammers being opportunistic and designing campaigns focused on real-time, surging trends when people are likely not to be on guard because it’s so new.”

By analyzing 300 million websites, Bolster found more than 400,000 related to crypto scams over the last year. The firm predicts this figure will go up by 75% for this year.

Other key findings note that fake prizes, giveaways, or sweepstakes were the most prolific type of scam, with Bitcoin, Chainlink, and Ethereum being the top three most targetted tokens.

The Cardano anti-scam task force is a step in the right direction. However, as Hoskinson mentioned, it’s no substitute for common sense.

Source: ADAUSD on TradingView.com

Bitcoin’s renewed push above the descending channel trendline suggests bulls are preparing to push BTC and altcoins to new highs.

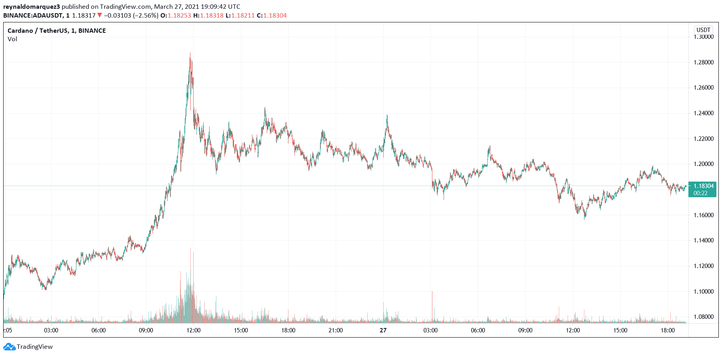

Cardano’s price recovered sharply from the $1.050 support zone. ADA is likely to continue higher if it clears the main $1.220 resistance zone in the near term.

After a steady decline, cardano’s price remained stable above $1.000. ADA price traded as low as $1.038 before it started an upside correction. There was a decent increase above the $1.080 and $1.110 resistance levels.

The price even surged above the $1.150 level and the 100 simple moving average (4-hours). The bulls pushed the price above the $1.220 resistance. A high was formed near $1.287 and the price is currently correcting lower.

There was a break below the $1.220 and $1.200 support levels. ADA even traded below the 23.6% Fib retracement level of the upward move from the $1.038 swing low to $1.287 high. It is now trading nicely above $1.165 and the 100 simple moving average (4-hours).

Source: ADAUSD on TradingView.com

It seems like there is a major support forming near $1.165. The 50% Fib retracement level of the upward move from the $1.038 swing low to $1.287 high is also near $1.165. Besides, there is a key bearish trend line forming with resistance near $1.218 on the 4-hours chart of the ADA/USD pair.

If there is an upside break above the $1.200 and $1.220 resistance levels, the price could start a strong increase. In the stated case, the price could rise steadily towards the $1.280 and $1.335 levels.

If cardano’s price fails to clear the $1.200 and $1.220 resistance levels, it could start a fresh decline. The key breakdown support is forming near the $1.165 and $1.150 levels.

A downside break below the $1.150 level could open the doors for a fresh decline towards $1.050. The next major support is near the $1.000 level.

Technical Indicators

4-hours MACD – The MACD for ADA/USD is slowly losing momentum in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for ADA/USD is now approaching the 50 level.

Major Support Levels – $1.165, $1.150 and $1.050.

Major Resistance Levels – $1.200, $1.220 and $1.280.

Following the Cardano 360 event, the platform developer Input Output Hong Kong (IOHK) has published a summary of the key points. In addition to showing a demo of a decentralized exchange like Uniswap running on Plutus, IOHK confirmed the date for “D-Day”.

Slated for March 31, Cardano’s developer announced that on this date they will hand over full control of block production to community stake pool operators. Therefore, the D-parameter, a metric that measures Cardano’s decentralization, will be reduced to 0. IOHK announced:

D-DAY CONFIRMED: Today, we have just successfully submitted an updated proposal to the #Cardano blockchain, handing over full responsibility for block production to the stake pool operator community on March 31st. This is what #Decentralization looks like. Onward!

Thus, embracing full decentralization. Cardano’s network has over 375,000 delegators and 2,350 registered pools. Cardano’s blockchain, migrated in 2020 to a consensus protocol based on Proof-of-Stake, is in its last epoch before the milestone. Cardano’s inventor Charles Hoskinson stated: “Been one hell of a journey”.

🚀Cardano’s decentralization journey: D=0 on 31 March, P2P rollout begins next

💪DevNets: 1,200+ developers onboard

✔️New IOG stake delegation: community call in early April

🧐LLVM smart contracts universality = more developers on #Cardano. Early version 6 months away 😲 2/5— Input Output (@InputOutputHK) March 27, 2021

In parallel, IOHK stated that more than 1,200 developers are creating applications for Cardano and expect an increase with the LLVM which will give “universality” to smart contracts deployed on this platform.

Plutus, the smart contract platform, is expected to be deployed on Cardano’s third Hard Fork Combinator event Alonzo. This will occur at some point in June, following Plutus testnet due to take place in the coming months. In addition, Silvu Petricescu and Gerard Moroney, Directors of Operations and Strategy at IOHK, reveal a partnership program:

Partner strategy is actually a key element of our broader strategy which is the differentiation strategy for Plutus. What we want to achieve is basically have these professional developers complement the work that the pioneer’s program is going to help us do and achieve. So we are going to fast-track our quality assurance and testing process towards the next Hard Fork.

According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) metric, an approximate 144,000 addresses bought 3.9 billion ADA at levels between $1.12 and $1.16. Therefore, ADA’s price presents a critical support level in that area.

Analyst John Isige predicts a 21% increase in ADA’s price to $1.35 if the cryptocurrency manages to validate by closing the gap in the referenced overbought zone. Isige stated:

The Relative Strength Index (RSI) reinforced the uptrend after recovering from the oversold region. Cardano’s momentum to $1.35 is bound to continue.

ADA trades at $1,18 with moderate losses in the 24-hour chart and sideways movement in the last hour. During the past weeks, ADA has followed the general market sentiment and present an 8.3% loss.

Bitcoin price bounced off the 50-day moving average but the real test is near $57,500 where the bears are likely to push back.

At yesterday’s Cardano 360 event, IOHK CEO Charles Hoskinson gave an update on the long-awaited Alonzo upgrade. Due to stress testing and exchange integration, Hoskinson expects a rollout in mid-August.

IOHK had previously penciled in a date of the end of March 2021 for this to happen. A five-month delay hasn’t gone down well with some sections of the community.

The Goguen phase is the great equalizer in terms of bringing smart contracts to Cardano. It was split into three development stages.

First was Allegra, which enabled token locking; this laid the foundation for smart contracts by bringing metadata functionality to record the specific purpose of tokens. Then there was Mary, which introduced the ability to create user-defined tokens. The final piece is Alonzo, which integrates the extended UTXO model with the Plutus smart contract language.

During Cardano 360, Hoskinson gave a timeline for Alonzo’s completion. He said this process requires integration into the ledger and node code, which is happening now through to April. At the same time, “alpha partners” will be running acceptance criteria and tests.

“What’s occurring right now, all throughout March and all throughout April is that integration into the node to get a CLI. As that integration is happening, partners are being brought in, and these are alpha partners, so they’re very close and deep in court of company.”

Once done, by the end of April or early May, IOHK will be ready to launch the Alonzo testnet. Hoskinson mentioned that large cohorts of programming professionals and Plutus pioneers are ready to stress test the network.

As Plutus was built by an independent team, in parallel with Shelley, Hoskinson warned there could be some “rough edges” in that integration. Hence QA and user acceptance testing are needed to circumvent any problems in that respect.

All of the above is scheduled to finish by the end of June. At this point, the final stage involves bringing all of the stakeholders up to speed. Hoskinson gives this a four to six-week time frame, taking us into mid-August for the Alonzo hard fork.

“If that occurs, what we will do is wait four weeks minimum for our partners, the Coinbases, the Binances, Yoroi, all these other people, who have infrastructure that needs to upgrade that needs to upgrade, test, and modernize for Alonzo before we do the Alonzo hard fork.”

The feedback from the Cardano community has been mixed. On the one hand, some have expressed positivity over the thoroughness of work going into Alonzo. But others have slammed the delay.

On that, Hoskinson noted a surge in toxicity and trolling. But he puts this down to a realization that Cardano is on track.

I’ve noticed a massive surge in toxicity, FUD, trolling, and outright slander lately. It must mean Cardano is finally perceived as a threat to the status quo and we are on the right track. Stay focused everyone, the next six months are going to be a rough but rewarding ride

— Charles Hoskinson (@IOHK_Charles) March 26, 2021

Despite the delay to Alonzo, the market did not react badly. Today, ADA is up 8% to $1.17.

Source: ADAUSD on TradingView.com

Sophia the Robot has generated more than $1 million in NFT sales, Bhad Bhabie is dropping NFTs to help the “troubled teen industry”, Cardano trying to convince top NFT platforms to port over.

Bitcoin price is still meeting strong sell pressure near a key trendline, indicating the possibility of further downside for BTC and altcoins in the coming days.

Input-Output Global CEO Charles Hoskinson announced that he has prepared his segment for the highly anticipated Cardano 360 event. In the mysterious post, Hoskinson hinted at a bug that allowed a hacker to mint 184 billion Bitcoin.

Just finished recording my segment for Cardano 360 tomorrow. It’s going to be a fun one 🙂 See everyone tomorrow! pic.twitter.com/dG2vqOd5Mj

— Charles Hoskinson (@IOHK_Charles) March 24, 2021

Known as the “Value Overflow Incident”, the bug was recorded in August 2010 and forced Bitcoin creator Satoshi Nakamoto to fork Bitcoin’s blockchain to “delete” the generated BTC. These were sent to two separate addresses.

A few hours after the event, a new version of the Bitcoin client was released and the chain considered “good” overtook the “bug blockchain” at block height 74691. The BTCs created by the bad actor ceased to exist.

In the image presented by Hoskinson, other tabs are also visible in his browser. This refers to smart contracts and the platform that will support them on Cardano’s blockchain, Plutus. Some users speculate that the reference to the “Value Overflow Incident” is a nod to the “double-spending” accusation that “Cardano never had” a few days ago.

In an earlier post, Hoskinson told “Cardano fans” that the event would be full of important announcements:

Cardano Fans, you’re really going to want to tune in to March’s Cardano 360 Episode. It’s going to be action-packed!

Led by IOHK’s Director of Marketing and Communications, Tim Harrison, and Aparna Jue, Product Director at IOHK, Cardano 360 is a monthly event where they give news on the development of the ecosystem.

Bring yer own cushion and don’t worry. If you can’t stick around, we’ll be dicing and slicing it and serving it up throughout next week in bite-size chunks.

Bring yer own cushion 🙏 and don’t worry. If you can’t stick around, we’ll be dicing and slicing it and serving it up throughout next week in bite size chunks 👍 #Cardano360 #Cardano https://t.co/OIjBw7uXCF

— Tim Harrison (@timbharrison) March 24, 2021

In the comments section, the majority of the community asked for more news on the deployment of Alonso and Plutus. Harrison also announced the conclusion of his segment for the event, and stated: “that there will be lots coming down the line”. He also confirmed that there will be updates on Cardano’s DeFi capabilities.

The event will start at 17:30 UTC, Input-Output Global further confirmed that partners, team members, and the community will participate. In addition, it is expected that there will be an update on everything that has happened since the deployment of Hard Fork Combinator “Mary”.

ADA’s price is showing losses of 1.8% on the last day chart. In the last month, Cardano’s native cryptocurrency only registers gains of 1.6%, showing little reaction to its Coinbase listing and the hype of the event happening tomorrow.

Bitcoin is stuck in a tight range but that has not stopped select altcoins from continuing their journey to new highs.

Replying to remarks over the lack of dapps running on Cardano, IOHK CEO Charles Hoskinson responded by saying demand is so high his firm cannot handle the applications flooding in. In many cases, as a strategy to cope with the demand, applications are being rejected.

Some Thoughts on DApps https://t.co/0rHRxdblPP

— Charles Hoskinson (@IOHK_Charles) March 21, 2021

Speaking on a live stream, Hoskinson said criticisms of Cardano having no dapps are entirely unreasonable. He drew attention to sneaker and cattle authentication apps already run on the chain using just metadata features.

Although full programmability at the base layer is missing at present, he likened the fault-finding to criticizing attendance at a nightclub that hasn’t yet opened.

“Yet they say, what are the dapps running on Cardano? That’s like saying you’re opening a nightclub, you haven’t opened it yet, and you say, ‘how come no-one’s in your nightclub?’ It’s like, we’re still building it.”

Hoskinson is more than confident that once Goguen is up and running, the ecosystem will fill out accordingly. However, right now, the firm cannot deal with the demand to build dapps on Cardano. He said the only thing to do under these circumstances is to turn down applications from developers.

“As if, smart contracts come and there’ll be no demand. We’re overwhelmingly subscribed. At the moment, our company has no more capacity to service deal flow that comes in for Cardano. People come to me, unless it’s a super high-value deal and some have jumped up the queue, we actually say no and turn them down…”

The Goguen era is expected to launch at the end of March. So far, IOHK hasn’t confirmed or denied that they will meet this deadline. Nonetheless, expectations are riding high. Once smart contracts are up and running, Cardano will be on even ground with its biggest rival, Ethereum.

Playing into the expectations, Hoskinson tweeted that this month’s Cardano 360 will be one to watch. The monthly program is scheduled to show on March 25 at 17:30GMT.

Cardano Fans, you’re really going to want to tune in to March’s Cardano 360 Episode. It’s going to be action packed!

— Charles Hoskinson (@IOHK_Charles) March 21, 2021

Although the “action” could refer to any number of things in the pipeline, a confirmed Goguen rollout date would be the best-case scenario for ADA holders.

With that, in the short term, what can the community expect with Goguen? Hoskinson referred to the projects making their way through the Catalyst program. He said a slew of NFT marketplaces, stablecoin offerings, oracles, and DEXes are on the way.

“If you look at Catalyst, there are six NFT marketplaces seeking funding, there are stablecoins seeking funding, some of which have already been deployed for example, on Emurgo. Oracles seeking funding, DEXes seeking funding….”

As such, accusations that Cardano is a ghost chain hold no merit. The only question remaining is, when will Goguen launch?

Source: ADAUSD on TradingView.com

Several altcoins are moving to new all-time highs as bulls struggle to lift Bitcoin price above $60,000.

ADA recently came within a penny of its previous U.S. dollar all-time price high.

Cardano’s (ADA) community long-awaited announcement has arrived. Coinbase has listed ADA on its main and pro platform. Starting today users will be able to start trading the cryptocurrency in all supported regions.

Users will be able to buy, sell, convert, receive and store the funds in ADA. These can be traded on the date referred to provide there is sufficient liquidity. The exchange will offer the following trading pairs ADA/USD, ADA/BTC, ADA/EUR, ADA/GBP.

For its Pro service, according to the exchange’s announcement, trading will be launched in 3 phases until full trading is reached. Coinbase will apply its trading rules and may suspend or stop the service if there is no “orderly market”.

At the moment, users can only make withdrawals to addresses created in Cardano’s Shelley era. That is, those starting with addr1. Coinbase will soon enable withdrawals for all Byron and Shelley addresses.

Following Coinbase’s announcement, ADA rose nearly 3.2% in less than an hour and reached $1.30. In the last 24 hours, the cryptocurrency has posted a 15.3% increased in the last week.

ADA hit an all-time high in late February when it stood at about $1.45. Cardano inventor and IOG CEO Charles Hoskinson hinted several times about announcements and partnerships that have boosted the rally. Among these was Coinbase’s listing.

Via his YouTube channel, Hoskinson welcomed Coinbase and called IOG’s relationship with the exchange “excellent.” He thanked the team they have worked with to enable ADA trading and stated:

I’m so happy to see that announcement today. It has been a long road. A lot of work went into that. It’s the beginning, I believe, of a great relationship which is going to extend trough out the years. Coinbase is one of the best exchanges in the world, one of the largest exchanges in the world for cryptocurrencies. We wished them well for the IPO. They have some of the greatest engineers in the cryptocurrency space.

Hoskinson said the partnership with Coinbase will continue and he expects staking support to be enabled. He was also enthusiastic about the participation traders will have with the announced trading peers. IOG’s CEO concluded:

We are going to continue working on the Rosseta spec with them (…). On behalf of everyone on Input Output Global to eveyone on Coinbase welcome to the familly, we are glad to have you. We love working with and we love working with you for this past long time. On behalf of the Cardano community welcome to ADA nation.

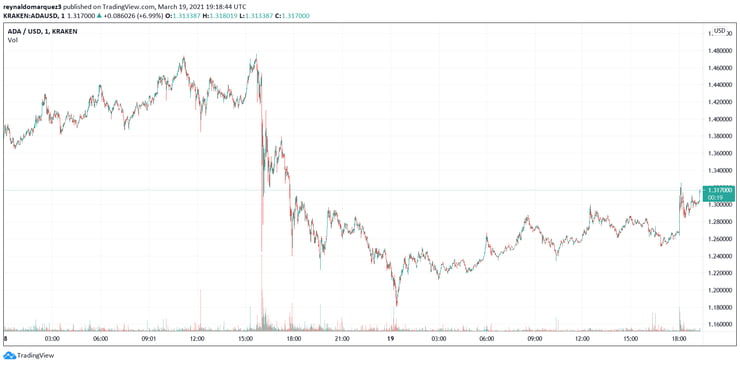

Cardano gained some positive traction in the early European trading hours Friday after erasing more than half of its bullish breakout move in the previous session.

The blockchain asset, better known by its ticker ADA across markets, climbed more than 2.25 percent to $1.25 into the ongoing intraday session. Its move uphill started near a session low of $1.178. At its intraday high, ADA was changing hands for as much as $1.298. The $1.178-1.298 range pretty much made for the trading area on Friday.

Nonetheless, the area appeared way below ADA’s week-to-date high achieved on Thursday. The Cardano token surged to $1.498 in a bullish move that appeared after it broke out of a technically bullish pattern — a Descending Triangle with an upside target near $1.50 (NewsBTC discussed the bullish theory here).

A strong upside rejection near $1.50 triggered a cascade of selling orders, crashing ADA down by more than 21.50 percent. The downside correction nearly wiped out half the bullish breakout move, underscoring that ADA needs to rebuild its bullish momentum near lower levels or risks extending its bearish correction even further.

So far, Cardano as a blockchain project has everything working in its favor. The protocol has grown into the conscience of traders who see it as a viable alternative to Ethereum, another blockchain project loaded with smart contract functionalities but suffering high transaction and gas fees issues.

Its growing prominence has led ADA higher by more than 600 percent in 2021 and 4,000 percent on a year-on-year timeframe. Meanwhile, Cardano’s latest protocol upgrade to “Mary” has enabled users to issue their unique tokens, including the booming non-fungible tokens (NFT), which has added further fuel to ADA’s bullish bias.

But short-term—technically—the Cardano token flirts with the prospect of declining further. It is in the middle of creating a Head and Shoulder, a structure that appears as a baseline with three peaks, the outside two are close in height, and the middle is highest. ADA ticks all three factors but awaits further confirmation as it hopes to trend lower towards the baseline to attempt a bearish breakout.

Should a decline appear, the ADA price would risk crashing by as much as the middle peak’s height. The candlestick(s) is about 0.32 dollars long. That puts the head and shoulder pattern’s breakout target to near $0.85.

Cardano’s price gained over 25% this week and it broke the key $1.200 resistance zone. ADA is likely to continue higher above the $1.300 and $1.400 resistance levels.

After forming a support base above the $0.9980 and $1.00 levels, cardano’s price started a fresh increase. ADA price broke the $1.120 and $1.200 resistance levels to move into a positive zone.

There was also a break above a crucial bearish trend line with resistance near $1.050 on the 4-hours chart of the ADA/USD pair. The pair even cleared the $1.220 resistance zone. It is now trading nicely above $1.2000 and the 100 simple moving average (4-hours).

ADA climbed towards the $1.480 resistance and high is formed near $1.472. Recently, there was a downside correction below the $1.335 support zone zone. The price also spiked below the 50% Fib retracement level of the upward move from the $1.001 swing low to $1.472 high.

Source: ADAUSD on TradingView.com

However, the bulls are protecting the key $1.2000 support zone. The price is also holding the 61.8% Fib retracement level of the upward move from the $1.001 swing low to $1.472 high.

If there is a downside break below the $1.200 support and the 100 simple moving average (4-hours), there could be a trend change. In the stated case, the price could decline towards the $1.050 support.

If cardano’s price stays above the $1.200 support, it could start a fresh increase. On the upside, an immediate resistance is near $1.300 and $1.335.

The next major resistance is near the $1.400 and $1.405 levels. A clear break above the $1.400 resistance will most likely open the doors for a steady increase towards the $1.500 level in the near term.

Technical Indicators

4-hours MACD – The MACD for ADA/USD is slowly gaining momentum in the bearish zone.

4-hours RSI (Relative Strength Index) – The RSI for ADA/USD is now testing the 50 level.

Major Support Levels – $1.200, $1.180 and $1.050.

Major Resistance Levels – $1.300, $1.335 and $1.400.

Bitcoin price briefly rallied above $60,000 but analysts say bulls are holding dry powder until after the March BTC futures expiry.

Select altcoins could move toward new highs if Bitcoin price continues to trade in a tightening range.

Cardano’s ADA was among the best performers in the cryptocurrency market this week as traders assessed its bullish prospects against a stagnating top rival Bitcoin and an ongoing craze for non-fungible tokens, or NFTs.

The blockchain asset jumped to the third rank after undergoing a 19 percent price rally. As of 1057 GMT, the ADA/USD exchange rate was roughly $1.24. The pair opened the week at $0.95, according to data fetched by Binance.

ADA’s latest move uphill pushed its year-to-date gains up by approximately 600 percent. Meanwhile, its year-on-year returns surged to a massive 4,656 percent, beating Bitcoin, Ethereum, gold, and even the global stock market in the period that saw a massive injection of fiat money by local governments and central banks all across the world.

…the nature of the Cardano token’s rally was more speculative in nature. Nic Carter, the co-founder of research company Coin Metrics, expressed his disbelief with the ADA’s rally, stating that Cardano has not launched a single project on its blockchain that could attest to its popularity.

“I am truly mystified as to why it is enjoying a resurgence in popularity.,” Mr. Carter noted.

Many analysts believe that Cardano majorly cashed on its blockchain rival Ethereum’s limitations. Lately, the second-largest blockchain network has turned too costly for its users, including developers operating billions of dollars worth of decentralized finance projects atop its public layer. In some instances, users ended up paying a transaction fee of $30 to send just $5.

Cardano projected itself as a viable alternative. In retrospect, the project enables users to build smart contracts, decentralized applications, and protocols atop its blockchain. It projects itself as a more scalable and secure version of Ethereum via its underlying proof-of-stake algorithm that makes it simpler for users to conduct transactions cheaper and faster.

Ethereum operates on an energy-intensive proof-of-work protocol. However, the blockchain is scheduled to switch to proof-of-stake by the end of this year.

Overall, the growing rivalry helped Cardano’s ADA to surge exponentially in the recent months.

More tailwinds for the ongoing Cardano price boom came from a stagnating Bitcoin and an ongoing craze for NFT.

Bitcoin underwent a sharp correction after establishing its record high above $61,000 during the weekend session. Part of its correction appeared on higher profit-taking sentiment. Meanwhile, global market uncertainty led by the suspense over the outcome of the Federal Reserve’s two-day policy meeting further kept Bitcoin from extending its short-term bullish bias.

ADA jumped about 20 percent against bitcoin in the last 24 hours, showing that traders decided to park their funds in the Cardano market on the latter’s near-term bullishness. That could be due to Cardano’s “Mary” update, which enabled users to create their unique tokens, including NFTs. These are digital files that represent ownership of a certain asset.

It has become the latest crypto craze. In one instance, a creator sold his JPEG file for about $69 million. So it appears, Cardano benefited from its involvement in the NFT space.