Celestia is the star of the modular network in late 2023 after its airdrop and staking TIA has become a good way to receive airdrops. Celestia is a chain that a lot of people overlooked because, before the launch, there was not a lot of information about Celestia and the airdrop. However, in the fast-paced world of cryptocurrency, overlooked gems can often surprise the market, and Celestia Network is no exception.

Celestia (TIA) Airdrop And What People Missed

Celestia network had stayed out of the limelight until it announced an airdrop eligibility site. Lots of people didn’t bother checking if they were eligible for an airdrop, because they felt it was irrelevant, people didn’t claim their airdrop at the deadline as requested by the team, which made the team extend the date to give more people the chance to claim.

At the end of the claim period, there were a lot of unclaimed airdrops to the extent the team had to distribute all the unclaimed airdrops to the wallets that claimed their airdrops, meaning that eligible wallets got double their initial allocations.

After the airdrop, the team focused on developing and creating utility for their chain, making the price of TIA skyrocket, as the demand for the chain and its token started to grow.

TIA Utility: Data Availability and Scalability

Celestia gives great utility towards Data Availability and Scalability giving other chains or upcoming chains a foundation to learn and work on. The Celestia team’s innovative approach, combined with partnerships and a focus on utility, set it apart in a crowded space.

In this guide, we will delve into the dynamics of Celestia, explore its transformative airdrop strategy, and discuss how staking TIA can position you for not only handsome rewards but also exclusive airdrops.

Unlike many projects that fizzle out post-airdrop, Celestia took a different path. The team continued developing the platform, adding significant utility to the Celestia chain. This utility, focused on data availability and scalability, spurred demand for the native token, TIA, ultimately driving its price higher.

Celestia (TIA) Network Collaborations

Celestia has partnered with most roll-ups of other chains like the Manta network which is another rollup that has been able to combine utility from the calamari network, and the EVM network. Collaborating with Celestia for better scalability and data availability increased the demand for Celestia(TIA).

Celestia (TIA) Network Airdrop Distribution

Celestia changed the way they distributed their TIA airdrop, which was different from what the market was used to. The Celestia pre-launch had incentivized node running events, rewarding node runners, but that was not enough to bring more people into exploring its ecosystem, it had to distribute its airdrop by rewarding all EVM users. If you had interacted on the EVM chain, you were eligible for the TIA airdrop.

Now, let’s delve deeper into the details surrounding TIA staking, Celestia’s impact on the crypto space, and the broader implications for investors seeking to navigate this dynamic landscape.

Reasons To Stake TIA

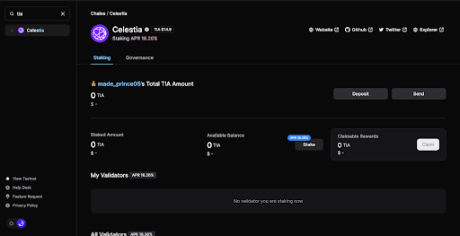

Staking TIA offers a multifaceted investment strategy, combining an attractive Annual Percentage Rate (APR), potential airdrop eligibility, and the broader positive trajectory of the Celestia platform. Taking a closer look at TIA staking, investors are drawn by the appealing APR, often exceeding 10%.

However, it’s essential to note that the choice of validator plays a crucial role in determining the staking rewards. As the Celestia platform continues to innovate and gain prominence, the allure of TIA staking is further heightened.

Celestia’s commitment to enhancing scalability and data availability. This, in turn, has led to increased demand for TIA, solidifying its position as a valuable asset within the crypto market.

Celestia’s unique utility and game-changing capabilities have positioned it as a frontrunner in the blockchain space. As a result, any new chain looking to launch and conduct a successful airdrop finds integrating TIA stakers as an effective strategy to garner attention. This is particularly true for projects building on the Celestia platform, where TIA’s association adds a layer of credibility and visibility

The association of TIA with projects like Dymension, where TIA stakers met airdrop eligibility criteria, underscores the growing trend of projects leveraging TIA stakers for increased visibility and credibility. As more projects within the Celestia chain ecosystem emerge, the potential for additional airdrops targeted at TIA stakers becomes increasingly promising.

While this analysis sheds light on the potential benefits of staking TIA, it’s crucial to acknowledge the ever-changing nature of the crypto market. Therefore, individuals considering TIA staking should conduct thorough research and stay updated on market trends to make informed decisions.

Exchanges to Buy Celestia (TIA)

To embark on the journey of acquiring TIA, one can explore various prominent exchanges where TIA is listed. Platforms such as Binance, Kucoin, OKX, and Bybit offer a convenient gateway for purchasing TIA.

A critical component of the staking process is securing a Keplr wallet. The Keplr wallet is an essential tool for managing and staking TIA securely. Users can download the wallet, create a new wallet by saving the seed phrase, and take precautions to safeguard their keys. The importance of protecting access to one’s crypto assets cannot be overstated, as the security of the Keplr wallet directly correlates with the safety of the stored TIA holdings.

How to Get Your TIA Wallet Address

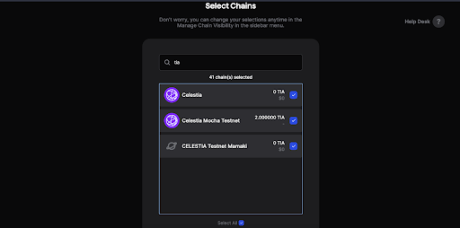

Go to your Keplr wallet and get your TIA address. You can get it by typing TIA in the search bar, but if it’s not available, you have to make it available.

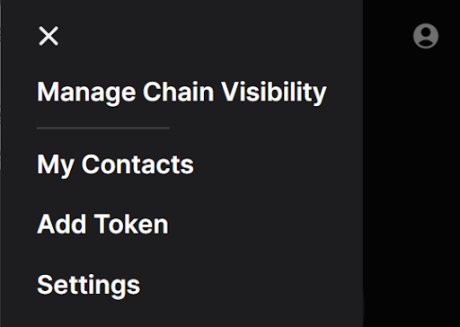

Click on the hamburger sign at the top left corner:

Click on Manage Chain Visibility next, type TIA, enable it, and Save it:

Go to your wallet dashboard and copy your TIA address, remember, the address is supposed to start with “Celestia”. Go to your crypto exchange and send TIA to that address.

The process of obtaining TIA is straightforward, with the cryptocurrency available across major exchanges. Additionally, users can explore the option of bridging from other Cosmos chains, such as converting ATOM on the Cosmos chain or INJ on the Injective chain to TIA.

Once TIA is secured in the Keplr wallet, staking becomes the next logical step. Users can access the Celestia Staking dashboard on Keplr, choose a validator based on their preferences, and stake their TIA accordingly. Choosing a validator that offers a high percentage of rewards is best.

It’s important to note that unstaking TIA involves a 21-day processing period, requiring users to plan their actions accordingly.

Protect Your Staked TIA

Securing a Keplr wallet is paramount for those looking to engage in TIA staking. The wallet serves as a secure tool for managing and staking TIA, requiring users to download it, create a new wallet with a saved seed phrase, and take necessary precautions to safeguard their private keys.

Never store your seed phrase in a place where it can be accessed on the internet. Do not copy your seed phrase on your device. It is best to write down your seed phrase on a piece of paper and keep it in a place only you can access.

CONCLUSION

It’s crucial to emphasize that the information provided here is not financial advice, but rather an analysis of the current trends in the crypto market. However, the logic behind acquiring TIA and staking is compelling.

The demand for TIA has been on a consistent uptrend, driving its value from an initial $2.2 to well over $10. The combination of robust staking rewards and the prospect of participating in airdrops makes TIA an enticing asset for investors looking to maximize their returns.