Solana-based platform Pump.fun suffered an exploit that left the crypto community with many questions. The attack stole millions of dollars in users’ funds, but the reasons behind it and the exact amount of the loot were unclear. Amid the uncertainty, some claimed that a crypto Robinhood had emerged.

$80 Million Taken In Crypto Heist?

On Thursday, the platform Pump.fun announced its bounding curve contracts had been compromised. In the post, the team alerted users that all trading was temporarily halted while they investigated the incident.

Pump.fun is a trading platform created to “prevent rugs” by ensuring that all created crypto tokens are safe. The platform allows users to easily launch instantly tradeable tokens with no presale and no team allocation.

This solution became an extremely popular alternative among influencers and users who wanted to create tokens without the complexity or high costs of launching a project.

It uses bonding curve contracts for the tokens, a mathematical model that determines a token’s price based on supply, increasing with the number of tokens bought. After the token’s market capitalization reaches $69,000, part of the liquidity is deposited on Raydium to be burned.

Since the attack, the team has assured users that the contracts have been upgraded to prevent further fund loss, adding that the protocol’s total value locked (TVL) is safe.

However, the community’s reports were contradictory and alarming. Some users claimed the attacker had taken $80 million in crypto from the platform’s bonding curve contracts, which worried the affected users.

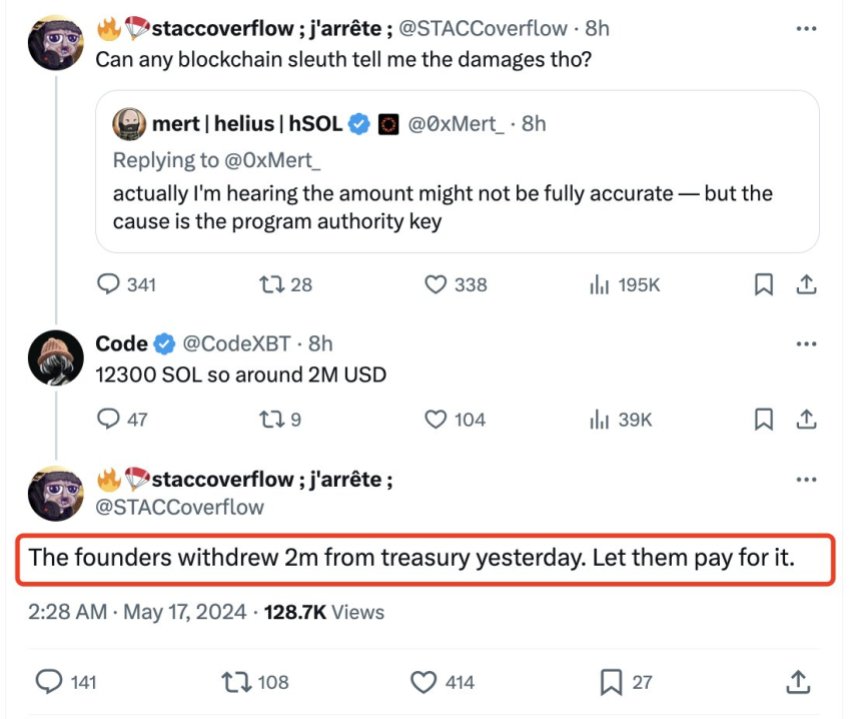

According to Lookonchain’s report, the hacker was quickly identified. At first, he pretended to be an unaware user, asking what the damages were. However, he later accused the platform’s founders of withdrawing the exact amount stolen a day prior.

An X user claimed the individual chose to “be a Robin Hood, dropping hacked cash to $SOL communities.” The attacker also stated in a post his desire to “change the course of history.” However, his “heroic outlaw” endeavors affected 1,882 addresses.

What Happened?

Despite the speculation and the attacker’s posts, it was later revealed that he was a Pump.fun ex-employee. In its post-mortem post, the platform’s team revealed that the individual had used their position to misappropriate funds from the bonding curve contracts.

The attacker illegitimately accessed the accounts after obtaining the private keys, “using their privileged position at the company.” The former employee used flash loans from Solana lending protocol to steal 12,300 SOL, worth around $1.9 million.

Per the post, he borrowed SOL to buy as many tokens as possible in Pump.fun. When the tokens hit 100% on their respective bonding curves, the attacker used the keys to access the bonding curve liquidity and repay the flash loans.

Fortunately, the attacker could only access $1.9 million out of the $45 million liquidity in contracts. Since then, the team has redeployed the bonding curve contracts and offered a plan to help affected crypto investors.

To make users whole, the team will “seed the LPs for each affected coin with an equal or greater amount of SOL liquidity that the coin had at 15:21 UTC within the next 24 hours.” Moreover, they are offering 0% trading fees for the next 7 days. As a user pointed out, this action is “non-trivial” since Pump.fun makes $1 million daily from fees.