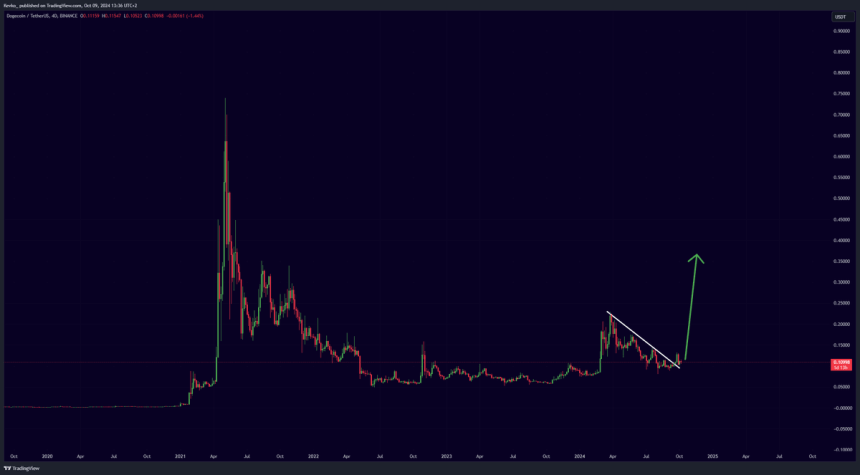

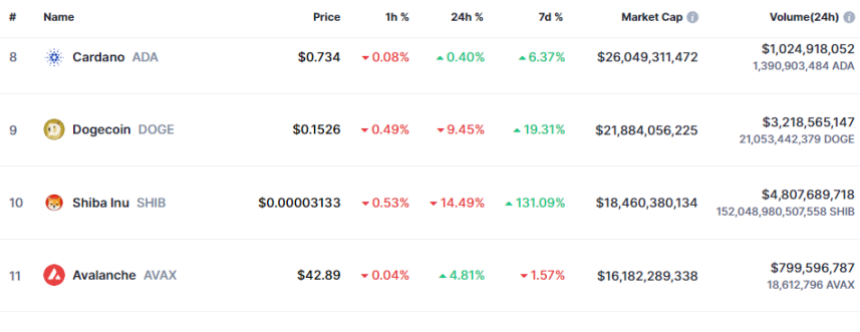

Dogecoin has been experiencing significant volatility, with a 44% surge followed by a 9% dip since October 10. This dramatic price movement has left analysts and investors cautiously watching the market, unsure of Dogecoin’s next move.

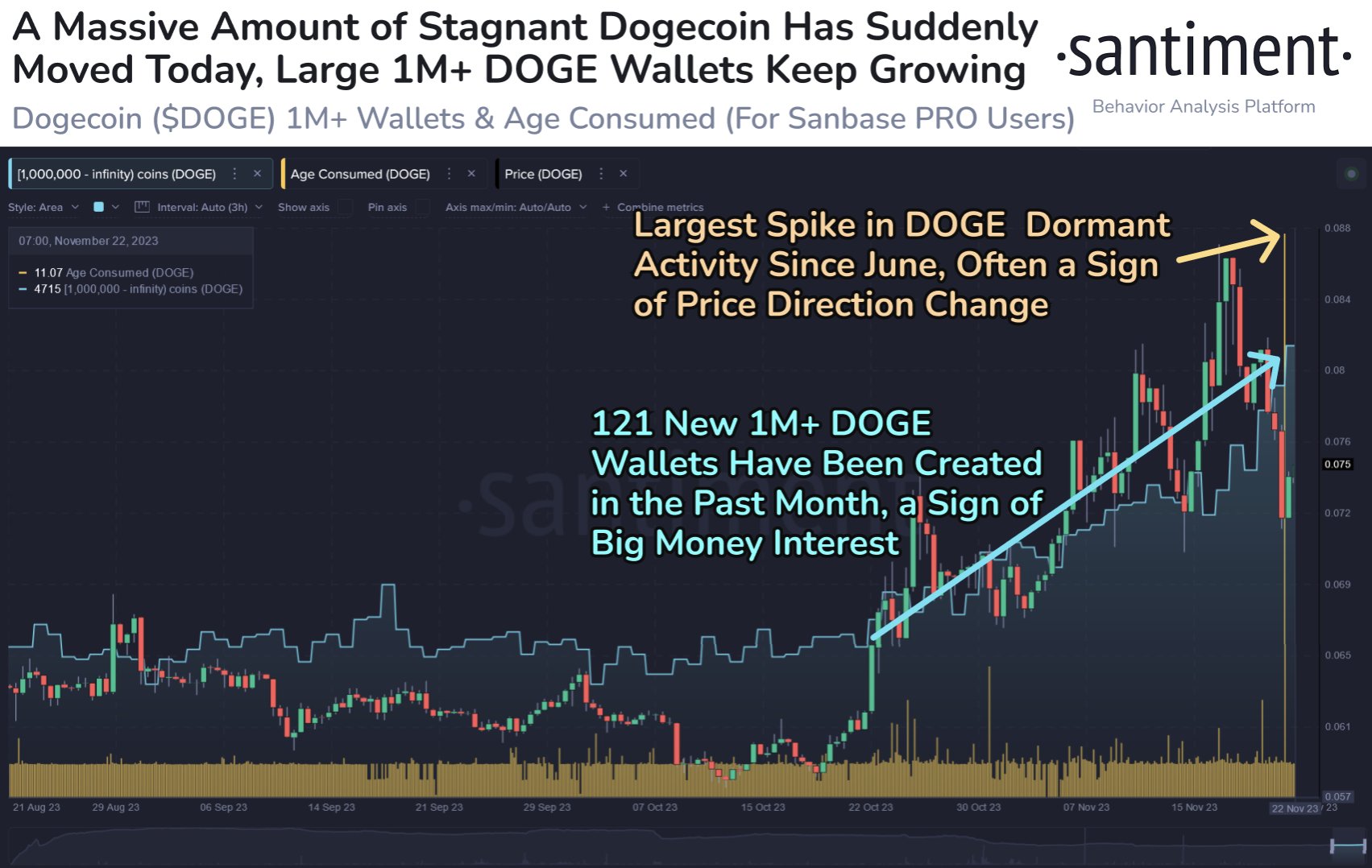

Some believe DOGE is gearing up for a massive rally, driven by renewed interest and momentum. In contrast, others are more skeptical, suggesting that the meme coin may be entering a consolidation phase.

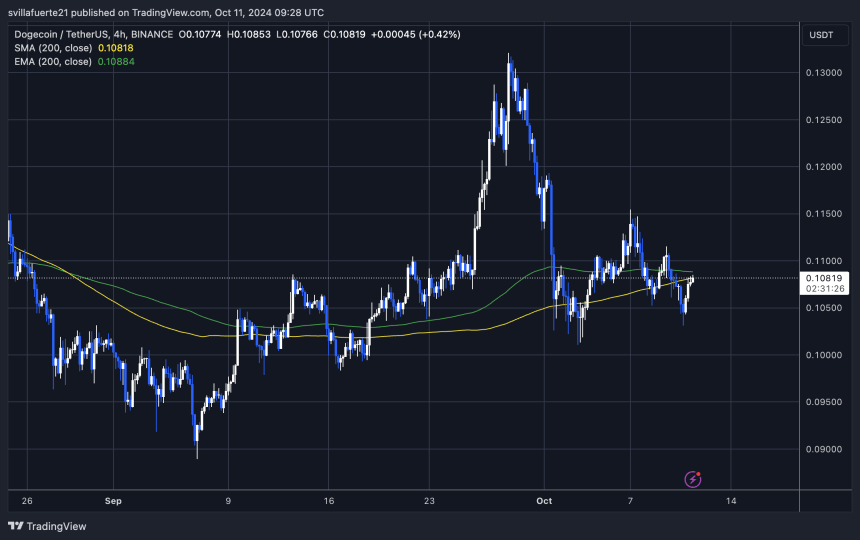

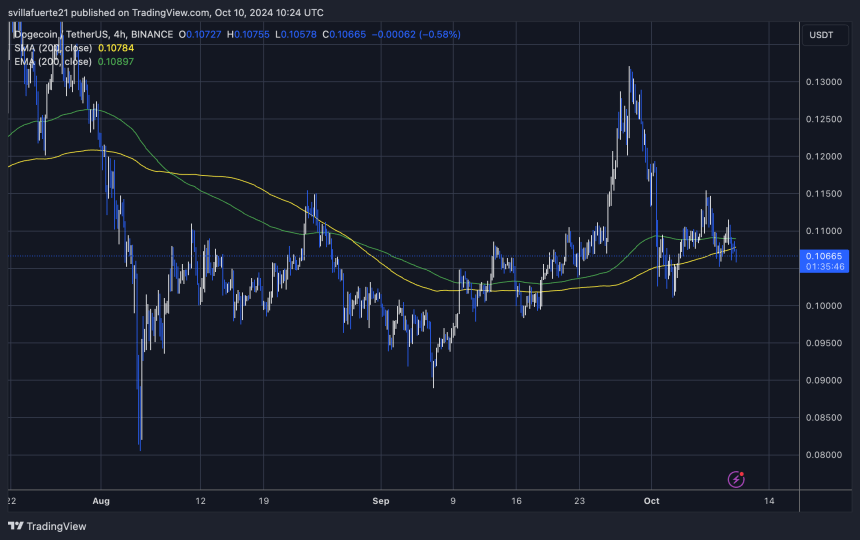

Top crypto analyst Bluntz recently shared a technical analysis on Dogecoin, highlighting its price fluctuated within a 4-hour range. According to Bluntz, the price has taken both sides of this range, resulting in a classic liquidity sweep, a move often seen before a major price shift.

As Dogecoin remains in this volatile environment, market participants are keenly awaiting further signs to determine whether the next move will be an upward rally or a consolidation period.

Dogecoin Testing Crucial Liquidity

Following recent price movements, Dogecoin is testing crucial liquidity levels, both on the supply and demand sides. Volatility has gripped the market, and uncertainty is leading to growing fear among investors, many of whom anticipate a DOGE rally in the coming weeks. Top crypto analyst Bluntz recently shared a technical analysis on X, highlighting the 4-hour Dogecoin chart showing a clear trading range between $0.15 and $0.133.

Bluntz notes that price action has swept both sides of this range—first the highs, then the lows—before being reclaimed, often indicating a liquidity sweep. This type of price movement is often seen before a larger, directional move, and Bluntz suggests it could create a bullish scenario for DOGE shortly.

He believes that once Dogecoin decisively breaks above this established range, a massive rally will likely follow, potentially taking DOGE to new highs.

However, while Bluntz’s bullish perspective offers hope for investors, Dogecoin’s current volatility and market uncertainty could still lead to sideways trading before any significant breakout occurs. Investors are watching closely for a break of the $0.15 level, which could signal the start of the anticipated upward move.

DOGE Holding Above $0.12

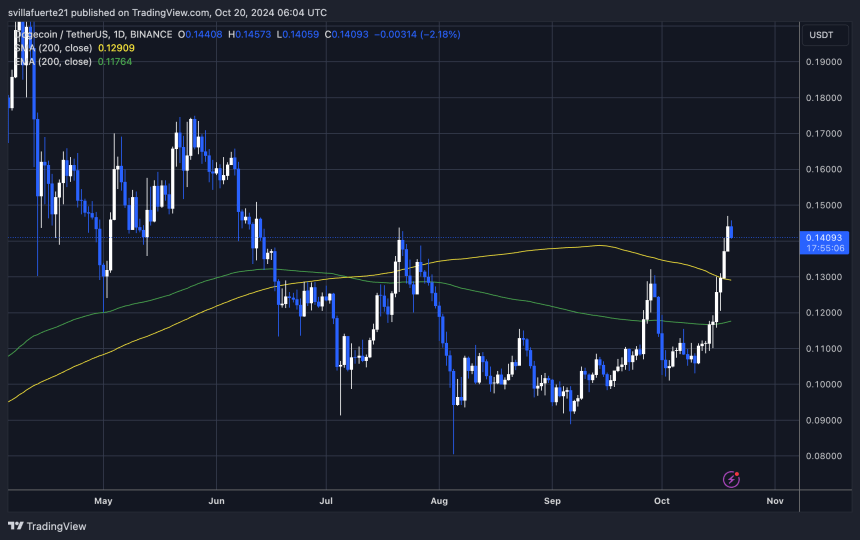

Dogecoin (DOGE) trades at $0.136 after five days of heightened volatility and uncertainty. Over the past two weeks, the price surged, and it is now holding above the crucial $0.12 mark, which acted as a strong resistance level in September and has since transformed into a key demand level. This price point is pivotal, as holding above could signal further bullish momentum.

The daily 200 moving average at $0.128 is another critical support level for Dogecoin. Maintaining strength above this moving average would suggest long-term stability and the potential for DOGE to push toward higher supply levels. However, if the price falls below this level, it could trigger a retrace, causing the recent rally to resemble a short-term “pump and dump” scenario.

If Dogecoin successfully holds above the $0.12 area, a healthy consolidation phase could unfold, setting the stage for a continued uptrend. Investors will closely monitor this level to determine whether the recent price action can maintain its momentum or if further downside is on the horizon.

Featured image from Dall-E, chart from TradingView