An analyst has explained that Dogecoin could rally towards $0.10 based on a pattern forming in its price if a support cluster continues to hold.

Dogecoin Has Observed A Buy Signal On Its 3-Day Chart

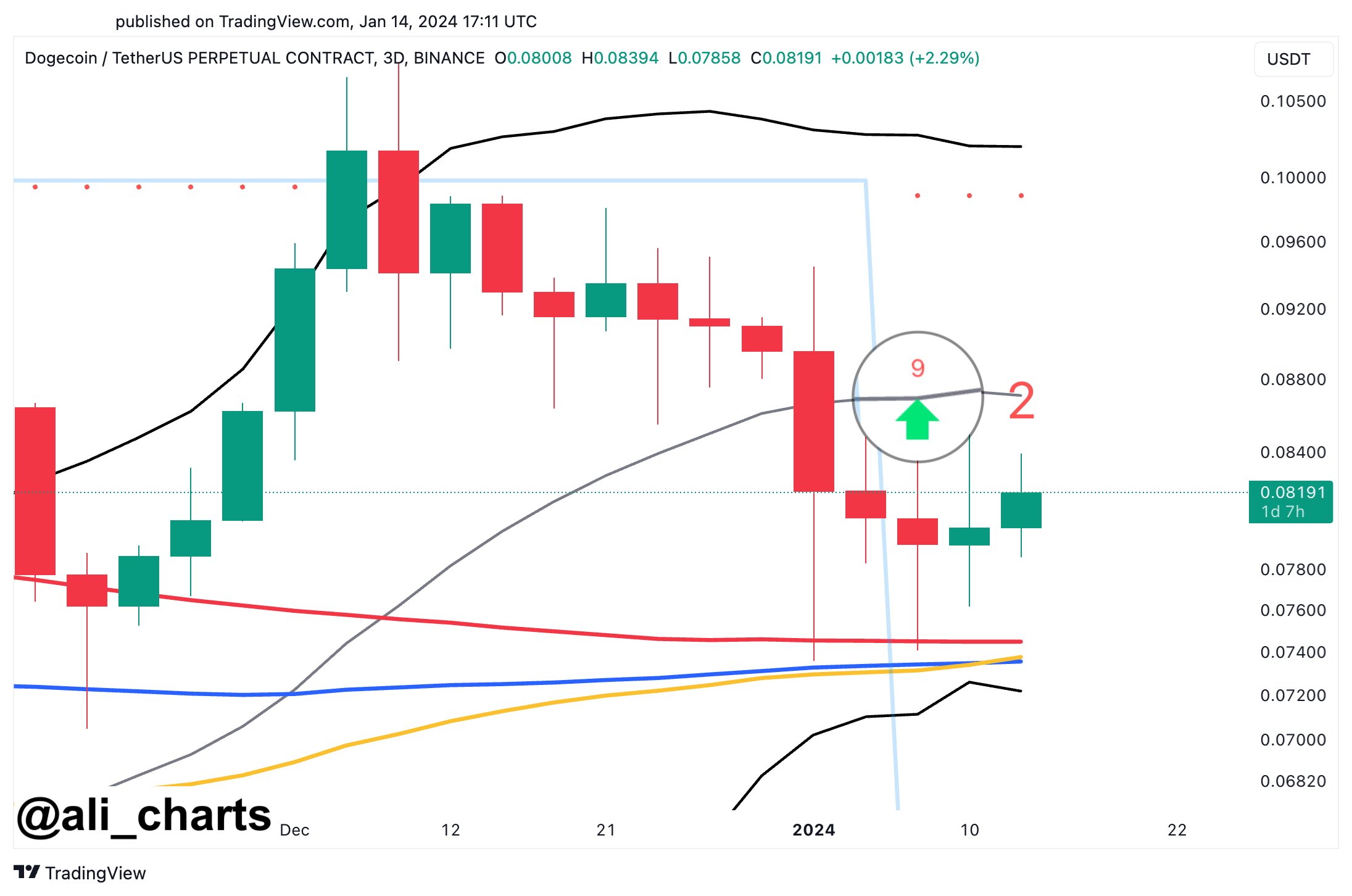

As explained by analyst Ali in a post on X, a TD-Sequential buy signal recently appeared for DOGE on its 3-day price. The “Tom Demark (TD) Sequential” here refers to an indicator in technical analysis that helps pinpoint locations of probable tops and bottoms in any asset’s price.

This indicator is made up of two phases. The first is called the “setup” phase, and it’s nine-candles long. During this phase, nine candles of the same polarity are counted, and following the ninth, the asset could be assumed to have hit a point of reversal.

Whether the setup would indicate a buy or sell signal naturally depends on the prevailing price trend. If the price were going up during the setup (the candles were green), then the setup’s completion would indicate a potential point of selling. Similarly, the TD Sequential would mark a sell signal in the opposite case.

Once the setup is complete, the second phase of the indicator, called the “countdown,” begins. This phase is thirteen candles long, and once these candles are in, the asset could once again be considered to have reached a probable bottom or top.

Now, here is a chart shared by Ali that highlights the completion of a TD-Sequential setup phase for the 3-day price of Dogecoin:

The above graph shows that the Dogecoin 3-day price has recently finished a TD-Sequential setup with red candles. This would imply that the indicator has given a buy signal for the asset.

So far, since this setup has formed, DOGE has registered two green candles on this chart, implying that the meme coin’s price may have indeed witnessed a change of direction.

In the same chart, the analyst has also highlighted a support cluster for the coin, where some important lines have converged around the $0.074 level. Based on this and the TD-Sequential pattern that has formed, Ali notes, “as long as the $0.074 support cluster continues to hold, DOGE has a great chance of rebounding to $0.100 or higher!”

From the current spot price of the cryptocurrency, a potential rally to this $0.100 target would mean a surge of around 24% for the asset. If DOGE retests the $0.074 support level and rebounds to this high, the coin would see a rally of over 35%.

DOGE Price

Dogecoin opened 2024 with a deep plunge, and the memecoin has so far been unable to recover from it, as its price has mostly been stuck in consolidation. At present, DOGE is trading around the $0.0804 mark.