On-chain data suggests Dogecoin is no longer the dominant meme coin in terms of its weekly active trader count. Here are the coins above it.

Dogecoin Has Been Surpassed In Trader Count By Other Memecoins

According to data from the market intelligence platform IntoTheBlock, DOG and DEGEN are the two assets that have managed to surpass the original meme-based cryptocurrency in terms of weekly trader count.

A “trader” here refers to an investor who has been holding onto their coins since less than 30 days ago. These investors generally tend to move their coins often, as they play the role of active traders in the market. They are certainly not the HODLers of the sector.

When the number of these traders goes up for any asset, it means that some fresh interest is potentially coming into the coin. Price actions like rallies are only sustainable when they have an ever-increasing fuel coming in, so the trader count going up can perhaps be a bullish indication in this direction.

On the other hand, the metric going down implies traders either are losing interest in the cryptocurrency or have decided to hold onto it in the long term, thus maturing past the 30-day threshold. Whatever the case be, though, a drawdown in the indicator does suggest a lack of new hands coming into the market.

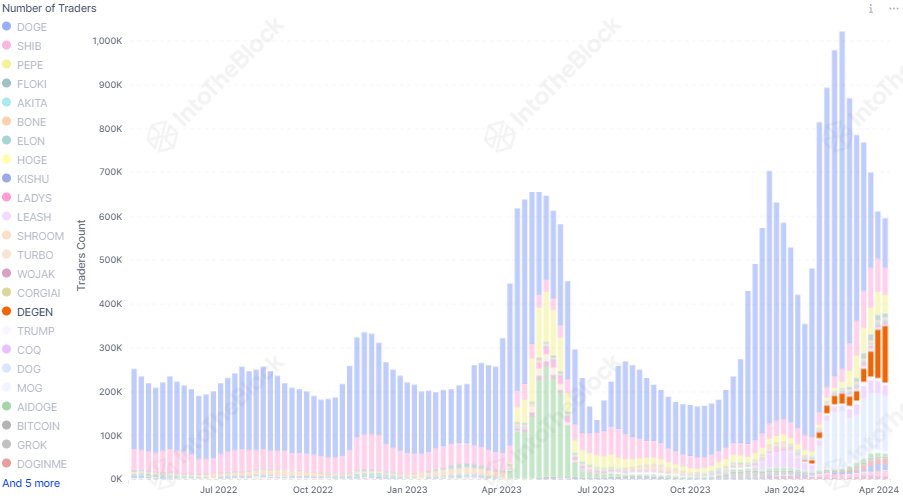

Now, here is a chart that shows the trend in the number of traders for the various meme coins in the sector:

As displayed in the chart, Dogecoin (in blue) has consistently remained number one in terms of the number of traders, which only makes sense as DOGE has generally been the most popular meme coin, as its market cap would indicate.

Hype and excitement are usually the number one driver for attracting users to a cryptocurrency. It would appear, though, that DOGE has recently been falling off in this metric.

“While DOGE has long dominated almost every metric in the memecoin market, it seems to be losing some of its dominance,” says the analytics firm. The interest behind the coin may thus not be at the same level anymore.

As for which meme coins have overtaken the cryptocurrency so far, IntoTheBlock notes, “DEGEN currently leads with 129k active traders, followed by DOG with 126k.”

Given this high interest in these memecoins, it’s possible they may be likely to go through some volatility in the near future as all these traders make moves at once.

In theory, this volatility can take these coins in either direction, but as the intelligence platform explains, “a strong increase in traders usually coincides with bullish momentum.”

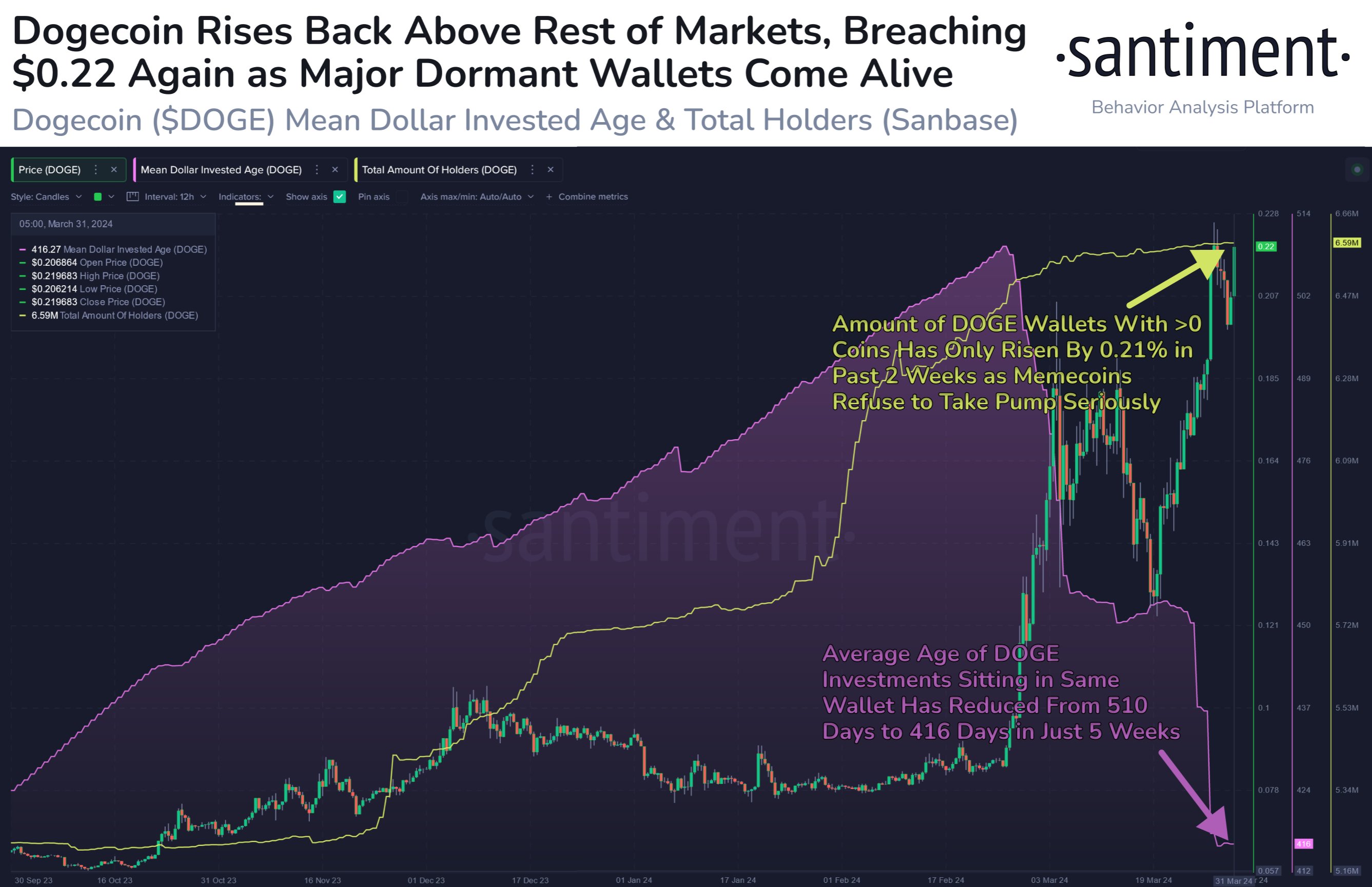

DOGE Price

Dogecoin had slipped below the $0.17 level last week, but the coin has since bounced back as it’s now trading just under $0.20.