DOT, the native currency of Polkadot, a smart contract platform, remains under pressure, posting sharp losses after soaring to an all-time high of around $55 in 2021. The coin is trading at about $6, volatile but up roughly 45% from 2022 lows, buoyed by the broader recovery across the crypto scene.

Will DOT Break Above Immediate Resistance Levels?

Despite DOT’s woes, one crypto trader, @Ashcryptoreal, is bullish on the coin’s prospects, pointing to the eventual implementation of Polkadot 2.0, a critical update for the cross-chain network. Taking to X on November 27, the crypto trader believes that Polkadot 2.0 will fix present issues plaguing the smart contract platform.

Specifically, Polkadot 2.0 represents an overhaul set to introduce several enhancements that could, if executed as stated, propel DOT above current resistance levels. With rising DOT demand, the coin, and by extension, the platform, could soar, rising to its former glory as one of the leading blockchains with dense user activity.

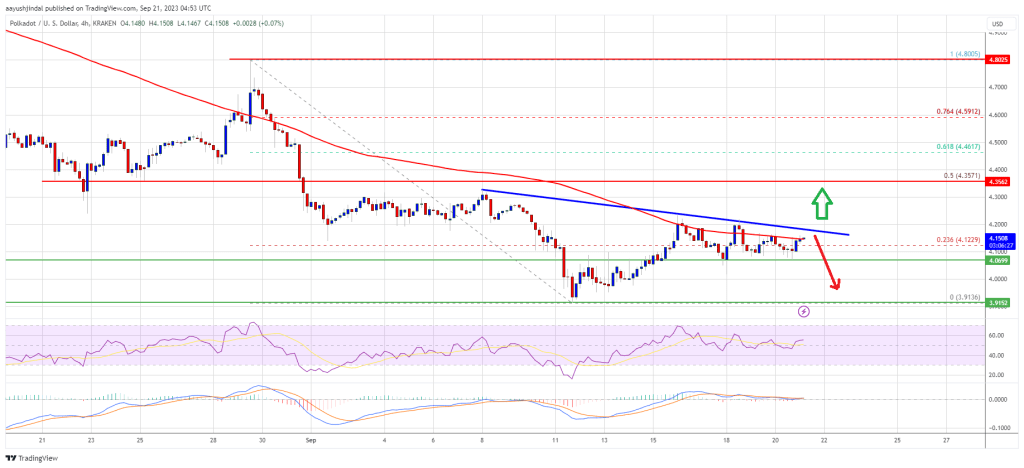

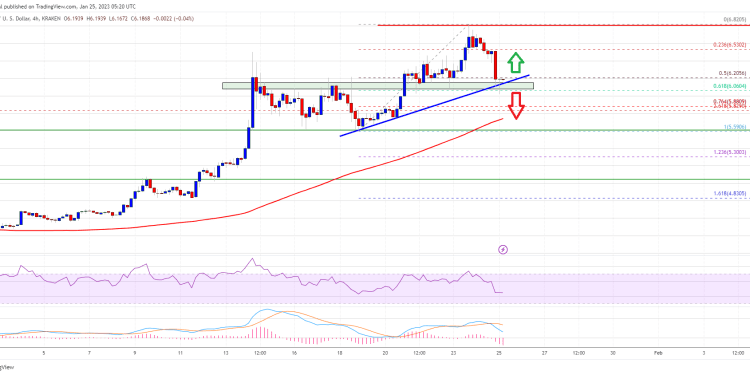

Looking at price action, DOT is moving within a broad horizontal range with caps at around $3.5 and $7.5. Despite the recent spike, which saw the coin roar by 45%, prices are moving inside the bull bar of early November.

Based on this, there must be a sharp expansion from spot levels above $5.6 with rising trading volumes for buyers to be in charge. Even so, the current formation still favors buyers.

What’s The Big Deal About Polkadot 2.0

Polkadot 2.0 overhauls certain features as it is currently in the network. However, most importantly, analysts observe that proposed changes could enhance the network’s capabilities and attract more developers.

After the update, Polkadot will migrate from the dynamic block space allocation system, allowing developers to purchase block space as needed, either in bulk or individually. This flexibility could make the network more appealing to various projects.

Additionally, Polkadot 2.0 will introduce elastic cores, enabling the network to adapt to varying computing demands depending on use. This adaptability may make the network more efficient. Moreover, it adapts to the diverse needs of developers.

The concept of coretime, which measures computing resource demands, will be a notable addition to Polkadot 2.0. Like in EOS, resources in “core time” will be purchased through auctions or pay-as-you-go basis, allowing developers more control.

Analysts expect these changes to increase the demand for DOT since the coin serves as a medium of exchange. All on-chain transactions are settled in DOT.