Wyckoff Analysis (WA) aims to understand why prices of stocks and other market items move due to supply and demand dynamics. It typically is applied to any freely traded market where larger or institutional traders operate (commodities, bonds, currencies, etc.). In this article we will apply WA to the cryptocurrency Storj ($STORJ) to make a forecast for approximate future events.

Link to the raw image: https://www.tradingview.com/x/BGsOkzGM

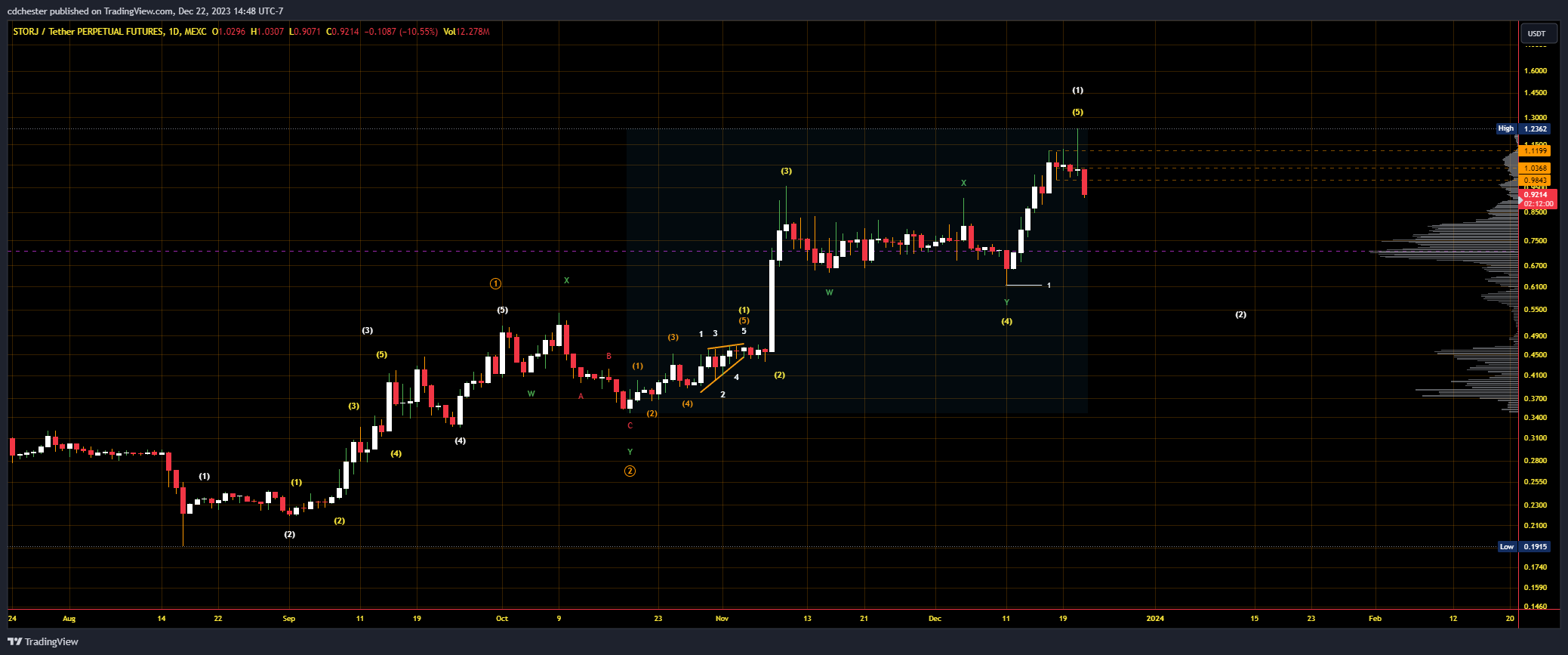

Storj is currently in Phase E of a Wyckoff Distribution Schematic #1. StockCharts says this about Phase E in their article on the Wyckoff Method:

Phase E depicts the unfolding of the downtrend; the stock leaves the TR and supply is in control. Once TR support is broken on a major SOW, this breakdown is often tested with a rally that fails at or near support. This also represents a high-probability opportunity to sell short. Subsequent rallies during the markdown are usually feeble. Traders who have taken short positions can trail their stops as price declines. After a significant down-move, climactic action may signal the beginning of a re-distribution TR or of accumulation.

The trading range for Storj was $1 – $1.12 and it has concretely fallen below that. From the picture below a major SOW has occurred, more so pointing to a Distribution occurring. This also coincides with our analyst’s Elliott Wave (EWT) view on Storj. They predict a small rally as Storj continues to fall in its Wave 2. The majority of the liquidity (per its relevant Volume Profile) is between the 38.2% and 61.8% LFR at $0.56 and $0.76 respectively. A liquidity cluster is typically expected between these LFRs in EWT leading us to the think a Wave 2 correction is happening. Additionally, the cluster is in the price range of the subwave 4, an EWT guideline.

Link to the raw image: https://www.tradingview.com/x/dD8hv9Aj

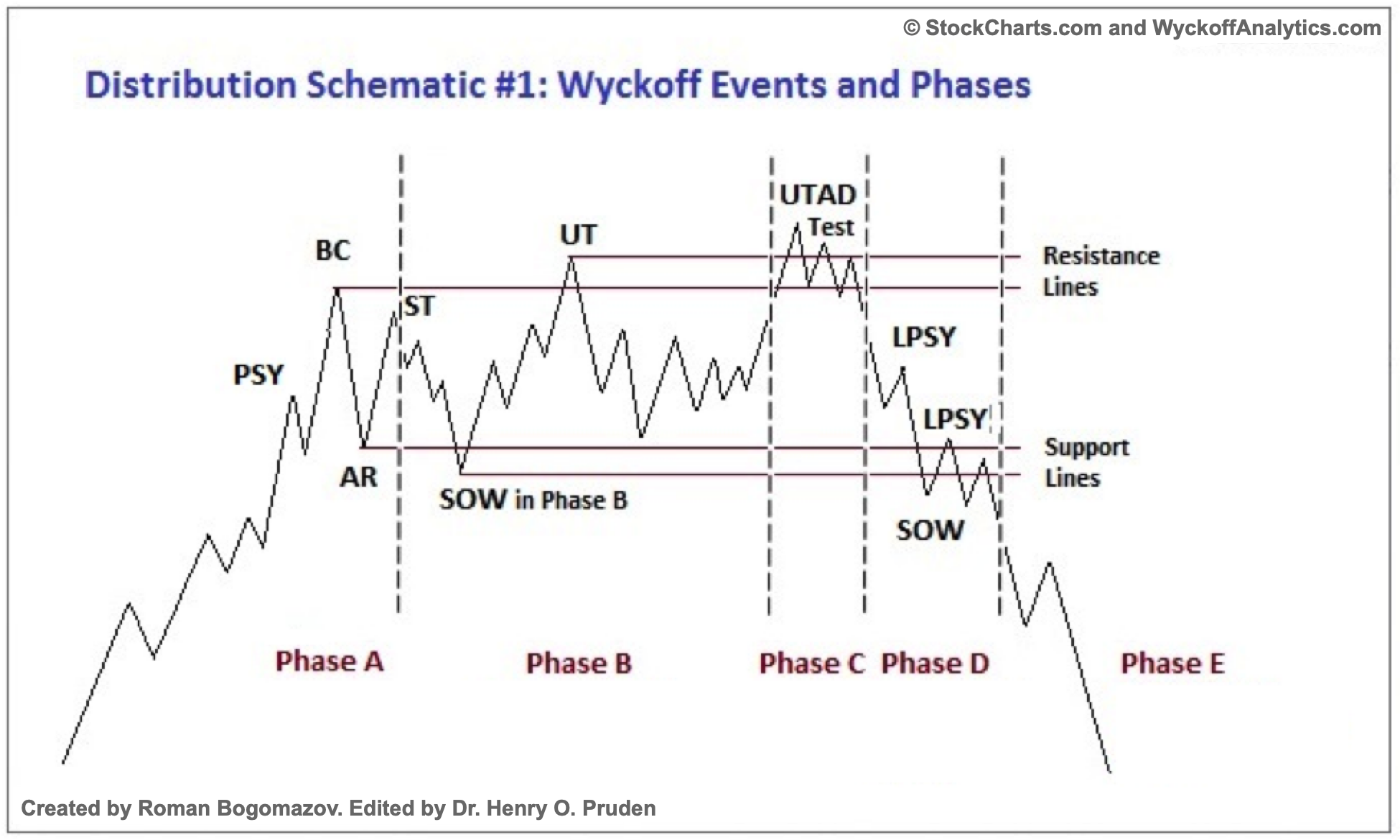

Below is the typical schematic for a Wyckoff Distribution Schematic #1.

Glossary

All quotes are from the first link in Supplemental Reading.

Preliminary Supply (PSY) – “where large interests begin to unload shares in quantity after a pronounced up-move”

Buying Climax (BC) – large operators selling their shares while the public buys them at a premium during a period of huge demand

Automatic Reaction (AR) – “With intense buying substantially diminished after the BC and heavy supply continuing, an AR takes place”

Secondary Test (ST) – when “price revisits the area of the SC to test the supply/demand balance at these levels”

Upthrust After Distribution (UTAD) – “a definitive test of new demand after a breakout above TR resistance”

Test – where larger traders “test the market for supply throughout a TR”

Sign of Weakness (SoW) – “a down-move to (or slightly past) the lower boundary of the TR, usually occurring on increased spread and volume”

Last Point of Supply (LPSY) – “exhaustion of demand and the last waves of large operators’ distribution before markdown begins in earnest”

Elliott Wave Theory (EWT)

“A theory in technical analysis that attributes wave-like price patterns, identified at various scales, to trader psychology and investor sentiment.”

Source: “Elliott Wave Theory: What It Is and How to Use It” by James Chen (2023)

Logarithmic Fibonacci Retracement (LFR) – A measured correction at certain Fibonacci ratios on a semi-log scale.

Logarithmic Fibonacci Extensions (LFE) – A measured rally at certain Fibonacci ratios on a semi-log scale.

Supplemental Reading

“The Wyckoff Method: A Tutorial” by Bogomazov & Lipsett

“Reaccumulation Review” by Bruce Fraser (2018)

“Jumping the Creek: A Review” by Bruce Fraser (2018)

“Distribution Review” by Bruce Fraser (2018)

“Introduction to Point & Figure Charts” from StockCharts

“P&F Price Objectives: Horizontal Counts” from StockCharts

“The Wyckoff Methodology in Depth” by Rubén Villahermosa (2019)

“Wyckoff 2.0: Structures, Volume Profile and Order Flow” by Rubén Villahermosa (2021)

“Elliott Wave Principle – Key To Market Behavior” by Frost & Prechter (2022)

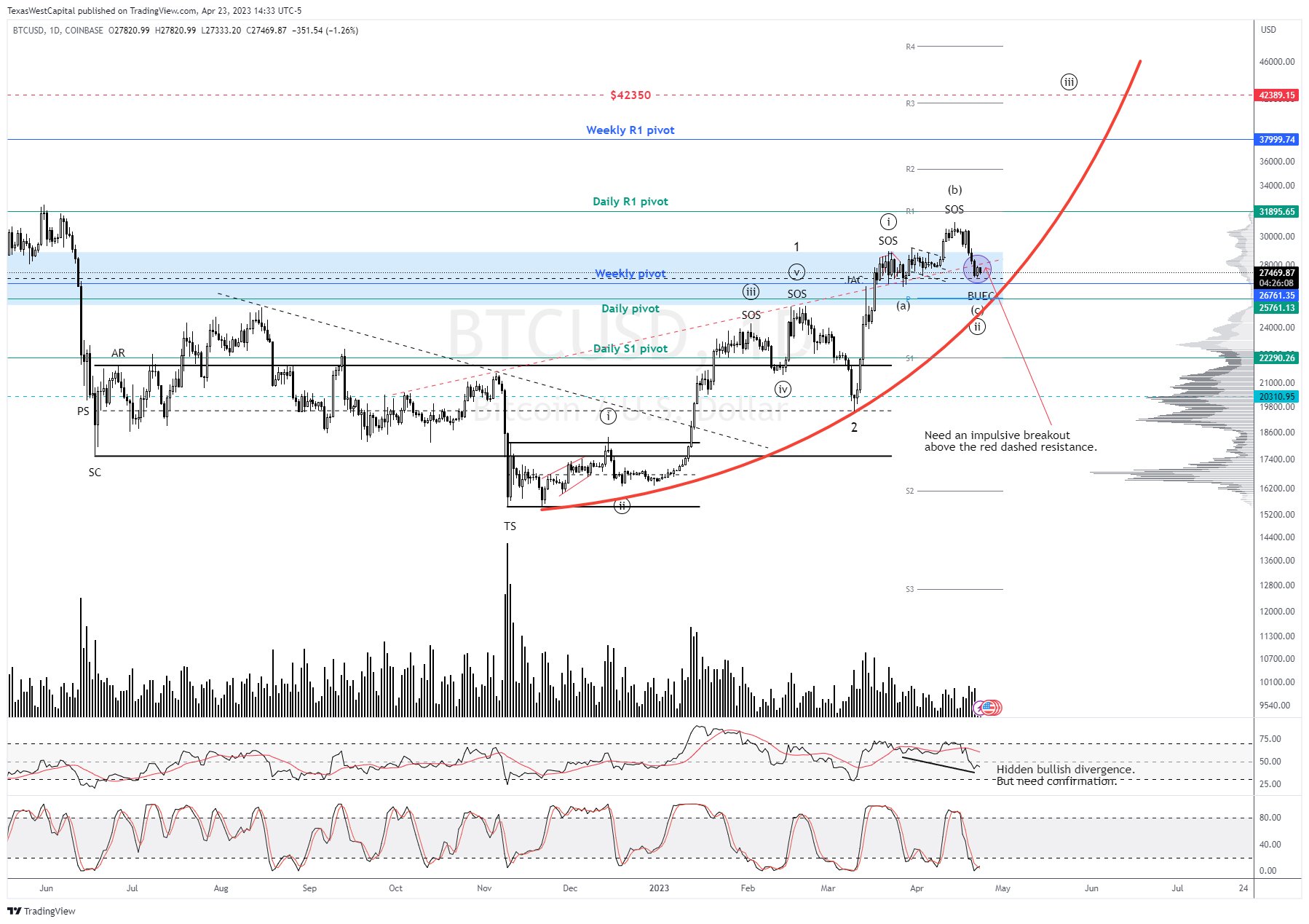

on my full Elliott Wave analysis on #Bitcoin and why I don’t believe there is a bear market – and why I expect the last leg up any day now.

on my full Elliott Wave analysis on #Bitcoin and why I don’t believe there is a bear market – and why I expect the last leg up any day now.