Ryan Sean Adams, a vocal Ethereum commentator and crypto investor, is bullish on MATIC, the native token of Polygon. Taking to X on November 8, Adams said MATIC should be a top-10 crypto asset, adding that people are asleep on layer-2s.

Polygon (MATIC) Remains In An Uptrend

When writing on November 8, MATIC is among the top 15 most valuable coins by market cap. It also remains volatile, fluctuating, and moving up and down the market cap leaderboard rankings. Even so, considering its spot valuation exceeding $7.3 billion according to CoinMarketCap (CMC), a crypto tracker, MATIC remains relatively liquid with a broad user base.

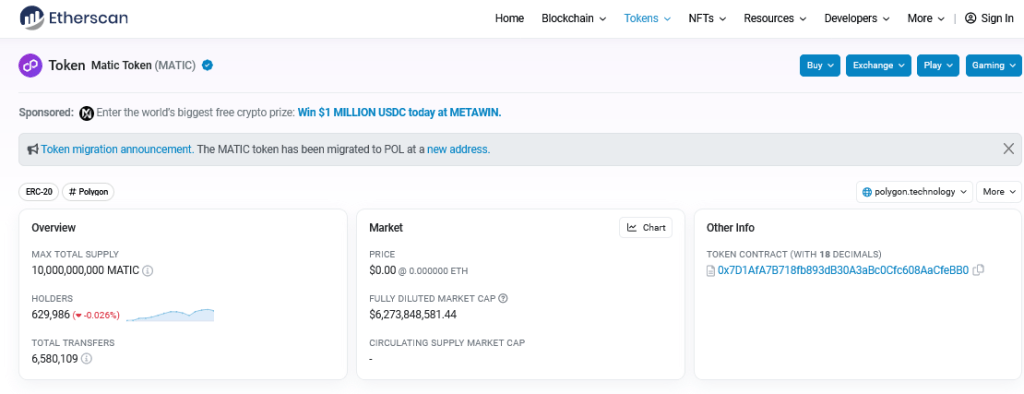

Etherscan data on November 8 shows that there are 629,967 MATIC holders, down roughly 2%, but the number remains higher despite the contraction following the crypto winter of 2022, which spilled over to 2023.

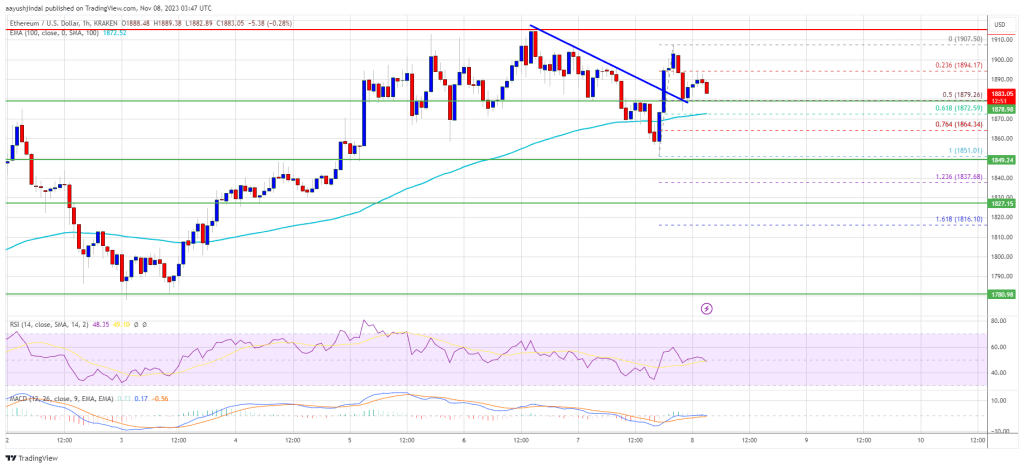

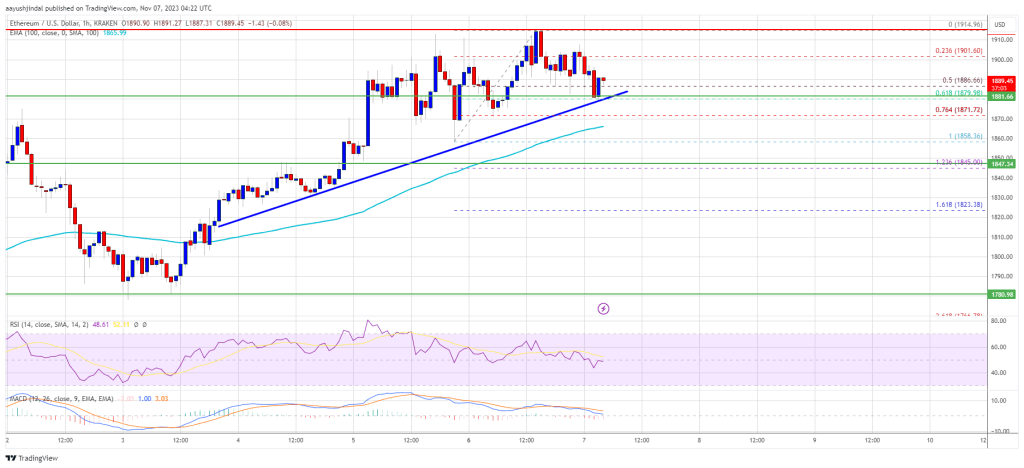

As of November 8, MATIC is up 60% from September 2023 lows. According to CMC, the coin is also up 13% on the last trading day, pushing weekly gains to over 27%. Looking at the candlestick arrangement in the daily chart, the uptrend momentum is strong, and buyers appear to be doubling down.

Presently, bull bars are aligned along the upper BB, suggesting that there is intense buying pressure. At the same time, MATIC is within a bullish breakout formation, breezing past August highs.

Polygon, a sidechain, is among the many scaling solutions for Ethereum. The platform is compatible with Ethereum, allowing protocols to build on Polygon while enjoying the high activity and security of the first smart contract network. Polygon is also considered a layer-2, though it isn’t technically a layer-2 since it doesn’t depend on roll-ups like Arbitrum or OP Mainnet.

Time To Double Down On MATIC And Layer-2 Tokens

In Adams’ view, considering layer-2 tokens, including MATIC or ARB, at spot levels could translate to more gains in the next bull run. Nonetheless, it should be noted that MATIC, for instance, is down 72% from 2021 highs.

Moreover, the coin is trending inside June’s bear trade range. A comprehensive close above this level may signal the end of the bear run, possibly anchoring buyers targeting $1.5.

In late October, Polygon Labs officially launched the POL, a token that will prime Polygon 2.0, Ethereum, signaling the first steps to see MATIC gradually phased out. POL will serve more roles in Polygon 2.0, specifically powering an ecosystem of zero knowledge-based layer-2 chains using Polygon’s infrastructure. News of this smart contract launch seemed to have catalyzed demand, driving token prices higher.