Bitcoin transaction fees have soared above Ethereum’s amid a renewed appetite for Ordinals-inscribed assets.

Cryptocurrency Financial News

Bitcoin transaction fees have soared above Ethereum’s amid a renewed appetite for Ordinals-inscribed assets.

The weakness in the U.S. Dollar Index suggests that risky assets such as Bitcoin and the S&P 500 Index may remain in favor of the buyers.

In a recent analysis shared on X (formerly Twitter), crypto analyst Michaël van de Poppe offered an insightful perspective on the current state of the altcoin market. His analysis draws parallels with historical trends, suggesting that the current corrections in altcoins may present strong buying opportunities for investors.

Van de Poppe’s analysis began by noting the ongoing corrections in the altcoin sector, which he interprets as part of a sustained uptrend. “Altcoins have multiple days/weeks correction while still in an uptrend,” he stated, indicating that these periods are not only natural but also beneficial for the market’s overall health.

He further explained the dynamics of these corrections, emphasizing their historical significance. “This [current] period is very heavily comparable to the period we experienced at the end of 2015, or at the end of 2019,” van de Poppe mentioned. He drew specific attention to Ethereum’s remarkable run from $1 to $14 in late 2015, which eventually led to a peak of $1,400 in 2017, demonstrating the potential for massive returns.

Van de Poppe’s analysis also touched upon the concept of higher timeframe support zones. He elucidated that during initial upward runs, corrections to these support zones offer ideal re-entry points for investors. “During the run in 2020, we’ve seen the DeFi summer taking place, which has a high chance of coming back to the surface in 2024,” he added, hinting at a potential bull run in the coming months.

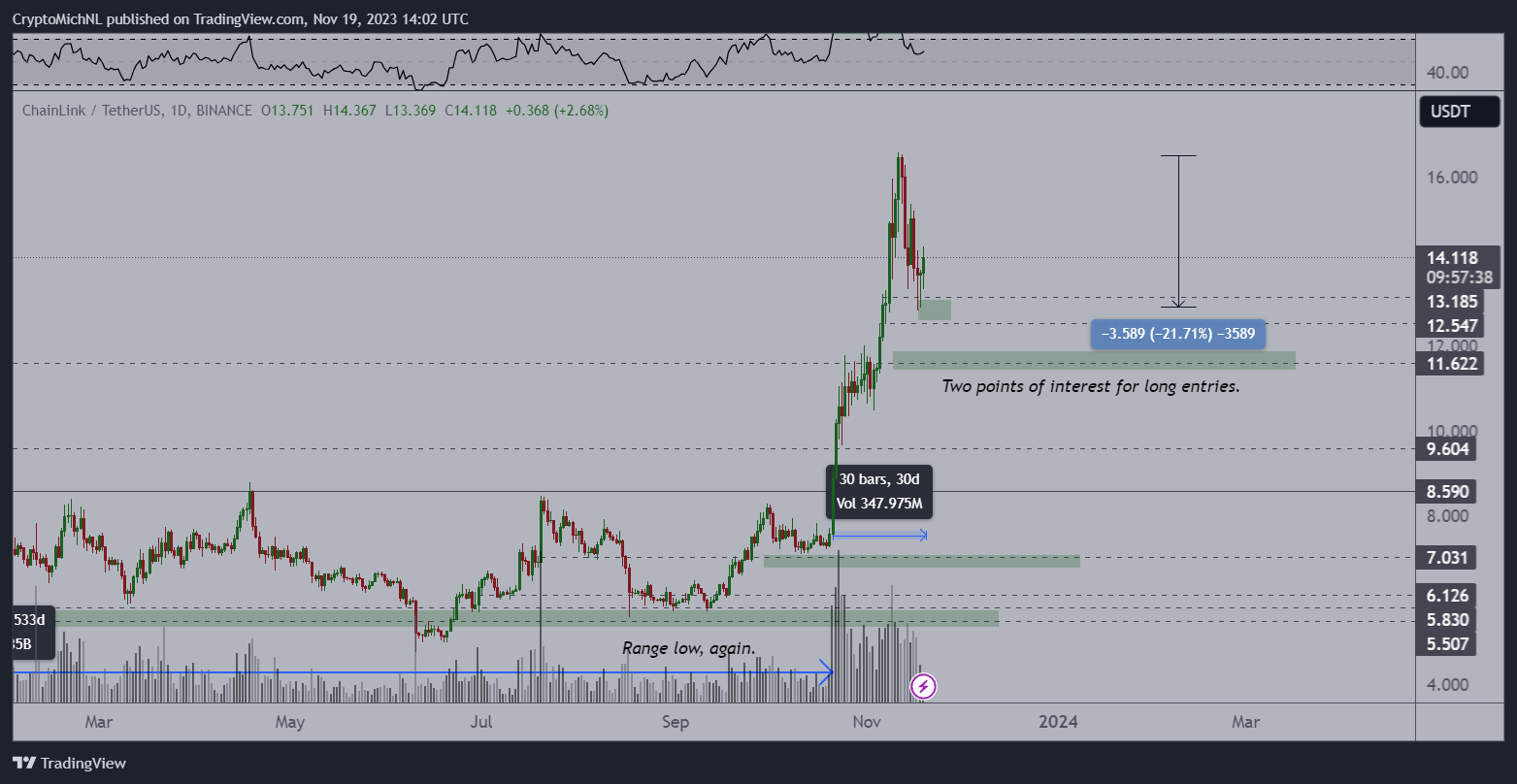

A significant part of his analysis involved a detailed comparison between Ethereum’s price action and that of other altcoins like Chainlink and Arbitrum. He noted, “If you compare the price action of Ethereum with the current price action of Chainlink, you’ll see that it’s just barely having a correction of 20%.” He suggested that further corrections could provide even clearer trends and entry points for investors.

Van de Poppe also emphasized the importance of time frames in analyzing these trends. “If you start to zoom in on the 1h, or 4h, or 15m timeframe, you’ll spot those trends as well. It’s just a matter of time frame,” he explained.

Looking at the LINK/USD 1-day chart, van der Poppe remarked, “Arguments can be made that we’re barely at the start of this first upwards wave of the cycle as this rally of Chainlink lasted less than 5 weeks.”

As the crypto analyst shows, Chainlink has already undergone a correction of -21.7%. According to him, there are two points of interest for a possible entry, in the range from $12.54 to $13.18 and around $11.62.

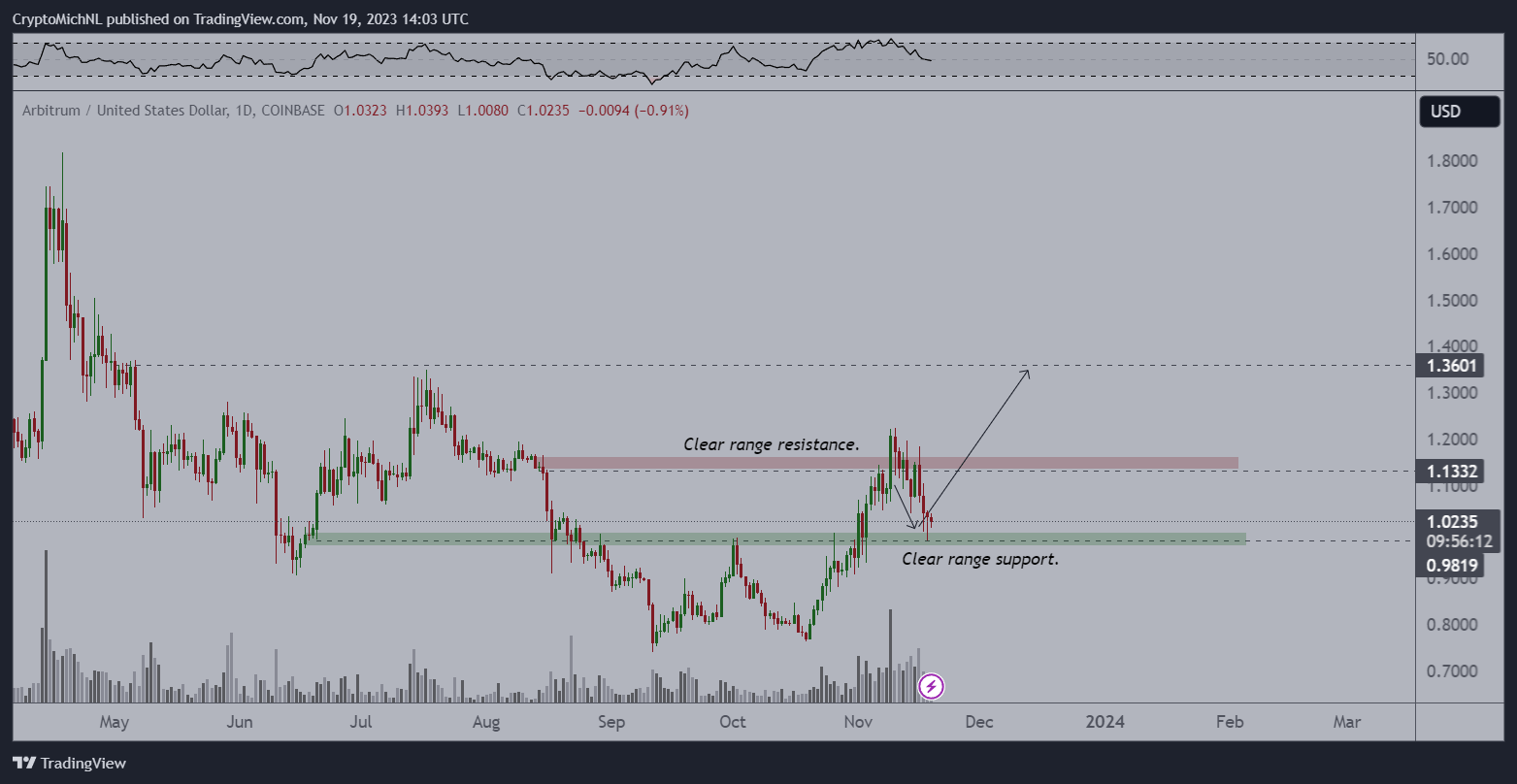

“Another example is Arbitrum, which is currently resting on support and, just like the rest of the markets, is providing a corrective move,” stated van der Poppe. The analyst identifies a “clear range support” at $0.98 in the 1-day chart of ARB/USD.

In conclusion, Michaël van de Poppe’s analysis presents a compelling case for considering altcoin corrections as potential opportunities for investment. His concluding advice to investors is “Don’t be afraid, if an altcoin drops between 30-50% at this stage of the cycle, time to look for your entries.”

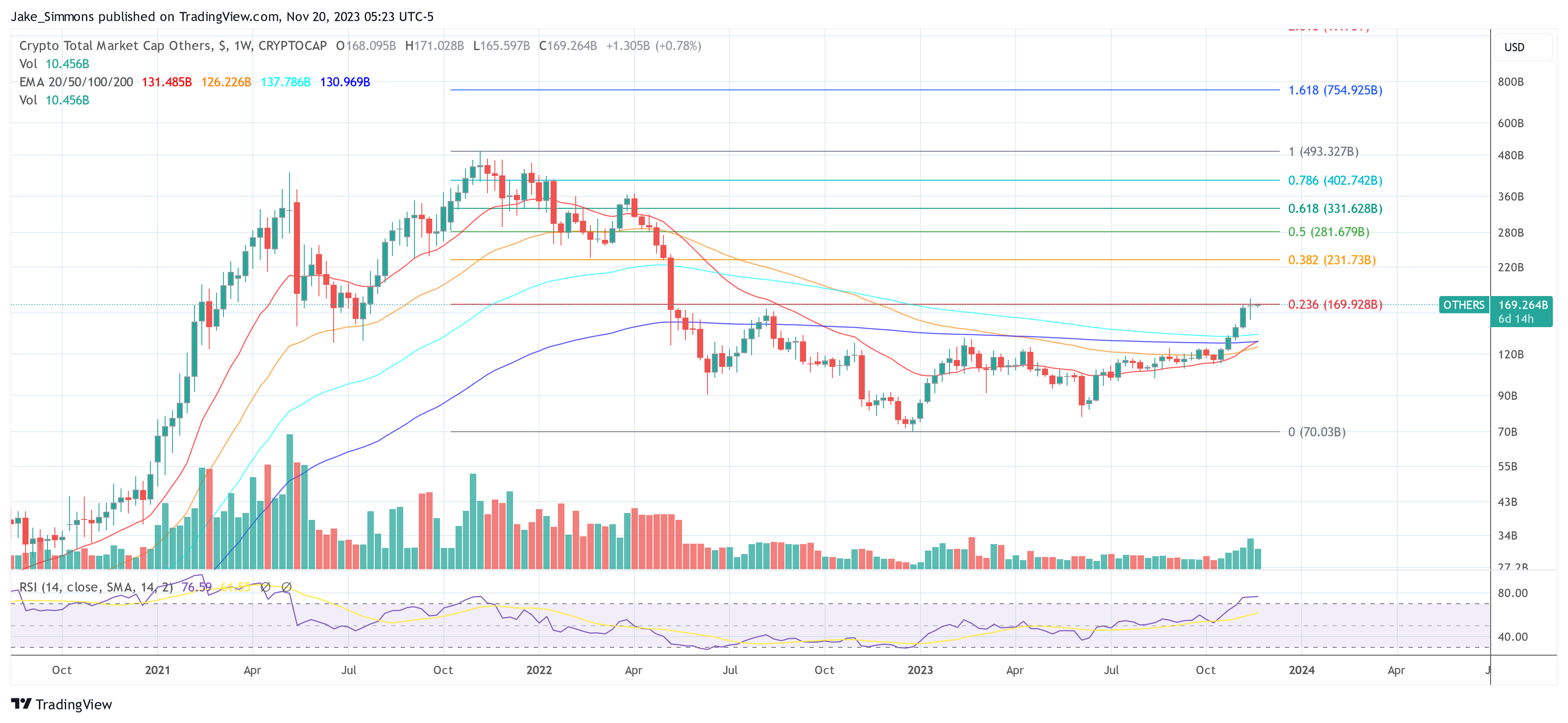

At press time, the total altcoin market cap stood at $169.264 billion, just below the crucial 0.236 Fibonacci retracement level of $169.928 billion. A break above this resistance could be a major bullish signal.

Ethereum price started a fresh increase from the $1,900 support. ETH is now facing resistance near $2,020, above which it could accelerate higher.

This past week, Ethereum price started a downside correction from the $2,120 resistance. ETH declined below the $2,020 and $2,000 support levels. It even spiked below the $1,920 support.

A low was formed near $1,905 and the price started a steady increase, like Bitcoin. There was a move above the $1,950 and $1,980 resistance levels. The bulls pushed the price above the 50% Fib retracement level of the downward move from the $2,092 swing high to the $1,905 low.

Ethereum is now trading above $1,980 and the 100-hourly Simple Moving Average. On the upside, the price is facing resistance near the $2,020 zone.

There is also a major bearish trend line forming with resistance near $2,020 on the hourly chart of ETH/USD. The trend line is near the 61.8% Fib retracement level of the downward move from the $2,092 swing high to the $1,905 low.

Source: ETHUSD on TradingView.com

A close above the $2,020 resistance could start another strong increase. The next resistance is near $2,090, above which the price could aim for a move toward the $2,120 level. Any more gains could start a wave toward the $2,200 level.

If Ethereum fails to clear the $2,020 resistance, it could start a fresh decline. Initial support on the downside is near the $1,980 level and the 100-hourly Simple Moving Average.

The next key support is $1,950. The main support is $1,900. A downside break below the $1,900 support might trigger more losses. In the stated case, Ether could drop toward the $1,850 support zone in the near term. Any more losses might call for a drop toward the $1,800 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,950

Major Resistance Level – $2,020

A wallet linked to Hong Kong-based crypto exchange Hashkey has reportedly sold over $90 million worth of Ethereum in the past 10 days. This massive selling activity appears to have triggered a slight decline in the ETH market, sparking speculations on the token’s price trajectory.

According to a Sunday post on X by blockchain analytics platform, Lookonchain, a crypto wallet with the address “0xD26e ” sold off 50,115 ETH, valued at $97.7 million, within a period of 10 days. Lookonchain notes that this wallet is related to Hashkey, having received a majority of the sold-off ETH from the Hong Kong-based exchange.

A wallet related to #HashKey dumped 50,115 $ETH($97.7M) in the past 10 days.

Wallet"0xD26e" deposited 50,115 $ETH($97.7M) to #Binance and #OKX, then withdrew 89.6M $USDT and 12.95M $USDC.

The average selling price probably is $2,047.https://t.co/qYLUghQetE pic.twitter.com/Nj4LzeytUu

— Lookonchain (@lookonchain) November 19, 2023

At an average selling price of $2,047, wallet “0xD26e” conducted its ETH sell-off on the Binance and OKX exchanges, withdrawing $89.6 million USDT and $12.95 million USDC in return.

As earlier stated, ETH dipped by over 4% in the last week, which is likely in response to such massive selling pressure. However, the second-largest cryptocurrency has now found some stability, gaining by 0.92% in the last day, as it attempts to breach the $2000 mark again.

Looking at ETH’s daily chart, it appears the selling spree by wallet “0xD26e” could be a precaution against an incoming significant decline in the token’s value. After all, the Relative Strength Index indicates that ETH just left the overbought zone and could still experience more losses in the coming days.

Albeit, this downward trend is likely to be short-lived, considering the high level of investor interest currently around the altcoin due to the brimming Ether spot ETF race in the United States.

On Friday, Fidelity Investments became the seventh and the latest asset management giant to join the brawl, having submitted its “Fidelity Ethereum Fund” proposal to the United States Securities and Exchange Commission (SEC).

In addition to the Massachusetts-based company, other asset managers looking to launch an Ether Spot ETF include prominent names like BlackRock, Hasdhdex, Grayscale, VanEck, and 21Shares and Ark.

It is expected that other asset managers will join the race over the next few weeks, which will lead to a rise in positive sentiments towards Ethereum.

While approval by the SEC is still very subjective and uncertain, the mere influx of Ether Spot ETF applications signals an increasing interest in the altcoin from traditional finance investors, which in turn boosts investments in any cryptocurrency.

For example, following reports of Blackrock’s filling on November 9, ETH gained by almost 13% to trade above the $2,130 mark in response to the buying pressure that followed.

At the time of writing, ETH trades at $1,950, with a 0.34% gain in the last hour, according to data from CoinMarketCap. Meanwhile, the token’s trading volume is down by 32.64% and valued at $7. 32 billion.

Amid the ongoing Ethereum scandal, former Ethereum advisor and attorney Steven Nerayoff has recently revealed how he plans on sharing proof of Ethereum founders’ fraud activities in the early days of the cryptocurrency asset.

Following an X (formerly Twitter) post by a user Heidi from Crytotips, the crypto enthusiast was seen trying to underscore the lack of authenticity from Nerayoff’s claims. According to her, his accusations were a no-brainer due to the disclosure lacking proof of his accusations.

However, Nerayoff in response to the video, asserted that he never claimed his accusations were going to be in the disclosure highlighting the crypto enthusiast’s lack of proper research. He further added that he is going to reveal the fraudulent acts of the founders in his lawsuit.

Nerayoff had always noted that his recording was not actually linked to his accusations but rather his involvement with Vitalik Buterin. “The recording isn’t directly related to the fraud but will illuminate a lot of what was happening & show my involvement. The fraud will be in the lawsuit,” Nerayoff stated.

Furthermore, the crypto expert also pointed out Nerayoff’s accusations towards federal agencies. According to her, the former advisor was a little paranoid with his accusations.

During an X space, Nerayoff accused some high federal agencies of fabricating evidence against him in order to take him out. These include the SEC, FBI, and the DOJ.

Nonetheless, in response to that, Nerayoff has asserted that this was actually proven and publicly filed. “The paranoia about the agencies? Well, that’s actually proven & publicly filed,” Nerayoff stated.

It appears Nerayoff’s claims about ETH not being decentralized from the early days are authentic.

The post also saw the crypto enthusiast pointing out Nerayoff’s claims of ETH not being decentralized from the beginning. According to her, cryptocurrencies are not expected to be decentralized from the start and only the core team members know about a crypto asset from the start.

If the expert is right then this basically means Will Hinman’s speech in 2017, about the asset being decentralized from the start was inaccurate.

During the early days of the asset, Hinman asserted the decentralized nature of ETH, when it was considered as a security by the SEC. According to him, ETH was too decentralized to be considered a security.

So far, both founders still have not responded to Nerayoff’s accusations. Nerayoff believes that their silence is due to the evidence he has against them.

“Vitalik & Lubin are vicious if they have leverage. Lubin said to me in July 2018 about a network “It’s a centralized piece of sh*t” right after the Hinman speech! They stay silent because I’ll drop more receipts,” Nerayoff stated.

Featured image from Pixabay

TVL, fee revenue and wallet activity are just three metrics investors can use to assess the health of the DeFi sector.

BlackRock has joined the Ethereum Spot ETF race as the asset management company has officially applied to the US SEC and is currently waiting for approval.

Following its Spot Bitcoin ETF filing, BlackRock, an American investment company has taken the proactive step by filing an Ethereum Spot Exchange Traded Fund (ETF) with the United States Securities and Exchange Commission (SEC).

The asset management company submitted the application on November 15, however, BlackRock has stated it formed the Trust as early as November 9.

According to BlackRock, the iShares Ethereum Trust would be used to facilitate the ownership of Ether through the issuance of shares, allowing investors to own a fractional undivided beneficial interest in the net assets of the Trust.

“The Trust was formed as a Delaware statutory trust on November 9, 2023. The purpose of the Trust is to own ether transferred to the Trust in exchange for Shares issued by the Trust. Each Share represents a fractional undivided beneficial interest in the net assets of the Trust. The assets of the Trust consist primarily of ether held by the Ether Custodian on behalf of the Trust,” BlackRock said in its filing.

Presently, the US SEC has not approved any Ethereum Spot ETF filing as well as Spot Bitcoin ETF applications. The regulatory body has delayed multiple applications to be reviewed from January 2024.

The crypto community has remained enthusiastic that the regulatory agency would eventually approve the pending ETF applications, as this could significantly push the growth and development of the crypto ecosystem as well as the cryptocurrencies involved.

The price of Ethereum is on the rise following BlackRock’s Ethereum ETF filing. The cryptocurrency’s price climbed almost 2% moving to $2,080 at some point following the announcement of the filing.

The sharp reaction has caused a stir in the cryptocurrency community, as investors gear up for a potential bull run if the US SEC gives its official authorization of Ethereum Spot ETFs.

The price of Bitcoin has also been growing steadily as new companies apply for Spot Bitcoin ETFs. Currently, Bitcoin’s price is trading at $36,408, while ETH is down from its initial surge and trading at $1,952.

The crypto ecosystem is presently watching closely for more updates on the US SEC’s ETF filing approvals and the price changes that follow them.

Ethereum price corrected lower and tested the $1,935 support. ETH is likely forming a double-bottom and might start a decent increase.

After facing rejection near the $2,090 zone, Ethereum price reacted to the downside. ETH traded below the $2,050 and $2,020 support level to enter a short-term bearish zone, like Bitcoin.

There was also a break below a key contracting triangle with support near $2,025 on the hourly chart of ETH/USD. However, the bulls took a stand near the $1,935 support zone. It seems like Ether is likely forming a double-bottom pattern, while Bitcoin is forming a double-top near $38,000.

Ethereum is now trading above the 23.6% Fib retracement level of the downward move from the $2,092 swing high to the $1,935 low. Immediate resistance is near the $2,000 zone.

The first major resistance is near $2,020 or the 100-hourly Simple Moving Average. It is near the 61.8% Fib retracement level of the downward move from the $2,092 swing high to the $1,935 low. A close above the $2,020 resistance could start another strong increase.

Source: ETHUSD on TradingView.com

The next resistance is near $2,090, above which the price could aim for a move toward the $2,120 level. Any more gains could start a wave toward the $2,200 level.

If Ethereum fails to clear the $2,020 resistance, it could start a fresh decline. Initial support on the downside is near the $1,950 level. The next key support is $1,935.

The main support is $1,920. A downside break below the $1,920 support might start a steady decline. In the stated case, Ether could drop toward the $1,850 support zone in the near term. Any more losses might call for a drop toward the $1,800 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $1,935

Major Resistance Level – $2,020

Ryan Sean Adams, a crypto investor and a vocal Ethereum supporter, notes that some ETH holders are panic selling and diversifying into layer-1 altcoins like Solana (SOL) or Cardano (ADA), primarily concerned that the coin may not outperform the market as it did in the last bull cycle when it soared to around $5,000.

In an X post on November 16, Adams said price action, despite these actions, might rapidly change even if ETH is no longer a 20-100X coin in the eyes of venture capitalists. The investor compares the current trading atmosphere to 2020, months before the second most valuable coin turned higher, surging to record levels.

Presently, Ethereum is trading below the $2,000 round number, pulling back from a recent higher but remaining within a bullish formation. Still, it appears the community is dissatisfied with this performance, especially with competitors, primarily SOL and ADA posting impressive gains.

As of writing on November 16, SOL has not only reversed losses of November 2022 when FTX filed for bankruptcy in the United States but has comfortably surged past key resistance lines, registering new 2023 highs of around $67. To quantify, SOL is up by over 200%.

At the same time, Cardano is firm, adding roughly 70% from October 2023 lows, looking at price action in the daily chart. By October, ADA had discouragingly sunk to as low as $0.25. However, the stellar recovery at the tail end of October sparked demand for the coin, driving it to present levels.

Cardano has been slugging in recent months despite the continuous ecosystem developments, including the refinement of the network’s performance during the Basho stage. Several enhancements, including pipelining, have been introduced to make the network more scalable and secure. Still, this didn’t reflect in ADA’s price action until the recent spike in October.

The difference in performance between Ethereum and competing altcoins, as price action reveals, could be due to project-related triggers but mainly the difference in market cap. Ethereum is the second most valuable project, only trailing Bitcoin, whose market cap is multiples higher than even the second largest smart contract platform by market cap, BNB Chain.

Subsequently, this makes ETH less volatile, forcing supporters, as Adam notes, to divest into other more volatile coins. These competing layer-1 altcoins have registered triple-digit gains in the last month alone. Nonetheless, even with ETH only adding 30% in the same period, Adams argues that the coin is a “fantastic asset” from a risk-adjusted basis for the average retail investor.

Liquidity protocol Aave’s parent company has been rebranded to Avara as it looks to streamline its suite of infrastructure products to attract a broader Web3 user base.

Cathie Wood, CEO of Ark Invest, has reiterated her bullishness on the crypto industry. In a recent interview with CNBC’s “Squawk Box,” Cathie Wood argued that the crypto industry is poised to reach a $25 trillion valuation, given a regulatory breakthrough in the US. Out of the multitude of digital assets on the market right now, Wood sees two cryptocurrencies driving much of that growth: Bitcoin and Ethereum.

The entire crypto industry has witnessed unprecedented growth since the middle of October. According to data from Coingecko, the entire crypto market cap has increased 35% from $1.096 trillion on October 15th to a current value of $1.4828 trillion.

However, Cathie Wood is of the notion that this growth isn’t over, and the industry will reach a $25 trillion valuation in the near future. A $25 trillion market cap means the industry would have to grow a whopping 1,585% from its current level.

Cathie Wood had predicted earlier in 2021 that Bitcoin would climb more than 10 times its value in the next five years, back when the asset was still trading around $50,000. Given that Bitcoin is now selling at around $37,000, the host of Sqwauk Box, Andrew Ross Sorkin, questioned Wood as to whether or not she still stands by her prediction.

“If we have this conversation in ‘25, ‘26, are you on track?” Sorkin asked. “Yes,” Wood replied.

The CEO did mention that this growth would be feasible only if there were a regulatory green light to allow financial institutions to participate in the cryptocurrency market. She also brought up the role that Spot Bitcoin ETFs will play in the projected spike, particularly BlackRock and Coinbase’s plan to offer a spot Bitcoin ETF in the US.

“I think BlackRock and Coinbase’s partnership is going to be very important,” she said.

Wood specifically called out two coins to look out for as catalysts for this growth: Bitcoin and Ethereum, the two leading assets. This isn’t surprising, as these two assets have developed better price stability than most over the years.

“Our expectation is that the crypto asset ecosystem will be dominated [by Ether and Bitcoin], and it will scale from a little more than $1 trillion today to $25 trillion in 2030 as this new world develops,” Wood explains.

The ARK Invest CEO has been a long supporter of Bitcoin. In another interview, she said she would prefer to hold Bitcoin for 10 years over cash and gold. The CEO is also no stranger to Bitcoin price predictions, as she has previously said that BTC will go to $500,000 and even reach $1.48 million in the next seven years.

According to CoinShares’ latest report, investment products tied to digital assets just reached a yearly institutional inflow of $1.14 billion. The majority of this money ($1.083 billion) has gone into Bitcoin investment products. This could signal the beginning of large-scale institutional investor participation that Wood believes will propel the crypto market cap to $25 trillion.

ARK Invest is also waiting for the SEC’s green light on its spot Ethereum ETF application. Approval of a Spot Bitcoin ETF by the SEC is expected to propel the crypto market into the next bull run.

On Wednesday, the Bitcoin price rallied toward $38,000 amid expectations of the United States Securities and Exchange Commission (SEC) finally approving the first Spot BTC ETF. The regulator would end up exercising its right to delay its decision further, something that has usually been bearish for the price. However, the Bitcoin price continued to show strength, suggesting that a Spot Bitcoin ETF approval might be priced into the market already.

The SEC announced on Wednesday that it had decided to further delay its decision on Spot Bitcoin ETF filings; in particular, the Hashdex Spot Bitcoin ETF filing which was due to a decision or a delay on November 15. The Commission had decided that it needed more time to contemplate and thoroughly investigate the filing before giving a final answer. This means that a decision for the Hashdex ETF filing is not expected until 2024.

Not only did the SEC decide to delay its decision on the Hashdex Spot ETF filing, but it also chose to do so on the Grayscale Ethereum Futures filing. This comes even after Grayscale had emerged victorious over the regulator in court, which demanded that the SEC review Grayscale’s Spot Bitcoin ETF filing.

Just like the Hashdex ETF, the SEC choosing to defer its decision on the Grayscale Ethereum Futures ETF pushes its deadline date into 2024, dashing hopes of the ETFs coming this year. However, both Bitcoin and Ethereum seemed to have shaken off this news with little to no reaction.

The approvals for a Spot Bitcoin ETF and an Ethereum Futures ETF have been anticipated by the crypto community for months now. And like any asset, investors may be becoming indifferent to whether the news affects their investment decisions or not.

Such a development would mean that the Bitcoin and Ethereum ETF approvals are being priced in already, and would not have much effect on the price when they are eventually approved. However, this does not seem to be entirely the case.

One example is when the price of XRP surged upon the rumors of BlackRock filing an XRP ETF, and then subsequently crashing once it was debunked. Then again, on Wednesday, as expectations around the SEC’s decision mounted, the prices of Bitcoin and Ethereum rallied to $38,000 and $2,080, respectively, suggesting that investors are still expecting approval to significantly move the market.

What seems to be happening is that news of delays from regulators is no longer having the bearish effects that they used to have. In this case, investors are simply not reacting to the news of a delay as they usually would seemingly because it is not widely understood that it is not the same thing as a rejection.

The Bitcoin price has since retraced since hitting $38,000 but it maintains a healthy $37,000 at the time of this writing. Ethereum has also followed suit, dropping to $2,046 from its Wednesday peak of $2,080.

Starknet has laid out its road map to begin decentralizing core components of its Ethereum layer 2 scaling network to defend against censorship and improve robustness.

Ethereum price remained strong and started a fresh increase above $2,000. ETH could continue to rise if it clears the $2,075 resistance zone.

After a downside correction, Ethereum price found support near the $1,920 zone. ETH traded as low as $1,933 and recently started a fresh increase like Bitcoin. There was a clear move above the $1,950 and $1,975 resistance levels.

There was a close above the 50% Fib retracement level of the downward move from the $2,118 swing high to the $1,933 low. Finally, it settled above the main $2,000 resistance zone.

Ethereum is now trading above $2,000 and the 100-hourly Simple Moving Average. There is also a key bullish trend line forming with support near $2,046 on the hourly chart of ETH/USD. Immediate resistance is near the $2,075 zone. It is close to the 76.4% Fib retracement level of the downward move from the $2,118 swing high to the $1,933 low.

Source: ETHUSD on TradingView.com

The next major resistance sits at $2,120. A close above the $2,120 resistance could start another strong increase. The first resistance is near $2,150, above which the price could aim for a move toward the $2,200 level. Any more gains could start a wave toward the $2,250 level.

If Ethereum fails to clear the $2,075 resistance or the $2,120 pivot level, it could start a fresh decline. Initial support on the downside is near the $2,045 level or the trend line.

The next key support is $2,025 or the 100-hourly Simple Moving Average. The main support is $2,000. A downside break below the $2,000 support might start a steady decline. In the stated case, Ether could drop toward the $1,920 support zone in the near term. Any more losses might call for a drop toward the $1,850 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $2,025

Major Resistance Level – $2,120

Crypto analyst Tony The Bull, founder of CoinChartist, has revealed why Ethereum is destined to cross $10,000. According to the crypto analyst, the king of the altcoins has its top just right after $10,000 using the Fibonacci extension.

In the latest issue of the CoinChartist newsletter, crypto analyst Tony The Bull used the Hurst Cycle Theory which showed cyclical reoccurrence across the ETH/USDT chart. As the analyst explains, the uptrend noticed in the Ethereum charts has usually come from the accumulation of the token.

Tony points out that this accumulation has always taken place “at the bottom boundary of the Ending Diagonal pattern.” The analyst further added that “Since intracycle harmonics come in twos and threes, three cycles should complete one larger cycle that concludes with a breakdown of this Ending Diagonal pattern.”

Taking this Ending Diagonal Pattern into account, Tony reveals that the top of the pattern puts the ETH price at $10,000. However, this is not the only pattern that suggests that the king of the altcoins will end up beating the $10,000 level.

He also pointed out that the previous ETH rally had started at the 0.5 Fibonacci extension and reached 1.414 the last time that the ETH price peaked. The analyst notes that Ethereum is once again at the 0.5 Fibonacci extension which led to a break out in the price and the same could happen here. But this time, the target is able $10,000 if the 1.414 Fib is reached again.

One interesting fact that the analyst points out in the newsletter is the fact that Ethereum is currently in overbought territory. However, where this would usually signal a bearish reversal coming for the digital asset, Tony does not believe this is the case here.

Rather, he explains that a cryptocurrency being overbought usually means that it is “a powerfully trending asset.” So even though it could lead to a reversal, it does not invalidate the bullishness of that digital asset.

He also mentions that “the Stochastic has confirmed a 1M above 80 on the Stock.” Now, whenever this has happened for Ethereum, it has often resulted in a pushup for the price. At the same time, ETH is moving to the upper Bollinger Band. Both of these setups could paint a bullish breakout for the asset.

However, the analyst warns that for this bullish scenario to play out, the Ethereum price would have to close above $2,450 this month. If the Stochastic moves back below 20, it could invalidate it and trigger a downtrend. “But if ETHBTC can push back above 20 this will generate a buy signal on the 1M Stochastic and kickstart Ether’s over-performance above Bitcoin,” Tony concluded.

The latest in blockchain tech upgrades, funding announcements and deals. For the period of Nov. 16-22, with live updates throughout.

In this week’s edition of The Protocol newsletter, we share a few trends stand out to close 2023: the proliferation of Ethereum layer-2 networks, the ascendancy of zero-knowledge cryptography and the appearance of tokens, smart contracts and now file hosting on the Bitcoin blockchain.

Bitcoin and select altcoins are showing strength, a possible sign that the bull trend has resumed.

An Ethereum insider has made startling allegations against Ethereum Founder, Vitalik Buterin, stating that the Russian inventor had copied his creations.

Former Ethereum Advisor, Steven Nerayoff has taken to X (formerly Twitter) to accuse Ethereum Founder, Vitalik Buterin of copying his inventions. Nerayoff criticized the intelligence of the current Ethereum leadership, making contentious remarks about Buterin and co-founder of Ethereum, Joseph Lubin.

“Vitalik slept on my couch & copied my inventions. He and SBF are images. They’re not smart because something seems off, something is off. The recording shows his and Joe’s stupidity and ignorance. Hear who understood Ethereum, me or them,” Nerayoff stated.

The former ETH Advisor continued on his tirade of allegations, casting doubts on Buterin’s contributions to the network. He stated that Buterin had never invented anything substantial and that the ETH founder was the sole reason behind the network never scaling.

The accusations also suggested that the only significant achievement in the Ethereum ecosystem was the issuance of utility tokens on ICOs, which Nerayoff claimed he had invented.

Nerayoff also made startling revelations, accusing Buterin and Lubin of deliberately damaging the cryptocurrency by focusing on issuing fraudulent ICOs to unsuspecting investors and potentially harming them.

“Did Vitalik invent anything? No, he did not. Ethereum never scaled bc of him. The only killer app was issuing Utility Tokens on ICOs, both of which I invented. Vitalik & Lubin sabotaged crypto. Their focus was merely to issue hundreds or thousands of fraudulent ICOs fleecing people,” Nerayoff stated.

In an X post on Tuesday, Stephen Nerayoff presented thought-provoking questions to the crypto community about Vitalik Buterin’s Ethereum scalability capabilities.

Nerayoff released a video on X by a community member, Mr. Huber which featured Vitalik Buterin describing plans for the ETH Network. He told the crypto community to remember the video when he eventually released evidential recordings of his conversation with Buterin about his ideas for ETH 2.0.

“Remember this video when I drop the recording and what I tell Vitalik about 2.0 and to fix misaligned incentive structures. Is Vitalik the savior they bill him as to make Ethereum scale or is he the reason it never scaled? Decide for yourselves,” Nerayoff stated.

The question raised by the former ETH Advisor has sparked debates and differing opinions about the Ethereum Founders. Although no proper evidence has been presented regarding the accusations laid against Buterin, the crypto community continues to watch and analyze the situation as it unfolds.