Bitcoin and select altcoins are looking strong at the start of October, but will the flashpan bullish momentum last?

Cryptocurrency Financial News

Bitcoin and select altcoins are looking strong at the start of October, but will the flashpan bullish momentum last?

The latest in blockchain tech upgrades, funding announcements and deals. For the week of Oct. 2-8, with live updates throughout.

The fund is a part of a wider VCC umbrella that brings various real-world assets to the blockchain.

Its the largest ether trust in the world with $5B in AUM.

Ethereum price is attempting a fresh increase above $1,720 against the US Dollar. ETH could accelerate higher if it clears the $1,750 resistance.

Ethereum’s price settled above the $1,650 level. ETH formed a base above $1,650 and recently started a decent increase above the $1,700 level, like Bitcoin.

There was a move above the $1,720 resistance level and the price tested the $1,750 zone. A high was formed near $1,756 and there was a minor downside correction. The price declined below the $1,735 level. However, it is still above the 50% Fib retracement level of the recent rally from the $1,668 swing low to the $1,756 high.

Ethereum is trading above $1,700 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1,750 level. There is also a connecting trend line forming with resistance near $1,750 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

The next major resistance is $1,800. A clear move above the $1,800 resistance zone could set the pace for a larger increase. In the stated case, the price could visit the $1,850 resistance. The next key resistance might be $1,920. Any more gains might open the doors for a move toward $2,000.

If Ethereum fails to clear the $1,750 resistance, it could start a downside correction. Initial support on the downside is near the $1,710 level. The next key support is $1,680.

The 76.4% Fib retracement level of the recent rally from the $1,668 swing low to the $1,756 high is also near $1,685 to provide support, below which the price could test the $1,650 support. A downside break below the $1,650 support might start another bearish wave. In the stated case, there could be a drop toward the $1,600 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,700

Major Resistance Level – $1,750

Some 5,000 ETH, worth over $8.2 million, have been moved from a wallet address associated with the FTX hacker. This development marks the first time assets have been transferred out of the hacker’s wallet following the exploit about a year ago.

Marked as one the biggest crypto heists ever, the now-defunct FTX exchange suffered a loss of over $600 million through an hack in November 2022, a few hours after filing for bankruptcy.

According to the on-chain analytics platform Spot On Chain, the FTX exploiter has now transferred 5,000 ETH in two transactions, moving 2,500 ETH to two separate wallets with a space of two hours between both transactions.

FTX Exploiter 0x3e957 just moved 2500 $ETH ($4.2M) to new addresses

This is the first time the address has been active since the hack 10 months ago. The address still holds 12.5K $ETH

Follow the next actions via our platform at

https://t.co/7LnmryLvhL pic.twitter.com/yl2NnMwaqW

— Spot On Chain (@spotonchain) September 30, 2023

Spot on Chain further revealed that following the first transaction, the hacker moved 700 ETH through the Thorchain Router and 1,200 ETH through the DeFi wallet Railgun, both crypto projects that are lauded for their privacy-focused features.

Aside from the origin of these transferred assets, the movements of the FTX exploiter have drawn much attention due to a key development in the crypto space, with many enthusiasts and analysts now speculating on a possible market sell-off.

This week, reports swelled that the US Securities and Exchange Commission (SEC) was looking to clear some Ether futures ETH for launch next week ahead of a possible government shutdown.

These reports picked up more steam in less than a day when the VanEck Investment firm announced plans to soon launch an Ether futures ETH, named the VanEck Ethereum Strategy ETF.

However, Valkyrie Investments, who had been tipped to be the forerunner for the SEC’s approval, finally won the race, securing the commission’s green light to launch the first-ever Ether futures ETF in the US.

Following the official launch of an Ether futures ETF, there is likely a massive positive effect on ETH price movement. Just in the last two days of similar positive news around this investment fund, the second-largest cryptocurrency already rose by 4%, based on data from CoinMarketCap.

Now, the recent token transfers by the FTX hacker are usually associated with an impending sell action. Thus, there is a possibility that this bad actor could be planning to take profit from the potential ETH price surge, which could be generated from the launch of ETH futures ETF.

Such selling action is a common practice by crypto whales and is known to induce a bearish trend, which could be dangerous for small traders.

At the time of writing, ETH trades at $1,677, with a 5.77% gain in the last day. Meanwhile, the token’s daily trading volume is down by 44.35% and valued at $3.8 billion.

Asset management firm Valkyrie, one of the frontrunners for the first Ethereum ETF (exchange-traded fund) in the United States, has decided to pause its purchase of Ether futures contracts until the US Securities and Exchange Commission approves an Ether futures ETF. This comes barely a day after the asset manager reportedly secured approval to offer investors exposure to Ether futures under its existing strategy ETF (BTF).

On Friday, September 29, Valkyrie filed a 497 with the SEC, saying that it would halt the purchase of Ether futures contracts and unwind its existing positions.

A part of the filing read:

Effectively immediately, The Fund will not purchase ether futures contracts until the effectiveness of an amendment to the Fund’s registration statement contemplating the addition of ether futures contracts to the principal investment strategy of the Fund. Until such time, the Fund will unwind any existing positions in ether futures contracts.

As reported on Thursday, September 28, the SEC appears to be fast-tracking the approval of Ethereum futures ETF in anticipation of a potential US government shutdown next week.

Following this report, Valkyrie disclosed that it had begun purchasing Ether futures contracts for its combined strategy ETF ahead of a possible launch next week.

However, this latest action poses questions about the odds of Valkyrie becoming one of the first firms to introduce an Ethereum ETF in the United States.

Bloomberg analyst Eric Balchunas has put forward a possible reason for Valkyrie’s decision to halt and unwind its Ether futures purchases. “SEC must have threatened them to cut it out,” Balchunas speculated via a post on X (formerly Twitter).

The plot thickens, Valkyrie just put out 497 that they are in fact not going to buy Ether futures until they are live (prob Tue) and are going to sell the Eth futures they bought (in an effort to jump line a bit). SEC must have threatened them to cut it out. Damn. https://t.co/yDkggCw3d1 pic.twitter.com/cKaV7k7AJs

— Eric Balchunas (@EricBalchunas) September 29, 2023

Valkyrie filed its unique Ethereum ETF application with the SEC in August. The asset manager seeks to convert its existing Bitcoin Strategy ETF (BTF) to a combined Bitcoin and Ether futures ETF.

According to Eric Balchunas’ analysis, about nine Ethereum ETFs will potentially start trading on Monday, October 2. Notably, asset manager ProShares owns three of these funds, with two being combined Bitcoin and Ethereum ETFs.

VanEck is another frontrunner for the first Ether futures ETFs in the US. The investment manager recently announced its intention to donate 10% of profits from its Ethereum ETF (EFUT) to The Protocol Guild, a compensation plan for Ethereum core contributors.

VanEck wrote on X (formerly Twitter):

If TradFi stands to gain from the efforts of Ethereum’s core contributors, it makes sense that we also give back to their work. We urge other asset managers/ETF issuers to consider also giving back in the same way.

Big announcement!

We intend to donate 10% of our $EFUT ETF profits (https://t.co/gr652AkUvv) to @ProtocolGuild for at least 10 years.

Thank you, Ethereum contributors, for nearly a decade of relentless building & ongoing stewardship of this common infrastructure.

Details

— VanEck (@vaneck_us) September 29, 2023

It is worth mentioning that the ETH price has seen some reprieve since news of the potential Ethereum ETF launch started making rounds. As of this writing, Ether is valued at $1,676, reflecting a substantial 5% price jump in the past week.

Cosmos, a blockchain where developers can create custom chains that interconnect and communicate, has revealed its roadmap for 2024. According to an X post on September 25, the roadmap centers on increasing modularity, improving the developer experience, addressing “technical debt,” and driving user adoption. With this, Cosmos developers plan to take on the more established platform, Ethereum.

At the heart of Cosmos are features such as Tendermint, a consensus system that anchors blockchains such as the BNB Chain; Cosmos SDK, a software developer kit that allows coders to build fluid and custom blockchains; and the Inter-Blockchain Communication (IBC), from where all deployed custom Cosmos chains can connect and communicate, effectively driving interoperability.

In 2024, reading from the roadmap, Cosmos aims to solidify its position by attracting developers from competing platforms as they repay the “technical debt.” In app development, technical debt leads to extra work and can be caused by resource constraints and shifting code requirements.

Cosmos will expand its developer base to repay this debt and make the Cosmos SDK more modular. Although the team claims the SDK has been modular in theory, swapping and modifications have made practical implementation more challenging.

Therefore, to tackle these challenges, the work already done on Cosmos SDK will continue into 2024. Then, the goal will be to make the kit more modular at the core. This will make it more adaptable and flexible, meeting developer requirements.

It is yet to be seen whether this will be achievable in 2024 and whether Cosmos will grow as dominant as Ethereum. Currently, Ethereum is the leading smart contract platform, based on its market cap and the total value locked (TVL) in decentralized finance (DeFi). Additionally, its ecosystem of layer-2s has been increasing, with more protocols and blockchains connecting to Ethereum to take advantage of the network’s pioneering activity.

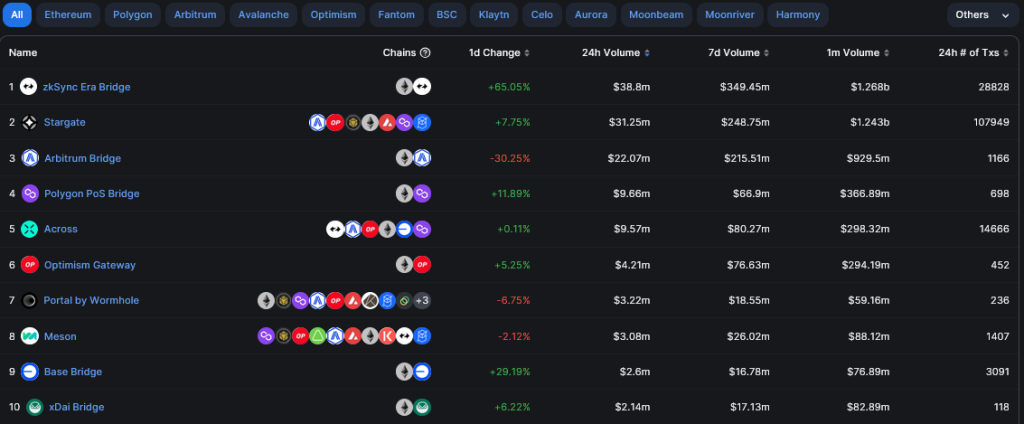

DeFiLlama data on September 29 shows that all the top 10 bridges are connected to Ethereum. To illustrate, Stargate–by Cosmos, is connected to Ethereum and multiple blockchains, including Avalanche and the BNB Chain.

Besides Stargate, other bridges are Ethereum Virtual Machine (EVM) compatible and predominantly connect to Ethereum layer-2s and Polygon, the sidechain. For example, the zkSync Era, Base, Arbitrum, Polygon, and the Optimism Gateway, are plugged into Ethereum. Cumulatively, these bridges move millions of dollars worth of tokens to and from Ethereum at any instance.

Crypto bulls are attempting a comeback. Here are the altcoins that traders are keeping an eye on.

Crypto bulls are attempting a comeback. Here are the altcoins that traders are keeping an eye on.

Crypto bulls are attempting a comeback. Here are the altcoins that traders are keeping an eye on.

Bloomberg analyst Eric Balchunas speculated that the SEC may have pressured Valkyrie to halt ETH futures contract purchases until the ETF was officially approved.

Bloomberg analyst Eric Balchunas speculated that the SEC may have pressured Valkyrie to halt ETH futures contract purchases until the ETF was officially approved.

Bloomberg analyst Eric Balchunas speculated that the SEC may have pressured Valkyrie to halt ETH futures contract purchases until the ETF was officially approved.

Ethereum price is attempting a fresh increase above $1,650 against the US Dollar. ETH could accelerate higher if it clears the $1,670 resistance.

Ethereum’s price formed a base above the $1,580 level. ETH remained stable and climbed above the $1,620 resistance zone to move into a positive zone, like Bitcoin.

There was a move above the $1,650 level but upsides were limited. A high was formed near $1,667 and there was a minor downside correction. The price is now trading near the 23.6% Fib retracement level of the upward move from the $1,583 swing low to the $1,667 high.

Ethereum is trading above $1,640 and the 100-hourly Simple Moving Average. There is also a key bullish trend line forming with support near $1,645 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

On the upside, the price might face resistance near the $1,670 level. The next major resistance is $1,720. A clear move above the $1,720 resistance zone could set the pace for a larger increase. In the stated case, the price could visit the $1,800 resistance. The next key resistance might be $1,820. Any more gains might open the doors for a move toward $1,880.

If Ethereum fails to clear the $1,670 resistance, it could a downside correction. Initial support on the downside is near the $1,645 level and the trend line.

The next key support is $1,620 or the, below which the price could test the $1,600 support. A downside break below the $1,600 support might start another bearish wave. In the stated case, there could be a drop toward the $1,540 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,620

Major Resistance Level – $1,670

After sinking roughly 30% from 2023 highs, Ethereum appears to be bouncing off from the pits of the crypto winter. Looking at candlestick arrangements in the daily and weekly charts, the coin has primary support at around $1,500 and is firm, bouncing off with decent trading volume.

At spot rates, ETH is up approximately 3% following positive developments sparked by the increasing adoption of its layer-2 scaling solution and the recent news that VanEck, a player managing billions of assets, is preparing to launch an Ethereum derivatives product.

Taking to X on September 28, Alex Masmej, the founder of Showtime, believes that Ethereum’s layer-2 ecosystem has expanded to such an extent that it no “longer makes sense to build on other platforms.”

The development and deployment of Ethereum layer-2 solutions took center stage following network congestion, which forced gas fees to spike to record highs in the last bull run.

Developers have responded to the network co-founder Vitalik Buterin’s urging. The expert believes they are quickly constructing and deploying safe, universal platforms that have gained widespread popularity.

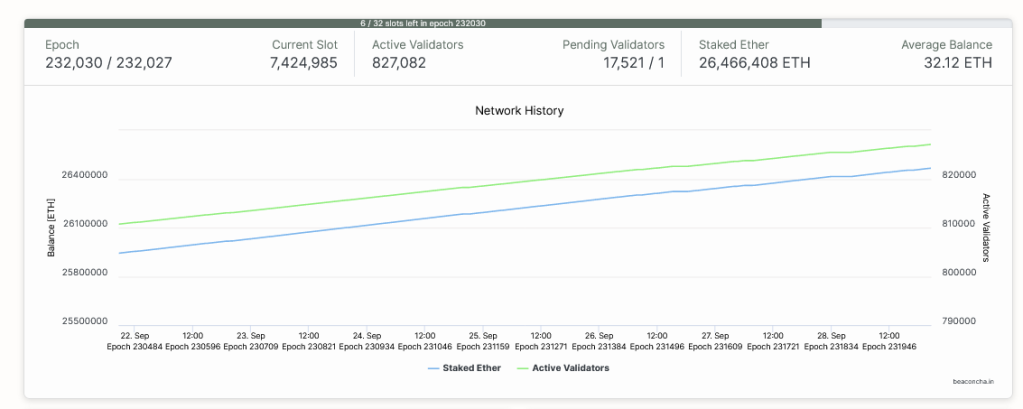

Layer-2 platforms bundle transactions off-chain before confirming them on-chain, allowing for faster and more cost-effective operations while benefiting from the security of Ethereum. As of September 28, there were over 827,000 validators whose job is to confirm transactions and ensure that the network is secure, thanks in part to their geographic distribution.

Most layer-2 solutions use optimistic rollups, including Arbitrum, Base, and OP Mainnet. However, Masmej also said that once ZK rollups, which utilize zero-knowledge proofs to validate transactions without revealing sensitive data, are available, it will end the scalability trilemma, further boosting the capabilities of layer-2 solutions.

In the founder’s assessment, high throughput options, including Solana, will be a hedge. At the same time, Cosmos, which drives blockchain interoperability, will act as a long-term source of inspiration. Meanwhile, Ethereum will continue to flourish as Layer-2 options gain traction.

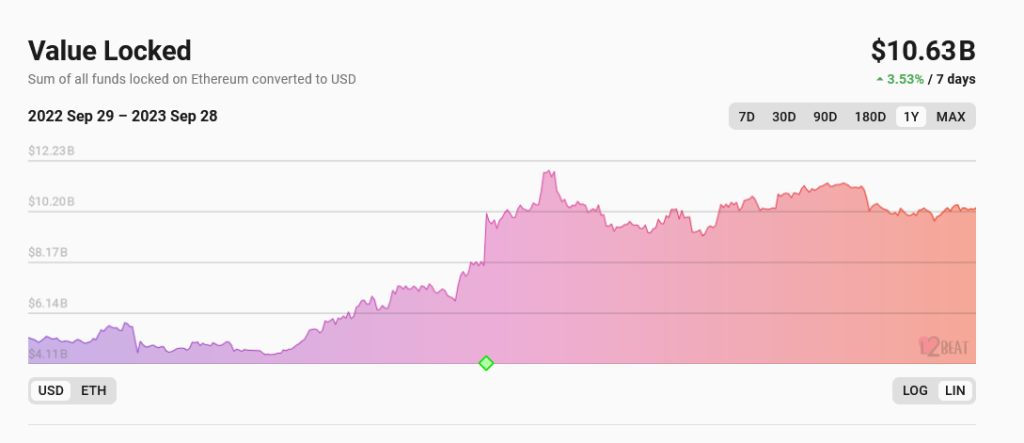

According to l2Beat data, popular solutions like Arbitrum and Base, which offer faster and cheaper processing environments while remaining coupled with Ethereum and enjoying the pioneer network’s fast-move advantage, have larger total value locked (TVL). As of September 28, layer-2 platforms have a TVL of over $10.6 billion, more than Solana’s market cap, which stood at $8 billion, according to CoinMarketCap.

Beyond layer-2 adoption, ETH is being catalyzed by the news that VanEck, a global asset manager, is preparing to introduce its Ethereum futures exchange-traded fund (ETF). Specifically, the VanEck Ethereum Strategy ETF (EFUT) will invest in ETH futures contracts provided by exchanges approved by the Commodity Futures Trading Commission (CFTC).

Like the Bitcoin Futures ETF product, which is already being offered, the Ethereum derivative product will allow institutions to gain exposure, boosting liquidity.

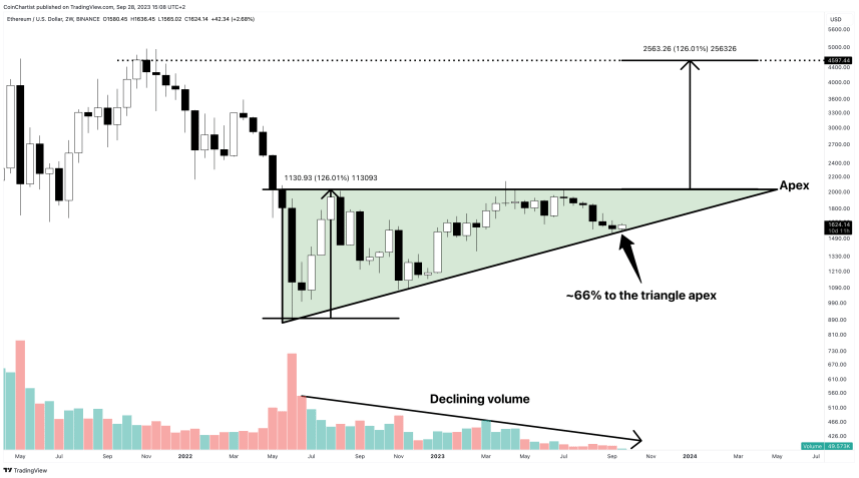

Could bullish Ethereum news related to the launch of an ETH futures ETF be the catalyst that triggers a massive breakout of a nearly 16-month long ascending triangle pattern?

If the pattern is valid, the target is roughly $4,000 per ETH and a revisit to former all-time highs from the last bull market.

Global asset manager VanEck, known best for its ETFs and Mutual Funds, today revealed the upcoming launch of the VanEck Ethereum Strategy ETF (ETUF).

ETUF will be “an actively managed ETF designed to seek capital appreciation by investing in Ether (ETH) futures contracts.”

Rather than investing in spot ETH, the Fund will trade Chicago Mercantile Exchange (CME) ETH futures, and will be managed by the firm’s Head of Active Trading, Greg Krenzer.

ETUF will trade on CBOE alongside VanEck’s Bitcoin Strategy ETF (XBTF). And although its inception of November 15, 2021 marked the end of the bull market in crypto, the introduction of Ethereum futures has the potential to kickstart the next bull run.

Show me the chart and I’ll tell you the news, is a famous quote from the late Bernard Baruch. The message reflects the fact that the largest technical moves tend to coincide with a news catalyst and vice-versa.

Essentially, the a bullish chart pattern could possibly appear before positive news – such as the launch of an ETH futures ETF – while the news itself is the catalyst for a strong breakout.

This is precisely what appears to be brewing in ETHUSD charts since June of 2022. Unlike Bitcoin which put in a bottom late in 2022, Ethereum found support about halfway through the year. Since then, Ether has consistently made higher lows, forming a potential ascending triangle chart pattern.

Now, the ascending triangle pattern is nearing the two-thirds point from its apex. This increases the chances of a breakout occurring as an Ethereum futures ETF gets launched have increased significantly. All that’s required is a breakout above $2,000 per ETH on higher than normal volume. Based on the measure rules, reaching the target objective could push prices to over $4,000.

VanEck Ethereum Strategy ETF (EFUT) will invest in ETH futures contracts traded on commodity exchanges registered with the CFTC.