Circle announced the launch of a new platform that uses pre-vetted templates to make building Web3 apps easier for traditional developers.

Bitcoin Maximalist Calls Ethereum ‘Garbage’, Here’s Why

Ethereum has long been the target of criticism from die-hard Bitcoin maximalists who believe that Bitcoin is the only worthwhile cryptocurrency despite the fact that Ethereum holds the second-highest percentage of the entire cryptocurrency market value.

Now, another Bitcoin maximalist, Steve Barbour, has referred to the leading platform for smart contracts as garbage.

Bitcoin Maximalist Makes Controversial Claim About Ethereum

In a social media post on X, the prominent Bitcoin enthusiast recently called Ethereum “garbage” and said it has no future. His argument essentially boils down to Ethereum failing to attract investors from the free market and nothing else.

Ethereum is garbage. The free market doesn’t want it and the captured market still can’t figure out what it is for.

— Steve Barbour (@SGBarbour) October 16, 2023

Barbour is the founder of Upstream Data, a mining infrastructure company building off-grid Bitcoin mining rigs. His claim comes behind the heels of Ethereum staking rewards falling to new lows.

The number of Ethereum in staking pools has been steadily growing over the past few months; however, this has not been accompanied by increased profitability. According to CoinGecko, liquid staking protocols accounted for 43.7% of the total 26.4 million ETH staked in August 2023.

The annual percentage yield (APY) from ETH staking has decreased over the years, going from 18% in 2020 to 3% in October. Since 2022, these protocols have paid out 100,000 ETH in quarterly incentives for staking, but the low APY has led many investors to question if staking ETH is still worthwhile.

Barbour and other Bitcoin maximalists claim that Ethereum is not as decentralized as Bitcoin, particularly given that the blockchain has recently moved from proof-of-work to a proof-of-stake consensus process.

Most of them believe that Bitcoin is the sole “true” cryptocurrency and that all other cryptocurrencies are worthless. Bitcoin maximalists have also been critical of other cryptocurrencies apart from Ethereum. Max Kaiser, another strong supporter of Bitcoin, has lately asserted that XRP is centralized.

Responses And Reactions

Ethereum has proven itself to be more than garbage, as evident in its vast number of supporters and large ecosystem. However, some supporters of Bitcoin agreed with the maximalist.

Agreed. It’s full of speculators

— Carnival_Poe (@Carnival_Poe) October 17, 2023

The free market has Ethereum now at $1,550. ETH has witnessed a 1.65% drop in price in the past 24 hours, and it continues to stay weaker against Bitcoin.

On the other hand, Bitcoin has increased in dominance against altcoins. Most of the money and attention has flowed into Bitcoin, and the crypto has witnessed a 6.39% increase in the past seven days.

As a result, ETH bulls have struggled to push above $1,600 and the crypto is now trading around the $1,550 support zone. If bulls fail to hold this level, it could start another decline to as low as $1,430.

This Bullish Divergence Is Once Again Forming For Bitcoin, Rally Soon?

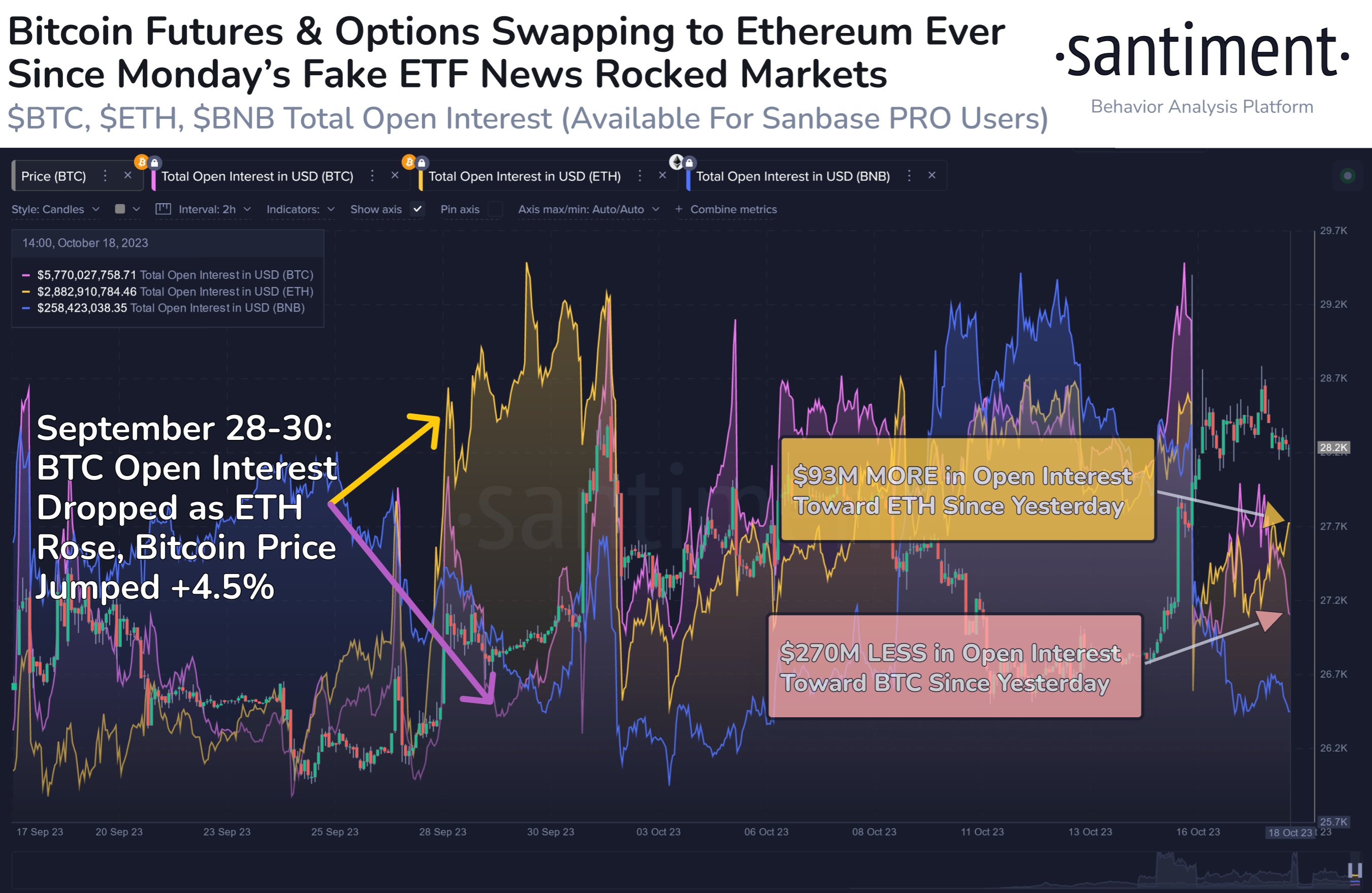

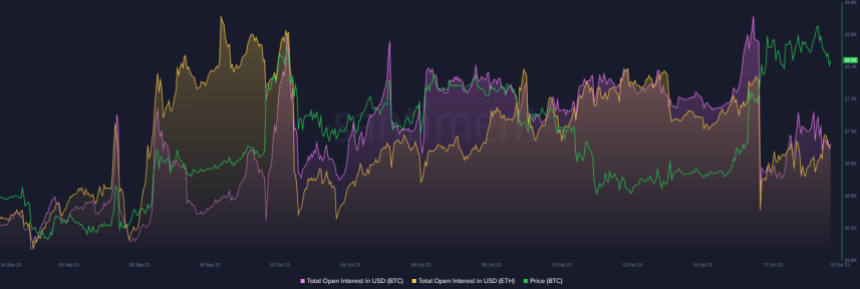

Data shows a divergence is forming between Bitcoin and Ethereum’s open interest, something that has been bullish for BTC in the past.

Bitcoin Open Interest Has Declined, While Ethereum Has Seen Rise

According to data from the on-chain analytics firm Santiment, the BTC open interest has been going down since Monday. The “open interest” here refers to the total amount of Bitcoin contracts (in USD) that are currently open on the futures and options market.

When the value of this metric increases, it means that there are more positions being opened up on derivative exchanges right now. Such a trend can lead to increased volatility for the asset, as more positions generally come with higher overall leverage for the sector.

On the other hand, decreasing values suggest the traders are either closing off their positions or are getting liquidated. The cryptocurrency may become calmer following this kind of trend.

Now, here is a chart that shows the trend in the open interest for Bitcoin and Ethereum over the past month:

As displayed in the above graph, The Bitcoin open interest has observed a downtrend in the last few days. This decline in the indicator had first started when the fake iShares ETF announcement led to more than $100 million shorts being flushed in a flash.

The metric saw a bit of a rebound not too long after this sudden sharp liquidation squeeze took place, but it was quick to return back toward a downward trajectory.

At the same time that this latest decline in the Bitcoin open interest has occurred, the Ethereum open interest has registered a rise instead. This suggests that while contracts are closing up on BTC futures and options, the ETH side of the market is seeing renewed interest.

Interestingly, as Santiment has highlighted in the chart, the last time this trend occurred, the Bitcoin price benefited from an uplift. This previous occurrence of the pattern was between September 28 and 30, and shortly after this, the BTC price saw an increase of about 4.5%.

The divergence between the metrics of the two assets was much more pronounced back then as compared to now; however, the scales of both the decline in the BTC open interest and the rise in the ETH open interest were far greater.

Nonetheless, the same general pattern has still repeated this time, so it now remains to be seen whether Bitcoin would see a bullish effect this time as well, and if so, to what degree, given the lesser scale of the divergence.

BTC Price

Bitcoin has gone stale during the last few days as its price is still trading around the $28,400 mark right now.

ETH Price Watch: Impact On Price As Traders Ditch Bitcoin On Derivatives Market

Ether (ETH), the second-largest cryptocurrency by market capitalization, has been on a downward trajectory for the past three months. Despite a brief fake-out rally, ETH has struggled to regain its footing in the crypto market.

The recent rally, though short-lived, has brought about interesting developments in the derivatives market. While Bitcoin’s open interest (OI) witnessed a significant drop, Ethereum saw an increase in its OI.

Open interest, often abbreviated as OI, is a crucial metric in the world of cryptocurrency derivatives. It represents the total value of outstanding contracts in the market. In simpler terms, it measures the amount of money traders have invested in futures or options contracts for a specific cryptocurrency.

ETH’s OI Garners More Interest

As of October, the crypto derivatives market has depicted an intriguing scenario. Bitcoin’s OI has been hovering around $6 billion, while Ethereum’s stands at $2.8 billion. Although ETH has not surpassed BTC in terms of open interest, it has certainly garnered more attention and interest.

A recent fake rally in Bitcoin’s price, triggered by false reports of an approved spot Bitcoin ETF, had a substantial impact on the cryptocurrency market. Bitcoin’s Open Interest (OI) declined by more than $270 million, decreasing to $5.7 billion as investors reacted to the misleading information.

On the other hand, Ethereum’s OI increased by over $93 million, reaching $2.8 billion during the same period, highlighting its resilience in the face of market volatility.

These events underscore the cryptocurrency market’s sensitivity to news and rumors, emphasizing the importance of accurate information in this space.

Furthermore, the contrasting trajectories of Bitcoin and Ethereum’s OI showcase Ethereum’s ability to attract renewed investor interest and maintain stability, solidifying its position as a prominent and enduring cryptocurrency in the market.

Potential Price Impact And ETH Current Status

At the time of writing, the CoinGecko price for Ethereum is $1,548. It’s noteworthy that ETH has experienced a 1.9% dip in the past 24 hours and a 0.6% loss over the past week.

Analyzing the daily price chart, Ethereum’s price action is characterized by a rising wedge formation. This formation serves as a key determinant of ETH’s short-term trajectory.

As long as the trendlines defining this pattern remain intact, there’s potential for the coin to serve as a dynamic support zone for buyers during market corrections.

However, a more pessimistic scenario looms in the event of a breakdown below the lower boundary of this wedge, which could signal the onset of a major correction for Ethereum.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from

Polygon Proposes Council for ‘Decentralized Governance,’ Names 13 Members

The project named 13 “inaugural members” to the council, including officials from Coinbase and the Ethereum Foundation.

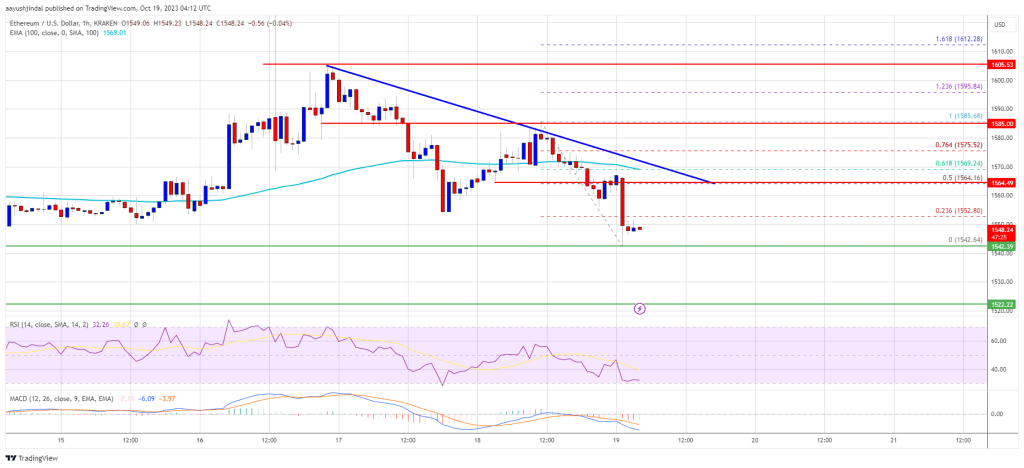

Ethereum Price On The Brink: 10% Drop Possible Toward $1,440

Ethereum price settled below the $1,565 support zone against the US dollar. ETH is accelerating lower and might drop toward the $1,440 support.

- Ethereum is gaining pace below the $1,550 support zone.

- The price is trading just below $1,565 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance near $1,565 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair remains at risk of more downsides toward the $1,440 support.

Ethereum Price Turns At Risk

Ethereum started a fresh decline and settled below the $1,600 pivot level. ETH traded below the $1,565 and $1,550 support levels, like Bitcoin.

A low is formed near $1,542 and the price is now consolidating losses. The current price action suggests high chances of more losses. There is also a connecting bearish trend line forming with resistance near $1,565 on the hourly chart of ETH/USD.

Ethereum is now trading just below $1,565 and the 100-hourly Simple Moving Average. On the upside, the price is facing resistance near the $1,565 level and the trend line. The 50% Fib retracement level of the downward move from the $1,585 swing high to the $1,542 low is also near the trend line.

The first major resistance is near the $1,575 zone or the 76.4% Fib retracement level of the downward move from the $1,585 swing high to the $1,542 low.

Source: ETHUSD on TradingView.com

A close above the $1,575 resistance might start a steady increase. In the stated case, Ether could start a recovery wave toward the $1,600 resistance. Any more gains might open the doors for a move toward $1,665.

More Losses in ETH?

If Ethereum fails to clear the $1,565 resistance, it could start another decline. Initial support on the downside is near the $1,540 level.

The next key support is $1,520. A downside break below the $1,520 support might spark sharp bearish moves. In the stated case, the price could drop toward the $1,440 level. Any more losses may perhaps send Ether toward the $1,350 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $1,520

Major Resistance Level – $1,565

Uniswap Is Decentralizing: Why Are DeFi Users Worried About This Feature?

Devin Walsh, Executive Director of the Uniswap Foundation, a non-profit organization supporting the growth and decentralization of the Uniswap decentralized exchange (DEX), believes that Uniswap is decentralizing. Walsh even compares the current state of the DEX to that of Ethereum. The executive also acknowledged that the DEX’s current level of success is due to the active participation and contribution of the developer community.

Uniswap Becoming More Decentralized?

The Executive Director responded to a thread on X where Antonio Juliano, the founder of dYxX, a layer-2 DEX on Ethereum, insinuated that Uniswap is now centralized. However, it started on a decentralized path.

With centralization, Juliano added, the protocol can iterate quickly, mainly to boost revenue. On the other hand, by being more decentralized, dapps allow users to enjoy the full advantages of decentralized finance (DeFi).

Decentralization of protocols launching on public ledgers, like Ethereum or Cardano, is crucial. Usually, the community will gauge how well a dapp is decentralized by looking at, among other factors, how decisions are made and which party spearheads development.

In the case of Ethereum, Walsh pointed out that the community has taken over from where Vitalik Buterin, the co-founder; and Consensys, a technology company developing solutions for Ethereum, left. Since then, multiple developers have been refining the network and ensuring it is secure and robust to anchor dapps.

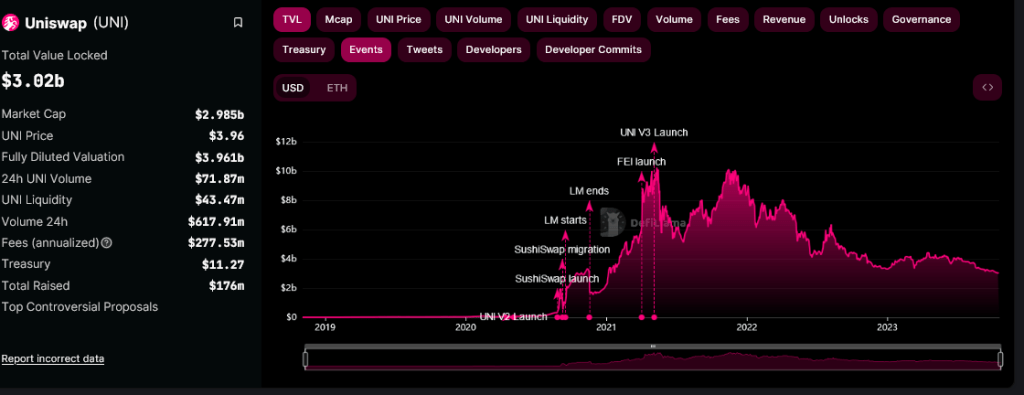

Uniswap is one of the most popular DEXes on Ethereum, looking at total value locked (TVL). DeFiLlama data shows that the exchange manages over $3 billion of assets and is primarily active on Ethereum. However, the exchange enables trustless swapping on layer-2 platforms like OP Mainnet, and public ledgers like the BNB Chain.

Preparing For Hooks And KYC?

Presently, Uniswap Labs leads the development of Uniswap. Nonetheless, Walsh said more developers are now building and contributing solutions. This, the Uniswap Foundation executive further observed, is especially considering the scheduled launch of Hooks in v4.

There is no specific timeline for when Uniswap will deploy the latest iteration, but the release of the Cancun upgrade on Ethereum will play a role. The protocol will be more customizable with Hooks since the feature acts more like a plugin.

Even so, there have been concerns that Hooks, though being developed by community developers, will be the basis for Uniswap to censor liquidity providers (LP) or traders who don’t verify by adhering to know-your-customer rules (KYC). UNI prices remain under pressure at spot rates and may break lower, registering new 2023 lows.

Ethereum DeFi protocol Hope Lend drained after exploit

The protocol, which had 526 Ether in total value locked, was emptied in an attack on Oct. 18.

Cracks Appear as Ethereum Staking Demand Wanes

Earlier this year, Ethereum staking was popular, particularly with Lido Finance’s rise to prominence in the DeFi space, but it is now facing challenges, suspicions, and resentment.

Stellar, Early Blockchain Built for Payments, Adds Smart Contracts to Take on Ethereum

The nine-year-old project, one of the earliest major blockchains, is getting a facelift to incorporate “smart contracts,” that theoretically could attract new applications and users – and potentially more demand for the XLM token.

Investment Manager Methodic Unveils Ether Staking Fund Offering Exposure to ETH Price and Yield

The Methodic CoinDesk ETH Staking Fund offers institutional exposure to spot ETH price and staking yields.

Real Reason Behind Ethereum Founder’s Massive ETH ‘Sales’ Exposed

A crypto wallet owned by the Ethereum founder Vitalik Buterin has seen a series of transactional activities lately, piquing the interest of crypto community members at a time when Ethereum selling pressures are rising.

Following this, Buterin has taken the initiative to address the concerns regarding his recent transfer of digital assets to multiple exchanges.

Ethereum Co-Founder Discloses Truth Behind Multi-Transfers

In a recent post on Warp Cast, a decentralized social network, Russian-Canadian computer programmer and founder of Ethereum, Vitalik Buterin publicized the real reason behind the latest ETH transfers made via his wallet address.

Buterin explained to the public that the large-scale ETH transactions that were performed using his wallet were not sold by him. He stated that over the years, he has mostly focused on donating large sums of Ethereum funds to charity organizations and other projects. He further solidified his claims saying that he had not sold ETH for personal profits since 2018.

“If you see an article saying ‘Vitalik sends XXX ETH to [exchange]’, it’s not actually me selling, it’s almost always me donating to some charity or nonprofit or other projects, and the recipient selling because, well, they have to cover expenses,” Buterin stated.

Buterin is well-known for his philanthropic acts toward charity organizations and medical interventions. The Ethereum co-founder made headlines in 2021, after donating $1 billion worth of SHIB tokens to a COVID-19 relief fund in India.

Additionally, in February 2023, Buterin donated $150,000 to Anka Relief to fund a crypto aid project that would support Türkiye after its recent earthquake experiences.

Although there have been many proofs of Buterin’s propensity to donate to multiple charities, the crypto community has remained skeptical and vigilant, relentlessly monitoring the Ethereum founder’s cryptocurrency activities, as well as these recent high-value ETH transactions.

Spokesperson Reveals $15 Million ETH Transfer From Kanro Charity

According to data from PeckShield Alert, a blockchain security and auditing firm, Vitalik Buterin recently made a large-scale transaction of $15 million USDC to the Gemini Exchange.

This transaction in question is among the list of recent transfers associated with the Ethereum founder. These movements have prompted both curiosity and concern in the crypto community, as observers attempt to determine the underlying motive behind Buterin’s transactions.

A report from Cointelegraph said an Ethereum Foundation Spokesperson has clarified the details behind the lofty transaction. According to the Spokesperson, the $15 million USDC transfer was only executed under Buterin’s Ethereum Name Service (ENS) and not from his wallet address.

The spokesperson also supposedly confirmed that the funds were from a transfer made by a charity multi-sig wallet, Kanro, which is closely linked to Buterin to sponsor a grant.

Ethereum LSDFi sector grew nearly 60x since January in post-Shapella surge: CoinGecko

The LSDFi sector’s total value locked has grown 5,870% since January as ETH holders seek better yields.

Ethereum Underperforms Bitcoin, Bulls Struggle To Protect Key Support

Ethereum price failed to start fresh increase above $1,600 against the US dollar. ETH is now struggling to stay above the $1,550 support zone.

- Ethereum extended its decline and tested the $1,550 support zone.

- The price is trading just below $1,580 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance near $1,570 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could accelerate lower if the bulls fail to protect the $1,550 support.

Ethereum Price Dips Further

Ethereum struggled to settle above $1,650 and started a fresh decline. ETH traded below the $1,620 and $1,600 support levels. There was a short consolidation phase before the price extended its decline, unlike Bitcoin.

There was a move below the $1,575 support and the price tested $1,550. A low is formed near $1,553 and the price is now consolidating losses. There is also a connecting bearish trend line forming with resistance near $1,570 on the hourly chart of ETH/USD.

Ethereum is now trading just below $1,580 and the 100-hourly Simple Moving Average. On the upside, the price is facing resistance near the $1,570 level and the trend line. The 23.6% Fib retracement level of the downward move from the $1,669 swing high to the $1,553 low is also just above the trend line.

The first major resistance is near the $1,600 zone or the 50% Fib retracement level of the downward move from the $1,669 swing high to the $1,553 low.

Source: ETHUSD on TradingView.com

A close above the $1,600 resistance might start a decent increase. In the stated case, Ether could rise and recover toward the $1,660 resistance. Any more gains might open the doors for a move toward $1,720.

More Losses in ETH?

If Ethereum fails to clear the $1,570 resistance, it could start another decline. Initial support on the downside is near the $1,550 level.

The next key support is $1,520. A downside break below the $1,520 support might send the price further lower. In the stated case, the price could drop toward the $1,480 level. Any more losses may perhaps send Ether toward the $1,420 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $1,550

Major Resistance Level – $1,570

Chinese Developers Eager To Build On Solana: Will SOL Breeze Past $30?

China developers are active and willing to build on leading blockchain platforms if statistics from Solana Hyperdrive Hackathon submission details are anything to go by. In an X post on October 17, Matty Taylor, the Head of Growth at the Solana Foundation, said there were far more developers from China who submitted applications, willing to participate in the Solana Hyperdrive hackathon than from the United States.

Solana Attracting Chinese Developers

The hackathon has a prize pool of $1 million, and all submissions had to be submitted by October 15. It is an online event aiming to “nurture and expand” the Solana ecosystem.

Developers from 68 countries submitted, with the highest numbers coming from China and Vietnam. The rest were mainly from the United States, India, Mexico, Turkey, and Germany.

That notable participation from Chinese developers can be a massive boost for Solana, indicating that the blockchain could be popular in the Asian economic powerhouse. China remains pro-blockchain and believes that the technology can give them an edge and even improve efficiency in some critical sectors, like agriculture, healthcare, governance, and finance, that the country seeks to enhance gradually.

However, China has banned crypto trading and mining, citing the “need to go green, protect consumers, and ensure financial stability.” The Chinese central bank, PBoC, said cryptocurrencies could pose a risk to the country’s financial system.

Unlike Ethereum, Solana permits fast transaction processing and is relatively scalable with decent activity. Although the project suffered following the collapse of FTX in November 2022, there has been a revival in price and on-chain activity.

The Revival, Will SOL Breach $30?

To illustrate, non-fungible token (NFT) trading activity on Solana has steadily risen over the past few months. While there was a spike, the network didn’t halt, as in previous instances, especially in 2022.

Instead, the high reliability seems to have inspired activity, directly helping revive SOL prices that collapsed by over 90%, worsened by news that Sam Bankman-Fried and Alameda Research allegedly embezzled customer funds. FTX had invested in Solana and has a considerable share of SOL, which will be liquidated and reimbursed to impacted clients.

At spot rates, SOL is up 36% from September 2023 lows and overly firm. Looking at the candlestick arrangement in the daily chart, SOL is trading at October and 2023 highs and could break higher if bulls press on. The October 16 bull bar is wide-ranging, has marked trading volumes, and could anchor the next leg towards July 2023 highs of around $32.

Uniswap’s New Fee Structure: Are You About To Pay More For These Tokens?

Recently, Uniswap, a prominent decentralized exchange, made headlines by introducing a 0.15% swap fee on specific tokens. While generating buzz and curiosity, this decision has raised several questions regarding its impact on traders.

Decentralized exchanges (DEX) facilitate peer-to-peer trading without intermediaries. The absence of centralized entities has advantages but also presents challenges, especially regarding fee structures.

Uniswap’s latest update to alter its fee structure is a significant shift with potential implications for its large user base.

Uniswap Fee Structure: Analyzing The Financial Impact

According to data shared by Colin Wu, a blockchain-focused reporter, the daily fees from this change on Uniswap V3 could range between $388,000 and $444,000.

Providing deeper insight into the platform’s operations, Wu mentions that approximately 35% to 40% of the entire transaction volume on Uniswap occurs on the front end.

These figures, while substantial, are just the tip of the iceberg. Specific tokens targeted for this new fee include popular tokens such as ETH, USDC, WETH, USDT, DAI, WBTC, agEUR, GUSD, LUSD, EUROC, and XSGD.

However, according to the Chinese reporter, this fee will only apply when these tokens are traded through Uniswap Labs interfaces on the mainnet and its supported Layer 2 networks.

Currently, about 35%-40% of the transaction volume in Uniswap is completed through front end, H/T @1kbeetlejuice. Ethereum Uniswap V3 in the past 24h is $810m, excluding major stablecoin pairs, which is $740m, the daily fees charged by V3 may be $388k-444k.… https://t.co/EAeV6xwQHX

— Wu Blockchain (@WuBlockchain) October 17, 2023

Understanding The Broader Context

While the announcement sparked curiosity, it also led to some confusion concerning the fees. Uniswap’s help center, in response, clarified that these newly implemented fees stand apart from the Uniswap Protocol fee switch, which is determined through votes by Uniswap’s governance mechanism.

Despite the explanation by the DEX’s team, the genesis of this new fee introduction remains ambiguous to many within the community.

In response to Wu’s initial post, several individuals opposed the update, with a particular user questioning the rationale behind the 0.15% fee, the considerations leading to this specific percentage, and the selection of particular tokens for the fee imposition.

According to data from Coinmarketcap, Uniswap has reported a significant trading volume of $518.3 million in the past 24 hours, capturing 18.3% of the market share within the decentralized exchange sector.

Meanwhile, Uniswap native token UNI has witnessed a substantial decline. The asset has dipped by more than 10% over the past two weeks and showed a continuous drop of 5.5% in the last 24 hours. Currently, UNI is trading for $3.8.

Featured image from Bitcoin-Bude, Chart from TradingView

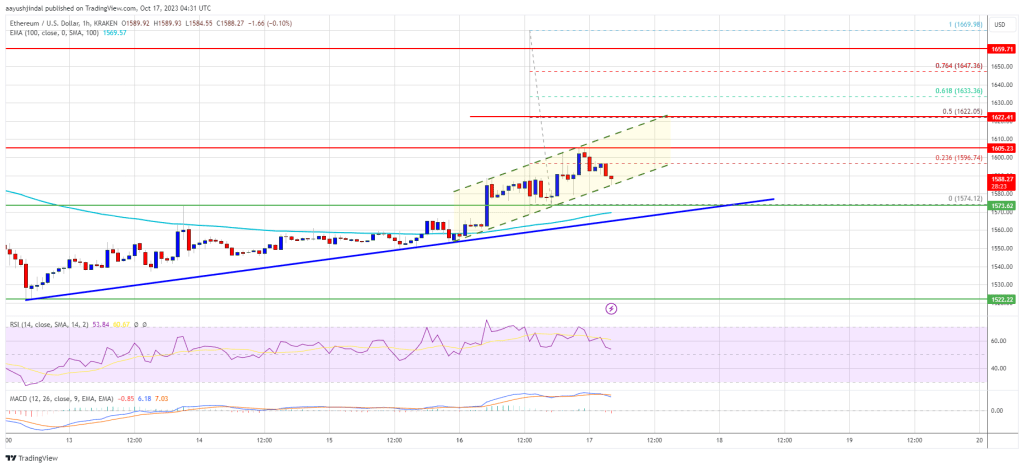

Ethereum Price Faces Crucial Test: Will $1,570 Withstand the Pressure?

Ethereum price started a steady increase from the $1,520 zone against the US dollar. ETH is now struggling to clear the $1,605 and $1,620 resistance levels.

- Ethereum is attempting a recovery wave above the $1,570 level.

- The price is trading just above $1,575 and the 100-hourly Simple Moving Average.

- There is a key bullish trend line forming with support near $1,572 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could rise further if there is a close above the $1,620 resistance level.

Ethereum Price Gains Traction

Ethereum started a fresh increase from the $1,520 level. ETH gained traction like Bitcoin and spiked above the $1,600 resistance level. It even climbed above $1,620, but the bears appeared near $1,650.

A high was formed near $1,669 before there was a fresh decline. Ether trimmed gains and settled below the $1,600 level. It tested the $1,575 support and is currently consolidating near the 23.6% Fib retracement level of the recent decline from the $1,669 swing high to the $1,574 low.

Ethereum is now trading just above $1,575 and the 100-hourly Simple Moving Average. There is also a key bullish trend line forming with support near $1,572 on the hourly chart of ETH/USD.

On the upside, the price is facing resistance near the $1,605 level. The first major resistance is near the 50% Fib retracement level of the recent decline from the $1,669 swing high to the $1,574 low at $1,620. A close above the $1,620 resistance might start a decent increase.

Source: ETHUSD on TradingView.com

In the stated case, Ether could rise and recover toward the $1,665 resistance. Any more gains might open the doors for a move toward $1,750.

Another Decline in ETH?

If Ethereum fails to clear the $1,605 resistance, it could start another decline. Initial support on the downside is near the $1,575 level and the 100-hourly Simple Moving Average.

The next key support is $1,550. A downside break below the $1,550 support might send the price further lower. In the stated case, the price could drop toward the $1,520 level. Any more losses may perhaps send Ether toward the $1,440 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,575

Major Resistance Level – $1,620

Price analysis 10/16: SPX, DXY, BTC, ETH, BNB, XRP, SOL, ADA, DOGE, TON

Stock markets flashed green at the weekly open, and crypto prices followed.

Protocol Village: ARPA Network’s Random Number Generator ‘Randcast’ Live on Optimism

The latest in blockchain tech upgrades, funding announcements and deals. For the week of Oct. 16-22, with live updates throughout.

Investor Demand for Ether Staking Yields Has Slowed: Coinbase

Staking yields have dropped to 3.5% from above 5% in the last few months, the report said.