Crypto analyst Wisdom Matic has shared realistic price targets for Bitcoin (BTC), Dogwifhat (WIF), and Fantom (FTM). The analyst suggested that these coins would reach these price levels in this bull run, although he didn’t state when exactly it would happen.

Bitcoin, Dogwifhat, And Fantom To Reach These Price Targets

Wisdom Matic predicted in an X post that Bitcoin would reach $80,000, Dogwifhat would reach $7, and Fantom would reach $2. He claimed these were realistic targets compared to other predictions, providing a more bullish outlook for these coins. However, the analyst failed to state whether these price targets represented the market top for these coins or were prices he expected these coins to reach soon enough.

However, based on market experts’ predictions, Wisdom Matic’s predictions will likely be short-term targets. Experts like Standard Chartered and Bernstein have predicted that Bitcoin could at least reach $100,000 in this bull run. Interestingly, Standard Chartered predicted that BTC could reach this price level even before the US elections on November 5. Meanwhile, they added that Bitcoin could reach $150,000 by year-end if Donald Trump wins the election.

Bernstein analysts predicted that Bitcoin could rise to as high as $90,000 if Trump wins, although they still see the flagship rising above $100,000 before the market peaks. Meanwhile, in a recent market update, 10x Research founder Markus Thielen predicted that Bitcoin could rise to $75,000 by late October as it breaks its current all-time high (ATH) of $73,000.

Bitcoin’s rise to a new ATH this month is also supported by the fact that the flagship crypto usually records double-digit gains in October. Therefore, a repeat of these double-digit gains would easily send the BTC price above $70,000 and on its way to a new ATH.

The Altcoins Also Boast Bullish Outlooks

Dogwifhat and Fantom can undoubtedly reach Wisdom Matic’s price targets, as they both boast bullish outlooks. As the foremost meme coin in the Solana ecosystem, Dogwifhat moves alongside SOL and is bound to rise as SOL surges.

Solana’s fundamentals are currently bullish, which supports the price rise. Some of these bullish fundamentals include the plan to launch the Solana Seeker mobile next year. Meanwhile, institutions like Franklin Templeton and Citibank want to adopt the Solana network for their tokenized offerings. Wisdom Matic predicted that SOL will reach $350, representing a new ATH for the coin.

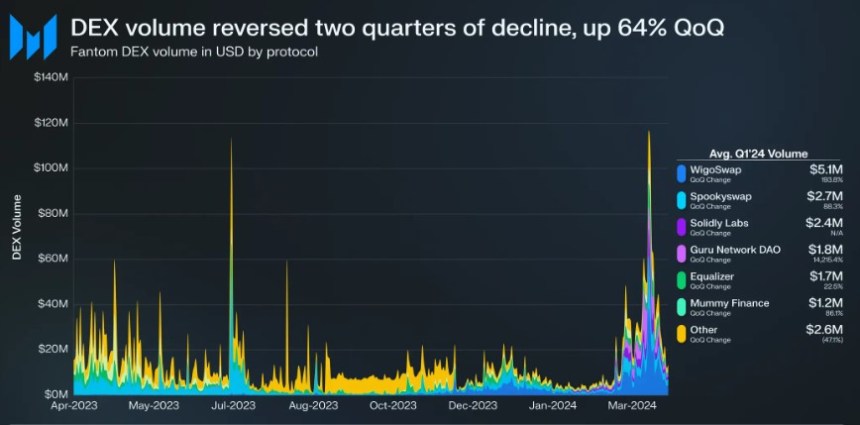

Fantom’s outlook is also bullish because of its fundamentals. Fantom is set to transition to Sonic sometime in November or December of this year. Sonic will be EVM-compatible, ensuring that decentralized applications (dApps) on other EVM chains can be integrated onto the network. Andre Cronje, Sonic’s co-founder has also hinted at potential decentralized finance (DeFi) plans for the Sonic ecosystem, which is also bullish for the FTM price as it could aid the coin’s adoption among DeFi users.

Reclaiming the support at 0.568 would be crucial for FTM to maintain its bullish momentum,” the analyst said. “Should FTM fail to bounce even after reaching the Bullish OB area, it would signal a bullish invalidation, indicating a continuation of the bearish trend.”

Reclaiming the support at 0.568 would be crucial for FTM to maintain its bullish momentum,” the analyst said. “Should FTM fail to bounce even after reaching the Bullish OB area, it would signal a bullish invalidation, indicating a continuation of the bearish trend.”