The Department of Justice filed dozens of victim impact statements from FTX creditors Monday ahead of Bankman-Fried’s sentencing next week. These victims hail from around the world, with the letters describing their FTX holdings and the effect FTX’s bankruptcy had on their lives.

FTX Claims Holder Attestor Takes Creditor to Court Over Alleged ‘Seller’s Remorse’

London-based investment firm Attestor Capital, a top holder of FTX bankruptcy claims, has filed suit against a FTX creditor who allegedly promised to sell the firm two FTX accounts, only to back out of the deal once the value of its claims skyrocketed.

Pantera Capital Plans $250M Solana (SOL) Buy, Analyst Predicts Record Rally Toward $1000

Pantera Capital, a prominent crypto-focused asset manager with assets totaling $5.2 billion, has launched a fundraising campaign to purchase discounted Solana (SOL) tokens from the bankrupt estate of crypto exchange FTX.

According to Bloomberg, the initiative, known as the Pantera Solana Fund, offers investors the opportunity to purchase up to $250 million worth of SOL tokens at a significant discount to the FTX estate.

Solana Token Acquisition Plan

Pantera Capital’s marketing materials, shared with prospective investors in February and reviewed by Bloomberg, outline the opportunity to purchase SOL tokens at a price 39% below the 30-day average or at a fixed price of $59.95.

However, Bloomberg notes that investors participating in this opportunity must agree to a vesting period of up to four years. This approach reportedly allows FTX liquidators, led by John J. Ray III, to offload SOL tokens gradually, freeing up funds for creditors without exerting immediate downward pressure on the token’s price.

According to Pantera’s pitch document, the FTX estate currently holds approximately 41.1 million SOL tokens, valued at $5.4 billion as of the close of Wednesday’s trading session. This constitutes roughly 10% of the total supply of SOL tokens.

According to its investor pitch, Pantera aimed to close the fund by the end of February. Although the amount raised by the deadline remains undisclosed, sources familiar with the matter confirmed to Bloomberg that Pantera has secured some funds.

Investors interested in participating in the Pantera Solana Fund must commit a minimum of $25 million. Pantera Capital plans to charge a management fee of 0.75% and a performance cut of 10%.

Apart from its substantial SOL token holdings, FTX and its sister firm, Alameda Research, have invested significantly in startups within Solana’s broader ecosystem.

According to Bloomberg, FTX’s venture arm, Solana Ventures, and Lightspeed Venture Partners jointly announced a $100 million blockchain gaming fund in November 2021.

Ultimately, the estate’s intention to sell these tokens presents an opportunity to raise funds to repay creditors, considering the notable surge of SOL’s price in the past year. SOL has experienced a staggering 650% increase, trading nearly four times its price when FTX faced its crisis in November 2022.

Crypto Analyst Forecasts SOL To Shatter Previous ATH

SOL, the fifth-largest cryptocurrency by market capitalization, has continued its remarkable upward trajectory and is currently trading at $147.

The token’s price has increased significantly by 14% in the past 24 hours alone, and over the course of 30 days, it has soared by an impressive 56%.

Despite this uptrend, SOL remains 43% below its previous all-time high (ATH) of $259, achieved in November 2021. However, crypto analyst Altcoin Sherpa believes that SOL will break its previous ATH during this market cycle, with the only uncertainty being the size of the break.

Altcoin Sherpa suggests that reaching $500 is highly probable, and an even more astonishing milestone like $1000 is not entirely out of the question. The analyst further emphasizes its confidence in SOL’s potential, stating that it remains one of their more substantial investments. Altcoin Sherpa also highlights the next significant level to watch for SOL, which is $170.

Featured image from Shutterstock, chart from TradingView.com

Pantera Looks to Purchase Discounted Solana Tokens With New Fund: Bloomberg

Prices of Solana’s SOL are up nearly 600% over the past year, CoinGecko data shows.

BlockFi Settles With FTX, Alameda Estates for $874.5M

The settlement with FTX and Alameda Research is a key part of BlockFi’s bankruptcy and reorganization plan.

Analyst: OP Is Undervalued But Will Skyrocket Because Of Coinbase And Base

Adam Cochran, a partner and professor, is bullish about OP, the native token of Optimism, the layer-2 scaling solution for Ethereum.

Taking to X, Cochran is convinced OP is undervalued, pointing to the significance of Coinbase and the brand it has created over the years as a crypto exchange and investor in multiple products. In 2023, Coinbase backed the development of Base, a layer-2 scaling solution for Ethereum that uses Optimism infrastructure for its optimistic roll-up.

OP Will Rocket Because Of CoinBase And Base

In coming up with this assessment, the investor highlights Coinbase’s vast user base and ability to drive retail adoption towards Base potentially. And, as aforementioned, since Base uses Optimism, the expected adoption spike will significantly boost OP from current spot levels.

Cochran argues that the “power of discoverability” associated with Coinbase, a brand that facilitates billions of dollars in daily trading, will be crucial to Optimism’s success. This is particularly relevant when looking at OP prices when writing.

When writing, OP is stable but up 220% from October lows. The token has been trending higher, benefiting from the broader crypto rally. Even so, though in an uptrend, OP has not reclaimed 2023 highs of around $4.2.

To drive the point home, Cochran compares how the BNB Chain blew up in the number of active users. In the last bull run, the chain had an active decentralized finance (DeFi) and non-fungible token (NFT) ecosystem. The BNB Chain’s popularity and soft landing is because the smart contracts platform is associated with Binance, the world’s largest cryptocurrency exchange.

Further to the point, the success of Solana, the partner argues, lends its success to the now-defunct FTX. At its peak, FTX injected billions to fund the development of Solana. It was also actively involved in financing some of Solana’s active protocols.

The Great Convergence Of Supportive Events

Presently, Coinbase is streamlining its operations, recently stopping support for Bitcoin, Litecoin, and other UTXO tokens via Coinbase Commerce. Their focus is on Ethereum-compatible tokens, which could provide hints that Coinbase Commerce might soon be integrated into Base.

From the protocol level, Ethereum plans to implement upgrades to make transacting on layer-2 platforms even cheaper. The Dencun Upgrade is scheduled for March and will see Ethereum enhance as part of its long-term scaling roadmap.

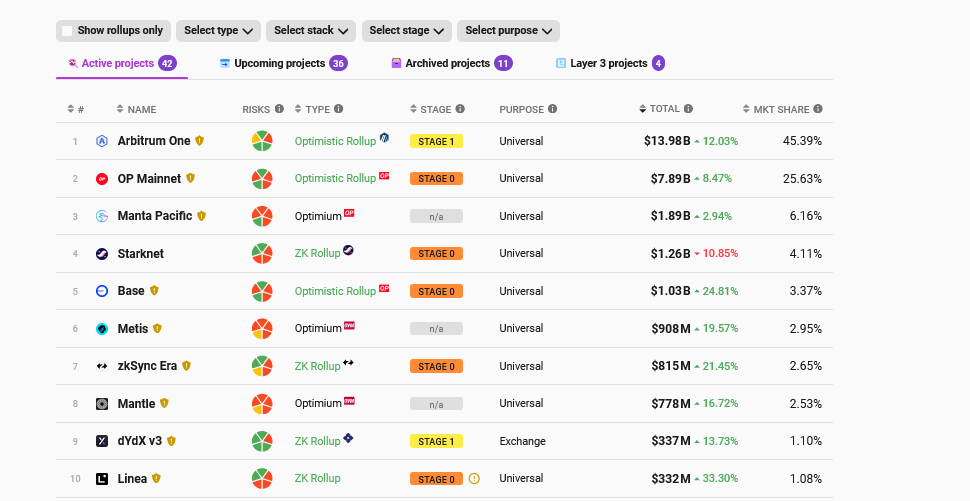

L2Beat data on March 1 shows that Optimism has a total value locked (TVL) of $7.8 billion, roughly half that of Arbitrum. Meanwhile, Base has been rising up the rankings, commanding a TVL of approximately $1 billion.

Solana Veterans Raise $17M For ‘Backpack’ Crypto Wallet, Exchange

Armani Ferrante’s and Tristan Yver’s startup raised the funds at a $120 million valuation.

FTX Estate Can Sell Near 8% Stake in AI StartUp Anthropic, Court Rules

The FTX bankruptcy estate has been granted approval to sell its stake in artificial intelligence (AI) startup Anthropic, court filings from Thursday show.

Swiss Crypto Hedge Fund Tyr Capital Clashes With Client Over FTX Exposure: FT

Tyr investor TGT has brought claims against the hedge fund that it ignored several warnings over its ties with FTX.

Alameda Research’s Worldcoin Investment Hits All-Time High, Exceeding $50M As WLD Price Climbs

Worldcoin, the digital identity token ERC-20 project on the Ethereum (ETH) blockchain, has garnered significant attention. Its native token, WLD, emerges as the top performer among the top 100 cryptocurrencies by market capitalization.

The token has experienced a remarkable 31% uptrend in just 24 hours and a staggering 217% surge over the past fourteen days. This surge not only marks a new all-time high for WLD but also positively impacts Alameda Research, the now-bankrupt trading arm of the defunct FTX exchange, which holds a substantial stake in Worldcoin.

Alameda Research’s Stake In Worldcoin Reaches $186 Million

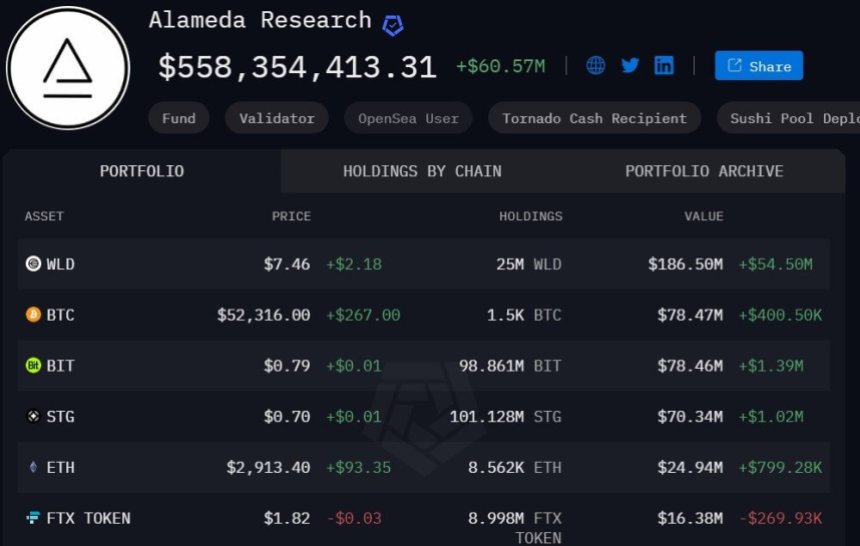

According to on-chain data, Alameda Research, a cryptocurrency trading firm co-founded by Sam Bankman-Fried and Tara Mac Aulay in 2017, has witnessed a surge in its Worldcoin holdings.

As WLD reached a new all-time high of $7.9788 on Monday, the trading firm’s investment in the project surged by $50 million, reaching a new record. Currently, Alameda Research holds 25 million WLD tokens, valued at $186 million, representing 33% of their total portfolio.

This portfolio also includes other digital assets such as Bitcoin (BTC), BitDAO (BIT), Ethereum (ETH), Stargate Finance (STG), and the FTX token FTT.

Whale Activity And AI Hype Drive WLD’s Price Surge

Analysts such as Zameer Attar attribute the WLD price spike to strong whale activity, with one notable whale wallet withdrawing 2.09 million WLD tokens ($5.82 million) from Binance.

This withdrawal caused a 25% surge in the price of Worldcoin, resulting in the whale’s holdings reaching an impressive $8.03 million. Additionally, the launch of OpenAI Sora by Sam Altman, one of the founders of Worldcoin, has triggered bullish action in WLD tokens.

Interestingly, Sora can create videos of up to 60 seconds with highly detailed scenes, complex camera movements, and multiple characters with emotions, which surrounding the hype of artificial intelligence (AI) has spurred investor interest, leading to more bullish sentiment surrounding WLD.

Worldcoin, founded by Sam Altman, Alex Blania, and Max Novendstern, aims to revolutionize the global identity and financial network by creating a public utility known as World ID.

This privacy-preserving identity network enables users to verify their humanness online while maintaining their privacy through zero-knowledge proofs. The project has garnered significant funding, raising over $250 million across various funding rounds from investors, including a16z, Khosla Ventures, Bain Capital Crypto, Blockchain Capital, and Tiger Global.

The combination of whale activity and positive market sentiment surrounding AI technologies has contributed to the considerable surge in Worldcoin’s price.

Featured image from Shutterstock, chart from TradingView.com

Worldcoin’s Rocketing WLD Token Could Benefit Creditors of Three Arrows Capital, FTX

However, WLD prices may run into headwinds as a token unlock worth $165 million is set to begin today, occurring until Feb.26, data from Token Unlocks show.

Sam Bankman-Fried’s Sentence Might Be Lighter Than You’d Expect

Restitution paid to victims can be considered when sentencing, and judges in the Southern District of New York routinely impose shorter terms than guidelines suggest for white-collar cases.

Bitcoin Hits $52,000 High: Are These Giant Sell-Offs About To Crash The Crypto Party?

According to a recent report from Spot On Chain, Bitcoin might be on the edge of a notable plunge. So far, the flagship cryptocurrency has recently broken through the $52,000 mark and traded above it for the first time since December 2021.

However, Spot On Chain reveals that Bitcoin faces potential challenges that could affect its immediate market performance. Two significant sell-off events loom on the horizon, potentially influencing Bitcoin’s price dynamics in the short term.

These developments have sparked speculation, prompting a closer examination of their possible impacts on the cryptocurrency market.

Major Bitcoin Sell-Off Events On The Horizon

The first of these events involves Genesis, a prominent crypto asset manager authorized to offload a significant portion of its Grayscale Bitcoin Trust (GBTC) shares. The second event is marked by the US government’s announcement to sell some of its Bitcoin holdings acquired from the Silk Road platform.

Genesis has received approval to sell 35 million GBTC shares, estimated to be worth around $1.3 billion. This occurrence mirrors an earlier liquidation event involving FTX, which notably impacted Bitcoin’s market price, illustrating the potential volatility such moves can introduce.

It is worth noting that the upcoming Genesis sell-off represents a significant moment for Bitcoin, as it tests the resilience of its recent price gains against the backdrop of large-scale disposals.

The #Bitcoin price has been on the rise for the past 7 days and finally broke the $52K mark again after 2 years!

However, there are two impending big threats to the short-term $BTC price. Can it overcome?

1. #Genesis was approved to sell 35M Grayscale Bitcoin Trust shares… pic.twitter.com/Qn7wbQXaDa

— Spot On Chain (@spotonchain) February 15, 2024

The US government’s decision to auction off 2,875 BTC, valued at $150.6 million, adds to the market’s cautious outlook. With the government holding one of the largest Bitcoin reserves globally, its actions have a marked influence on market perceptions and the cryptocurrency’s price stability.

Spot On Chain highlighted historical instances, such as the sale of 8.2K BTC through Coinbase, which have shown that government sell-offs can temporarily lead to fluctuations in Bitcoin’s price.

Optimism Amid Uncertainty

Despite these concerns, certain segments of the crypto community view these events as minor hurdles in the broader trajectory of Bitcoin’s growth.

Non event… ETFs buying in 300-500m a day lol

— Cryptamurai

I County Capital (@cryptamurai) February 15, 2024

Notably, the increasing involvement of Bitcoin spot exchange-traded funds (ETFs) in the Bitcoin market suggests a growing institutional interest that could offset the effects of the sell-offs.

CryptoQuant has recently highlighted that roughly 75% of new investments into Bitcoin are coming from spot ETFs. This is quite evident as BitMex research reported that the Bitcoin spot ETF market saw an inflow of over $340 million yesterday.

Bitcoin Spot ETF Flow – 14th Feb 2024

All data in. Another strong day, with +$340m net flow for all the Bitcoin ETFs pic.twitter.com/xy7t1hGhyw

— BitMEX Research (@BitMEXResearch) February 15, 2024

Featured image from Unsplash, Chart from TradingView

FTX to Sell Custody Unit for $500K After Paying $10M Just Months Before Collapse

The bankrupt exchange’s unit, Digital Custody Inc., which FTX bought for $10 million, sold for just $500k to CoinList.

FTT Crashes 30% As FTX Relaunch Hopes Fade: Is the Dream Over?

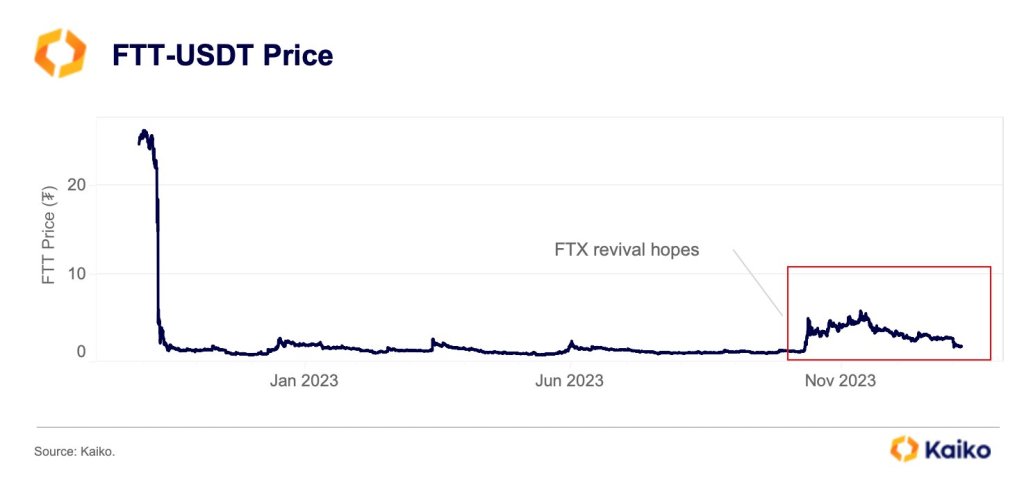

The dream of a revived FTX exchange evaporates, triggering a massive sell-off of its native token, FTT. According to Kaiko, on February 5, FTT, the now utility-free currency of the defunct exchange, plummeted over 30% last week, erasing much of its recent gains fueled by speculation of an FTX comeback.

FTX Won’t Resume Operations

The worrying drop follows reports that the bankrupt exchange, once led by Sam Bankman-Fried, is unlikely to resume operations. Notably, the news comes despite a glimmer of hope for FTX customers.

At a recent court hearing, the exchange’s representatives claimed it expects to repay its users fully. However, repayments would be based on the worth of their assets during FTX’s bankruptcy.

It should be noted that by the time FTX went bankrupt in late 2022, crypto assets were at the last phase of a bear market, with prices plunging to multi-month lows. Bitcoin, the world’s largest crypto asset, was trading below $20,000. After FTX collapsed, prices crashed below $16,000 before bouncing back strongly.

Following a court hearing in late January, FTX lawyer Andrew Dietderich, in a now-deleted YouTube video, said the exchange wouldn’t be looking to relaunch due to the absence of buyers. For this reason, the exchange is looking at allowing creditors to obtain approvals from investors seeking repayments.

Claimants impacted, given the new conditions and trajectory the exchange plans to take, have to provide sufficient proof that they held assets in FTX before it collapsed.

This new detail raises concerns for thousands, if not hundreds of thousands, of claimants, who argue that the actual value of their assets lies at the pre-crash level. On average, Bitcoin and top coins were roughly double digits higher than the November 2022 lows.

FTT Is Free Falling, Reverses November Gains

For the better part of 2023, FTT prices recovered steadily. To demonstrate, since November 2023, FTT prices have risen by over 300%. The encouraging surge was fueled solely by the possibility of FTX 2.0 launching and implementing a new management model.

With that hope fading, FTT appears to be facing a harsh reality check. Questions about its utility are being asked since FTT served as a critical cog in the FTX ecosystem when the exchange operated normally.

When writing on February 5, FTT changes hands at around $1.7. Looking at price charts, bears are in control, completely reversing the gains of November 2023. As it is, $0.95 remains to be a key support line.

Multicoin Capital Is in Talks to Sell Roughly $100M FTX Bankruptcy Claim: Source

Positive news around the FTX bankruptcy has seen claims being sold for upward of 70 cents on the dollar, now climbing towards the eighties.

FTX Seeks to Sell 8% Stake in Anthropic for Sake of ‘Shareholders’

Court filings show the crypto estate wants to agree procedures so that it can sell the shares at the “optimal” time.

Forget Bitcoin, This Billionaire Is Betting Big On Solana For 2024

In the dynamic world of cryptocurrency, Arthur Hayes, the former CEO of BitMEX, is painting an optimistic picture for the potential recovery and growth of Solana in the crypto market. Known for his adept navigation through market fluctuations, Hayes recently shed light on Solana’s positive trajectory, emerging from the shadows cast by the downfall and legal entanglements of FTX.

Solana (SOL), once the favorite of the now-convicted founder Sam Bankman-Fried, had faced uncertain speculations about its destiny in the aftermath of the FTX collapse. However, Hayes’ sanguine remarks have reignited interest in the network’s future possibilities.

With a history of accurate market predictions, Hayes divulged his investment strategy in a recent essay. Within it, he explored the potential downturn of Bitcoin (BTC) and his decision to divest some tokens to minimize losses, including Solana and Bonk tokens.

Solana Recovery Sparks Hayes’ Optimism For Strategic Altcoin Investments

Hayes envisions a robust investment in Solana and various altcoins if Bitcoin’s price dips below $35,000, signaling his confidence in Solana’s prospective recovery and growth.

I think it might be time to get back on the train fam. Maybe after a few US banks bite the dust this weekend. pic.twitter.com/SxCwK3BVYB

— Arthur Hayes (@CryptoHayes) February 1, 2024

Solana’s market performance has been marked by notable price swings. Following a bullish surge in late 2023, the cryptocurrency experienced a correction in early 2024 but has showcased resilience, maintaining a price indicative of investor trust.

Hayes’ earlier bullish comments on Solana have coincided with a price uptick, adding credibility to his positive outlook. His recent commentary has sparked renewed optimism in the crypto community regarding Solana’s potential, particularly in the aftermath of the FTX catastrophe.

Fam I have something embarrassing I must admit.

I just bot $SOL, I know its a Sam-coin piece of dogshit L1 that at this point is just a meme. But it is going up, and I’m a degen.

Let’s Fucking Go!

— Arthur Hayes (@CryptoHayes) November 2, 2023

Emphasizing Solana’s promise, Hayes took to his social media platforms to express his bullish sentiments, sharing a chart illustrating the cryptocurrency’s price movements. The post swiftly gained traction, proposing a strategic approach to rejuvenating the Solana market, especially in the face of potential turbulence in the U.S. banking system.

SOL Rollercoaster: From Correction To Bullish Optimism

Solana’s journey in the market has been a rollercoaster of highs and lows. Commencing from a modest position in October 2023, SOL soared to impressive heights by Christmas before undergoing a correction with the onset of the new year. Nevertheless, the digital currency has displayed resilience, charting a course that hints at potential recovery and growth.

The former BitMEX big boss Hayes is expressing optimism about Solana’s recovery and growth potential. His bullish stance, coupled with his market acumen and past successful predictions, has reignited interest and hope within the crypto community regarding Solana’s future prospects.

Featured image from Adobe Stock, chart from TradingView

FTX Hack Mystery Possibly Solved: U.S. Charges Trio With Theft, Including Infamous Attack on Crypto Exchange

The federal indictment doesn’t identify Sam Bankman-Fried’s FTX as the pilfered company, but Bloomberg reported that’s who it was.

That FTX Super Bowl Ad? ‘Like an Idiot, I Did It,’ Larry David Says

Sam Bankman-Fried’s cryptocurrency exchange infamously collapsed months after the commercial.