Restitution paid to victims can be considered when sentencing, and judges in the Southern District of New York routinely impose shorter terms than guidelines suggest for white-collar cases.

Bitcoin Hits $52,000 High: Are These Giant Sell-Offs About To Crash The Crypto Party?

According to a recent report from Spot On Chain, Bitcoin might be on the edge of a notable plunge. So far, the flagship cryptocurrency has recently broken through the $52,000 mark and traded above it for the first time since December 2021.

However, Spot On Chain reveals that Bitcoin faces potential challenges that could affect its immediate market performance. Two significant sell-off events loom on the horizon, potentially influencing Bitcoin’s price dynamics in the short term.

These developments have sparked speculation, prompting a closer examination of their possible impacts on the cryptocurrency market.

Major Bitcoin Sell-Off Events On The Horizon

The first of these events involves Genesis, a prominent crypto asset manager authorized to offload a significant portion of its Grayscale Bitcoin Trust (GBTC) shares. The second event is marked by the US government’s announcement to sell some of its Bitcoin holdings acquired from the Silk Road platform.

Genesis has received approval to sell 35 million GBTC shares, estimated to be worth around $1.3 billion. This occurrence mirrors an earlier liquidation event involving FTX, which notably impacted Bitcoin’s market price, illustrating the potential volatility such moves can introduce.

It is worth noting that the upcoming Genesis sell-off represents a significant moment for Bitcoin, as it tests the resilience of its recent price gains against the backdrop of large-scale disposals.

The #Bitcoin price has been on the rise for the past 7 days and finally broke the $52K mark again after 2 years!

However, there are two impending big threats to the short-term $BTC price. Can it overcome?

1. #Genesis was approved to sell 35M Grayscale Bitcoin Trust shares… pic.twitter.com/Qn7wbQXaDa

— Spot On Chain (@spotonchain) February 15, 2024

The US government’s decision to auction off 2,875 BTC, valued at $150.6 million, adds to the market’s cautious outlook. With the government holding one of the largest Bitcoin reserves globally, its actions have a marked influence on market perceptions and the cryptocurrency’s price stability.

Spot On Chain highlighted historical instances, such as the sale of 8.2K BTC through Coinbase, which have shown that government sell-offs can temporarily lead to fluctuations in Bitcoin’s price.

Optimism Amid Uncertainty

Despite these concerns, certain segments of the crypto community view these events as minor hurdles in the broader trajectory of Bitcoin’s growth.

Non event… ETFs buying in 300-500m a day lol

— Cryptamurai

I County Capital (@cryptamurai) February 15, 2024

Notably, the increasing involvement of Bitcoin spot exchange-traded funds (ETFs) in the Bitcoin market suggests a growing institutional interest that could offset the effects of the sell-offs.

CryptoQuant has recently highlighted that roughly 75% of new investments into Bitcoin are coming from spot ETFs. This is quite evident as BitMex research reported that the Bitcoin spot ETF market saw an inflow of over $340 million yesterday.

Bitcoin Spot ETF Flow – 14th Feb 2024

All data in. Another strong day, with +$340m net flow for all the Bitcoin ETFs pic.twitter.com/xy7t1hGhyw

— BitMEX Research (@BitMEXResearch) February 15, 2024

Featured image from Unsplash, Chart from TradingView

FTX to Sell Custody Unit for $500K After Paying $10M Just Months Before Collapse

The bankrupt exchange’s unit, Digital Custody Inc., which FTX bought for $10 million, sold for just $500k to CoinList.

FTT Crashes 30% As FTX Relaunch Hopes Fade: Is the Dream Over?

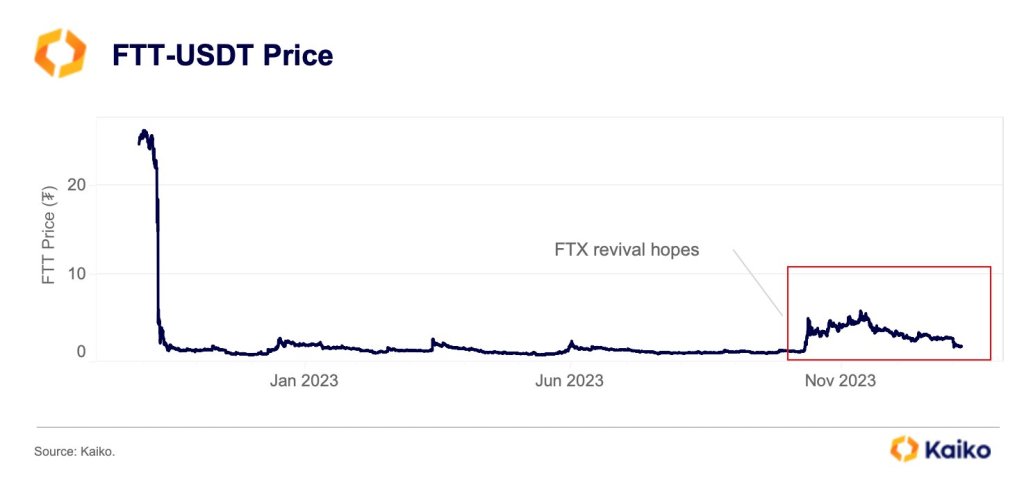

The dream of a revived FTX exchange evaporates, triggering a massive sell-off of its native token, FTT. According to Kaiko, on February 5, FTT, the now utility-free currency of the defunct exchange, plummeted over 30% last week, erasing much of its recent gains fueled by speculation of an FTX comeback.

FTX Won’t Resume Operations

The worrying drop follows reports that the bankrupt exchange, once led by Sam Bankman-Fried, is unlikely to resume operations. Notably, the news comes despite a glimmer of hope for FTX customers.

At a recent court hearing, the exchange’s representatives claimed it expects to repay its users fully. However, repayments would be based on the worth of their assets during FTX’s bankruptcy.

It should be noted that by the time FTX went bankrupt in late 2022, crypto assets were at the last phase of a bear market, with prices plunging to multi-month lows. Bitcoin, the world’s largest crypto asset, was trading below $20,000. After FTX collapsed, prices crashed below $16,000 before bouncing back strongly.

Following a court hearing in late January, FTX lawyer Andrew Dietderich, in a now-deleted YouTube video, said the exchange wouldn’t be looking to relaunch due to the absence of buyers. For this reason, the exchange is looking at allowing creditors to obtain approvals from investors seeking repayments.

Claimants impacted, given the new conditions and trajectory the exchange plans to take, have to provide sufficient proof that they held assets in FTX before it collapsed.

This new detail raises concerns for thousands, if not hundreds of thousands, of claimants, who argue that the actual value of their assets lies at the pre-crash level. On average, Bitcoin and top coins were roughly double digits higher than the November 2022 lows.

FTT Is Free Falling, Reverses November Gains

For the better part of 2023, FTT prices recovered steadily. To demonstrate, since November 2023, FTT prices have risen by over 300%. The encouraging surge was fueled solely by the possibility of FTX 2.0 launching and implementing a new management model.

With that hope fading, FTT appears to be facing a harsh reality check. Questions about its utility are being asked since FTT served as a critical cog in the FTX ecosystem when the exchange operated normally.

When writing on February 5, FTT changes hands at around $1.7. Looking at price charts, bears are in control, completely reversing the gains of November 2023. As it is, $0.95 remains to be a key support line.

Multicoin Capital Is in Talks to Sell Roughly $100M FTX Bankruptcy Claim: Source

Positive news around the FTX bankruptcy has seen claims being sold for upward of 70 cents on the dollar, now climbing towards the eighties.

FTX Seeks to Sell 8% Stake in Anthropic for Sake of ‘Shareholders’

Court filings show the crypto estate wants to agree procedures so that it can sell the shares at the “optimal” time.

Forget Bitcoin, This Billionaire Is Betting Big On Solana For 2024

In the dynamic world of cryptocurrency, Arthur Hayes, the former CEO of BitMEX, is painting an optimistic picture for the potential recovery and growth of Solana in the crypto market. Known for his adept navigation through market fluctuations, Hayes recently shed light on Solana’s positive trajectory, emerging from the shadows cast by the downfall and legal entanglements of FTX.

Solana (SOL), once the favorite of the now-convicted founder Sam Bankman-Fried, had faced uncertain speculations about its destiny in the aftermath of the FTX collapse. However, Hayes’ sanguine remarks have reignited interest in the network’s future possibilities.

With a history of accurate market predictions, Hayes divulged his investment strategy in a recent essay. Within it, he explored the potential downturn of Bitcoin (BTC) and his decision to divest some tokens to minimize losses, including Solana and Bonk tokens.

Solana Recovery Sparks Hayes’ Optimism For Strategic Altcoin Investments

Hayes envisions a robust investment in Solana and various altcoins if Bitcoin’s price dips below $35,000, signaling his confidence in Solana’s prospective recovery and growth.

I think it might be time to get back on the train fam. Maybe after a few US banks bite the dust this weekend. pic.twitter.com/SxCwK3BVYB

— Arthur Hayes (@CryptoHayes) February 1, 2024

Solana’s market performance has been marked by notable price swings. Following a bullish surge in late 2023, the cryptocurrency experienced a correction in early 2024 but has showcased resilience, maintaining a price indicative of investor trust.

Hayes’ earlier bullish comments on Solana have coincided with a price uptick, adding credibility to his positive outlook. His recent commentary has sparked renewed optimism in the crypto community regarding Solana’s potential, particularly in the aftermath of the FTX catastrophe.

Fam I have something embarrassing I must admit.

I just bot $SOL, I know its a Sam-coin piece of dogshit L1 that at this point is just a meme. But it is going up, and I’m a degen.

Let’s Fucking Go!

— Arthur Hayes (@CryptoHayes) November 2, 2023

Emphasizing Solana’s promise, Hayes took to his social media platforms to express his bullish sentiments, sharing a chart illustrating the cryptocurrency’s price movements. The post swiftly gained traction, proposing a strategic approach to rejuvenating the Solana market, especially in the face of potential turbulence in the U.S. banking system.

SOL Rollercoaster: From Correction To Bullish Optimism

Solana’s journey in the market has been a rollercoaster of highs and lows. Commencing from a modest position in October 2023, SOL soared to impressive heights by Christmas before undergoing a correction with the onset of the new year. Nevertheless, the digital currency has displayed resilience, charting a course that hints at potential recovery and growth.

The former BitMEX big boss Hayes is expressing optimism about Solana’s recovery and growth potential. His bullish stance, coupled with his market acumen and past successful predictions, has reignited interest and hope within the crypto community regarding Solana’s future prospects.

Featured image from Adobe Stock, chart from TradingView

FTX Hack Mystery Possibly Solved: U.S. Charges Trio With Theft, Including Infamous Attack on Crypto Exchange

The federal indictment doesn’t identify Sam Bankman-Fried’s FTX as the pilfered company, but Bloomberg reported that’s who it was.

That FTX Super Bowl Ad? ‘Like an Idiot, I Did It,’ Larry David Says

Sam Bankman-Fried’s cryptocurrency exchange infamously collapsed months after the commercial.

FTX Expects to Fully Repay Customers but Won’t Restart Defunct Crypto Exchange

Its FTT token surged nearly 11% after the news.

FTX Unloads $1 Billion GBTC Shares; Will The Bitcoin Rally Be “Vicious”?

Fred Krueger, an investor and crypto analyst, is predicting a “vicious” Bitcoin (BTC) rally shortly. He cites the recent unprecedented accumulation of the coin by Wall Street heavyweights.

This surge in institutional interest coincides with the recent approval of the first spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC).

Wall Street Ramping Up Bitcoin Purchase

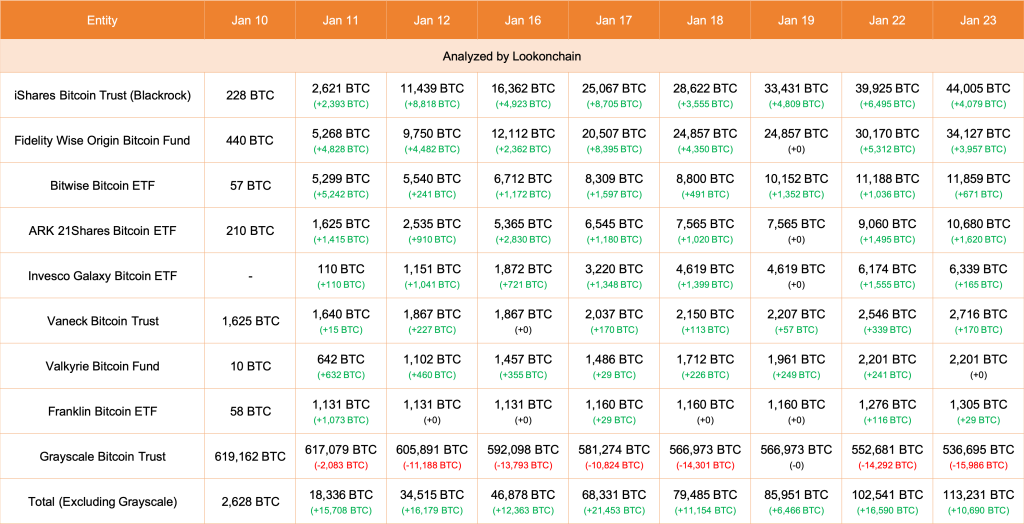

In a post on X, Krueger pointed to the substantial Bitcoin purchases by major financial institutions, including Fidelity Investments, BlackRock, and Ark Invest. To illustrate, the analyst noted that Fidelity was buying approximately 4,000 BTC every day.

Related Reading: Bitcoin Goes To The Doctor: 5 Key Metrics For BTC In 2024

On the other hand, Ark, Krueger continues, has been gobbling upwards of 1,500 BTC daily. BlackRock, the world’s largest asset manager, has yet to release its Bitcoin holdings. However, based on the pace of Ark Invest and Fidelity Investment’s accumulation rate, BlackRock is likely buying coins at a faster pace. So far, Lookonchain data places BlackRock’s IBIT holdings of BTC at over 44,000.

If anything, the rate at which these Wall Street institutions are doubling down on Bitcoin is a net bullish for price. Notably, BTC demands remain high more than a week after the United States SEC authorized the first spot of Bitcoin ETFs. That they are steadily buying suggests that institutions are bullish about Bitcoin’s potential.

The heightened pace of BTC accumulation is less than three months before the network halves its miner rewards. The Bitcoin halving event in early April will reduce miner rewards from 6.25 BTC to 3.125 BTC. If past price performance guides, the resulting supply shock might trigger another wave of higher highs, even lifting prices above 2021’s peaks of $69,000.

BTC Falls, FTX Unloads Millions Of GBTC Shares

Even amid the overall optimism, BTC is still struggling. Days after the approval of spot Bitcoin ETFs, BTC has been trending lower, shedding double digits. It even temporarily fell below $40,000 on January 23 before recovering to spot rates.

Analysts pin the sell-off to FTX, the defunct crypto exchange, off-loading an estimated $1 billion of Grayscale Bitcoin Trust (GBTC). With the FTX estate selling their stake in GBTC, prices are expected to stabilize as the unique selling event is alleviated and institutions double down, buying more BTC at spot rates.

Observers also note that GBTC outflows were matched or surpassed by the spike in inflow to other funds, mostly BlackRock’s ETF product.

FTT Bucks Market Turmoil As FTX Estate Revealed To Be Behind GBTC Sales

FTT was up 11% in the past 24 hours as the broader market tracked by CoinDesk 20 slumped 4%.

FTX Affiliate Alameda Research Drops Grayscale Lawsuit

Tk

FTX Sold About $1B of Grayscale’s Bitcoin ETF, Explaining Much of Outflow: Sources

BTC’s price has fallen since bitcoin ETFs were approved. In theory, now that FTX is done selling its substantial holdings, the selling pressure could ease since a bankruptcy estate liquidating holdings is a relatively unique event.

Brace For Crypto Market Waves: FTX And Celsius Are Sending MATIC, ETH, And WBTC To Binance

The crypto market might be about to experience a further downturn as a recent development suggests an imminent selloff is on the horizon. This comes following the recent market moves by Grayscale, which is believed to be responsible for the recent decline in Bitcoin’s price.

Celsius And FTX Crypto Funds On The Move

On-chain data shows that defunct crypto lender Celsius Network recently transferred 34.08 million MATIC to the crypto exchange Binance. Meanwhile, a wallet address linked to Alameda Research, the sister company of defunct crypto exchange FTX, also recently sent 135 WBTC to Binance, 207 WBTC, and 1150 ETH to Wintermute.

These transactions are more significant, considering that Celsius and FTX are in a bankruptcy liquidation process as they look to repay their customers. As such, transferring these funds to trading platforms like Binance suggests that these tokens could be dumped on the market soon enough.

Celsius, in particular, is known to have been making major moves in the market as of late. NewsBTC had recently reported how Celsisus had transferred $125 million worth of ETH last week to various crypto exchanges, something which could have possibly contributed to recent bloodbaths in the crypto market.

On the other hand, selloffs by Alameda could form part of FTX’s repayment plan, which it filed back in December 2023. This is a huge possibility, considering the defunct trading firm was used as a tool by Sam Bankman-Fried (SBF) to defraud FTX customers.

Another Whale Contributing To Recent Market Downturn

Grayscale is also believed to have contributed greatly to the recent downturn in the crypto market. The asset manager has had to offload some of its BTC holdings in a bid to fulfill redemptions from GBTC investors. These investors have been taking profits ever since GBTC was converted into a Spot Bitcoin ETF, with an outflow of over $2 billion from the fund since then.

Crypto analytics platform Arkham Intelligence recently revealed that Grayscale had sent out another 12,870 BTC from their wallets. That figure brought the total number of BTC that the asset manager has deposited into Coinbase to 47,900 BTC, which is said to be worth around $1.97 billion based on current prices.

As noted by Arkham, these transactions likely represent redemptions of BTC shares. Interstingly, JP Morgan predicts that Grayscale’s GBTC could experience an outflow of up to $3 billion. If so, then the market could be in for more pain as the asset manager would have to offload more BTC to fulfill these redemptions.

Sam Bankman-Fried’s Parents Ask Court to Dismiss FTX’s Lawsuit Seeking to Recover Funds

Joseph Bankman and Barbara Fried, the parents of Sam Bankman-Fried, have asked a court to dismiss a lawsuit by the bankrupt cryptocurrency exchange FTX seeking to recover funds it alleges were fraudulently transferred.

FTX Founder Sam Bankman-Fried Won’t Face Second Criminal Trial, U.S. Prosecutors Say

FTX’s Bahamas Wing Reaches Agreement With U.S. Bankruptcy Team, Streamlining Future Actions

This deal will pave the way for assets to be be pooled and distributed to FTX.com customers.

FTX Files Reorganization Plan to End Bankruptcy

Asset values for creditor claims will be calculated at prices on the day FTX filed for bankruptcy in November 2022, the plan says.

FTX loses $53K every hour on ‘bankruptcy fees,’ latest filings show

More than $118 million in legal and advisory fees were billed to the bankrupt crypto exchange between August and October, amounting to $1.3 million per day.