The Bitcoin market is currently experiencing a turning point, largely driven by recent trends in Bitcoin exchange-traded funds (ETFs). Yesterday, Bitcoin’s price rose above $43,000, a movement closely tied to changing dynamics in ETF inflows and outflows, particularly involving the Grayscale Bitcoin Trust (GBTC).

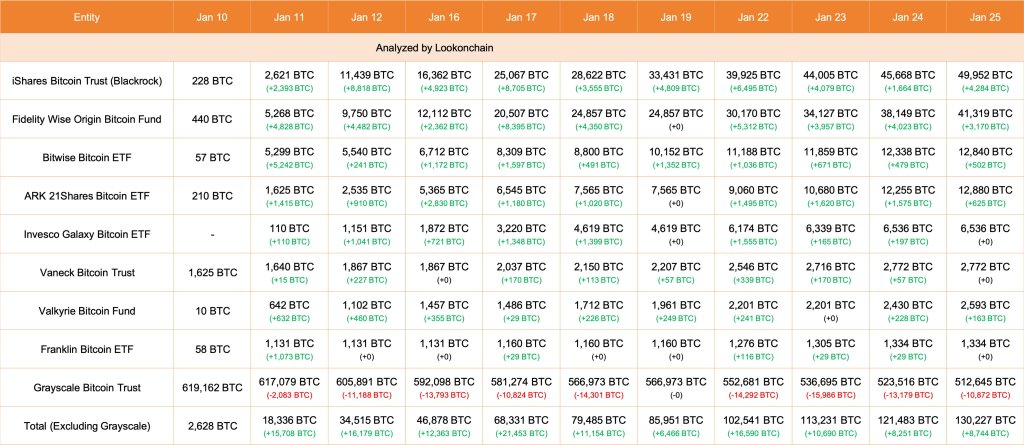

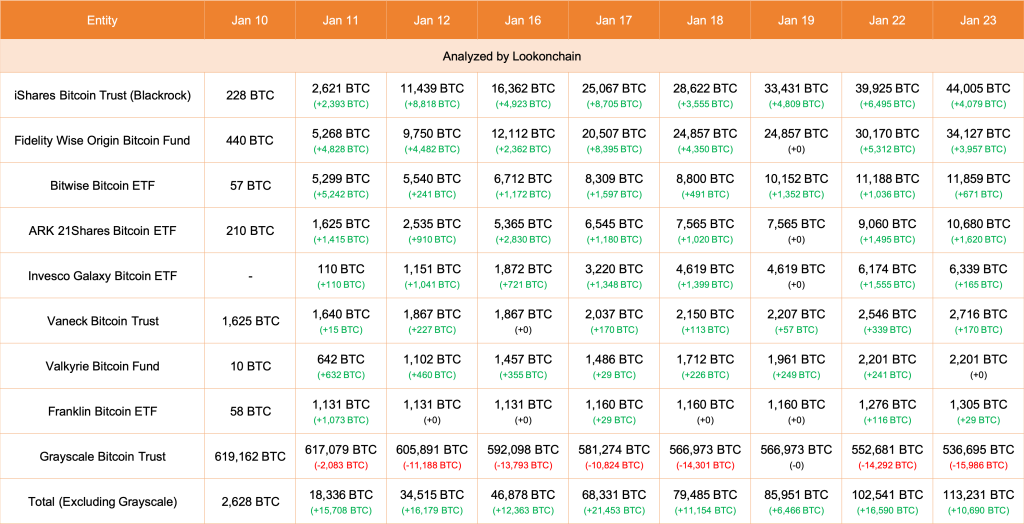

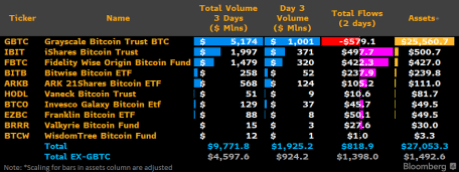

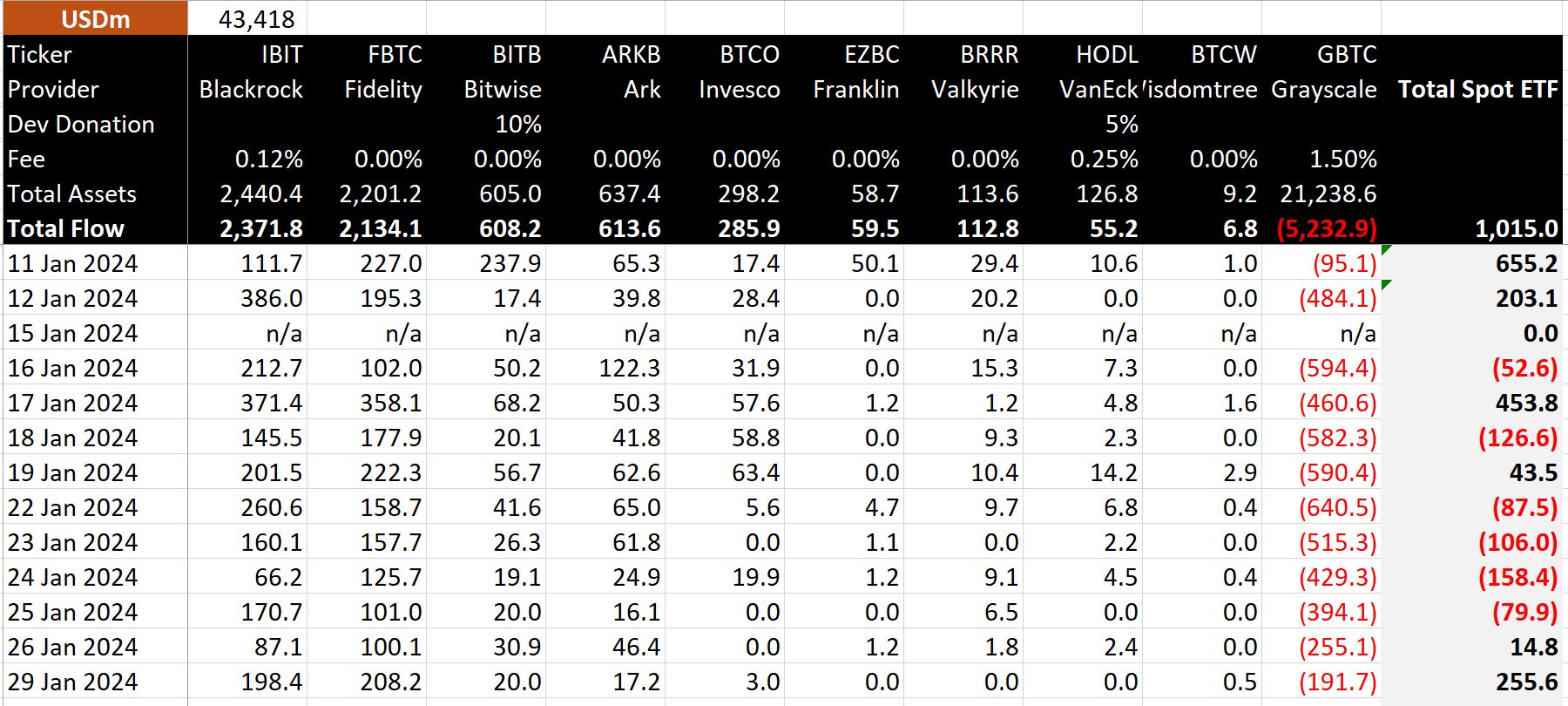

On January 29, (Bitcoin ETF Day 12), a notable shift occurred. The Bitcoin spot ETFs witnessed a substantial net inflow of US$255 million, while Grayscale’s GBTC experienced a significant net outflow of $191 million. The other nine ETFs, led by Fidelity and BlackRock, saw a combined net inflow of $446 million, making it the third-highest inflow day for Bitcoin ETFs.

New All-Time High Until Bitcoin Halving?

This scenario of high inflows and reduced outflows from Grayscale’s GBTC presents an intriguing change from previous days, where GBTC outflows dominated and weighed heavily on the market sentiment.

Crypto analyst @WhalePanda, who’s part of the “Magical Crypto Friends” YouTube channels (along with Samson Mow, Charlie Lee, and Riccardo Spagni), commented on this development, stating, “Net inflow of $250 million in a day is crazy. That’s 5800 Bitcoin being removed from the market in just one day.”

He highlighted the significance of this volume, especially when compared to the daily Bitcoin mining rate of 900 BTC. MicroStrategy bought $615 million BTC between November 30 and December 26.

While WhalePanda acknowledged that inflows will slow down one day, he expects this to happen later on. “The increased price is driving more exposure, leading to more inflows, which in turn pushes the price even higher. This is a classic example of the bull cycle flywheel mechanics at play, even before the halving,” he remarked.

The renowned crypto expert further elaborated that “the amount of Bitcoin float will significantly drop over the next couple of days and once the price starts moving with limited supply left… Things can go crazy. No, not $1 million crazy. Crazy for me is breaking ATH before halving.”

In a separate post on X, @WhalePanda expressed his outlook for the week, “This is going to be a big week for #Bitcoin. With GBTC outflows decreasing and a strong inflow day last Friday, we might be seeing the beginning of a new trend.” He emphasized the potential of this momentum to become a self-fulfilling prophecy, driving Bitcoin’s price higher.

Spot BTC ETFs Remain The Focus

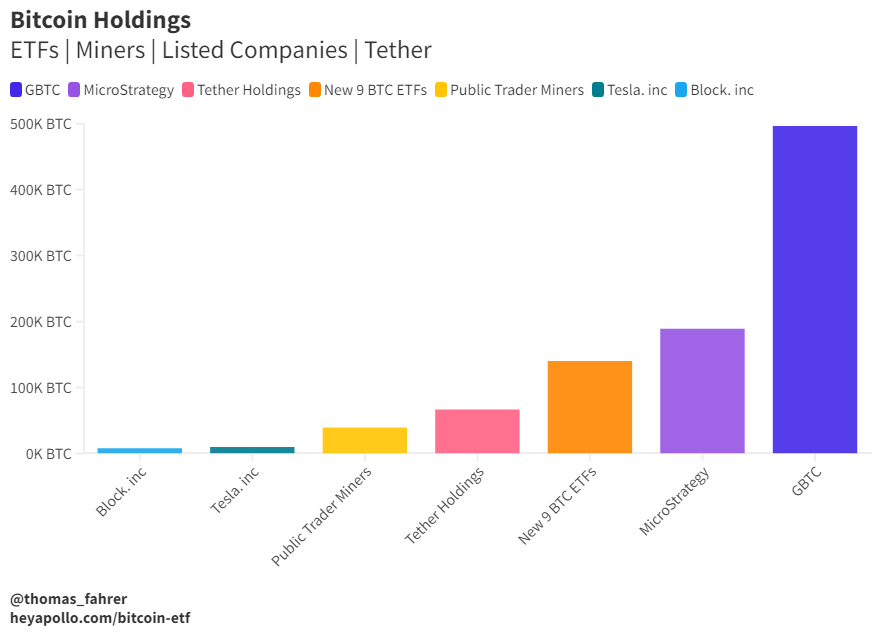

Thomas Fahrer, co-founder of Apollo Sats, added context to these massive spot BTC figures, noting, “The 9 New ETFs hold more BTC than Tether, Tesla, Block, and all of the Public Miners combined. Soon they will surpass MSTR, and later even GBTC.”

Alex Thorn, head of research at Galaxy, commented on the potential implications for BTC’s price trajectory, especially in relation to ETH: “With Grayscale outflows appearing to slow down and other Bitcoin ETF flows remaining positive, I’m curious about the future direction of the ETHBTC cross. A lower trajectory seems like the path of least resistance in the near term.”

with grayscale outflows seeming to abate and other #bitcoin etf flows now appearing holding positive, i’m again wondering where the ETHBTC cross is headed. lower again feels like the path of least resistance near-term pic.twitter.com/DVPi1pdWP0

— Alex Thorn (@intangiblecoins) January 30, 2024

This confluence of ETF inflows, decreasing outflows from Grayscale, and the anticipation of the upcoming Bitcoin halving are creating a unique bullish market environment. However, at press time, BTC is trading below a key resistance at $43,444.