Craig Salm discusses what scenario is likely to play out for the firm’s ongoing bid to gain approval for its spot Bitcoin ETF following Tuesday’s appeals court hearing.

GBTC Discount Narrows to Lowest Level Since November Following Court Hearing

The three judge panel appeared skeptical of the SEC’s reasoning for denying conversion of the trust to an ETF.

A Dozen Reasons Why the SEC Should Have Approved Grayscale’s Spot Bitcoin ETF

First Mover Americas: Grayscale Bitcoin Trust at Issue in Court

The latest price moves in bitcoin (BTC) and crypto markets in context for March 7, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Alameda Sues Grayscale and DCG to Allow Redemptions, Reduce Fees

The bankrupt trading firm is seeking injunctive relief to allow FTX debtors to realize what it claims is more than $250 million in asset value.

Cathie Wood: Ark dumps 500K GBTC shares, adds Coinbase stock as Bitcoin recovers 40%

Ark’s GBTC weight in the portfolio actually increased despite the fund selling 500,000 shares in the past month.

Valkyrie Investments Wants To Take Over Grayscale Bitcoin Trust, Reveals Plans

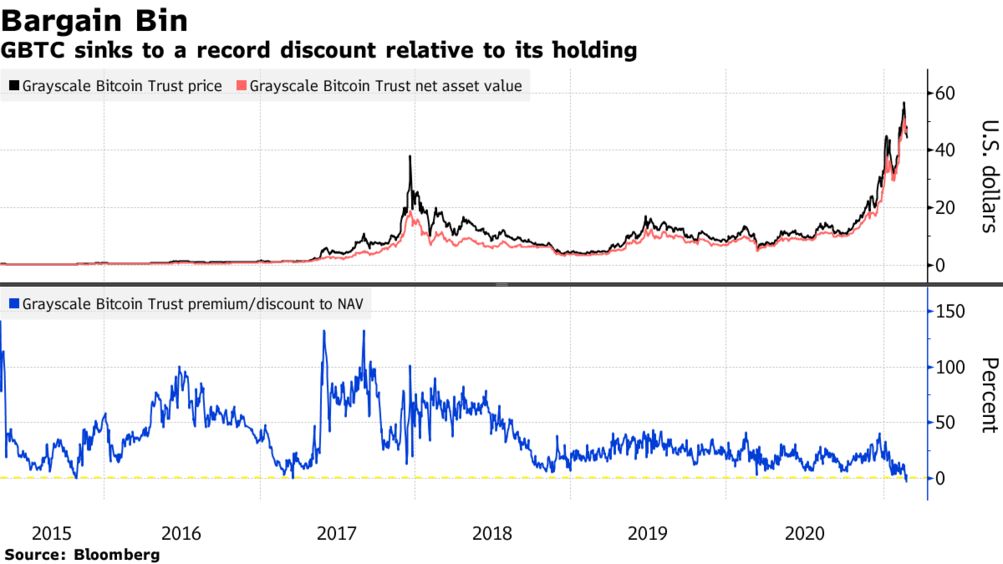

The state of the Grayscale Bitcoin Trust (GBTC), the largest BTC trust in the world, has sparked concerns among investors in the space. With such a large discount to net asset value (NAV), there have been discussions on where the fund goes from here and if it is in trouble. Valkyrie Investments has now joined the conversation but is taking an entirely unexpected route.

Valkyrie Wants The Grayscale Bitcoin TRUST

In a statement that was released on Dec. 28, co-founder and CIO of Valkyrie Investments Steven McClurg revealed the company’s interest in taking over the management of Grayscale Bitcoin Trust. The statement highlights the unique challenges that are being faced by the GBTC and present the Valkyrie team as the best to manage the fund.

It points to its experience in managing its own bitcoin fund, which it says has been operating with daily liquidity since it was launched a year ago. In addition, it also puts forward its experience with its multiple publicly traded BTC ETFs that were launched in 2021 as a good reason for why it would be a good fit.

“We understand that Grayscale has played an important role in the development and growth of the bitcoin ecosystem with the launch of GBTC, and we respect the team and the work that they have done,” the statement said. However, in light of recent events involving Grayscale and its family of affiliated companies, it is time for a change. Valkyrie is the best company to manage GBTC to ensure its investors are treated fairly.”

The company also announced a brand new fund called the “Valkyrie Opportunistic Fund, LP” which it says was created to help investors take advantage of the GBTC discount to NAV. “we are very interested in realizing the true value of the underlying bitcoin for our investors and will actively pursue this goal on their behalf,” McClurg said.

The Roadmap To Success

Valkyrie’s statement also included its plan to actually improve the management of the Grayscale bitcoin trust if it were to take over. These were divided into three points.

The first was that it plans to facilitate orderly redemptions for investors at NAV when they want it through a Regulation M filing. According to the statement, this would allow the investors to redeem shares without delays and at a fair price.

Next was the plan to lower the fees associated with the fund. Valkyrie wants an over 50% reduction in the fee to fit in with best industry practices. As such, it plans to reduce the fee from 200 basis points to 75 basis points.

Last but not is the fact that Valkyrie wants to honor investor share redemptions in both BTC and cash. Its reasoning behind this was that it believes that it gives investors “greater flexibility and choice when it comes to redeeming their shares.”

McClurg closes out the statement with a call for the statement to be considered. “We are committed to putting the interests of GBTC shareholders first, and we have the experience and expertise to do so effectively,” the co-founder said.

The GBTC discount to NAV remains high despite some recovery recorded as 2022 drew to a close. It had reached a high of 48.57% on Dec. 16 but by the end of the day on Friday, Dec. 30, the GBTC discount had fallen to 45.17%.

Grayscale May Liquidate 600,000 BTC Holdings Following SEC Opposition To ETF

Grayscale Investments may offer to buy up to 20% of Grayscale Bitcoin Trust (GBTC) shares. This is a move the company hopes will close the gap between the GBTC share price and the company’s underlying Bitcoin holdings.

Grayscale Can’t Act Independent Of Investors

The Wall Street Journal released a letter by Grayscale CEO Michael Sonnenshein urging that Grayscale would consider issuing a tender offer should the Security and Exchange Commission (SEC) and shareholders give their approval. Being a close-ended fund, GBTC shareholders can only liquidate their holdings on the open market.

Under the Williams Act (part of the Securities Exchange Act of 1934) that governs tender offers in the US, an investor tendering for a security must disclose their source of funds, legal agreements related to the offer, and reasons for the offer.

If the company cannot return GBTC shareholders funds, it will continue to offer the tender until it’s converted to an ETF.

Sonnenshein wrote to investors:

In the event we are unsuccessful in pursuing options for returning a portion of the capital to shareholders, we do not currently intend to dissolve GBTC, but would instead continue to operate GBTC without an ongoing redemption program until we are successful in converting it to a spot bitcoin ETF.

Grayscale is currently embroiled in a lawsuit with the SEC after its application to convert GBTC to a spot Bitcoin ETF on June 29, 2022.

The letter by the CEO was an attempt to ease shareholder concerns after a turbulent few months across the crypto market.

ETF Conversion Seems To Be Only Option

As it stands, Grayscale doesn’t have a specific timeline for when it may explore other options apart from the ETF conversion.

The lawsuit seems to be a long-drawn battle. Grayscale filed its opening brief against the SEC on Oct. 11, 2022. In response, SEC filed a brief on Dec. 13, 2022 denying Grayscale’s accusations that its rejection was discriminatory and arbitrary.

The firm has until Jan. 13, 2023 to respond. Afterwards, a three-judge panel will be selected to listen to oral arguments and rule on the case.

Grayscale’s Bitcoin Trust has roughly $10.78 billion or 633,000 BTC in assets under management. The fund has failed to meet its goal, and it’s currently changing hands at a 48.8% discount to Bitcoin.

Source: YCharts

Sonnenshein didn’t clarify if the business may later sell off its Bitcoin holdings. However, a market dump like Grayscale could see Bitcoin crashin to a fresh yearly low.

Grayscale selling off its Bitcoin stash could also drive down confidence in crypto as significant liquidations for those engaged in Bitcoin derivatives markets. This would hurt crypto volumes, and send a bearish crypto market further down.

Why The GBTC Discount Could Lead To A Bitcoin Sell-Off

Grayscale Bitcoin Trust (GBTC) remains the largest bitcoin trust in the world with billions of dollars worth of BTC, but in the last year, the trust has had a hard time keeping up with the market. The result of this has been a large premium that has continued to widen through the bear market. Currently, the GBTC is trading at a record-high premium, which has sparked speculations of a potential BTC sell-off in the pipeline.

GBTC Nears 50% Premium

The month of November was fraught with adversity for the crypto space and this is mirrored by the GBTC premium. It shows a near-steady increase in the discount or premium to NAV which has carried on into the month of December.

On Dec. 7, the GBTC premium to NAV saw one of its largest jumps when it move from 43.61% on Dec. 6 to 47.27% on Dec. 7. This has brought the premium to new all-time highs and even though the following days did not see as large of an increase, a near 1% increase each day saw the GBTC close out last week at a premium to NAV of 48.62%.

Now, what this means is that the price of ‘one BTC’ is trading for 48.62% lower on the GBTC than it is on the spot market. Normally, this would present as an opportunity to buy for cheap but GBTC investors are not buying any actual bitcoin, and with the issues that Grayscale’s parent company, DCG, has been facing, it has become increasingly obvious to investors that the fund may be headed for trouble.

Will This Lead To Bitcoin Sell-Off?

The GBTC currently holds more than 640,000 BTC worth around $11 billion at today’s prices. As such, the speculations about a potential collapse do not stem from concerns about Grayscale itself but about its parent DCG company.

DCG is reportedly in a $2 billion debt, most of which stems from Genesis Trading which had limited withdrawals a few weeks ago, and Eldridge. Rumors circulating on the interwebs are that DCG actually GBTC shares to collateralize its loan from Genesis, which makes up the large majority of its loan.

On a recent episode of ‘The Chopping Block’, Haseeb Qureshi, Managing Partner at Dragonfly Capital, said that the $1.1 billion promissory note to Genesis could be “callable. What this means is that if Genesis were to be liquidated or go into bankruptcy, then DCG would be required to pay the total value of the loan. The problem is that DCG does not have the needed amount to honor it if this does happen. Subsequently, DCG could look towards GBTC for a bailout if this were to happen.

Nevertheless, the GBTC continues to hold up through adversity. Coinbase has previously publicly stated that it holds all of GBTC’s bitcoin in its custody service, and if prices were to start recovering from here, then the premium to NAV could begin to close.

Fir Tree fund sues Grayscale in effort to force changes to Bitcoin Trust

The New York-based hedge funds want Grayscale to cough up information about its flagship Bitcoin trust which it believes could reveal potential mismanagement.

The biggest Bitcoin fund just hit a record -35% discount — A warning for BTC price?

Institutional interest in Grayscale Bitcoin Trust continues to dwindle 10 months into the crypto bear market.

Bitcoin Investment ETFs And Trusts Have Slowed Since May

Many investors are uneasy since Bitcoin value has fallen by around 70% since its peak in November 2021. In the meantime, market sentiment is at an all-time low due to analysts’ expectations of a major recession. This is especially clear from the decline in the equity markets as measured by the S&P 500 and Nasdaq 100 indices, which has a big impact on how people invest in BTC on regulated markets.

Bitcoin Investment Vehicles Have Taken A Beating

When taking a look at the Grayscale Bitcoin Trust, the share price has significantly decreased from its peak of roughly $56 to $11.94. At the same time, the share values of 3iQ CoinShares Bitcoin ETF and Purpose Bitcoin Canadian ETF both fell sharply.

The Grayscale Bitcoin Trust (GBTC) has fallen deeply to $11.94 since its peak. Source: TradingView

Despite the shares’ significant discount, GBTC’s daily trading volume has drastically decreased to 3.075M. It suggests that institutional investors might be skeptical about Bitcoin-related financial products on the regulated market or they might just believe that the bear market is not yet over.

The daily trading volume of GBTC has sharply dropped to 3.075M despite the generous discount of the shares. Source: YCharts

Additionally, given the current market conditions, certain trusts and ETFs are gradually selling off their holdings. For instance, since reaching its high in February 2022, the total amount of BTC held by the Grayscale Bitcoin Trust has decreased.Moreover, since the market peaked in May 2021, the total number of Bitcoins held by various trusts and ETFs has sharply decreased.

The Sharpe ratio indicates that GBTC is a bad asset with a very low risk-adjusted performance in terms of return on investment. In fact, the Sharpe ratio has recently dropped to 0.453 after declining over time. It implies that while GBTC’s volatility is fairly high, the projected return on investment is rather modest.

Loss After Loss

The current pioneer crypto investment vehicles in regulated markets, including trusts and ETFs, have to some extent displayed the pessimistic signal. Despite the significant discount at which GBTC has been sold, the daily trading volume is steadily declining, and several trusts and ETFs, such as Grayscale Bitcoin Trust, have been urged to sell their BTC holdings.

The total number of BTC held by trusts & ETFs has plummeted since May 2021. Source: CryptoQuant

The current Bitcoin investment tools in regulated markets such as trusts and ETFs have shown the bearish signal to a certain extent. Although GBTC has been traded at a substantial loss, the daily trading volume keeps decreasing and some trusts and ETFs including Grayscale Bitcoin Trust have been encouraged to divest their Bitcoin holdings.

Sharpe ratio tells us that GBTC is a poor asset with a very low risk-adjusted performance. Source: YCharts

Because the shares of GBTC sold or bought by institutional investors are reported quarterly, many recent trades may have not been listed yet. However, these above figures could give us some clues of what may be actually happening with Bitcoin behind the scenes.

Retailers can only be aware that a local bottom has been reached after it has already occurred, like in the case of institutional investors who purchased GBTC in late June just prior to the July rise.

Most notably, the Sharpe ratio shows that GBTC’s return on investment is rather low and that this asset appears to be quite risky. Therefore, at this time, investors would be ready to begin hedging against the rising negative downside risk of bitcoin.

Featured image from Unsplash, charts from TradingView.com, Ycharts, and Cryptoquant

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

More capital enters the flagship Grayscale trust as it eyes regulator approval to become an exchange-traded fund later this year.

Grayscale parent company expands GBTC purchase allocation to $1 billion

The new allocation extends DCG’s purchase authorization for the Grayscale Bitcoin Trust by $250 million.

Will The SEC Approve A Bitcoin Futures ETF In 2021? Here Are The Implications

Rumors are flying. The SEC could approve a Bitcoin Futures ETF before the year ends. It seems like the US Security And Exchange Commission will not give the go-ahead to the mythical Bitcoin ETF just yet… or ever, but a new option has a few companies salivating. What does this mean? And why a Bitcoin Futures ETF before one for the asset itself? That’s what we’re here to explore.

Related Reading | Skybridge Capital Applies For Cryptocurrency ETF And Accumulates $100 Million For ALGO Fund

But first, why is the SEC hesitant about approving the Bitcoin ETF? Investopedia responds:

“The reason is that bitcoin, the largest cryptocurrency in the world by market capitalization, remains largely unregulated. Additionally, the Securities and Exchange Commission (SEC) is hesitant to allow an ETF focused on the new and largely untested cryptocurrency market to make its way to the public.”

If that’s true, what makes us think that a Bitcoin Futures ETF is not only possible, but imminent? Well, last month The SEC Chairman Gary Gensler told the Aspen Security Forum:

“I anticipate that there will be filings with regard to exchange-traded funds (ETFs) under the Investment Company Act (’40 Act). When combined with the other federal securities laws, the ’40 Act provides significant investor protections.

Given these important protections, I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures.”

🤯 pic.twitter.com/XUlSV31jEw

— Eduardo Prospero (@edprospero23) September 23, 2021

Is A Bitcoin Futures ETF What US Investors Want?

Since Gary Gensler sent such a clear signal, the financial world responded in unison.

“At least four asset managers have filed for ETFs that invest in bitcoin futures after Securities and Exchange Commission chair Gary Gensler earlier this month indicated that he could approve such funds. But investors may not want them in lieu of physically backed bitcoin ETFs, analysts have said.”

According to Investopedia, “A bitcoin ETF mimics the price of the digital currency, allowing investors to buy into the ETF without trading bitcoin itself.” However, who’s interested in ETFs when bitcoin, the asset, is widely available? Some investors or groups simply can’t invest in bitcoin because their own internal rules won’t allow them to. They can’t purchase bitcoin through a brokerage account. No financial institution backs it, so no one protects them. And, of course, there’s the feared volatility.

Bloomberg explains how Bitcoin fixes this:

“A Bitcoin ETF could help get around those restrictions since the format is more widely accepted. “There are all sorts of custody and regulatory hurdles for big financial institutions to jump through,” said Ross Mayfield, investment strategy analyst at Robert W. Baird & Co. “If it were offered in an ETF, it clears a lot of that up for financial institutions.”

However, it appears that the SEC won’t approve one any time soon. Why would they approve a Bitcoin Futures ETF instead? Bloomberg continues:

“For the SEC’s purposes, Bitcoin futures also offer an additional level of security because they are governed by the Chicago Mercantile Exchange and require investors to put down cash on margin to trade, as a form of collateral.”

BTC price chart 09/27/2021 on Coinbase | Source: BTC/USD on TradingView.com

Experts And Important Players Disagree

While some companies can’t wait for the Bitcoin Futures ETF to be available, others are less enthusiastic. One of those is Michael Sonnenshein, CEO of Grayscale Investments. His company is one of the many that applied for a Bitcoin ETF and are still waiting for approval. In a recent CNBC interview, he said:

“It would be shortsighted of the SEC to allow a futures-based product into the market before a spot product,” Sonnenshein told CNBC’s “Squawk Box” on Tuesday. “They really should be allowing both products into the market at the same time and let investors choose which way they want.”

Related Reading | Did The SEC’s Gary Gensler Threaten Crypto And DeFi In The WaPo Interview?

Of course, he’s heavily invested in this outcome. His company’s Grayscale Bitcoin Trust is incredibly successful, but if they manage to turn it into an ETF, it might go parabolic. However, he’s not the only one that thinks that way. In the Bloomberg article, another expert elaborated on the Bitcoin Futures ETF ‘s limitations:

“With futures-based products, you introduced additional cost, more complexity, you have futures contracts that have to be rolled,” said the ETF store’s Geraci. “It’s just a sub-optimal option for investors.”

In any case, the Bitcoin Futures ETF approval is just speculation. Gary Gensler said he looked forward to reading his staff’s review of the fillings, which is not a guarantee by any stretch of the imagination.

Featured Image by Markus Winkler from Pixabay – Charts by TradingView

Market Wrap: Bitcoin Sells Off as Regulatory Concerns Resurface

“We expect volatility to remain under pressure until mid [to] late August,” said one trading firm.

Bitcoin’s key momentum metric hints at bullish divergence as BTC clings to $33K

The RSI is seeing higher lows after rebounding from its oversold areas as Bitcoin price is forming lower lows.

6 Insurers Initiate New Cryptocurrency Investment Positions: Report

Insurance firms have increased their interest in crypto investments in recent months.

Grayscale Bitcoin premium rebounds as BTC price falls below $35K — What does it mean?

A recent market outlook published by Glassnode shows institutions are returning to the Bitcoin market after May 19 crash.

Ark Investment tips $20M into Grayscale Ethereum Trust

Ark’s Q1 SEC report revealed holdings of 639,069 shares in Grayscale’s Ethereum Trust, worth more than $20 million.