Liquid staking tokens like Lido, Rocket Pool, and ether.fi follow ether’s gains.

Ethereum Foundation Researchers’ Proposal to Slow ETH Issuance Draws Pushback

The proposal, initially introduced in February, could harden Ethereum’s native cryptocurrency, ether, as as a form of money – by reducing the inflation of new supply. But some members of the community say if it’s not broke, don’t fix it.

Fidelity Adds Staking to Ether ETF Application, Sending LIDO Up 9%

Money management giant Fidelity wants to allow traders of its potential ethereum fund to be able to stake some of the assets, it wrote in an amendment with the U.S. Securities and Exchange Commission (SEC).

Crypto Custodian Taurus Enlists Lido to Bring Liquid Ethereum Staking to Swiss Banks

Taurus, which counts Deutsche Bank and Santander as partners, expects European jurisdictions to follow Switzerland’s example.

Lido (LDO) Action Heats Up: Nearly 90% Of Holders See Profits On Crypto Climb

The past week has been a triumphant one for Lido DAO, with its LDO token surging an impressive 22%, leaving a sluggish broader crypto market in its dust. This notable feat mirrors the 18% ascent of Ethereum, its underlying blockchain, showcasing a deep synergy between the leading liquid staking platform and its technological foundation.

But the good news doesn’t stop there. A staggering 87% of Lido DAO token holders are reaping the rewards of their investment, according to data from IntoTheBlock. This solid figure underscores the strong performance of LDO, attributed largely to its stellar weekly performance, as the crypto trading analytics platform noted.

Lido Holders Get Good Returns From Their Investment

Following a strong price move by $LDO this week, ~87% of LDO addresses are now in profit. pic.twitter.com/3rLodKvK21

— IntoTheBlock (@intotheblock) January 10, 2024

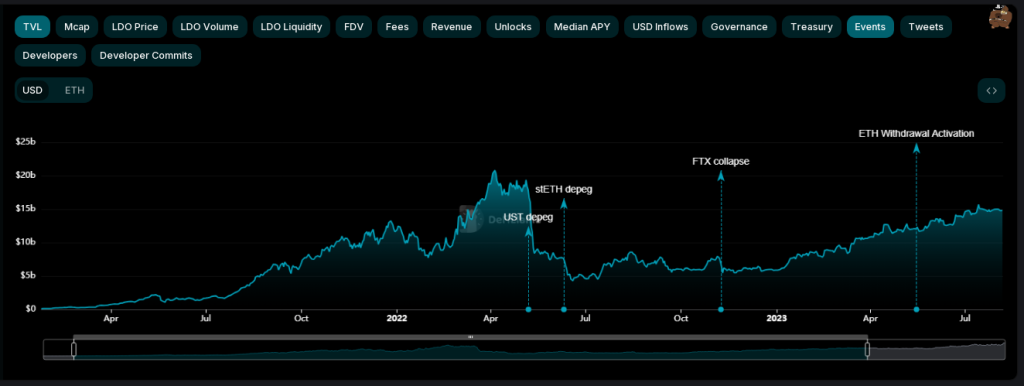

Furthermore, Lido’s Total Value Locked (TVL), a crucial metric reflecting the amount of cryptocurrency deposited in its protocol, has also ballooned a remarkable 19% in tandem with the price hike.

Analysts attribute LDO’s ascent to a potent cocktail of factors. First and foremost, its symbiotic relationship with Ethereum. As the leading smart contract platform enjoys renewed momentum, projects built on its infrastructure – like Lido – relish the rising tide that lifts all boats.

Furthermore, Lido’s recent bounce back from a critical support level at $2.80 appears to have ignited a bullish fervor. Technical indicators whisper of a potential retest of the $3.60 resistance barrier, suggesting further upward potential.

Adding fuel to the fire is the skyrocketing demand for Ethereum staking. Lido’s user-friendly model allows investors to earn rewards on their ETH without locking them up for extended periods, a flexibility that resonates deeply with yield-hungry crypto enthusiasts. This, coupled with Lido’s robust platform and proven track record, is attracting new users at a steady pace.

Strong TVL Numbers Put Lido In Contention

The surging TVL is a testament to this burgeoning trust. As more users deposit their ETH on Lido, the total value locked in the protocol increases, further validating its platform and potentially attracting even more participants. This positive feedback loop could propel Lido towards solidifying its position as the premier Ethereum staking solution.

However, a note of prudent caution remains. Lido’s recent upswing hasn’t been entirely organic. The absence of major platform-specific developments raises questions about the rally’s long-term sustainability. Additionally, a large token sale earlier triggered a temporary dip, highlighting the potential for volatility.

Technical analysis also suggests that breaking the $3.60 resistance is crucial for continued upward momentum. Failure to do so could lead to a pullback, and investors should be prepared for such a scenario.

Ultimately, while Lido DAO is riding a wave of momentum, fueled by its association with Ethereum, its robust platform, and the ever-growing demand for liquid staking solutions, investors should approach with cautious optimism.

Featured image from Freepik

Lido Tests of ‘Distributed Validator Technology’ Portend 2024 Decentralization Push

A big selling point of blockchain networks is that they are “decentralized.” But just a few validators, including those run by Lido, have gradually amassed a lion’s share of the power over the dominant smat-contracts blockchain, Ethereum. One idea is to decentralize the validators themselves.

Former Lido holder files class action lawsuit against Lido DAO for crypto losses

The investor claimed that 64% of Lido tokens are controlled by just a few venture capital firms, preventing ordinary investors from having any control over decisions.

Lido DAO (LDO) New All-Time High? One Analyst’s Perfect Setup To $37

Lido DAO has grown over the years to become the leading liquid staking protocol on the Ethereum network and its native LDO token has enjoyed tremendous success on the back of this. The protocol’s continuous growth has been purported to be what will push LDO to new all-time highs and one crypto analyst has revealed how high the token’s price could go.

Lido DAO To Beat Previous $7.22 All-Time High

Back in the bull run of 2020-2021, the price of Lido DAO’s native LDO token soared with the rest of the market and eventually touched its all-time high price of $7.22. Naturally, this has been the level that bulls have been trying to get back to that would put all holders back in profit. However, crypto analyst Weslad expects the altcoin to completely clear this all-time high price by at least a 4x.

In an analysis posted on the TradingView website, Weslad reveals the roadmap for LDO’s price to rise another 1,400% from here. According to the analyst, the LDO/USDT has been showing a “robust ascending triangle pattern.” This pattern, the analyst says, suggests that LDO could move to test the Neckline which is a critical supply zone for the asset.

The analyst who is obviously very bullish on LDO expects that this level will be breached and that the altcoin will eventually turn this resistance mark into support. “The Buy back area on the chart should give all the bull an opportunity to accumulate the coin before major move begins and at same time the chart indicates the outlined target,” Weslad says.

The first target in this setup is already above its ATH price at $9.,176. From here, the analyst expects another bounce up to take the Lido DAO price above $15.9, double its previous all-time high. But it still doesn’t end here.

A final setup outlined by the crypto analyst brings the next target to $29.3. After that comes the coveted $37 level, which is at the very peak of this expected rally.

Just below the buy back zone at around $1.9, the analyst outlines a stop loss zone below $1.473. “The stop loss range is an important area that need to be watched closely should incase price turn around,” the analyst warns.

LDO Enters Top Gainers

The bullishness surrounding Lido DAO and the native token LDO is not without metric, especially given the token’s performance in the last week. LDO has seen its price rise approximately 27% in one week to breach the $2.47 mark.

Even more impressive is its 24-hour positive moves that have come out to 10.5%. This rise puts it in the list of the top 10 gainers in the last day behind the likes of Kaspa (KAS) and PancakeSwap (CAKE).

LDO’s large transaction volume has also fallen in the last week which suggests that whales are winding down their activities. While this could mean there is not a lot of buying going on by these large whales, it also suggests there is not a lot of selling happening either. This could point toward a tendency to hold and wait for better prices rather than selling tokens now.

Coinbase, Ether Liquid Staking Tokens Lido, RocketPool Surge on BlackRock ETH ETF News

Asset management giant BlackRock registered a Delaware company for a spot ether trust, fueling speculations about a potential ETF filing.

Proof of Stake Alliance updates recommendations for staking providers

The POSA updated its staking principles to say that providers should communicate clearly and should not control the amount of liquidity a user must provide.

LidoDAO launches official version of wstETH on Base

LidoDAO took control of the deployment for a wrapped version of its flagship token, stETH, on Base.

9 protocols criticize LayerZero’s ‘wstETH’ token, claiming it’s ‘proprietary’

Connext, Chainsafe, Sygma, LiFi, Socket, Hashi, Across, Celer, and Router issued a joint statement criticizing the new token.

Cracks Appear as Ethereum Staking Demand Wanes

Earlier this year, Ethereum staking was popular, particularly with Lido Finance’s rise to prominence in the DeFi space, but it is now facing challenges, suspicions, and resentment.

LidoDAO Records Overwhelming 92% Votes To Exit The Solana Network

In a recently concluded voting program, it was revealed that over 92% of LidoDAO members (Lido token holders) of the decentralized liquid staking protocol Lido Finance, voted in favor of Lido ceasing its operations on the Solana Network.

LidoDAO Cut Ties With The Solana Network Following Community Vote

The proposal was first introduced by Lido on Solana’s peer-to-peer (P2P) team on September 5, due to financial limitations. Following the introduction, the voting program began on September 29, 2023, and was concluded a week later on October 6.

The P2P team in charge of the development of Lido on the Solana Network offered the community members two options in the voting program. These included the organization leaving the Solana Network, or providing funds to the organization to sustain its operations on the Solana Network.

In the proposal by the P2P team, Lido requested that LidoDAO provide $20,000 per month to fund technical maintenance activities related to sunsetting operations on Solana over the following five months. The proposal also expressed worries about not being able to meet goals in the next year due to the challenging market conditions.

“Achieving even 2% of the market share in 2023-2024 seems improbable, particularly in the current Solana market, without any marketing assistance and given Lido DAO’s committee resolution 22 to discontinue all incentives in Solana,” the team’s proposal stated.

According to Yuri Mediakov, the P2P team invested a total of $700,000 in Lido on the Solana project to build and support the product in the past year but ended up making $220,000 in revenue, resulting in a net loss of $484,000. Therefore, in order to support the project for the next 12 months, the team would need around $1.5 million.

However, at the end of the vote, over 65 million (92.7%) of LDO tokens (voted by token holders) were in favor of sunsetting operations on Solana Network. Meanwhile, 5.1 million (7.2%) of LDO tokens voted in favor of providing funds to the organization to continue its operation on the Solana Network. The total number of Lido (LDO) tokens concluded in the vote was 70.1 million LDO tokens.

The organization highlighted in an excerpt that the decision was a necessary one to make despite how difficult it was:

Whilst this decision was difficult in the face of numerous strong relationships across the Solana ecosystem, it was deemed a necessity for the continued success of the broader Lido protocol ecosystem.

According to LidoDAO, the organization will cease accepting staking requests as of October 16, while users will have to unstake on Solana’s frontend by February 4, 2024. Failure to unstake before the deadline will result in unstaking through the Command Line Interface (CLI). In addition, Voluntary node operator off-boarding will commence on November 17, 2023.

Nonetheless, staked Solana (stSOL) token holders are still expected to receive rewards during the sunsetting process. However, Lido’s staking services are now solely supported on Ethereum and Polygon.

The P2P team has been working on Lido’s Solana project since acquiring it from Chorus One in March last year.

Ethereum LSDFi sector grew nearly 60x since January in post-Shapella surge: CoinGecko

The LSDFi sector’s total value locked has grown 5,870% since January as ETH holders seek better yields.

Solana wind down ‘deemed a necessity’ after low fees, says Lido Finance

Unsustainable financials and low fees generated by Lido on Solana were two of the main reasons for the sunsetting.

Ethereum Has Become More Centralized Since the Merge and Shanghai Upgrades: JPMorgan

The increase in staking has reduced the appeal of ether from a yield perspective, the report said.

Opposing Centralization in Ethereum Staking

3 key Ether price metrics suggest that ETH is gearing up for volatility

Network, futures and user data all point toward Ether potentially charting a new course.

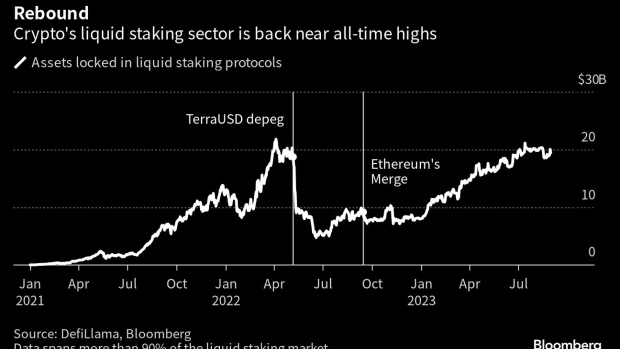

Defying The Crypto Crash: Liquid Staking’s $20 Billion Rise Amid Market Uncertainty

The crypto market has witnessed several fluctuations, but specific sectors’ resilience within this domain remains attractive. Recently, despite a noticeable dip in the broader crypto market, one area seems poised to touch its peak, demonstrating the potential and adaptability within the crypto ecosystem, per a report.

Liquid staking, a sector that facilitates rewards for token pledges supporting blockchain operations, shows signs of resurgence. This re-emergence occurs despite an overarching downturn in crypto assets.

Recovery Amid Crypto Crisis

According to Bloomberg, citing data from DefiLlama, there is a roughly 292% surge in assets secured in liquid staking services, reaching a monumental $20 billion from a low in June 2022. This ascent is all the more significant considering the broader crypto slump during that period.

Bloomberg noted a recovery in liquid staking’s position as “the titan of decentralized finance (DeFi).” Thanks to blockchain-based automated software, this crypto framework enables individuals to trade, borrow, and lend without intermediaries.

Notably, once the crown jewel of DeFi applications, liquid staking has overtaken lending. Protocols specialized in liquid staking, such as Lido and Rocket Pool, witnessed their zenith in April of the previous year.

They amassed assets slightly exceeding $21 billion. However, this momentum was disrupted by the destabilization of TerraUSD, leading to a massive $2 trillion setback in the crypto market.

Despite the gloomy overtones in the crypto sector, where major tokens and a majority of DeFi services are yet to recover from the blows of 2021 and 2022, liquid staking stands out, showcasing a comeback, as seen in the chart below.

Global Regulatory Stance On Staking

Liquid staking plays a pivotal role, especially in the Ethereum blockchain. It offers a mechanism where users can stake their tokens and, in return, receive a liquid token representing their staked amount.

This process allows users to participate in securing the network while maintaining liquidity. Simply put, they can earn staking rewards without locking up their assets, ensuring flexibility and maximizing potential gains.

Kunal Goel, a research analyst at Messari, parallels these services to “the on-chain equivalent of government bonds.” The analyst elaborates that while these aren’t devoid of risks, they exude a comparatively lower risk profile and, thus far, have remained untainted by hacks or exploits.

This resurgence in liquid staking doesn’t go unnoticed and has been juxtaposed with regulatory decisions concerning crypto globally. The US, for instance, has intensified its regulatory lens on the crypto sector, especially on staking products.

Such measures prompted key players like Kraken and Bitstamp to halt their regional staking products. Richard Galvin, co-founder at DACM, noted:

The regulatory crackdown around staking products offered by centralized exchanges has definitely helped liquid staking.

Featured image from iStock, Chart from TradingView