Network, futures and user data all point toward Ether potentially charting a new course.

Cryptocurrency Financial News

Network, futures and user data all point toward Ether potentially charting a new course.

The crypto market has witnessed several fluctuations, but specific sectors’ resilience within this domain remains attractive. Recently, despite a noticeable dip in the broader crypto market, one area seems poised to touch its peak, demonstrating the potential and adaptability within the crypto ecosystem, per a report.

Liquid staking, a sector that facilitates rewards for token pledges supporting blockchain operations, shows signs of resurgence. This re-emergence occurs despite an overarching downturn in crypto assets.

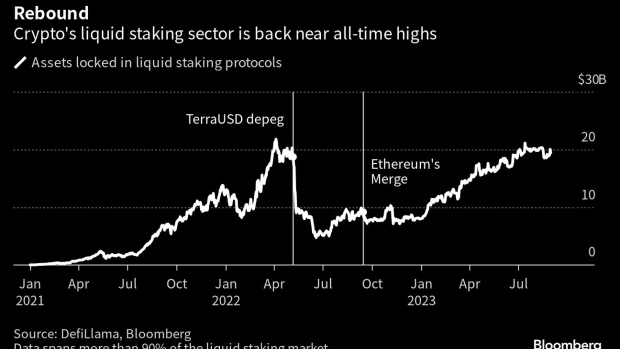

According to Bloomberg, citing data from DefiLlama, there is a roughly 292% surge in assets secured in liquid staking services, reaching a monumental $20 billion from a low in June 2022. This ascent is all the more significant considering the broader crypto slump during that period.

Bloomberg noted a recovery in liquid staking’s position as “the titan of decentralized finance (DeFi).” Thanks to blockchain-based automated software, this crypto framework enables individuals to trade, borrow, and lend without intermediaries.

Notably, once the crown jewel of DeFi applications, liquid staking has overtaken lending. Protocols specialized in liquid staking, such as Lido and Rocket Pool, witnessed their zenith in April of the previous year.

They amassed assets slightly exceeding $21 billion. However, this momentum was disrupted by the destabilization of TerraUSD, leading to a massive $2 trillion setback in the crypto market.

Despite the gloomy overtones in the crypto sector, where major tokens and a majority of DeFi services are yet to recover from the blows of 2021 and 2022, liquid staking stands out, showcasing a comeback, as seen in the chart below.

Liquid staking plays a pivotal role, especially in the Ethereum blockchain. It offers a mechanism where users can stake their tokens and, in return, receive a liquid token representing their staked amount.

This process allows users to participate in securing the network while maintaining liquidity. Simply put, they can earn staking rewards without locking up their assets, ensuring flexibility and maximizing potential gains.

Kunal Goel, a research analyst at Messari, parallels these services to “the on-chain equivalent of government bonds.” The analyst elaborates that while these aren’t devoid of risks, they exude a comparatively lower risk profile and, thus far, have remained untainted by hacks or exploits.

This resurgence in liquid staking doesn’t go unnoticed and has been juxtaposed with regulatory decisions concerning crypto globally. The US, for instance, has intensified its regulatory lens on the crypto sector, especially on staking products.

Such measures prompted key players like Kraken and Bitstamp to halt their regional staking products. Richard Galvin, co-founder at DACM, noted:

The regulatory crackdown around staking products offered by centralized exchanges has definitely helped liquid staking.

Featured image from iStock, Chart from TradingView

Layer 2 network Mantle has staked 40,000 ether (ETH) on staking protocol Lido after it passed a governance vote on treasury management earlier this month.

The crypto verse has recently witnessed a massive splash as an unidentified entity dove deep into the Ethereum ecosystem. A recent report from Lookonchain reveals that in a span of 24 hours, the whale has purchased $10 million worth of Lido Staked Ethereum (stETH).

Lookonchain, an on-chain analytics firm, broke the news earlier today on their X (formerly known as Twitter) account revealing that a whale address was responsible for the withdrawal of 10 million Dai (DAI) from Maker.

The smart whale withdrew 10M $DAI from @MakerDAO and bought 5,403 $stETH again at an average price of $1,851 6 hrs ago.https://t.co/rIWyjsfRpf pic.twitter.com/aGwmc46gmc

— Lookonchain (@lookonchain) August 10, 2023

According to the firm, this withdrawal wasn’t without purpose as the whale used the funds strategically invested to purchase 5,403 Lido Staked Ethereum, each at an average price of $1,851.

For those tracing the activities of this whale, this isn’t a maiden voyage into the stETH seas. As reported by Lookonchain, this exact address recorded two hefty transactions on 24 July 2023.

The first transaction saw the whale dispensing 5.17 million USD Coin (USDC) to acquire 2,802 stETH at a rate of $1,844 each. Not stopping there, the whale converted a subsequent 10 million USDC into 5,421 ETH, which was then fully transitioned to stETH.

While the motives of crypto whales, just like their real-world counterparts, often remain beneath the surface and obscured from the prying eyes of small investors, given the nature of this particular whale’s stETH acquisitions, it’s plausible to hypothesize some reasons behind its latest move.

Strategic staking could be a reason behind the whale’s $10 million stETH purchase. Ethereum’s transition to a proof-of-stake mechanism through ETH 2.0 has opened doors for staking returns. Acquiring stETH, a representation of staked ETH, could be a strategic move by the whale to earn rewards while maintaining liquidity.

Another plausible hypothesis could be speculation for price appreciation. It is worth noting that the whale might anticipate a significant price appreciation in the near future and investing a sizable amount can yield substantial returns if the price moves in the favored direction.

Diversification of their portfolio can also be a possible reason behind the whale’s substantial stETH purchase, especially given the significant amounts of USDC previously deployed by the whale, so moving some of these holdings into stETH may be a calculated strategy to achieve diversification.

However, despite the large buys, stETH hasn’t seen any significant movement. Particularly, the asset has only declined by 0.5% with a current trading price of $1,850.

Featured image from Unsplash, Chart from TradingView

The new layer 2 network passed a governance vote that establishes the Mantle Economics Committee as well as introduces more liquid staking into the ecosystem by authorizing liquid staking protocol Mantle LSD and the allocation of 40,000 ETH from its treasury to stETH.

The largest staking service provider also crossed $15 billion in total value locked, a level not seen since May 2022.

A Lido team member claimed Rocket Pool is not really governed by its DAO, but Rocket Pool community members pushed back, claiming the protocol is becoming more decentralized.

While Raft is centered around its R stablecoin backed by Lido’s stETH, the team has had ongoing conversations about introducing RAFT, an additional token intended to empower community members and help decentralize the protocol

Ethereum hummed along through the latest AWS outage but one commentator said its reliance on Lido for staking could cause issues in the future.

While the product offers investors single-asset exposure to the liquid staking leader, the Switzerland-based firm classified this product as class 7 risk, the highest level.

Its R stablecoin is collateralized by one crypto asset: liquid staking leader Lido’s staked ether (stETH).

Two decentralized finance projects are butting heads over a governance proposal that could see the recovery of 40 ETH stolen in Sushiswap’s April hack.

Lido (LDO), the leading liquid staking derivatives (LSD) protocol, recently made waves in the crypto community by enabling staked ETH (stETH) withdrawals. Expectations were high as many anticipated a surge in stakers unstaking their ETH.

However, contrary to these predictions, Lido has witnessed a remarkable increase in ETH deposits, reaching a record-breaking level. This surge has also been reflected in the protocol’s native token which has recorded a rally of more than 20% in the past week.

Despite the introduction of stETH withdrawals, Lido experienced a surge in ETH deposits, defying expectations of widespread unstaking. On Friday, the platform witnessed a significant milestone as the total number of ETH deposited hit an all-time high.

According to data provided by Lido, an astounding 6,373,289 ETH is currently staked with Lido, equivalent to more than $11.5 billion. Interestingly, while ETH deposits on Lido continue to soar, stETH withdrawals have remained stagnant around the 450,000 ETH mark, as reported by data from Nansen.

It is worth noting that these withdrawal requests have yet to be processed, contributing to the overall stability of stETH withdrawals. This trend raises questions about the anticipated unstaking frenzy, prompting a closer examination of the factors influencing stakers’ decisions.

As the most significant liquid staking derivatives protocol, Lido holds an impressive 75% market share, surpassing its competitors in the Liquid staking (LSD) space. Notably, according to data from Nansen, Coinbase and Rocket Pool trail behind, occupying the second and third positions.

Furthermore, while it may sound like positive news that ETH deposit is surging while withdrawal flattens, it is worth noting there are several reasons behind this so as not to get carried away. On the one side, the stabilized withdrawal can be attributed to the pending processing of withdrawal requests.

On the other side, it can be attributed to stakers’ long-term commitment to the protocol and the attractiveness of Lido’s offerings amidst the volatile crypto landscape.

Along with its surge in market share, Lido native token LDO’s price has experienced an upward trend in the past week up by more than 20%. Lido has surged from a low of $1.81 seen last Friday to trading as high as $2.48 on Wednesday.

LDO market capitalization has also recorded huge gains in the past 7 days. LDO’s market cap has surged 20.7% from a cap low of $1.5 billion to a high of over $2 billion on Wednesday. Meanwhile, LDO’s daily trading volume has only continued to range between $60 million and $100 million throughout the week.

Interestingly, the asset has plunged over the past 24 hours down by 4.4%. LDO currently trades slightly above $2 with a price of $2.18 at the time of writing with a 24-hour trading volume of $62.1 million.

Featured image from Analytic Vidhya, Chart from TradingView

Anchorage joins AAVE, Lido and BitDAO in adopting the off-chain voting platform Snapshot.

The bankrupt crypto lender wants its huge stash of staked Ether back, but it could be in for a wait.

In the fast-paced world of cryptocurrencies, Lido DAO (LDO) has made significant waves in the past week, experiencing an impressive surge of nearly 20%. Though the surge comes at a time the global crypto market is not deep in a downtrend, Lido’s current rally can be attributed to two notable factors.

Over the past seven days, LDO has recorded a significant spike, up by 16%. The asset has picked up from trading at a low of below $2 as of May 9 to trading at a high of $2.25, at the time of writing. Meanwhile, over the past 24 hours, the rally continues as the asset is currently up 6.3% with an increasing trading volume.

One possible catalyst for Lido’s remarkable performance over the past 7 days is the increased buying activity by cryptocurrency whales. According to a recent report by Onchain analyst Lookonchain, three whale accounts have been observed accumulating LDO tokens.

Notably, these whales have been seen transferring their LDO assets from centralized cryptocurrency exchange Binance to personal wallets, indicating a deliberate accumulation strategy. The magnitude of these whale transactions is noteworthy.

For instance, one address withdrew a substantial amount of 724,822 LDO tokens, valued at approximately $1.52 million, from Binance for $2.01 per token. Another whale withdrew 655,641 LDO tokens, equivalent to $1.38 million, from Binance at $1.83 per token. Additionally, a third whale purchased 570,883 LDO tokens using 974,000 USDC for $1.71 on May 12.

This influx of capital from these significant players in the market has undoubtedly contributed to the surge in Lido’s value.

Another driving force behind Lido’s recent upward trend is the launch of Lido V2. This highly anticipated upgrade brings several notable features to the Lido DAO ecosystem, enhancing its appeal to investors and participants. A key highlight of the V2 release is the ability for users to withdraw their staked Ethereum (ETH).

With the new Withdrawals page, Lido users can easily deposit their staked Ethereum tokens, such as stETH or wstETH, and receive ETH in return. Lido has streamlined the withdrawal process, reducing the withdrawal period to as short as 1-5 days.

This improvement not only enhances the liquidity and accessibility of staked Ethereum but also provides users with greater flexibility and control over their assets. Additionally, the V2 upgrade introduces a modular staking router, which promotes staking diversity among several cohorts.

Solo stakers, decentralized autonomous organizations (DAOs), and Distributed Validator Technology (DVT) clusters can now participate in staking activities through Lido, further expanding the network’s staking capabilities.

LDO’s price has already risen nearly 20% since the upgrade, with a market currently above $2 at the time of writing. Alongside the price surge, Lido DAO’s market capitalization has also experienced a notable rise. The market cap moved from $1.4 billion last Friday to $1.9 billion today.

Moreover, the trading volume of LDO has also witnessed a significant uptick over the same period indicating the increasing accumulation of the asset. Lido’s trading volume has surged from $47.4 million last Friday to more than $104 million in the past 24 hours.

Featured image from iStock, Chart from TradingView

The bankrupt crypto lender has been moving its massive stash of staked Ethereum.

Lido users can now unstake their stETH and receive ETh at a 1:1 ratio.

Ethereum was upgraded to allow withdrawals on April 13, but Lido had not previously integrated with the new feature.

The company raised $4.2 million in seed round, led by ElectricCapital.