Polygon (formerly Matic Network) is a game-changing Layer 2 scaling solution that addresses Ethereum’s scalability challenges. It empowers developers to create and deploy scalable, interoperable decentralized applications (dApps) by utilizing sidechains, plasma chains, and innovative scaling techniques.

If you’re unfamiliar, sidechains are unique blockchains that are bound to the main Ethereum blockchain and are effective in supporting many Decentralized Finance (DeFi) protocols available on the Ethereum network. This enables rapid transaction speed and cost-effectiveness while maintaining the security and decentralization of the Ethereum network.

As a Layer 2 solution, Polygon operates in parallel to the Ethereum blockchain. Rather than individually validating each transaction, batches of transactions are sent to the Ethereum blockchain, significantly accelerating the validation process and reducing fees.

Polygon implements a proof-of-stake consensus mechanism wherein users can stake tokens for a predetermined duration to validate transactions. In return for their staking activities, participants are rewarded with MATIC tokens.

To ensure robust security, Polygon implements the advanced technique of “commit-chain” or “checkpointing.” It securely anchors the state of Polygon chains onto the Ethereum mainnet at regular intervals, enhancing data integrity and leveraging Ethereum’s inherent security. By capitalizing on Ethereum’s proven security measures, Polygon provides users with a reliable and resilient platform for their transactions and dApps.

The Polygon Network offers a comprehensive set of features that address scalability, security, and developer-friendliness. In this article, we will delve into the key attributes of the Polygon network and assess its substantial potential within the Ethereum ecosystem.

Features Of The Polygon Network

Cross-Chain Connectivity

Polygon network offers bridges that enable smooth transfers of assets and data across diverse blockchains. This fosters interoperability between chains, empowering users to leverage the advantages of multiple blockchain networks and access a broader array of decentralized finance (DeFi) protocols and applications.

Polygon presents a Layer 2 scaling solution for Ethereum by leveraging sidechains to address scalability challenges. This solution facilitates quicker and more economical transactions, alleviating congestion and mitigating high fees on the Ethereum network

Ethereum Compatibility

Polygon seamlessly integrates with the Ethereum Virtual Machine (EVM), enabling developers to effortlessly migrate their existing Ethereum decentralized applications (dApps) to the Polygon network. This compatibility guarantees a seamless transition and adoption of Polygon while leveraging the extensive Ethereum ecosystem and developer tools.

Commit-Chain Checkpointing

Polygon employs commit-chain checkpointing, securing the state of its chains by anchoring them onto the Ethereum mainnet. This approach guarantees the integrity of data, harnesses Ethereum’s robust security measures, and safeguards against any unauthorized alterations or tampering of the sidechain data.

Ethereum Network Security

Leveraging Ethereum as its anchor chain, Polygon leverages the inherent security and decentralization of the Ethereum network. This integration fortifies the overall security of the Polygon ecosystem, ensuring users have access to a reliable and resilient platform for transactions and decentralized applications (dApps).

Developer-Centric Environment

Polygon provides an array of developer tools and infrastructure that empower developers to create and deploy decentralized applications (dApps) seamlessly. The Polygon Software Development Kit (SDK) offers a streamlined framework for building scalable applications on the network, simplifying the development process.

Polygon also prioritizes the needs of developers by offering extensive documentation, guides, and resources. This ensures that developers have access to the necessary information and support to comprehend and harness the platform effectively. The availability of comprehensive resources fosters a vibrant developer community, encouraging collaboration and driving innovation on the network.

MATIC Token Utility And Exchange Availability

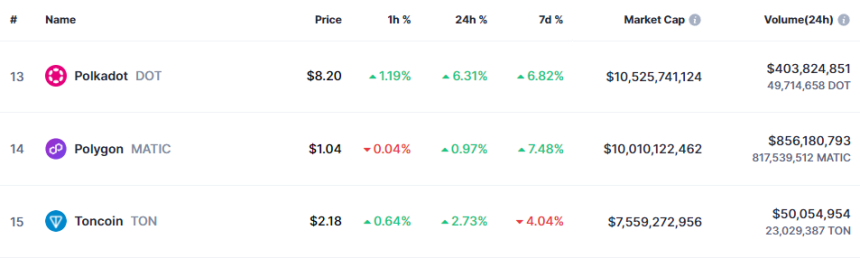

Polygon’s rebranding decision resulted in the retention of MATIC as its token ticker symbol. MATIC, an ERC-20 token, ensures compatibility with numerous Ethereum projects. Within the Polygon network, users rely on MATIC to secure and govern the network and cover transaction fees.

The MATIC token serves multiple purposes within Polygon’s ecosystem. Users can utilize MATIC for fee payments during transactions on the Polygon platform. MATIC can also be staked to contribute to the network’s security and earn rewards.

Furthermore, MATIC holders have the ability to engage in governance activities by voting on proposed modifications, influencing the evolution of the network.

In terms of exchange availability, MATIC can be traded on various platforms, including prominent exchanges like UniSwap. This wide accessibility on exchanges enhances liquidity and provides individuals with convenient access to acquire or trade MATIC tokens.

How To Get Started On The Polygon (MATIC) Network

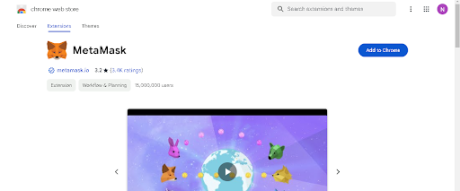

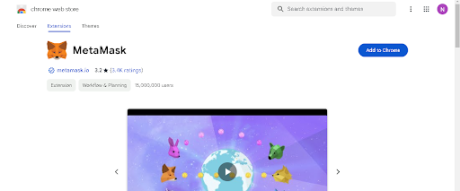

To engage in token transactions on the Polygon network, users must acquire a MetaMask wallet. MetaMask, a widely used browser extension wallet, provides a seamless interface for interacting with blockchain networks, including Ethereum. This user-friendly wallet is accessible as a browser extension for popular browsers like Google Chrome.

To ensure your MetaMask Wallet is added to your browser as an extension, click on the ‘Add to Chrome’ icon located at the top right corner, as depicted below:

After installation and setup, MetaMask enables users to effectively manage their cryptocurrency wallets, seamlessly interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks, all directly from within their web browsers.

Remember to diligently write down your seed phrase on a physical sheet of paper and store it in a secure location. Avoid storing it online or on any electronic device to ensure maximum security.

For the next step, add the Polygon (MATIC) network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On The Polygon (MATIC) Network

In order to execute trades on the Polygon (MATIC) network, you will need to fund your wallet with MATIC so as to enable you to cover gas fees. These fees cover the expense associated with utilizing computational resources related to transaction processing and validation.

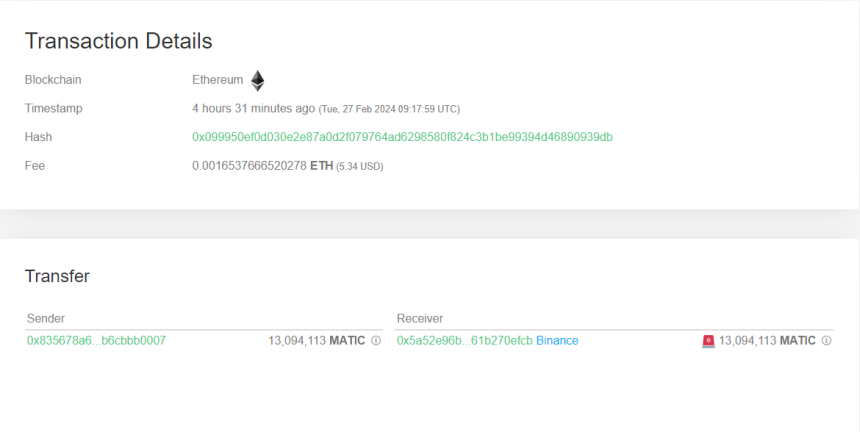

To purchase MATIC tokens, you can utilize centralized exchanges like Binance. Simply copy your wallet address from MetaMask and proceed to transfer MATIC tokens from your Binance account to your MetaMask wallet.

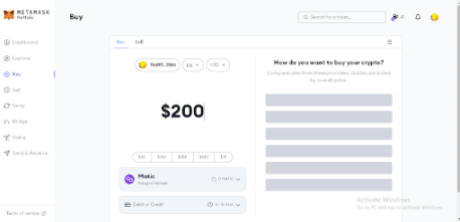

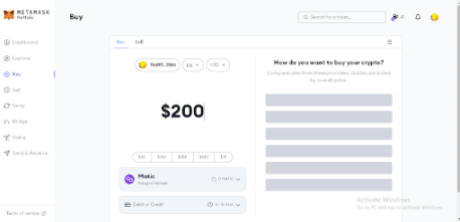

In addition, it is possible to acquire MATIC directly within the MetaMask wallet by utilizing conventional payment methods such as credit or debit cards and other similar options.

Simply click on the “Buy/Sell” button within the MetaMask interface to access the designated section. Within this interface, you can specify the desired amount of MATIC (or any other token) you wish to purchase in terms of US dollars. Additionally, you can select your preferred payment method before finalizing the transaction by clicking on the “Buy” button.

It’s imperative for users to be aware that when purchasing cryptocurrencies directly within MetaMask, you will be required to provide information such as your country and state. However, rest assured that this process is simple and can be completed within a minute.

You can expect your MATIC tokens to arrive in your wallet within a few minutes at most. Once they have arrived, you are ready to start trading tokens on the Polygon network. To begin your trading journey, navigate to UniSwap and commence your trading activities.

How To Trade Tokens On The Polygon Network Using UniSwap

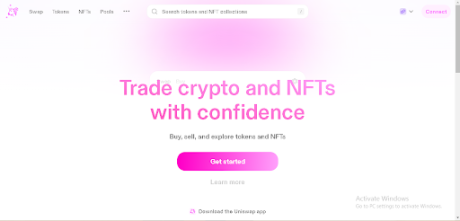

Uniswap is an Ethereum blockchain-based decentralized exchange (DEX) protocol that enables users to trade Ethereum-based tokens from their wallets directly, eliminating the necessity for intermediaries or conventional order books. Uniswap provides users with a hassle-free method to purchase and sell various tokens.

To safeguard your wallet against fraudulent activity, ensure that you are accessing the legitimate Uniswap website.

Begin by clicking on the “Launch App” button located in the top right corner, as depicted in the image below:

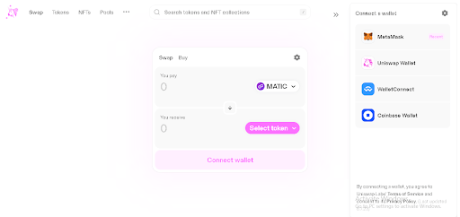

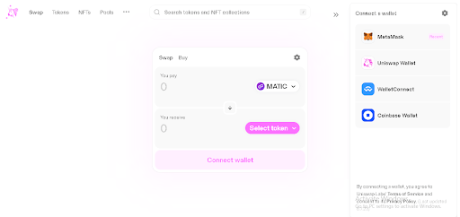

Next, proceed by selecting the “connect” option located at the top right corner of the UniSwap interface, as depicted in the provided image below:

Establish a connection with your preferred wallet, as shown in the image below. In this instance, the suggested wallet is Metamask:

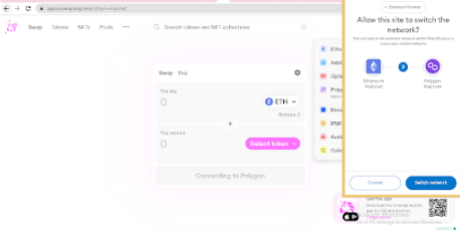

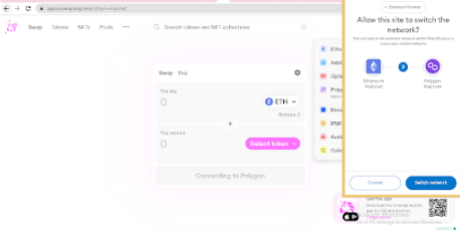

After establishing the connection, adjust your Metamask settings to the Polygon (MATIC) network. (If you are already connected to the Polygon network, there is no need to make any network switches).

Once you have successfully connected MetaMask to the Polygon network, navigate to UniSwap to begin trading on the Polygon network through the platform.

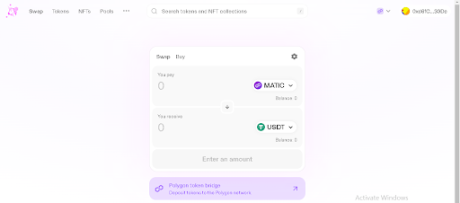

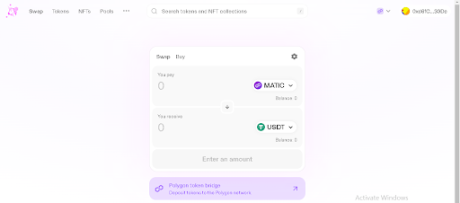

Moving forward, you need to choose your desired tokens within the UniSwap interface. As Uniswap operates on a token-to-token trading model, click on the “Select Token” button to designate the specific trading pair you wish to trade against.

To illustrate, if you intend to purchase USDT using MATIC, simply choose the MATIC – USDT trading pair, specify the desired amount, and click on “Swap” or “Trade Now.” Confirm the transaction in your Metamask wallet, and you will be able to view the tokens in your wallet’s asset list.

Buying And Selling Tokens With Metamask

Metamask extension wallet, connected to the Polygon network, allows users to buy and sell tokens seamlessly. To proceed, ensure that you are connected to the Polygon network and possess MATIC tokens for swapping and covering gas fees.

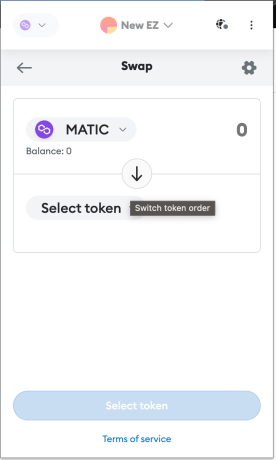

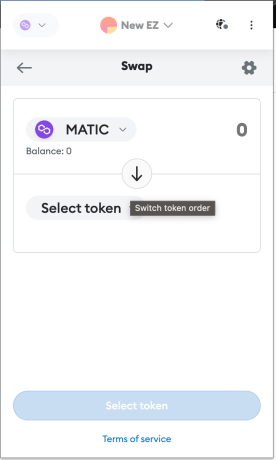

Then, locate the “Swap” button, as illustrated below. Clicking on it will direct you to the Swap interface within the Metamask wallet.

Using the image above as a guide, users can search for tokens by name or contract address, just like on UniSwap. Enter the amount of MATIC you want to swap, make sure you have the correct token, and click on “Swap”. Once the transaction is confirmed, the tokens you bought will be sent to your wallet.

Tracking Token Prices on The Polygon Network

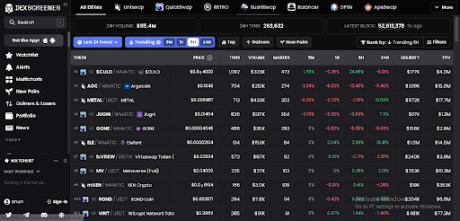

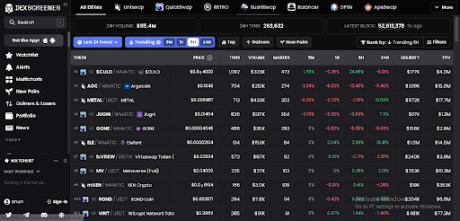

Polygon network users can equip themselves with potential on-chain tools like Dexscreener, which opens up a world of new opportunities for traders. Dexscreener provides users with extensive market insights for specific tokens, ranging from real-time price data to in-depth contract information. It also helps users make well-informed trading decisions based on reliable and up-to-date data.

Stay ahead of the curve on the Polygon network with Dexscreener, keeping track of token metrics and market dynamics.

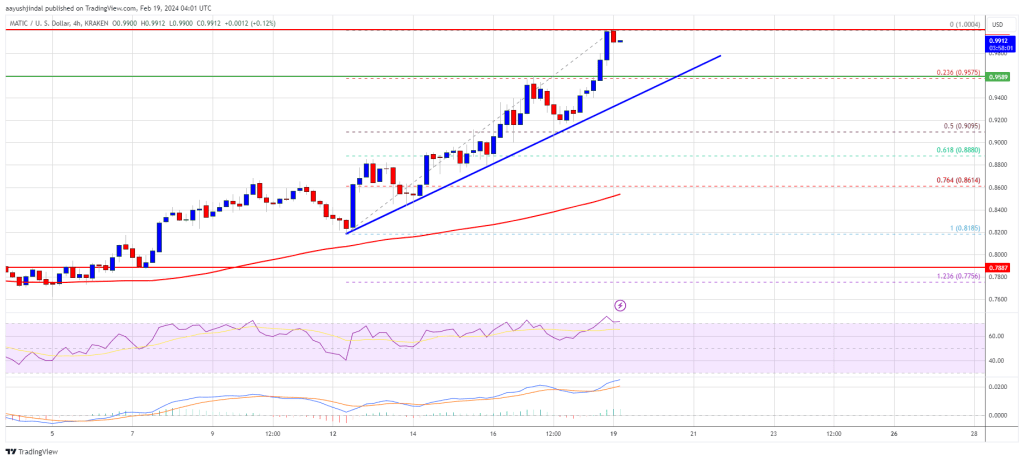

Dexscreener on the Polygon network offers invaluable features tailored to users. One standout feature is its charting functionality, which provides real-time and historical price data for various tokens.

By utilizing these charts, users can gain valuable insights into price trends, trading volumes, and other important metrics.

Check below for a visual representation:

Conclusion

The Polygon network provides a robust and user-friendly environment for traders to thrive. With its innovative features, growing ecosystem, and commitment to scalability, Polygon is poised to play a pivotal role in shaping the future of decentralized finance.

As Polygon continues to experience growth and wider adoption, we anticipate a broader selection of applications and services tailored to meet the diverse requirements of traders. The network’s dedication to scalability, interoperability, and user satisfaction establishes it as a frontrunner in the ever-evolving blockchain industry.

(@DrProfitCrypto)

(@DrProfitCrypto)  euroPeng

euroPeng  (@Pentosh1)

(@Pentosh1)

(@sandeepnailwal)

(@sandeepnailwal)