The news about X Layer comes as other major cryptocurrency exchanges, like Coinbase and Kraken, have also pursued their own layer 2 networks over the last year.

Immutable, King River Capital, Polygon Labs Set Up $100M Web3 Gaming Fund

Immutable and Polygon Labs will identify investment opportunities while King River will manage the investment process and deploy the capital across game studios and web3 infrastructure firms.

Polygon Lands First User of New ‘AggLayer,’ Inking Deal With Astar Network

By plugging into the AggLayer, Astar users will have access to the liquidity in the Polygon ecosystem, allowing cross-chain transactions between Astar and Polygon zkEVM, making the experience feel like a single chain.

Polygon, StarkWare Tout New ‘Circle STARKs’ as Breakthrough for Zero-Knowledge Proofs

Circle STARKs are supposed to accelerate the proving process for zero-knowledge rollups, according to a white paper published by Polygon Labs and StarkWare.

Polygon Releases ‘Type 1 Prover,’ Claiming Milestone Set by Ethereum’s Vitalik Buterin

The announcement means that existing EVM chains or optimistic rollups can connect to the prover without modification, then plug into Polygon’s newly released Aggregation layer, providing access to “all of the liquidity and value on Ethereum itself,” Polygon said.

Polygon Labs Cuts 19% of Staff, 60 Roles, for ‘Enhanced Performance’

The Ethereum-focused developer firm attributes the layoffs to working more effectively, rather than financial reasons.

Polygon Plans ‘AggLayer,’ in Bid to Synthesize Modular, Monolithic Blockchains

The new “AggLayer,” set for launch next month, relies on zero-knowledge proofs, a type of cryptography that Polygon Labs is betting on as a core underpinning of future blockchain architecture.

Fox, Polygon Release Blockchain-Powered Tool ‘Verify’ to Weed Out Deepfakes

“Verify” is an open-source protocol built on Polygon’s PoS blockchain, specifically used to establish the origin and history of registered media.

Neon EVM Hits Record-High 730 TPS On Mainnet

In the rapidly evolving landscape of blockchain technology, Neon EVM, a smart contract on Solana (SOL) has emerged as a frontrunner by introducing a landmark parallel processing architecture on its mainnet.

This approach has enabled Neon EVM to achieve an increase in performance, scalability, and efficiency, according to a press release share with NewsBTC.

Neon EVM Dominates Transaction Processing

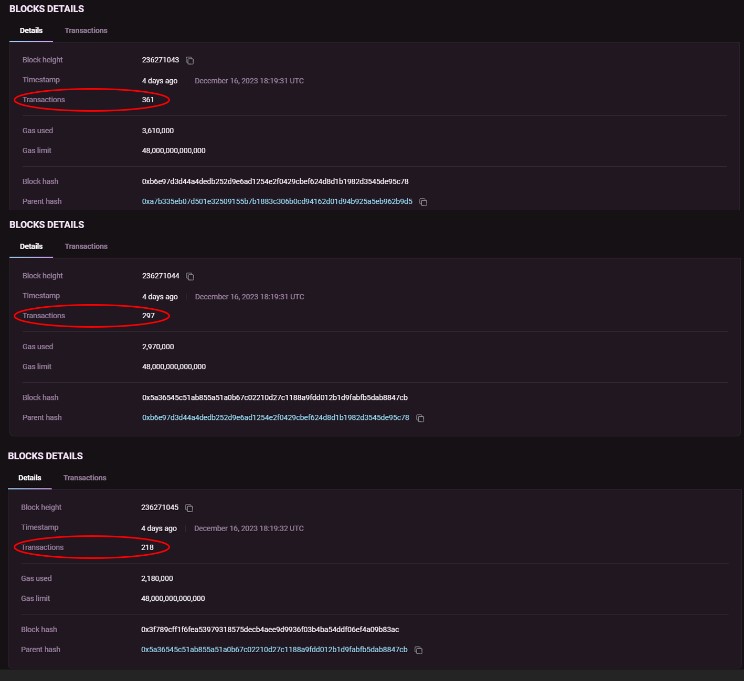

Neon EVM, the first parallel Ethereum Virtual Machine (EVM) on mainnet, has achieved a record-breaking 730 Transactions Per Second (TPS) on its mainnet. Notably, this is the first time such high tps has been achieved on an EVM mainnet.

The milestone was reached on December 16, 2023, when Neon EVM’s mainnet showcased its transaction processing capabilities. While many blockchains demonstrate high tps on testnets, Neon EVM’s has standout by improving its scalability.

Neon EVM, which went live on the mainnet in July 2023, operates as a fully Ethereum-compatible environment on the Solana blockchain. Since its launch, Neon EVM has garnered investor interest, resulting in multiple listings on platforms such as ByBit, Crypto.com, and Gate.io.

Given these developments, the utility token NEON has experienced remarkable growth, with its value surging from $0.67 to $1.45 in just three days, representing a 116% increase.

Neon EVM’s success comes when there is growing interest in high-speed, parallelized processing blockchains. Currently, Neon EVM stands as the only parallel processing EVM live on the mainnet, showcasing its tps capabilities compared to other blockchain networks.

Outshining Ethereum’s Transaction Speed

The fundamental difference between Neon EVM and blockchains like Bitcoin and Ethereum lies in their transaction processing approach. While Bitcoin and Ethereum process transactions sequentially, Neon EVM allows for simultaneous processing of multiple transactions, facilitating increased throughput and reducing the likelihood of congestion during periods of high demand.

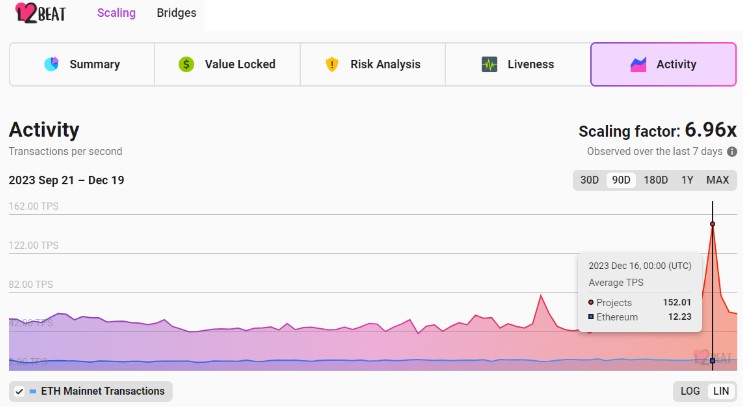

In a notable comparison, Neon EVM’s parallel processing architecture outperformed the combined tps of the entire Ethereum ecosystem on December 16, as reported by L2Beat.

The project’s commitment to Ethereum compatibility on the Solana blockchain and its high-speed transactions and low-cost benefits positions Neon EVM as an interesting project as a new Bull Cycle emerges.

Layer 2 Scaling Solutions On The Rise

Polygon, the layer 2 scaling solution that operates alongside the Ethereum blockchain, has also demonstrated its transaction processing speed capabilities.

In a recent post on X (formerly Twitter), Sandeep Nailwal, the founder of Polygon, shared notable statistics highlighting the network’s performance. According to Nailwal’s post, Polygon’s Proof of Stake (PoS) chain seamlessly handled over 16 million transactions in a single day, showcasing its scalability and efficiency.

During the peak period, the Polygon PoS chain achieved a throughput of 255 tps. This figure is approximately 2-3 times higher than the combined throughput of the entire Ethereum ecosystem.

Moreover, the validators on the Polygon network generated approximately 1 million in transaction fees in a single day, reflecting the network’s high level of activity. However, it is worth noting that gas fees experienced a spike during this period, which is a broader issue impacting the entire Ethereum ecosystem.

In terms of rewards for validators, the block rewards on the Polygon network amounted to over 155,000 MATIC tokens. This translates to substantial revenue for validators, totaling around 1.2 million in a single day. These rewards incentivize validators and contribute to the overall security and stability of the PoS chain.

The spike in transactions in both of these Layer-2 networks showcase the growing importance of scalability solutions. In the coming months, hundred of new users could onboard the crypto market via either of these solutions hinting at a potential benefit for their underlying tokens.

Featured image from Shutterstock, chart from TradingView.com

Chainlink Data Feeds Available on Polygon zkEVM

Developers building on Polygon’s zkEVM will be able to incorporate these data feeds into their on-chain applications.

Chainlink Data Feeds Available on Polygon zkEVM

Developers building on Polygon’s zkEVM will be able to incorporate these data feeds into their on-chain applications.

Polygon Adds Data Solution Celestia as Option for New Layer-2 Developers

The integration means that Celestia will plug into Polygon’s customizable software stack, which is powered by zero-knowledge technology, allowing developers to make use of the data availability solution when launching their own blockchain.

Polygon Adds Data Solution Celestia as Option for New Layer-2 Developers

The integration means that Celestia will plug into Polygon’s customizable software stack, which is powered by zero-knowledge technology, allowing developers to make use of the data availability solution when launching their own blockchain.

Crypto Analyst Reveals 10 Top Altcoins To Watch This Week

The altcoins market has recently witnessed a resurgence of interest and confidence, primarily driven by the largest cryptocurrency, Bitcoin (BTC). This renewed enthusiasm has resulted in a bull uptrend, with most of the top 100 cryptocurrencies benefiting from Bitcoin’s resurgence.

However, the market is currently experiencing a correction as Bitcoin and Ethereum (ETH) face pullbacks after failed attempts to breach upper resistance lines. Despite this correction, crypto analyst Miles Deutscher shares insights and highlights several altcoins with potentially significant gains.

SOL Emerges As Safe Haven In Crypto Market Correction

Solana has exhibited remarkable growth, even as the broader market experiences a correction. With a 0.5% gain in the past 24 hours, SOL’s potential for further upside cannot be ignored.

Deutscher suggests that SOL may continue to benefit from the ongoing rotation of investments from other Layer-1 solutions like Avalanche (AVAX) and Fantom (FTM).

Thorchain (RUNE) has been on an impressive upward trajectory, prompting investors to consider buying on deep corrections and wicks. The primary decentralized exchange (DEX) on Thorchain, THOR, has also shown positive movement, further bolstering the growth potential.

Polygon (MATIC) has recently shown signs of strength and has generated whispers within the crypto community about a potential zero-knowledge (ZK) narrative. If this narrative materializes, MATIC, a leader in the space, could attract significant positive flows.

Within the ZK narrative, altcoins like Dusk Network (DUSK), Loopring (LRC), and Mina Protocol (MINA) are poised to benefit. Deutscher believes that each altcoin offers unique strengths and value propositions, and their performance will depend on the strength of the emerging ZK narrative.

Soteria (SEI) has gained attention as it enters the top 10 for volume traded by pairs on Upbit. Considered a “new coin,” SEI exhibits fundamentals similar to the next altcoin on the watchlist.

Tidal Finance (TIA) is a relatively new token similar to the early days of Aptos (APT). The market tends to favor new and innovative tokens, and although TIA’s rally may have started to cool off, it still holds explosive potential. With a current market capitalization of $700 million, TIA remains an intriguing opportunity for investors.

DEX And Gaming Altcoins Poised To Thrive

In addition to altcoins, perp decentralized exchange (DEX) tokens like GMX, DYDX, and Gnosis (GNS) are positioned to benefit from market volatility.

According to Deutscher, these tokens have shown a correlation between price movements and fundamental factors. If volatility persists, these tokens could present favorable medium-term investment opportunities.

Yield Guild Games (YGG) and Gamestarter (GMT), gaming tokens with initial upward movements, are expected to continue outperforming the broader market. These gaming tokens could witness sustained growth with the YGG conference scheduled for November 18.

While the current correction in the cryptocurrency market has led to pullbacks in Bitcoin and Ethereum, the altcoin landscape still offers potential opportunities for investors.

Solana’s continued uptrend, along with the prospects of altcoins like Thorchain, Polygon, and those associated with the ZK narrative, suggest possible avenues for growth. Additionally, emerging tokens like Soteria and Tidal Finance, perp DEX tokens, and gaming tokens may also provide favorable investment prospects.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock, chart from TradingView.com

Polygon Labs Commences $85M Grant Program to Draw Builders to Its Ecosystem

Polygon Labs is offering a total of 110 million of its native token, MATIC, to projects in DeFi, gaming and social media, among others.

Polygon Labs And NEAR Foundation Partner For zkWasm L2 Prover Integration

Polygon Labs (MATIC) and the NEAR Foundation have recently announced their collaboration on the development of a zero-knowledge (ZK) prover for the WebAssembly (Wasm) blockchain.

The alliance aims to “bridge the gap” between Wasm-based chains and the Ethereum ecosystem, providing customization and options for developers building with the Polygon CDK (Chain Development Kit).

NEAR Foundation Joins Polygon As Core Contributor

According to Polygon Labs’ announcement, introducing a zkWasm prover will enable developers utilizing Polygon CDK to choose from various provers when building their projects.

This can be leveraged in various scenarios, including launching or migrating an Ethereum Virtual Machine (EVM) chain or constructing a Wasm chain for closer alignment with Ethereum and access to liquidity.

The zkWasm prover will serve as a new runtime, generating zero-knowledge proofs that validate the correctness of native Wasm runtime execution. This advancement is expected to enhance scalability and decentralization, bringing the NEAR protocol closer to Ethereum.

As part of this partnership, the NEAR Foundation is set to become a core contributor to Polygon CDK, expanding the toolkit’s capabilities for developers.

Sandeep Nailwal, the co-founder of Polygon, expressed pride in collaborating with NEAR on this research and emphasized the value of the zkWasm prover in providing developers with increased customization options.

To provide further context, WebAssembly is a widely used framework for running complex programs in web browsers, offering performance comparable to native computer applications. In the context of Web3, the Wasm Virtual Machine serves as a runtime for blockchains like NEAR and Polkadot, differing from the Ethereum Virtual Machine.

Scalability And Decentralization Boost?

Per the announcement, in the future, an in-development interop layer will allow chains to join a unified ecosystem of Layer 2 solutions deployed through Polygon CDK.

This ecosystem will encompass alternative layer-1 chains, EVM layer-2 solutions, and Wasm chains, providing interoperability and defragmentation of liquidity across different chains.

Illia Polosukhin, co-founder of NEAR Protocol, expressed optimism about the collaboration, emphasizing that it will bring the benefits of zero-knowledge proofs not only to NEAR but to the entire Web3 ecosystem. Polosukhin stated:

We are very excited to work with Polygon Labs to bring all the benefits of zero-knowledge proofs not just to NEAR but all of Web3. NEAR is integrating more with Ethereum by innovating in new research frontiers, and the shared expertise of these two teams will bring a much-needed expansion of the ZK landscape and defragmentation of liquidity across chains. And by creating and using the zkWasm prover, NEAR will also improve the scalability and decentralization of the NEAR L1.

Overall, the collaboration between Polygon Labs and the NEAR Foundation holds significant implications for both protocols. Integrating the zkWasm prover will enhance the capabilities of Polygon CDK, providing developers with more options in building “custom blockchains.”

Additionally, it will bring NEAR Protocol closer to Ethereum, expanding its interoperability and liquidity opportunities.

As of the latest update, MATIC, the native token of Polygon, is on the verge of reaching the $0.800 level, a milestone that has not been attained since July. The token currently trades at $0.7903, showcasing a noteworthy upward trajectory.

This positive movement is further bolstered by an impressive 11% uptrend recorded over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Near Foundation and Polygon Labs Collaborate to Build ZK Solution

The aim of the tie-up is to allow for greater interoperability across chains.

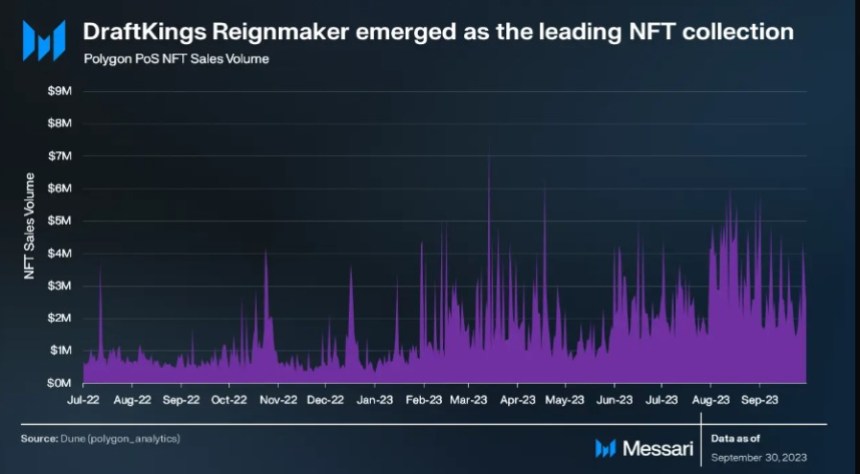

Polygon’s NFT Sales Skyrocket By 131% To $20 Million In Q3 2023

Polygon (MATIC), a Layer 2 (L2) blockchain network, experienced remarkable growth in the third quarter of 2023. According to a report by Messari, the platform witnessed a significant increase in non-fungible token (NFT) sales, successful network upgrades, and the activation of a new token.

Polygon NFT Sales Skyrocket

Per the report, in Q3 2023, Polygon witnessed a staggering 131% quarter-on-quarter increase in weekly NFT sales volume, reaching an impressive $20 million. This growth was primarily attributed to the success of DraftKings’ Reignmaker NFT collection, which became the top collection on the network.

The collection featured officially licensed cards from renowned sports organizations like the National Football League Players Association (NFLPA), Professional Golfers’ Association of America (PGA TOUR), and Ultimate Fighting Championship (UFC). Furthermore, through Q3, Polygon achieved significant milestones in terms of technological advancements.

Moreover, Polygon activated the POL token on its mainnet during Q3 2023. POL serves as an upgrade to the existing MATIC token and offers holders the opportunity to contribute to network security across various chains within the Polygon ecosystem through a native re-staking protocol.

The token features an inflationary model with an annual issuance rate that is subject to community governance, which, according to the report, enhances the overall security and decentralization of the platform.

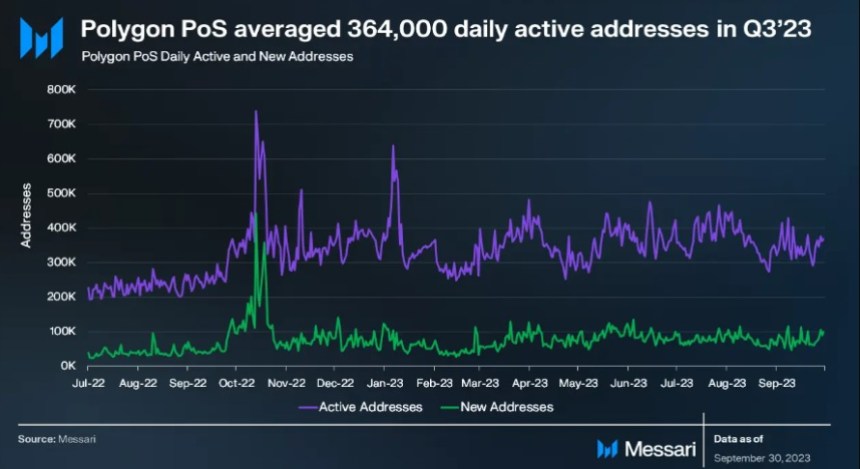

Daily Active Addresses Surge Fueled By DeFi Dominance

During Q3, Polygon experienced a 1.4% quarter-on-quarter growth in daily active addresses, reaching an impressive 364,000. The decentralized finance (DeFi) sector accounted for the majority of the active addresses on the network, showcasing the platform’s strength and popularity within the decentralized finance space.

What’s more, Polygon Labs unveiled Polygon 2.0, a comprehensive upgrade roadmap aiming to unify all Polygon protocols and blockchains using ZK technology. This initiative seeks to establish Polygon as the “Value Layer of the Internet” and introduces significant updates to protocol architecture, tokenomics, and governance.

One of the key upgrades includes transitioning the network to a zkEVM Validium network, ensuring enhanced security while sharing the same level of robustness as Ethereum (ETH).

Furthermore, according to Token Terminal data, Polygon has shown positive momentum in price performance, network fees, and circulating market cap.

The network’s native token, MATIC, has experienced an increase of 3.95% over the past 24 hours, trading at $0.6556, reflecting positive sentiment among investors.

Over the past 30 days, the coin has experienced a notable increase of 13.01%, signaling a potential recovery from previous market downturns.

However, the six-month data shows a decrease of 34.97%, indicating the impact of market volatility on the long-term value of the token.

Polygon’s circulating market cap currently stands at $6.00 billion, exhibiting a 15.36% increase. However, the fully diluted market cap of $6.49 billion, which considers the total supply of tokens, has grown by 12.79%.

The network’s fees over the past 30 days amounted to $1.21 million, representing a slight decline of 8.57%. However, on an annualized basis, the fees reached $14.68 million, indicating a downward trend of 20.24%.

Featured image from Shutterstock, chart from TradingView.com

Polygon Co-Founder Jaynti Kanani Steps Down

Kanani, who founded Polygon in 2017 alongside Sandeep Nailwal and Anurag Arjun, announced his plans in a post on X (formerly Twitter) on Wednesday.

MATIC Price Downtrend Halted As Google Cloud Joins Polygon Network

Google Cloud, the renowned cloud computing service provided by Google, has made a significant move by becoming a validator on the Polygon (MATIC) network.

This collaboration aims to bolster the security of the Polygon Proof-of-Stake (PoS) network, with Google Cloud employing its infrastructure, which powers popular platforms like YouTube and Gmail, to contribute to the network’s integrity.

Google Cloud Strengthens Polygon Network Security

Polygon Labs, the team behind the Polygon protocol, recently announced that Google Cloud has joined their validator set. This move brings Google Cloud into the fold of over 100 validators responsible for verifying transactions on the Layer 2 Ethereum (ETH) network offered by Polygon.

In a statement shared on X (formerly known as Twitter), Polygon highlighted the significance of Google Cloud’s involvement, emphasizing utilizing the same infrastructure that underpins YouTube and Gmail to safeguard the fast and cost-effective Ethereum-based Polygon protocol.

According to the announcement, by joining forces with over 100 other validators, Google Cloud adds to the collective efforts to secure the Polygon PoS Network.

Including reputable and security-focused validators like Google Cloud provides an additional layer of confidence for Heimdall, Bor, and the Polygon PoS ecosystem users.

The collaboration between Google Cloud and Polygon Labs extends beyond a validator partnership. It is described as an ongoing strategic collaboration, indicating a long-term commitment to advancing the adoption and development of Web3 technologies.

As part of their joint efforts, Google Cloud APAC released a YouTube video titled “Polygon Labs is solving for a Web3 future for all,” further underscoring their shared vision for a decentralized web. The Google Cloud team further stated:

Is there an easier way to build and grow Web3 products? That’s the mission of Polygon Labs, and with the help of Google Cloud, it’s one step closer to making this vision a reality. We are now serving as a validator on the Polygon PoS network, contributing to the network’s collective security, governance, and decentralization alongside 100+ other validators.

Overall, the involvement of Google Cloud, a prominent player in the cloud computing industry, as a validator on the Polygon network brings increased credibility and expertise to the ecosystem.

This collaboration is expected to enhance Polygon’s network infrastructure’s overall security and reliability, benefiting users who rely on the platform for seamless and efficient blockchain transactions.

MATIC Breaks Free From 3-Month Downtrend

Polygon’s native cryptocurrency, MATIC, has successfully broken a 3-month downtrend that had pushed the token to reach a yearly low of $0.5040 on Wednesday.

However, in the past 24 hours, there has been a notable rebound in MATIC’s price, experiencing a 1.7% surge and currently trading at $0.5240.

This upward movement is further supported by the Squeeze Momentum Indicator, which has broken the downtrend pattern, indicating the initiation of a recovery phase for MATIC since Friday.

It is important to note that MATIC’s ADX indicator displays a spike downwards, suggesting low volatility and a neutral battle between bullish and bearish forces in the cryptocurrency market.

Looking ahead, MATIC faces obstacles around the $0.5442 zone, which it failed to surpass on September 21. Conversely, if the uptrend continues, the next significant hurdle lies at $0.5951 before reaching the $0.6000 level, which has not been achieved since late August.

The sustainability of MATIC’s uptrend and its ability to strive towards its yearly high of $1,569, reached in February, remains uncertain and will require further observation.

Featured image from Shutterstock, chart from TradingView.com