By inheriting Ethereum’s security, Canto will be more decentralized and will enable trustless guarantees when bridging assets over, Polygon Labs said.

Polygon 2.0 — MATIC conversion to POL outlined in preliminary improvement proposals

The Ethereum layer-2 developer has introduced the first improvement proposals to begin the transition to its Polygon 2.0 ecosystem.

Polygon 2.0 Roll Out Officially Begins, Is MATIC Set For A Major Surge?

Polygon Labs announced today the roll out of their ambitious Polygon 2.0 implementation. The announcement, made via a tweet, marks the release of three pivotal Polygon Improvement Proposals (PIPs) and a detailed roadmap for phase 0. “The wait is over. Polygon 2.0 implementation kicks off now,” the tweet reads, signaling the beginning of a new era for the platform.

Earlier this summer, Polygon Labs had unveiled their vision for Polygon 2.0, a roadmap that aims to scale Ethereum blockspace to create what they term as the “Value Layer of the Internet.” This transformative vision promises unlimited scalability and unified liquidity. To bring this vision to fruition, a series of upgrades to the Polygon protocol architecture are imperative. Phase 0, announced today, is the first step in this direction.

Phase 0 focuses on four main upgrades to the protocol:

- The transition from MATIC to POL.

- Establishing POL as the native (gas) token for PoS.

- Designating POL as the staking token for PoS.

- The introduction of the Staking Layer, a feature that will empower validators to secure a diverse range of chains within the evolving Polygon 2.0 ecosystem.

What Phase 0 Of Polygon 2.0 Brings

Polygon Labs has indicated that if the community endorses these proposals, the implementation could begin as early as the fourth quarter of this year. It’s noteworthy that the changes detailed in the first three PIPs are designed to be seamless, ensuring no disruptions for end-users at this stage.

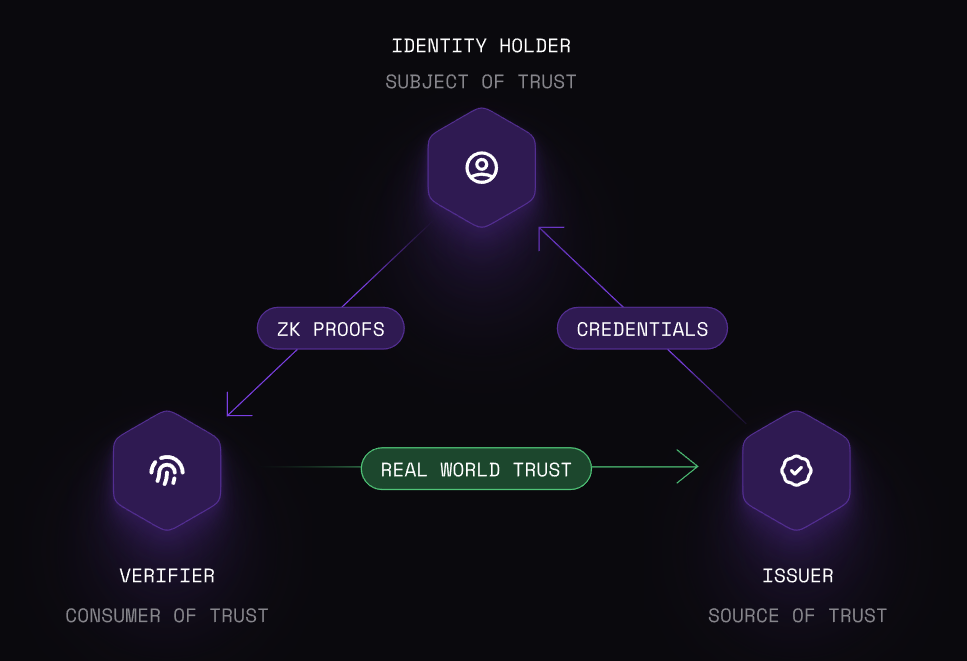

An official blog post, also released today, provides deeper insights into the transformative journey of Polygon 2.0, which was first introduced to the public in June. This set of proposed enhancements seeks to revolutionize nearly every facet of the Polygon ecosystem. The three PIPs released today offer a comprehensive blueprint for phase 0. Their goal is to construct a network of interconnected zero-knowledge-powered L2 chains, effectively scaling Ethereum to the vast expanse of the Internet.

Central to these PIPs is the transition process, the specifications for the revamped token of the Polygon 2.0 architecture, and crucial updates to the Polygon PoS native token.

PIP-18, titled “Polygon 2.0 Phase 0,” offers a comprehensive overview of the initial phase, detailing the upgrades that will be further elaborated upon in subsequent PIPs. The milestones of phase 0 are crafted with the user in mind, ensuring minimal disruptions for those already operating on Polygon PoS and Polygon zkEVM chains.

Meanwhile, PIP-17 delves into the intricacies of the POL token, outlining the associated contracts that will oversee its emission and migration. The POL token is not just a new name; it represents a next-generation token designed to accommodate an ecosystem of ZK-based Layer 2 chains, enabling staking, community ownership, and governance.

Lastly, PIP-19 focuses on the transition of the native gas token on Polygon POS from MATIC to POL. This transition is designed to ensure maximum compatibility with existing systems, with the native token’s properties remaining unchanged.

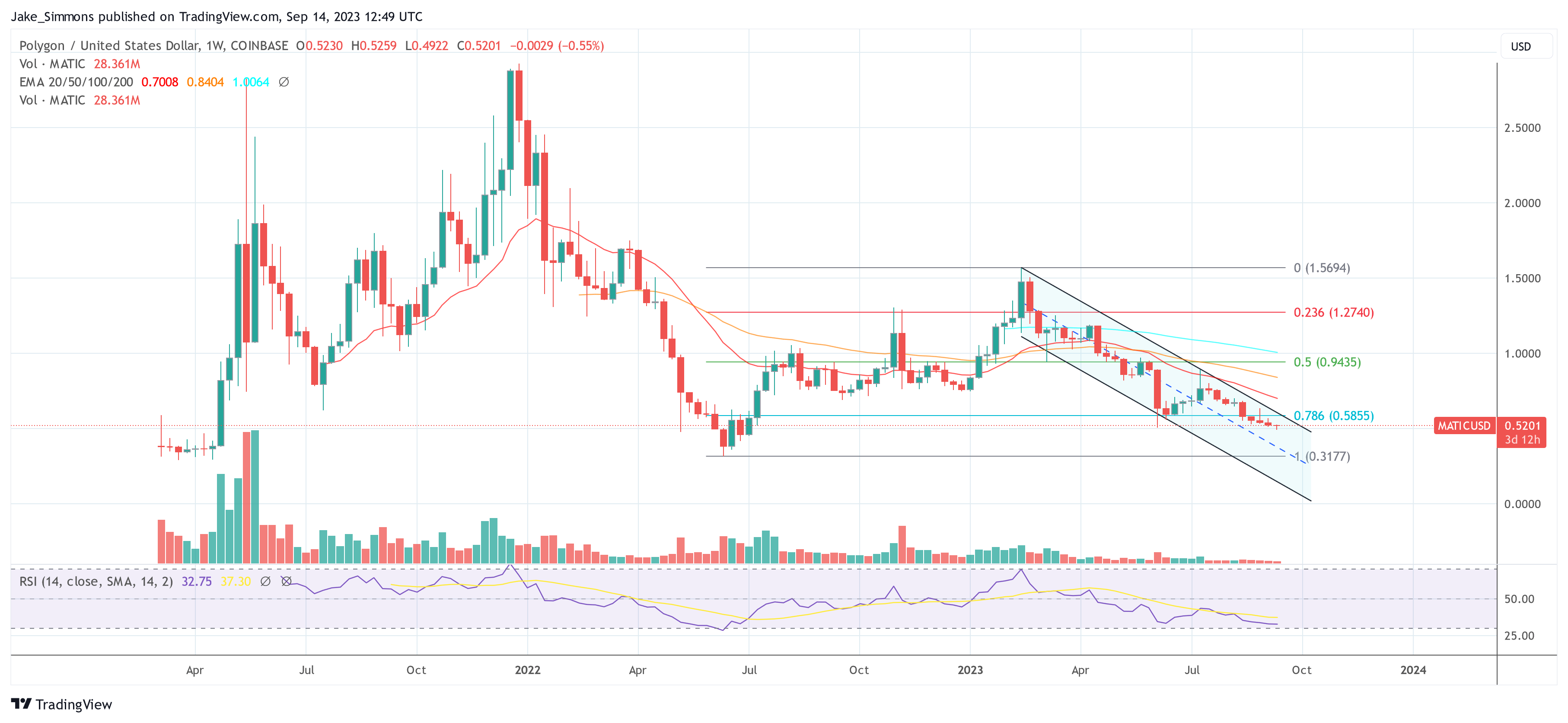

MATIC Price Analysis

The MATIC price currently remains in a downtrend channel that saw its beginning in mid-February this year. MATIC hit its yearly high of $1.56 on February 13 and has fallen 68% since then. However, a look at the 1-week chart shows that there is hope for MATIC bulls.

At the time of writing, MATIC was trading at 0.5184. All it would take to breathe new life into the MATIC price is a move above $0.5855. This price level marks the 78.6% Fibonacci retracement level, in addition, a move above this price would signify a breakout from the downtrend channel. The bulls could regain the upper hand and target the 20-week EMA at $0.7007.

Another key resistance level is at $0.7698, where the 200-day EMA is located. A rise to this price level would already represent a 45% rally. As then, the 50% Fibonacci retracement level at $0.9435 could be targeted by the bulls. Major selling pressure can also be expected at $1.27 (23.6% Fibonacci retracement level) before the yearly high would be within reach.

Polygon 2.0 clearly has the potential to awaken the bulls from their slumber. However, the $0.5855 price level is the critical key. If MATIC fails at this price level, a sweep of 65-week low at $0.3177 could loom.

Polygon Foundation Refutes Claims Of Dumping MATIC On Binance – Here’s What Happened

Blockchain analytics site Lookonchain flagged recent transactions of two on-chain addresses allegedly owned by the Polygon Foundation. The platform reported that one of these wallet addresses had transferred large amounts of MATIC – the Polygon network’s native token – to Binance in the past two days.

According to Lookonchain, the two addresses, tagged as “Polygon Foundation: 0x8d36” and “Polygon Foundation: 0xf957,” have collectively transferred nearly $6 million worth of MATIC to Binance over the past month, with more than half of the amount deposited onto the exchange in the last two days.

Polygon Labs Founder Denies Dumping MATIC Tokens

In an X post, Polygon Labs founder Sandeep Nailwal swiftly refuted the suggestions that the Polygon Foundation may be dumping MATIC tokens on Binance. The founder asserted it was “another” case of incorrectly labeling wallet addresses.

Nailwal emphasized the need to exercise caution before publishing claims of this nature, as they can create FUD (fear, uncertainty, and doubt) in the crypto community.

For context, FUD refers to the spread of negative – and sometimes false – information about a cryptocurrency or the general market to create fear and doubt among investors and potentially influence prices.

It is worth mentioning that the founder’s claims align with the words of Polygon Labs CEO Marc Boiron, who was the first to raise this issue of wallet mislabeling. Boiron had also insisted that the Polygon Foundation controls none of the addresses.

In response to Boiron, Lookonchain stated that the crypto intelligence platform Nansen conducted the address labeling.

Wallet Addresses Are Strongly Linked To Polygon Foundation, Nansen Reiterates

Nansen responded to the situation, explaining why the two wallets were linked to the Polygon Foundation. Meanwhile, the analytics firm put in a robust defense for its address labeling system, claiming that every label undergoes a “rigorous documentation process.”

Going further in its explanation, Nansen cited some instances where prominent figures at Polygon Labs interacted with the “Polygon Foundation: 0x8d36” address. In one example, Polygon’s head of growth, Sanket Shah, reportedly sent ETH to the address for “gas purposes.”

For the second address, “Polygon Foundation: 0xf957”, Nansen said its counterparties consist of the first address and other entities closely associated with Polygon, including the head of investments, Shreyansh Singh.

Nansen concluded that:

The evidence for both of these addresses shows a very strong link to various individuals and entities of the Polygon Foundation, and that’s why we labeled these addresses as part of the Polygon Foundation.

Despite this, Nansen claims to have removed the labels “as a gesture of goodwill” since the Polygon Labs CEO openly denied links to the two addresses.

Shibarium wallets surpass 100K after SHIB devs relaunch bridge

Shytoshi Kusama, the co-founder of the SHIB token, said the bridge was fixed with the help of Polygon Labs co-founder Sandeep Nailwal.

NFT project y00ts to return $3M grant as it ditches Polygon for Ethereum

DeLabs has promised to return the $3 million grant initially provided by Polygon Labs to support y00ts from Solana to Polygon.

Polygon Labs Promotes Boiron to CEO; President Wyatt to Depart

The management changes come as Polygon, which runs two of the most closely watched networks for scaling Ethereum transactions, is in the midst of a rebrand to the next chapter of its corporate development, known as “Polygon 2.0.”

Polygon 2.0 Roadmap Calls for ‘Unified Liquidity,’ Restaking, New Chains on Demand

The new Ethereum scaling solution’s architecture will include a shared bridge and a “coordination layer” that connects all of Polygon’s chains, including an emphasis on zero-knowledge technology that has become one of this year’s hottest blockchain trends.

Polygon Introduces AI Interface Powered by ChatGPT to Aid App Developers

The interface, called Polygon Copilot, will help developers obtain analytics and insights for their applications on the Polygon blockchain.

Polygon Proposes POS Chain To Become ZK Compatible

In a pre-proposal discussion post, Polygon co-founder Mihailo Bjelic argues why the mainchain should go through a major upgrade.

Polygon Labs Rolls Out Open Database for Blockchain Use Cases

Polygon Labs, the Ethereum scaling platform, has launched an open database showcasing positive use cases of blockchain on any application.

Google Cloud to optimize Polygon zkEVM scaling performance

Polygon Labs and Google Cloud will team up in a multi-year agreement to drive the development and adoption of the Ethereum scaling protocol’s infrastructure and developer tools.

Web3 Service Unstoppable Domains and Polygon Labs Roll Out .polygon Domains

The new tool will allow users to expand their digital identity across over 750 decentralized applications, games and metaverses on the Polygon network.

Polygon launches decentralized ID product powered by ZK proofs

The public launch of Polygon ID comes 12 months after it was first launched in a closed-environment to a select group of builders.