Shiba Inu (SHIB) has displayed immense momentum lately standing out as one of the best-performing meme coins in light of the general optimism that took over the cryptocurrency market in the last week.

Shiba Inu To $0.000066 Could Be Possible In A Short Time

With the price of Shiba Inu rallying in the past few days, the crypto asset has garnered significant attention from investors as several experts predict a rise to new yearly highs.

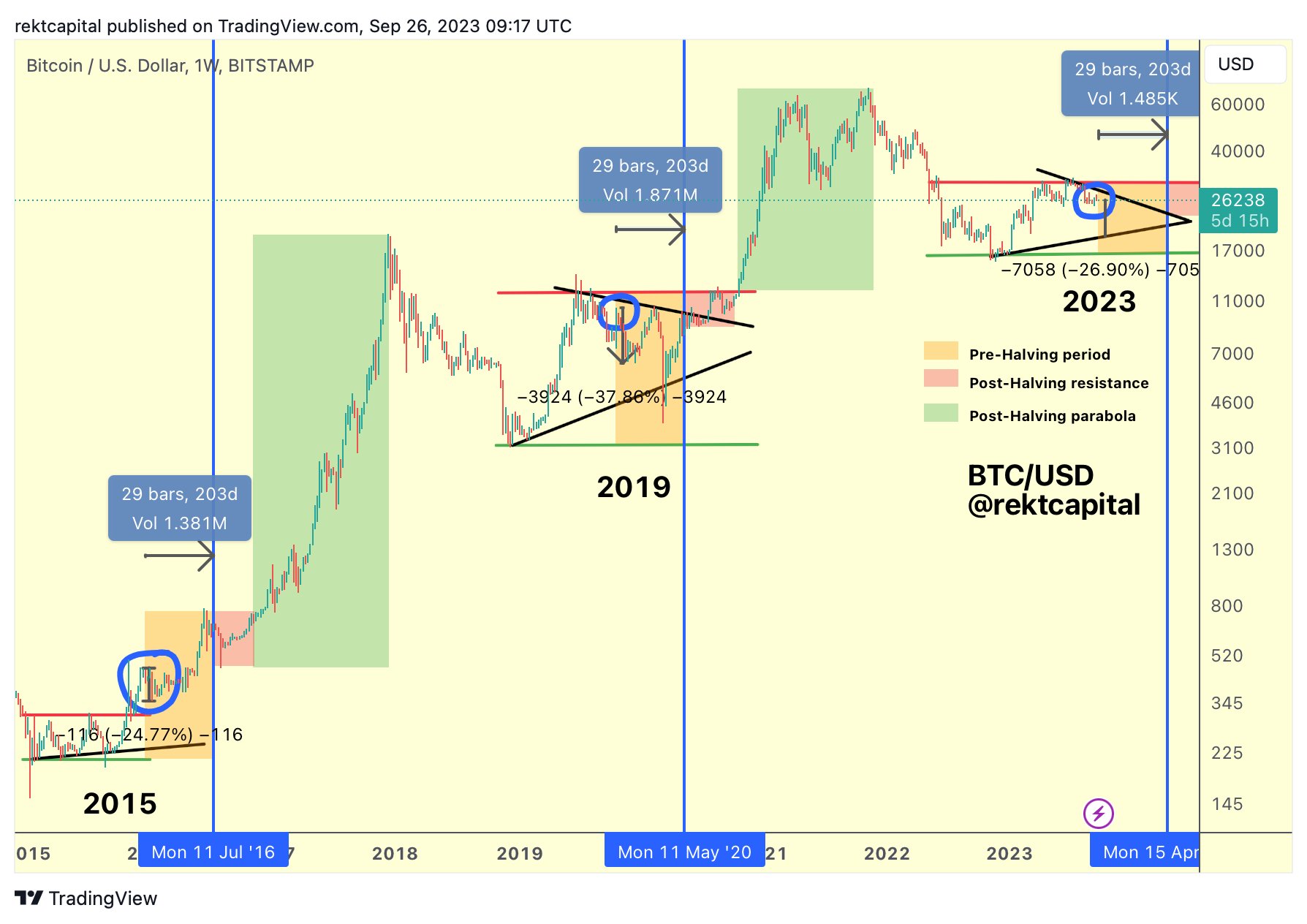

In the same vein, cryptocurrency analyst and investor Rekt Capital has shared his optimistic prediction for Shiba Inu with the crypto community on the social media platform X (formerly Twitter), fueling hope of notable gains in the short term.

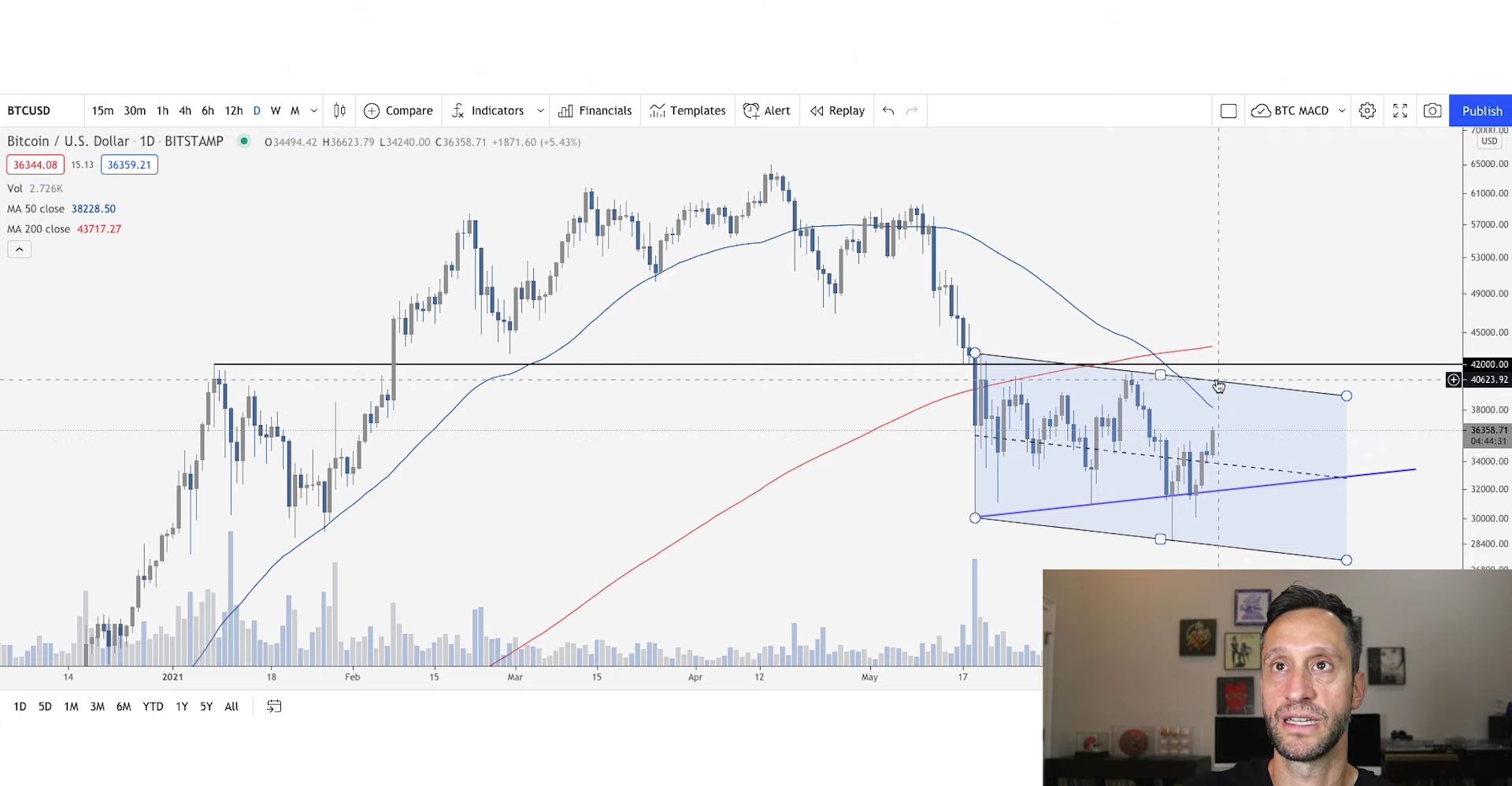

Rekt Capital’s analysis underlines the digital asset’s potential to soar higher to a level not seen for more than 2 years. The crypto analyst pointed out that SHIB arrived at a resistance he dubbed “Black Resistance,” which it previously rejected.

As a result, the meme coin must now “maintain the blue level” indicated in his chart as fresh support in order to create a “new Re-Accumulation Range at the highs possibly.” Due to this, the expert expects Shiba Inu to rise to the $0.000066 price level shortly.

The post read:

Shiba Inu Reached the black resistance which SHIB rejected from. Now SHIB needs to hold this blue level as new support to potentially develop a new Re-Accumulation Range at the highs.

Rekt Capital also highlighted another of his earlier forecasts, in which he projected the coin to reach the aforementioned price mark. At first, Rekt Capital noted that the asset had reached the blue resistance point.

Furthermore, he asserted that SHIB has increased by over 300%, since the initial post from November last year. In the post, the analyst claimed that SHIB regained the Orange area’s top as a support.

Consequently, SHIB ought to be able to return to the pinnacle of its “black market structure over time.” However, he presently anticipates Shiba Inu to undergo a rally after it concludes its “Macro U-shaped reversal.”

SHIB Anticipated For A Potential Rebound

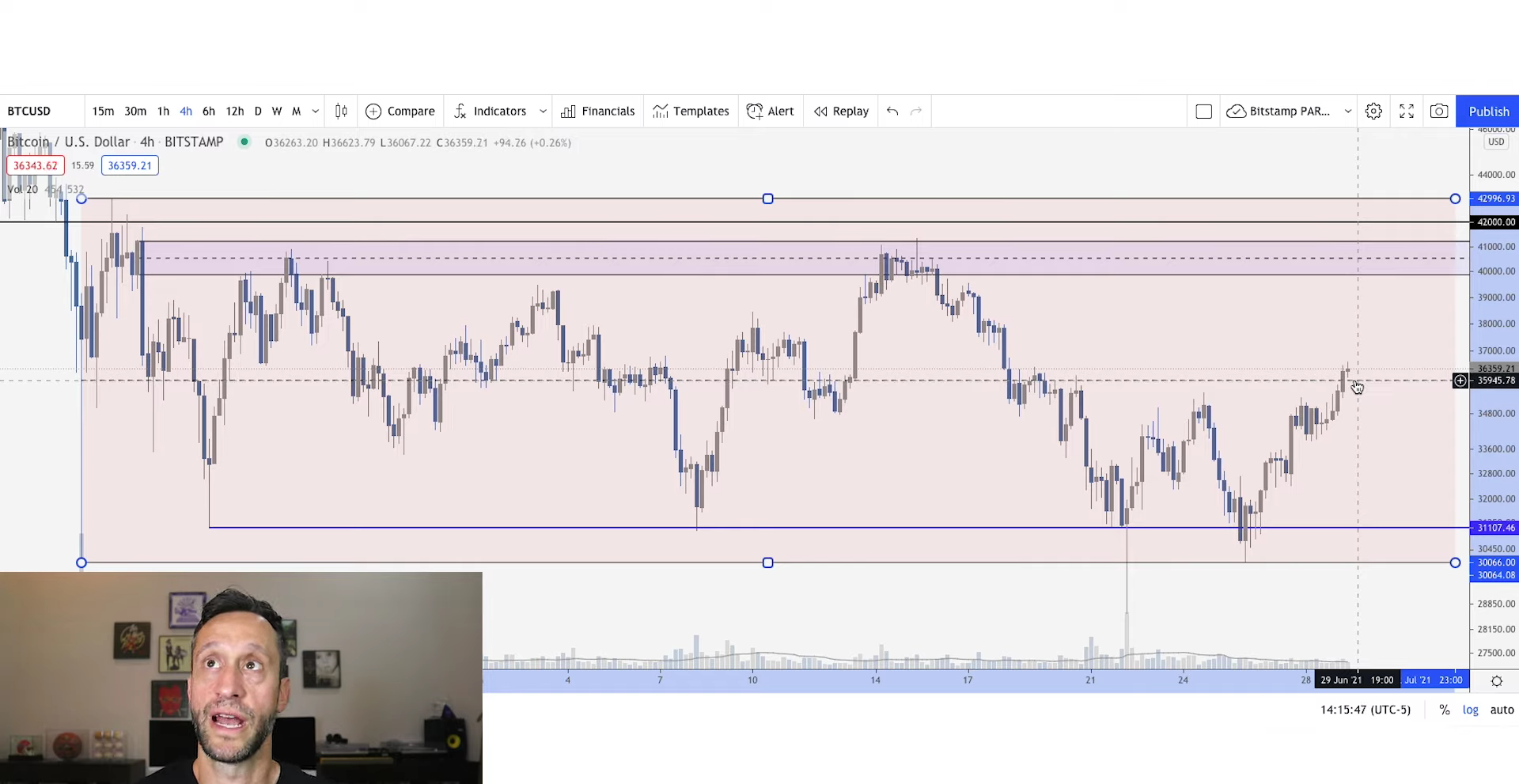

Amid the recent bearish sentiment around the market, Santiment – a crypto analytics platform, has identified SHIB as one of the leading assets that is poised for a potential recovery.

Data from Santiment shows that SHIB and dogwifhat (WIF) are the major coins expected by traders to undergo a rebound. This comes after the wild day that saw Bitcoin reach a new peak before markets went into a “reset mode.”

Santiment has also underscored a “speculative bullishness” for Solana (SOL) lately. This is a result of the speculation surrounding Solana’s potential to reach the $1,000 threshold.

SHIB at the time of writing was trading at $0.00003155, indicating a drop of 13% in the past day. Meanwhile, its market cap and trading volume are both down by 13% and 62% respectively.