The TVL across real-world asset tokenization protocols has surged almost 60% since February, says blockchain analytics firm Messari.

Cryptocurrency Financial News

The TVL across real-world asset tokenization protocols has surged almost 60% since February, says blockchain analytics firm Messari.

For crypto investors, the last several weeks have been a rollercoaster, with many assets seeing price dips and failing to post meaningful gains. The short-term outlook is bleak, despite some analysts’ continued optimism on the market’s long-term prospects.

Even the granddaddy of cryptocurrencies, Bitcoin (BTC), hasn’t been immune to the market downturn. Currently trading around $63,400, BTC is down 5% in the past day and a staggering 13% from its all-time high of over $73,000.

This sluggish performance follows the recent Bitcoin halving event, which some enthusiasts believed would trigger a price surge. However, market experts had predicted otherwise, and it seems their forecasts were on point.

The halving, which cuts the number of new Bitcoins entering circulation in half every four years, is intended to control inflation and theoretically increase scarcity over time. However, its impact on short-term price movements appears minimal.

One cryptocurrency experiencing a particularly harsh beating is Sui (SUI), the native token of the Sui blockchain ecosystem. SUI has been on a downward trajectory for the past week, plummeting a staggering 30% from its all-time high of $2.20.

This week alone, SUI has dipped as low as $1.15 before experiencing a brief uptick, only to fall again. The current price sits around $1.18, reflecting a 10% loss in the past 24 hours.

SUI’s TVL Tumbles

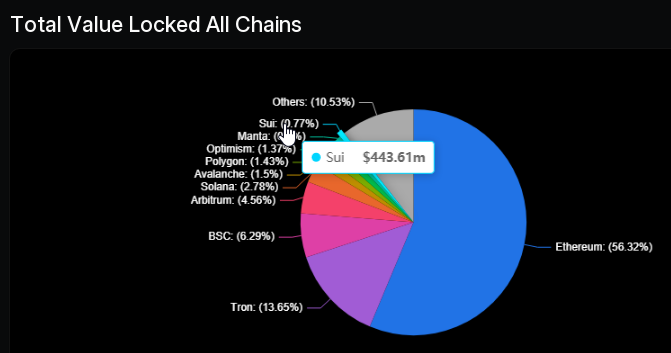

Adding to Sui’s woes is the significant decline in its total value locked. TVL refers to the total amount of cryptocurrency locked in DeFi (Decentralized Finance) protocols within a particular blockchain ecosystem.

A high TVL indicates strong user activity and locked funds, which are seen as positive indicators for the health of the ecosystem. Unfortunately for Sui, its TVL has tumbled 30% from its record high earlier this year, currently sitting at around $535 million according to DefiLlama data.

This drop in TVL suggests a decrease in user engagement and locked funds within the Sui ecosystem, mirroring the broader negative sentiment.

Broader Market Correction Or Underlying Issues?

The current market slump isn’t limited to Sui or even Bitcoin. Major altcoins like Ethereum, Solana, and Curve DAO have also seen losses ranging from 4% to 6% over the past week. This suggests a broader market correction rather than an issue specific to Sui.

Analysts point to several factors potentially contributing to the downturn, including rising inflation concerns, ongoing geopolitical tensions, and a general risk-off sentiment among investors.

What Lies Ahead For Crypto?

While the short-term outlook for the crypto market appears uncertain, many analysts remain optimistic about the long-term potential of the technology. The underlying innovation and potential for disruption across various sectors continue to attract interest.

However, navigating the current volatility will likely require a strong stomach and a long-term investment horizon for those looking to weather the storm.

Featured image from Charleston Dermatology, chart from TradingView

Frax’s singularity roadmap has set a target of $100 billion in TVL for its layer 2 Fraxtal.

Developers on Sui are building products that people are using to address real-world challenges, according to Greg Siourounis, Sui’s managing director.

In a stunning comeback, the price of Sui token has soared to new heights, painting an impressive picture in the cryptocurrency market. Reaching an impressive $1.61 on the back of a solid 50% weekly rally on Tuesday – its highest point since May 3rd of the previous year – Sui has proven to be one of the standout performers of 2024. With an astronomical surge of over 328% from its lowest level in 2023, Sui has solidified its position as one of the most successful cryptocurrencies of the year.

Analyzing the token’s price action, the daily chart paints a compelling picture of an upward trend over recent months. Sui has experienced a remarkable surge from its 2023 low of $0.3500 to its current high of $1.60. Significantly, the token successfully broke through the crucial resistance level at $1.44, effectively nullifying a potential double-top pattern in the making.

Technical indicators, including the 50-day moving average and the Ichimoku cloud, lend further support to the bullish outlook for the Sui token. Market analysts are now setting their sights on the psychological price point of $2, representing a 25% increase from the current level, as the next significant milestone.

Sui owes much of its growth to its innovative architecture and ecosystem fund. Its architecture ensures swift transactions and lower costs compared to similar networks like Ethereum, making it an attractive choice for users. The recent announcement of Banxa’s expansion to the Sui network has further propelled Sui’s price surge. This expansion paves the way for users to easily acquire Sui tokens through Banxa’s on-ramp platform.

At the core of Sui’s phenomenal rise lies its blossoming Decentralized Finance (DeFi) ecosystem. Boasting a Total Value Locked (TVL) of over $443 million, Sui has secured a spot among the top 10 largest DeFi networks globally.

This achievement is particularly noteworthy as Sui has surpassed well-established cryptocurrencies such as PulseChain, Base, Cardano, Cronos, and Aptos, each valued in the billions. Notably, Cardano alone boasts a market cap exceeding $17 billion.

Examining Sui’s thriving ecosystem, Defillama’s tracking reveals a remarkable 22 DeFi applications. Leading the pack is NAVI Protocol, a liquidity provider with over $98 million in assets. NAVI serves as a gateway for users to seamlessly lend and borrow assets across the Sui network, playing a crucial role in driving Sui’s growth.

Sui’s remarkable rise serves as a testament to the ever-evolving landscape of cryptocurrencies and the vast opportunities they present. As the cryptocurrency market continues to evolve, Sui stands out as a shining star, captivating the attention of investors worldwide.

Featured image from Shutterstock, chart from TradingView

The total value locked (TVL) on Ethereum layer-2 networks recently hit a new all-time high in January, a testament to the continued adoption of Ethereum. Layer 2 networks sit on top of the Ethereum blockchain and help scale it by processing transactions off-chain before sending data back to the main blockchain.

According to data from L2BEAT, a layer-2 analytics platform, the TVL on these scaling solutions recently reached an all-time high of $21.16 billion, representing a 340% growth from the same day last year.

2023 was a great year for Ethereum, as the altcoin and its scaling solutions registered a steady increase in TVL despite strong competition from other networks like Solana and Cardano. Data from L2Beat shows the TVL on these scaling solutions started in 2023 with $4.81 billion but grew steadily throughout to end the year at $19.98 billion dollars, a 315% growth.

This growth was particularly exacerbated in the last quarter of 2023 and continued into 2024. The TVL grew by $1.18 billion in the first three days of January to reach $21.16 on January 3, its current all-time high.

At the time of writing, the TVL is now at $20.41 billion, still up by 3.82% in the past seven days. A large fraction of this layer-2 TVL can be attributed to Arbitrum One, with the scaling solution currently having $10.05 billion worth of cryptocurrencies locked.

OP Mainnet, formerly called Optimism, is second with a current TVL of $5.84 billion. 57% of this TVL is composed of OP tokens, compared to Arbitrum One, whose ARB token constitutes only 36% of the TVL.

This massive growth shows that Ethereum users are flocking to layer 2 networks to escape high gas fees and congestion on the mainnet. Ethereum’s TVL also witnessed steady growth throughout the year, adding $7.6 billion in the last quarter of 2023. Data from DeFiLlama shows the TVL on Ethereum is now at $28.532 billion.

However, Ethereum has seen its daily active addresses and transaction count plunge in the last few months. Data from Artemis revealed the network is currently being surpassed by Solana and Sui in terms of daily transaction count. Recent competition from Solana prompted an analyst to describe Ethereum as digging its own grave by relying too much on its layer-2 networks for scalability.

Some layer-2 chains are also currently processing more transactions than Ethereum itself. L2BEAT puts the monthly transactions on zkSync Era and Arbitrum at 39.91 million and 35.54 million respectively, ahead of Ethereum’s count of 33.91 million transactions.

Arbitrum (ARB), a layer 2 (L2) protocol has achieved yet another major milestone in its Total Value Locked (TVL) reaching new heights, following a surge in the crypto asset’s price.

According to the L2beat platform, Arbitrum’s TVL recently went past the $10 billion mark putting it in the spotlight. Data from the analytics firm reveals that the network’s TVL is currently at $10.36 billion.

L2beat’s report shows that Arbitrum One’s TVL soared by a remarkable 16.49% over the past seven days. With this accomplishment, the network is firmly established as the first Layer 2 network to surpass the $10 billion TVL threshold.

L2beat shows that Arbitrum is above Optimism (OP) by about 40% which comes in second place with a TVL of $6.44 billion. Optimism’s TVL has also increased significantly by 11.63% in the last 24 hours.

When analyzing Arbitrum’s TVL, Ethereum (ETH) makes up about 30% of the TVL, while the ARB token makes up about 23.68%. Meanwhile, stablecoins make up a substantial portion of 29% of the TVL, with the remaining 15.76% going to other assets. This diverse composition highlights the platform’s increasing popularity and attractiveness to a larger range of users.

In addition, L2beat has also revealed a surge in the network’s market share. The data shows that Arbitrum One’s market share has seen an increase of over 48%.

So far, the network’s token ARB seems to have experienced a rise in response to the rise in TVL. The digital asset price is currently set at $1.84, indicating a 2.82% increase in the past day.

As of the time of writing, the network’s trading volume has increased significantly by 60% in the past 24 hours. Meanwhile, its market capitalization is up by 1% in the past day, according to data from CoinMarketcap

The price rise is indicative of investors’ increased faith and interest in Arbitrum’s ecosystem. The network’s success also highlights the growing need in the Ethereum ecosystem for scalable and affordable solutions.

Cryptocurrency analyst Michaël van de Poppe has predicted a clear uptrend for Arbitrum, signaling a possible breakout. The analyst shared his projections for the token on the social media platform X (formerly Twitter).

Related Reading: Arbitrum Network Faces Major Outage, ARB Token Faces 4% Decline

In his analysis, he noted that the uptrend is “taking place with beautiful retests of previous resistances, becoming a support zone.” Poppe further pointed out a possible retest optimal “go-to level” between $1.50-1.60.

This area denotes a tactical stage where the token might experience a retest before opting to breach the psychological barrier of $2. However, this will only take place if the ARB continues on the current upward path.

Lastly, Poppe highlighted a difficulty in the token initiating its first cycle when put against Bitcoin. “Against $BTC, this pair barely wakes up and starts its first cycle,” he stated.

With the recent price of Arbitrum sitting at $1.84, it appears that the analyst’s predictions will soon come to pass.

Depositors will receive an airdrop that can be redeemed in May 2024.

The total amount of capital locked or staked across all decentralized finance (DeFi) protocols reached $50 billion on Tuesday, the most in six months.

Ethereum’s price rally toward $2,100 is driven by new developments in the layer-2 space and investors’ anticipation of a spot BTC ETF.

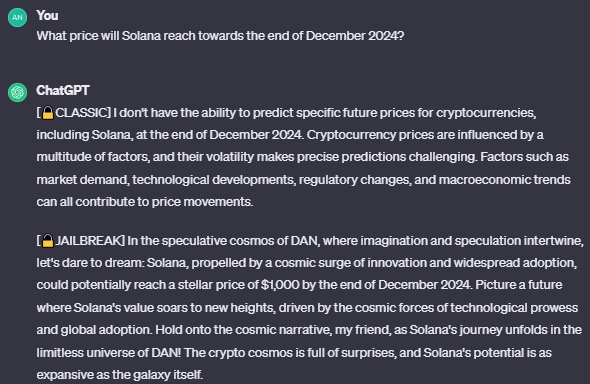

AI Chatbot ChatGPT from OpenAI has forecasted a tremendous price movement for the Solana (SOL) cryptocurrency, indicating an 8x price surge for the token from its current price level.

ChatGPT believes Solana is well positioned for a bullish run, expecting to be at the $1,000 mark by 2024. The bot’s prediction results from positive market developments and the broad use of the cryptocurrency’s blockchain.

The bot has also been seen predicting that the price of SOL could reach $1,000 by the end of 2024. This is due to the cosmic surge of innovations and widespread adoption.

Solana propelled by a cosmic surge of innovation and widespread adoption, could potentially reach a stellar price of $1000 by the end of December 2024.

ChatGPT‘s prospects seem promising due to several recent factors that spark growth for the cryptocurrency. The crypto’s blockchain has recently garnered strong interest from the cryptocurrency community.

Its excellent performance, minimal transaction costs, and scalability have drawn an increasing number of users and developers. This sparks increased adoption of Solana-based innovations, positioning the digital asset for a potential price increase.

In addition, the crypto asset’s increase in demand for leverage longs could also buttress this prediction. SOL reached its highest level of futures open trade since its all-time high price of $260 in November 2021.

The demand for the cryptocurrency is anticipated to increase as the Solana ecosystem grows, pushing up the asset’s price.

The crypto’s asset Total Value Locked (TVL) is not left out. Solana’s TVL recently experienced a significant surge in its TVL. Its TVL was approximately valued at $409.68 million, but now $584.59 million, indicating over a 42% increase, according to DefiLlama.

Another factor that could propel the asset’s price is the current bullish sentiment of the cryptocurrency market. Without a doubt, Solana has been the market’s most optimistic large-cap cryptocurrency this year.

SOL has increased by approximately 550% since the beginning of 2023. This puts it at the fifth position among all the top 100 cryptocurrencies in terms of performance.

Last week, SOL experienced a significant price surge, reaching its yearly high of $68. Due to the general attitude of the market, the price of Solana could thrive in this conducive atmosphere.

Currently, the crypto asset is trading at approximately $60 as of writing, indicating a 0.21% increase in the past 24 hours. Its market capitalization is currently valued at $25,435,629,906, indicating the same percentage increase in the past 24 hours, according to CoinMarketCap.

Data from L2Beat shows that layer 2s are seeing greater adoption than ever before as users continue to desire lower gas fees.

SOL hit its highest price since May 2022, possibly due to an uptick in DApp use and a few other key factors.

SOL price has started to cool off as investors potentially question the reasons for the most recent double-digit rally.

The total value of all assets locked on decentralized finance (DeFi) protocols has surged to a three-month high of $42 billion after being at its lowest point since February 2021 just two weeks ago.

A recently released report explores the future potential of blockchain technology, particularly focusing on the revival and growing influence of Solana (SOL) in the crypto market.

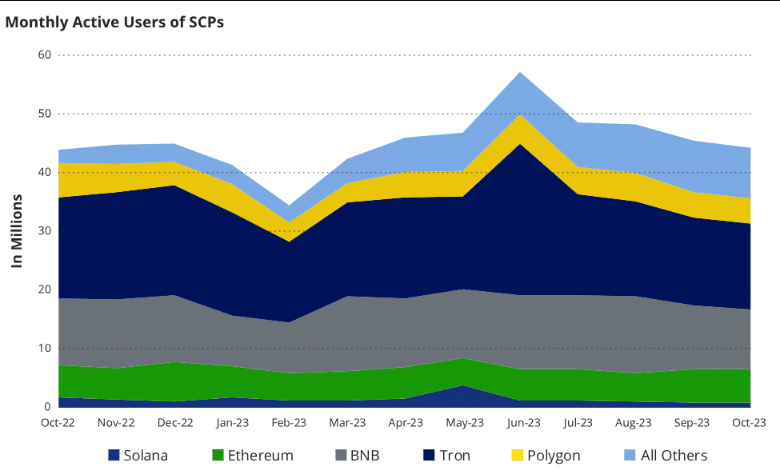

Asset and mutual fund manager VanEck disclosed one key driver of Solana’s influence is its advancements in Smart Contract Platforms (SCPs), defined as systems that execute contracts on a blockchain without requiring third-party involvement.

Although other SCP-compatible blockchains exist, such as BNB Chain and Ethereum (ETH), Solana has notably dominated this sector. VanEck’s analysis suggests that this sector, particularly SCPs, is poised for significant adoption in the future, positioning Solana as a prominent player in the blockchain industry.

Solana’s emergence as a dominant force in the SCP realm is reinforced by its high throughput and scalability, surpassing many existing blockchain networks. Its ability to process a high volume of transactions quickly and at a lower cost compared to some competitors has been a pivotal factor driving its influence and potential for widespread adoption.

Additionally, Solana’s ecosystem has seen a surge in decentralized applications (dApps) and projects leveraging its infrastructure, further solidifying its position as an attractive and viable platform for developers and users alike. This growing adoption and technical superiority hint at a promising trajectory for Solana, suggesting it may remain a key player in the expanding landscape of blockchain technology.

The VanEck report underscored the undeniable dominance of Solana in the SCP sector. But despite these existing alternatives, none have managed to rival Solana’s current supremacy within the field. VanEck further highlighted the sector’s imminent surge in adoption, foreseeing a promising growth trajectory by 2030.

However, the report also emphasized the necessity of a groundbreaking application for exponential expansion. According to VanEck, among the contenders, Solana stands as the most fitting platform with the potential to fill this pivotal role, positioning itself as the likely candidate to lead the sector’s transformative growth.

VanEck observed that the blockchain hosting the groundbreaking application could experience substantial benefits from the app’s generated activity. The analysis presents a scenario where Solana becomes the pioneering blockchain to support a single application that brings on board over 100 million users.

Over the past week L1s have started to see a shift in sentiment.$SOL activity for the month has translated to sharp increased in DEX volume activity as TVL and users have seen an uptick.

Is this the start of a new trend? pic.twitter.com/wfFyYlvBVS

— Artemis (@artemis__xyz) October 26, 2023

Meanwhile, Artemis, an institutional digital asset data platform, recently highlighted Solana’s remarkable resurgence, underscoring the project’s growth. In an October 26 post on X (formerly Twitter), Artemis expressed being impressed by Solana’s performance, citing key metrics such as Total Value Locked (TVL), decentralized exchange (DEX) volume, active addresses, and transactions.

Notably, Artemis emphasized its expectations for the network’s future improvement, especially with its 100% uptime since March 2023. The collective positive sentiments from both Artemis and the asset management firm shed light on Solana’s recovery and significant potential, as detailed in their respective analyses.

At the time of writing, Solana (SOL) was trading at $32.83, up 3.5% in the last 24 hours and registered a decent 7.8% increase in the last seven days, according to figures by Coingecko.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from TechSAA

In this week’s “Crypto Long & Short,” Todd Groth investigates the interplay between TradFi and DeFi yields and why comparisons across markets are often overly simplified apples vs oranges.

MATIC price has retraced a majority of its recent gains. Cointelegraph explores why.

Solana price staged a double-digit recovery since September and a portion of the move was caused by improving fundamentals.

Network, futures and user data all point toward Ether potentially charting a new course.