Network, futures and user data all point toward Ether potentially charting a new course.

Cryptocurrency Financial News

Network, futures and user data all point toward Ether potentially charting a new course.

ARB price slumps to a new low as a decline in TVL, active addresses engaging with its DApps and a general malaise across the crypto market take their toll.

As financial institutions look to come on-chain, total value locked, or TVL, is anticipated to be the leading indicator of where adoption will occur.

The decentralized finance (DeFi) market slumped to its lowest point since February 2021 in terms of total value locked (TVL) on Wednesday.

Base, the Ethereum Layer 2 rollup developed by crypto exchange Coinbase, is already making a name for itself in the market. The blockchain’s Total Value Locked (TVL) has been on a rapid rise over the last few weeks, rising triple-digits in just the last two weeks alone. So the question now is, what’s driving the TVL growth?

Unlike other Layer 2 networks, Base seemed to have gotten its big break with the growing trend of meme coins being launched on the network. The most notable of these was the BALD meme coin which went from less than $100,000 in market cap to over $50 million in a matter of days. As the popularity of BALD ramped up, so did the popularity of Base and decentralized finance (DeFi) traders clamored to bridge to the blockchain.

The rug deployer rugged the project not long after, making off with over $9 million in liquidity. Following this, there were speculations of former FTX CEO and founder Sam Bankman-Fried Nverbeing the mastermind behind BALD, although nothing came from these accusations.

However, instead of the blockchain’s first big project rugging being a deterrent, it seems to have had the opposite effect. More developers have moved to launch their projects on the blockchain seeing the potential. This includes the likes of SushiSwap, Uniswap, and Compound, among others, which have all provided support for the Base network.

New projects such as Alien Base, SwapBased, and Krav have also been gaining ground with their TVL growing rapidly during this time as well. So for Base, it has been able to turn a negative situation into a positive one.

In the last two weeks, the Base TVL has grown from $13 million to more than $130 million, data from DefiLlama shows. This represents an almost 900% increase in TVL during this time, making it the fastest-growing Ethereum Layer 2 blockchain in terms of TVL.

Base’s rapid growth has already put it in the race with other Layer 2s. However, when put in comparison against other established Layer 2 networks, Base still has a long way to go. It is currently the 5th-largest Layer 2 in terms of TVL, lagging well behind the likes of Arbitrum, Polygon, and Avalanche.

Nevertheless, Base’s bull case continues to grow with over $203 million already bridged to the blockchain and daily active users sitting above 100,000 over the last four days. Given Coinbase’s backing and Base’s growing popularity, it may not be long until it becomes one of the most prominent Layer 2 blockchains in the space.

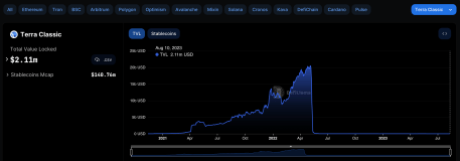

Terra Classic (LUNC) has suffered persistent declines since the network’s collapse back in 2022. These declines have ranged from its price through to the network’s Total Value Locked (TVL). And even while development abounds among its community members to try to restore it to its past glory, the numbers point to a low possibility of recovery.

After Terra’s crash in 2022, the network lost a significant chunk of its TVL due to investors pulling out their funds as well as developers moving their decentralized applications and protocols to other networks. Over time, there seemed to be a stable trend but once again, the network has lost out against its better counterparts.

Data from the on-chain tracker DeFiLlama shows that as of Thursday, the total Terra Classic (LUNC) TVL is sitting at $2.11 million. This is notable because this is the lowest that the network’s TVL has ever been. It is also a long way from the over $20 billion all-time high TVL of the Terra blockchain before its tragic collapse.

The vast majority of its meager TVL is spread across just two DeFi protocols: Terraswap and Astroport Classic, with $1.07 million and $933,527 in TVL, respectively. The highest that Terra’s TVL has been in 2023 is $12 million back in April 2023.

Terra’s TVL has now declined by over 83% from its 2023 peaks. In the same vein, DeFiLlama shows $0 decentralized exchange (DEX) volumes over the last week, meaning that trading activity on the network has grounded to a halt.

Over the last year, the Terra community has been consistent about trying to help the network recover. However, the kind of decline that the cryptocurrency suffered as a result of the crash is not easy and near impossible to recover from.

Throwing in the fact that the network’s activities are almost non-existent, the chances of recovery have become even slimmer. But perhaps the biggest hindrance to its recovery is the fact that LUNC’s supply ballooned to over 6 trillion coins. Given this, even a surge to the $1 mark is out of reach for the token, unless there is a significant reduction in its supply.

LUNC’s price continues to struggle at this time, trading at $0.00007746 at the time of writing. Its market cap is currently sitting at $450 million, making it the 80th-largest cryptocurrency by market cap.

PayPal’s stablecoin announcement and a handful of Ether ETF applications are bulls’ biggest hopes for a price trend reversal.

Ethereum is currently dominating the DeFi and smart contract niches when it comes to the Total Value Locked (TVL). However, while Ethereum is still the king, other chains like Solana, Avalanche, and Polkadot compete to prove themselves worthy contenders to the throne.

Solana, in particular, has seen some massive growth recently in terms of its total value locked (TVL). According to on-chain data from Messari, Solana outperformed other chains by achieving a total value-locked (TVL) gain of 14% over the course of the previous month.

The aggregated TVL of the entire DeFi sector has been in a freefall since November 2022, and Solana hasn’t been exempted. However, Solana’s growth during the past month was driven in significant part by an increase in the TVL of protocols for staking and yielding based on Solana.

TVL refers to the total amount of assets deposited in a decentralized finance (DeFi) protocol and is used as a metric to rank platforms. On-chain reports show that Solana grew its TVL by $45 million in July, corresponding to a 14.4% growth.

According to DeFi Llama, Solana currently sits at the 9th position in terms of TVL locked in all chains. Solana is now at a TVL of $320.07 million, representing a massive growth from its $205.11 million TVL at the beginning of the year.

While Ethereum still has the highest value with a TVL of $23.3 billion, it saw its TVL decline by 13% over the past month. Binance Smart Chain (BSC) also posted a monthly loss in TVL, dropping by 4.6% to $3.3 billion.

While the increase in TVL is due in part to an increase in the TVL of protocols, Solana also witnessed a surge in price at the beginning of July. Data from Coinmarketcap shows the price of Solana shot up from $18.9 on July 1 to $27.4 on July 16 to reach a market cap of $11.81 billion.

Solana, along with Bitcoin, led the surge in the crypto market around this time period. As a consequence, the surge in Solana’s price led to a direct proportion in the value of the total assets locked in DeFi protocols on the chain.

Despite having a TVL growth in the last month, user activity on the chain dropped toward the end of the month. Its market cap also dropped to $9.7 billion at the end of July, demonstrating the volatility of the crypto market.

At the time of writing, Solana is trading at $24.85 and is up by 14.93% in a monthly timeframe. Although experts predict Solana can surge above $30 before the end of the year.

Transactions on Optimism recently eclipsed the Arbitrum network, but do the project’s fundamentals support a sustainable growth trajectory?

The Aave price may have been impacted by this week’s Curve Finance scandal, but a robust insurance fund and steady fee revenue could protect against further downside.

The decentralized finance (DeFi) sector has endured a turbulent month, as transaction volume plummeting alongside a series of hacks and exploits.

Fidelity Digital Assets gave a bullish forecast for ETH in the next 12 months, while a separate survey from CryptoVantage found 47% of investors expect Ether to “surpass” Bitcoin.

Cardano’s DeFi footprint and network activity show an uptick in users, but will it be enough to sustain ADA’s recent bullish price action?

The Ethereum network has faced withdrawals from its smart contract applications, putting the recent ETH price rally in check.

Bitcoin dominance is rising, but so is Ethereum’s share of market dominance among its altcoin competitors. Cointelegraph explains why.

The total value locked has increased by 12% in one week, according to data source L2Beat.

Ethereum price looks poised for additional downside as low as the $1,560 level.

Data analytics platforms have reported billions of dollars in outflows from Binance over the last week, but this can be misinterpreted, argues Changpeng Zhao.

3 key indicators are behind the prolonged bearish trend in Ether, and data fails to identify an immediate catalyst for a price breakout.

The ETH price could come under short-term pressure due to a downtrend in deposits, reduced DEX volume market share and futures data showing traders with a bearish bias.