A recently released report explores the future potential of blockchain technology, particularly focusing on the revival and growing influence of Solana (SOL) in the crypto market.

Asset and mutual fund manager VanEck disclosed one key driver of Solana’s influence is its advancements in Smart Contract Platforms (SCPs), defined as systems that execute contracts on a blockchain without requiring third-party involvement.

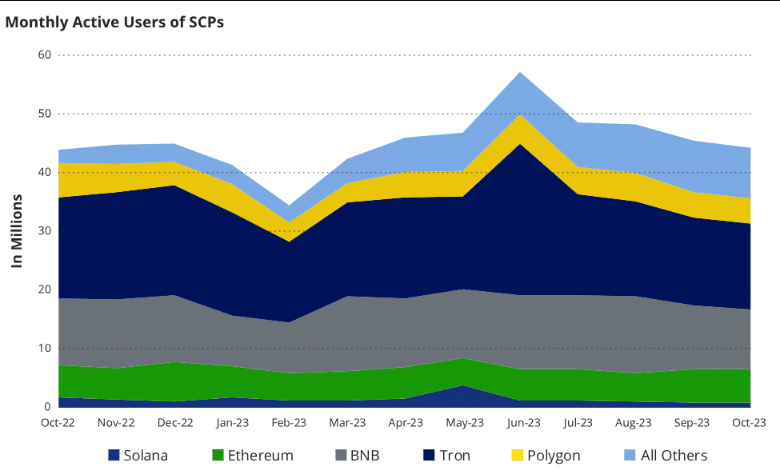

Although other SCP-compatible blockchains exist, such as BNB Chain and Ethereum (ETH), Solana has notably dominated this sector. VanEck’s analysis suggests that this sector, particularly SCPs, is poised for significant adoption in the future, positioning Solana as a prominent player in the blockchain industry.

Solana’s Dominance In Smart Contract Platforms

Solana’s emergence as a dominant force in the SCP realm is reinforced by its high throughput and scalability, surpassing many existing blockchain networks. Its ability to process a high volume of transactions quickly and at a lower cost compared to some competitors has been a pivotal factor driving its influence and potential for widespread adoption.

Additionally, Solana’s ecosystem has seen a surge in decentralized applications (dApps) and projects leveraging its infrastructure, further solidifying its position as an attractive and viable platform for developers and users alike. This growing adoption and technical superiority hint at a promising trajectory for Solana, suggesting it may remain a key player in the expanding landscape of blockchain technology.

The VanEck report underscored the undeniable dominance of Solana in the SCP sector. But despite these existing alternatives, none have managed to rival Solana’s current supremacy within the field. VanEck further highlighted the sector’s imminent surge in adoption, foreseeing a promising growth trajectory by 2030.

However, the report also emphasized the necessity of a groundbreaking application for exponential expansion. According to VanEck, among the contenders, Solana stands as the most fitting platform with the potential to fill this pivotal role, positioning itself as the likely candidate to lead the sector’s transformative growth.

VanEck observed that the blockchain hosting the groundbreaking application could experience substantial benefits from the app’s generated activity. The analysis presents a scenario where Solana becomes the pioneering blockchain to support a single application that brings on board over 100 million users.

Over the past week L1s have started to see a shift in sentiment.$SOL activity for the month has translated to sharp increased in DEX volume activity as TVL and users have seen an uptick.

Is this the start of a new trend? pic.twitter.com/wfFyYlvBVS

— Artemis (@artemis__xyz) October 26, 2023

Artemis’s Analysis: Solana’s Resurgence and Growth

Meanwhile, Artemis, an institutional digital asset data platform, recently highlighted Solana’s remarkable resurgence, underscoring the project’s growth. In an October 26 post on X (formerly Twitter), Artemis expressed being impressed by Solana’s performance, citing key metrics such as Total Value Locked (TVL), decentralized exchange (DEX) volume, active addresses, and transactions.

Notably, Artemis emphasized its expectations for the network’s future improvement, especially with its 100% uptime since March 2023. The collective positive sentiments from both Artemis and the asset management firm shed light on Solana’s recovery and significant potential, as detailed in their respective analyses.

At the time of writing, Solana (SOL) was trading at $32.83, up 3.5% in the last 24 hours and registered a decent 7.8% increase in the last seven days, according to figures by Coingecko.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from TechSAA