The Shiba Inu’s reign as king of memecoins may be facing a ruff patch. Dogecoin (DOGE) prices dipped this week after news broke of the US Securities and Exchange Commission (SEC) issuing a Wells Notice to Robinhood, a popular crypto exchange.

The notice, a precursor to potential enforcement action, alleges Robinhood violated multiple securities laws. This sent shockwaves through the crypto community, with many investors, particularly those holding large amounts of DOGE (often nicknamed “whales”), pulling their funds out of Robinhood.

The most significant outflow involved a whopping 164 million DOGE, worth roughly $25 million at the time, being transferred out of the exchange. This mass withdrawal by a whale investor likely contributed to the market jitters surrounding DOGE.

Another 164M $DOGE, worth $25M, have been transferred out of Robinhood.

These transactions occurred after the platform received a Wells notice from the SEC. #DOGE #Robinhood #CryptoNews

Source: MartyParty pic.twitter.com/oKxW1S8pTD

— Bitcoinsensus (@Bitcoinsensus) May 8, 2024

DOGE Price Wobbles: Short-Term Blues Or Long-Term Woof?

The price of DOGE tumbled 5.8% in the 24 hours following the Robinhood news. However, analysts caution against a knee-jerk reaction. While the legal troubles undoubtedly cast a shadow on Robinhood, the DOGE outflow, including the 164 million transfer, might not be the sole culprit behind the price dip.

Transferring cryptocurrency from an exchange to a personal wallet is often seen as a bullish move, indicating an intention to hold for the long term.

Dogecoin And Bitcoin: A Tale Of Two Blockchains

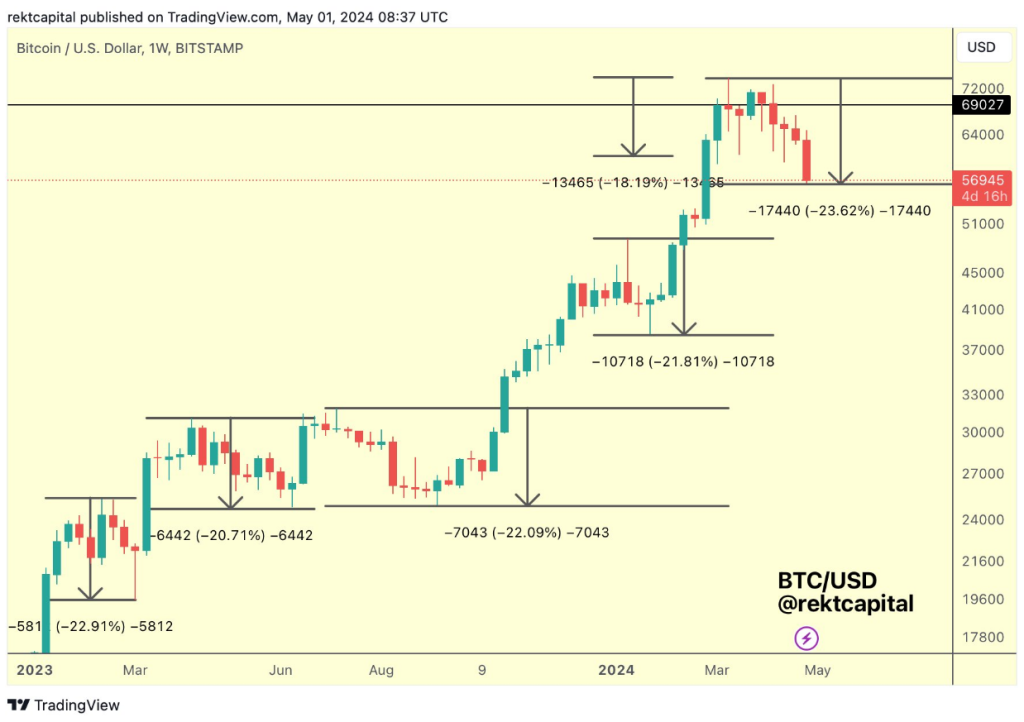

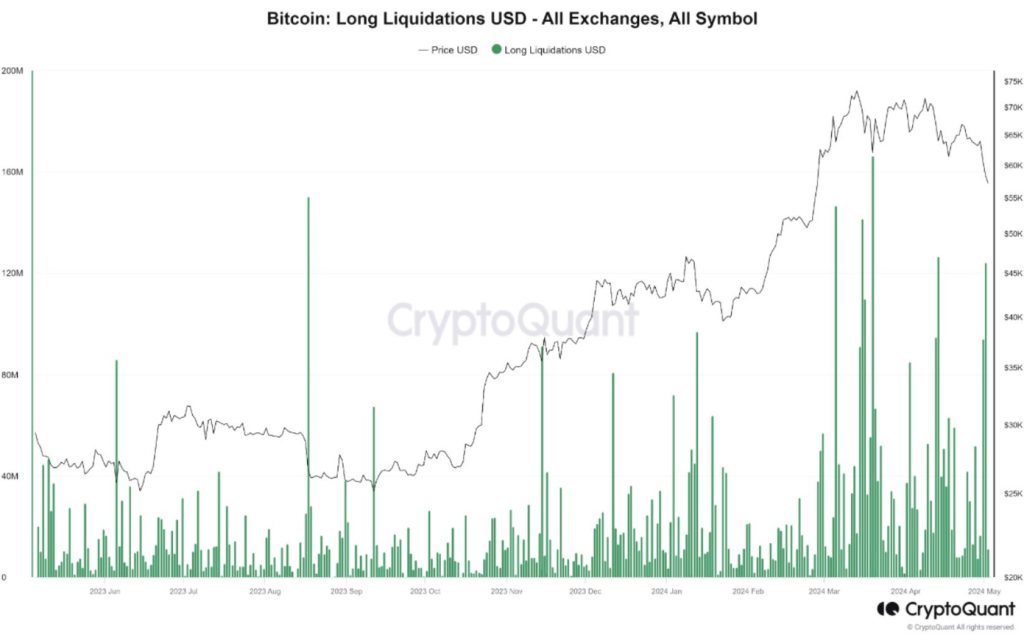

Another factor influencing DOGE’s price is its tight correlation with Bitcoin (BTC). Both currencies operate on the Proof of Work (PoW) consensus mechanism, which some see as outdated compared to newer, energy-efficient models.

The recent pullback in the broader crypto market, especially in Bitcoin, likely played a role in dragging DOGE down as well.

Rocky Road To $0.20? DOGE Faces Support Hurdle

DOGE enthusiasts were eyeing a price target of $0.20, but the recent drop presents a roadblock. The memecoin dipped below the crucial $0.15 support level, raising concerns about a further decline.

Analysts point to a potential support zone between $0.143 and $0.146, but a fall below that could trigger a more significant price correction.

Bullish Signs Amidst The Dip

Despite the short-term pessimism, there are glimmers of hope for DOGE. The buy orders for DOGE currently outweigh sell orders by a significant margin, suggesting continued investor interest.

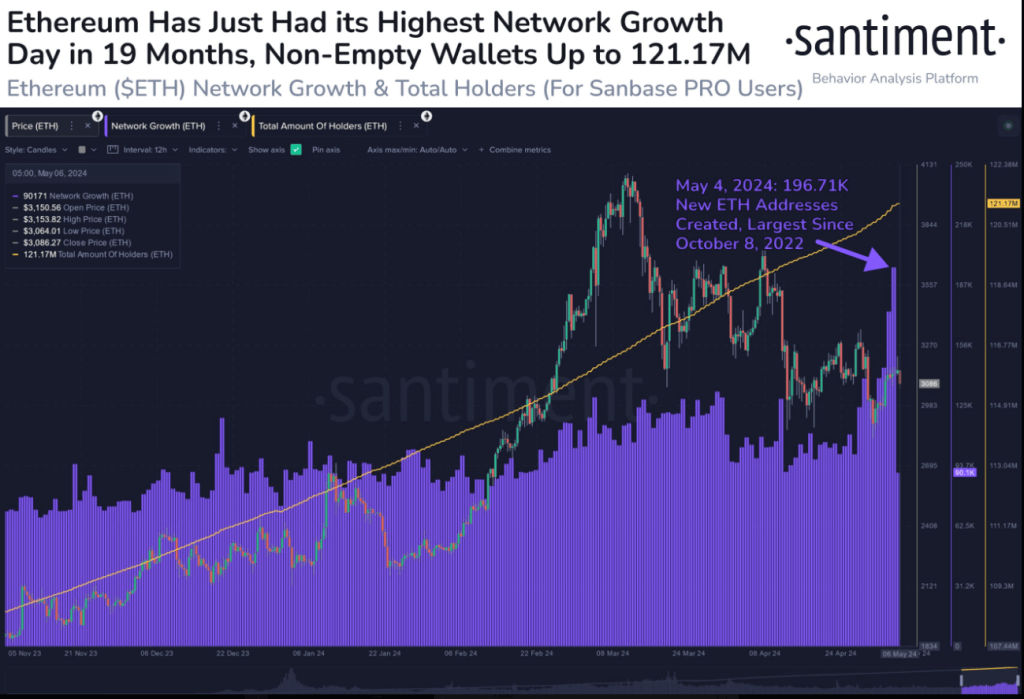

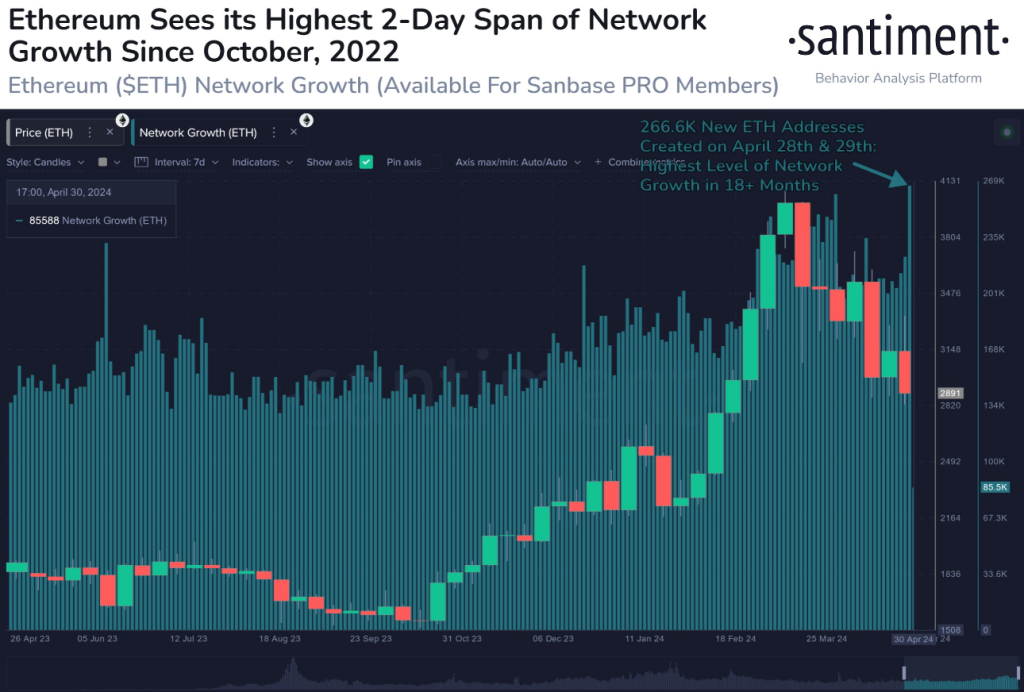

Related Reading: Forget The Price Dip: Ethereum Network Activity Hints At Imminent Takeoff

Additionally, the memecoin’s Relative Strength Index (RSI) sits at a neutral 47, indicating there’s room for new buyers to enter the market. Furthermore, DOGE managed to maintain a weekly price increase despite the daily drop, hinting at underlying resilience.

Doge Day Delayed, But Not Doomed

The coming weeks will be crucial for Dogecoin. The outcome of Robinhood’s legal battle with the SEC and DOGE’s ability to regain lost ground will determine its short-term trajectory. However, long-term forecasts for the memecoin remain cautiously optimistic.

Featured image from Yahoo Finance, chart from TradingView

…

…

150,000,000

150,000,000