The U.S. central bank raised its benchmark fed funds rate by 25 basis points at its most recent meeting.

Caitlin Long Sees ‘Coordinated Effort’ Among Regulators for Custodia Rejection

Custodia Bank’s CEO says crypto will find its way into the traditional banking system and regulators could be playing ‘whack-a-mole’ years down the road.

Coinbase beats Q4 earnings estimates amid falling transaction volume

Transaction volume on the exchange fell 12% in 2022’s fourth quarter, but the firm still beat forecast earnings despite a 57% year-on-year revenue drop.

Custodia Bank Renews Push for Fed ‘Master Account’ After Rejection

Custodia Bank filed an amended complaint against the Federal Reserve Friday, weeks after the Fed rejected its effort to secure a “master account” and become a member of the Federal Reserve System.

Binance Considers Severing US Ties in Face of Crypto Crackdown: Bloomberg

The crypto exchange has been investigated by a host of U.S. regulators and government agencies.

Bernstein: SEC Tightening of Crypto Regulations Is not an Existential Threat

Some in the industry had expressed concerns that crypto was actively being removed from the banking system with an attack on stablecoins and custody rules, the report said.

Bankman-Fried $250M Bond Is a ‘Joke,’ Claims Securities Lawyer

“MetaLawMan” James Murphy says that in 30 years of experience he has “never seen anything this lenient in a situation” where someone has lost millions of dollars of users’ money.

FTX’s Bahamas Unit Commingled Client, Corporate Funds, Liquidators Say

FTX Digital Markets Ltd. had bank accounts with a balance of $219 million, a report by PriceWaterhouseCoopers said.

Wyoming Lawmakers Pass Bill Prohibiting Forced Disclosure of Private Crypto Keys

The prohibition will not apply in cases where there is no alternative way to access the requisite information.

Crypto CEOs Need to Accept That Existing Regulations Also Apply to Them

Coinbase’s CEO thinks the rules that apply to other financial services don’t apply to his multi-billion-dollar financial services company. His ignorance – either intentional or literal – is concerning.

Kansas State Looks to Cap Crypto Political Campaign Donations at $100

The U.S. state is looking to amend its campaign financing rules to require donors’ names and addresses be collected – and mandate contributions be made strictly via U.S.-based entities.

Republicans Plan to Reintroduce Legislation Restricting Crypto in 401(k): Politico

The legislation will be introduced in the House by Rep. Byron Donalds (R-Fla), the report said.

Former SEC Chief Counsel Says Agency Needs to Make Clear Its Crypto Compliance Rules

TuongVy Le, a partner and head of regulatory & policy at investment firm Bain Capital, says the agency is refraining from passing a rules-based framework and has to make it clear what digital assets it would deem compliant under its jurisdiction.

SEC Case Against Bankman-Fried Postponed Pending Criminal Trial

Charges can wait until the Department of Justice’s case against the FTX founder concludes, the securities regulator said

CFTC Case Against Sam Bankman-Fried Postponed Until After Criminal Trial

The request to stay the SEC’s civil case against Bankman-Fried is still pending.

Crypto’s Banking Problem: Industry Needs Access but US Regulators Keep Digital Assets at Bay

Crypto can’t become what many of its proponents want it to be without banks, but U.S. regulators are circling the wagons around the banking system they oversee. That barrier is only getting wider as the Federal Reserve and other agencies turn away crypto firms trying to link with the traditional financial system.

Algorand Foundation CEO: SEC’s Crypto Crackdown Highlights Lack of Regulatory Clarity

Staci Warden says crypto-native firms are being punished rather than given guidance.

FTX creditor list shows airlines, charities and tech firms caught in collapse

The over 100-page long document lists every entity FTX owes money to, inclusive of Big Tech players to local businesses from its Bahamian headquarters.

CFTC commissioner: Crypto exchanges shouldn’t ‘self-certify’ tokens

Commissioner Christy Goldsmith Romero wants crypto exchanges blocked from self-certifying crypto and crypto products before going live on their platforms.

Asian Traders Behind Most Of Bitcoin’s Recent Gains, Report Reveals

Data shows most of Bitcoin’s recent gains since November 27 have been observed during Asian trading hours, according to a report.

Bitcoin Saw The Most Returns During Asian Trading Hours

As per the latest weekly report from Arcane Research, Asian trading hours saw positive cumulative BTC returns of around 16% between November 27 and January 15. The report defines the three principal trading hours: between 0 to 8 Central European Time (CET) for Asian hours, 8-16 CET for European, and 16-24 for the US.

Here is a chart that shows the cumulative returns that Bitcoin got during each of these trading hours since 27 November:

As shown above, Bitcoin has seen chiefly positive returns during Asian trading hours between 27 November and 15 January. This would suggest that traders in Asia have been participating in net buying throughout this period.

The US trading hours mostly saw consolidation in this timespan, implying that activity might have been at a standstill. BTC’s returns were also negative at the end of the year during these hours, while they always remained positive during Asian hours.

There was one exception. However, the market reacted strongly to the CPI news last week, and BTC observed gains. Bitcoin’s cumulative returns stand at 10% in the green during US hours, while they stand at 16% for Asian hours.

European hours also mostly saw sideways movement, with BTC remaining at slight negative returns through most of the period, until the recent surge, which also saw buying during this time zone. Still, this uplift was enough to bring the crypto back to neutral returns.

This means that most of BTC’s recent profits came during the Asian hours, with US participants only pushing the price in last week’s CPI surge, while European traders were mainly irrelevant for the coin.

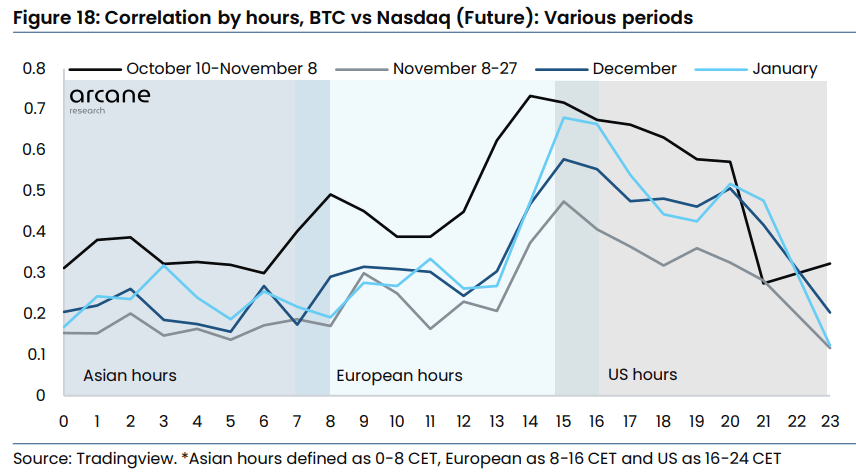

An exciting trend appears in the correlation between Bitcoin and Nasdaq futures for each time zone. The “correlation” here refers to a measurement of how closely the price of BTC has been following changes in Nasdaq futures.

The below chart highlights the trend in the daily Bitcoin correlation with Nasdaq futures sorted by hours of the day.

According to the report, the overall 30-day correlation between Bitcoin and Nasdaq has recently plunged to pretty low values. However, even so, it would appear that there is some relevant correlation during US trading hours still present. This means price action tends to follow Nasdaq futures in this time zone.

In Asian and European trading hours, however, the indicator’s value has consistently remained low this month so far.

BTC Price

At the time of writing, Bitcoin is trading around $20,800, up 20% in the last week.