In a recent turn of events, Ripple faced a significant security breach resulting in the loss of $112 million worth of XRP. Despite this setback, the cryptocurrency community has witnessed remarkable resilience from XRP whales, who have chosen to maintain their coin holdings. This unwavering support, coupled with Ripple’s swift response, has instilled confidence in the platform’s long-term viability.

XRP Whales Display Unwavering Faith

On-chain data provided by Santiment reveals that XRPLedger experienced a surge in whale transactions following the hack. A total of 217 transactions involving $1 million or more in XRP were recorded, marking the highest activity since July 2022. This surge underscores the whales’ belief in XRP’s potential, despite the temporary market turbulence caused by the hack.

Furthermore, wallets holding at least 10 million XRP now collectively possess 67.2% of the available supply, a concentration not seen since December 2022. This consolidation of XRP among influential investors indicates their long-term commitment to the asset.

Ripple Leadership Assures Community

In the wake of the hack, Ripple co-founder Chris Larsen provided reassurances that the Ripple blockchain itself remained secure. The unauthorized access was limited to his personal XRP accounts, separate from Ripple’s operations. Larsen’s prompt action in notifying exchanges to freeze the affected addresses demonstrates Ripple’s dedication to protecting its users’ assets.

Moreover, Ripple is actively collaborating with law enforcement agencies, and a substantial portion of the stolen funds has already been frozen. The team is diligently pursuing the remaining funds to ensure a comprehensive resolution of the situation.

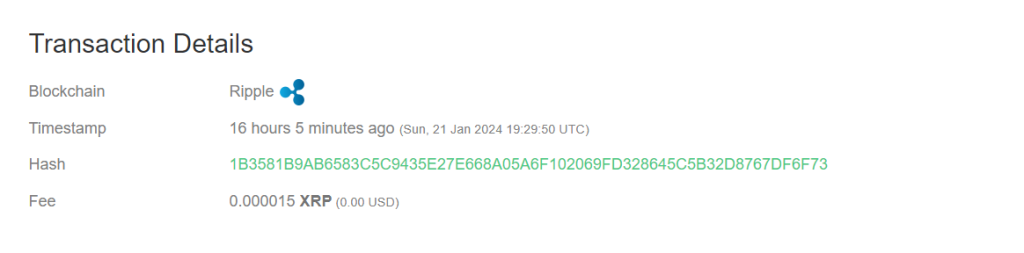

Binance’s Mysterious XRP Transfer

Amidst the Ripple hack incident, an unusual withdrawal of 20.62 million XRP tokens from Binance, the world’s largest cryptocurrency exchange, has raised eyebrows. While initial speculation pointed towards an external entity, further investigation revealed that the tokens were sent to an address associated with Binance’s hot wallet for storing XRP.

20,620,032 #XRP (10,572,279 USD) transferred from #Binance to unknown wallethttps://t.co/PoVVjUt5KO

— Whale Alert (@whale_alert) January 31, 2024

This development suggests that the $10 million transfer may be an internal operation within the exchange rather than a whale’s activity in the broader cryptocurrency market. Binance has yet to provide an official explanation for this movement, adding an element of intrigue to the situation.

A Tale Of Resilience

The Ripple hack incident has undoubtedly shaken the cryptocurrency community, but the unwavering support from XRP whales and Ripple’s proactive response have demonstrated the platform’s resilience. As the investigation into the hack continues and Binance sheds light on its mysterious XRP transfer, the Ripple ecosystem stands poised to emerge stronger from these challenges.

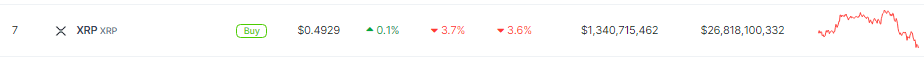

As the crypto community grapples with the intriguing dynamics surrounding the recent substantial XRP withdrawal from Binance, the broader question emerges: Is the current dip in XRP’s price merely a temporary setback or a prelude to a significant upward trajectory? Despite the recent setback and a price decline to $0.49, down 3.7% in the last 24 hours, the resilience of whale holdings amid the aftermath of the Ripple hack introduces a compelling narrative.

Featured image from Pixabay, chart from TradingView

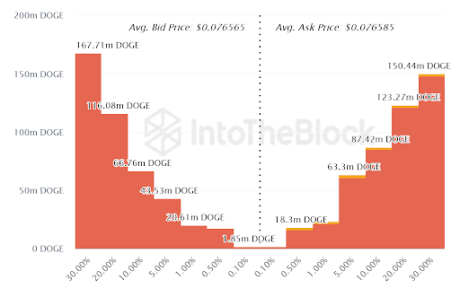

Source: IntoTheBlock

Source: IntoTheBlock Support Wall: Spanning $0.072-$0.073, with 200K addresses holding 28.6B

Support Wall: Spanning $0.072-$0.073, with 200K addresses holding 28.6B  Resistance Wall: Ranging from $0.074-$0.076, where 124K addresses hold 26.95B

Resistance Wall: Ranging from $0.074-$0.076, where 124K addresses hold 26.95B