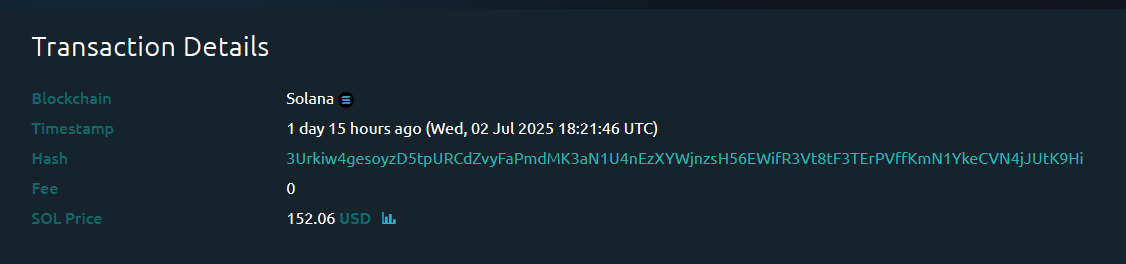

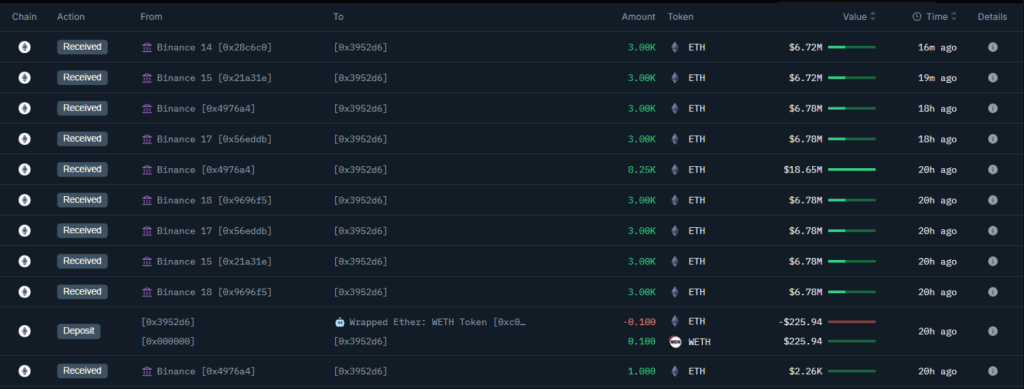

According to on‑chain tracker Whale Alert, an unknown wallet just received 1,000,000 SOL in a single move worth over $152 million. It all happened in a flash. The report set off alarms across the Solana network and sent traders scrambling.

Activity shot up almost immediately as everyone tried to figure out who was behind the transfer and why it mattered.

Massive Transfer Caught On Chain

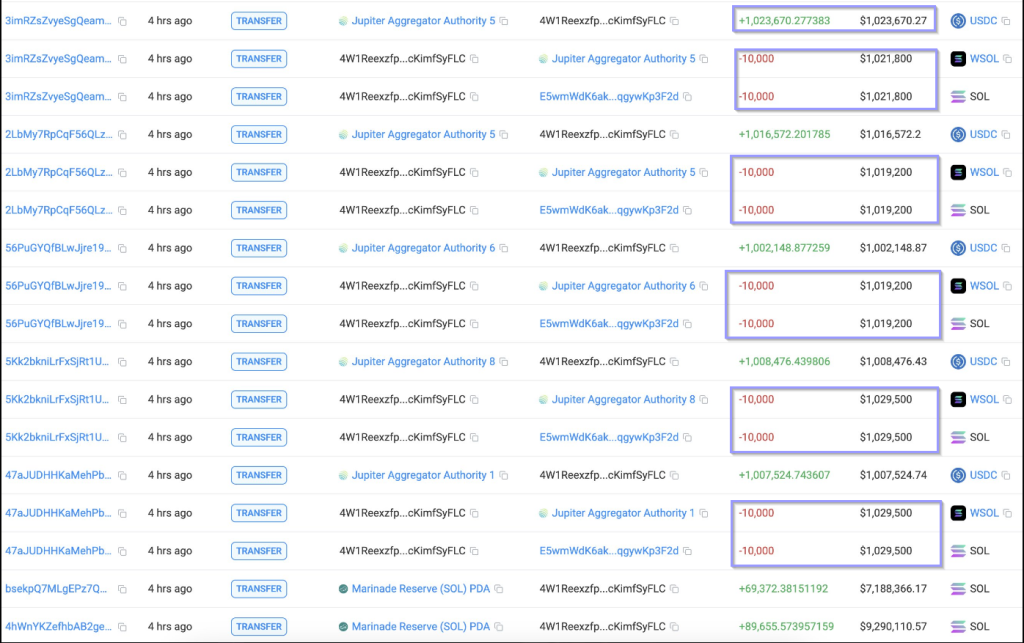

Based on reports, the one‑million‑SOL transfer lifted 24‑hour trading volume to $4.11 billion, a nearly 28% rise. Large moves of this size—more than $152 million at current prices—often reshape order‑book depth and liquidity as traders adjust their positions in response.

1,000,000 #SOL (152,067,512 USD) transferred from unknown wallet to unknown wallethttps://t.co/Mkaq1mDBPn

— Whale Alert (@whale_alert) July 2, 2025

Price Rally Tops $150 Barrier

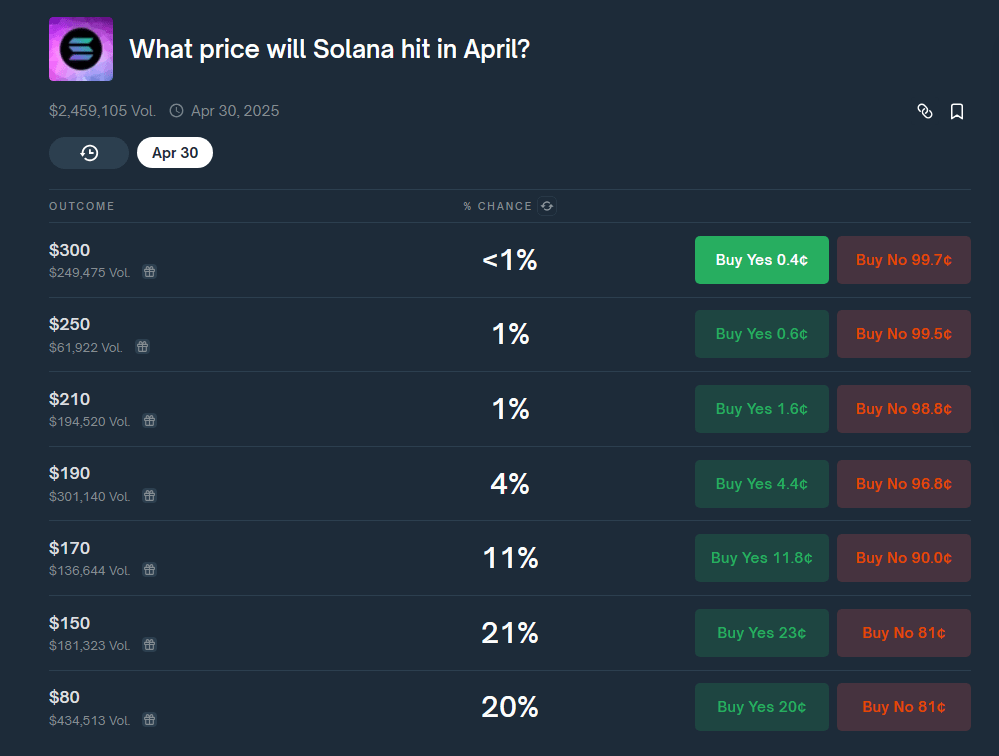

Traders watched SOL climb from about $146 to $151, up 6.10% in the last week. Some snapped up coins at $150, betting that the whale’s shift in assets hinted at a larger play.

Others took profits as the price crossed that round number, locking in gains. Either way, breaking above $150 marked a clear sign that short‑term momentum was back. It even pulled in fresh players looking for quick wins.

US‑Listed Solana ETF Gains Traction

On the same day, a new staking‑enabled Solana ETF went live on Cboe BZX. It started with $33 million in trades on its very first session. That outpaced many earlier crypto futures products, pushing more faith into SOL as an investment option.

Based on reports, traditional investors who were on the fence now had a regulated path to add Solana to their portfolios without jumping through extra hoops.

This double whammy—whale wallet shuffle and a fresh ETF—did more than bake a rally; it gave the market two clear signals. First, smart money still moves big chunks behind the scenes. Second, regulated products keep gaining ground in the crypto space.

It’s too early to say which event will have the longer‑lasting impact. But for now, SOL traders have some solid numbers to chew on. With on‑chain indicators flashing and institutional tools coming online, Solana’s path could get a lot more interesting in the weeks ahead.

Featured image from Meta AI, chart from TradingView

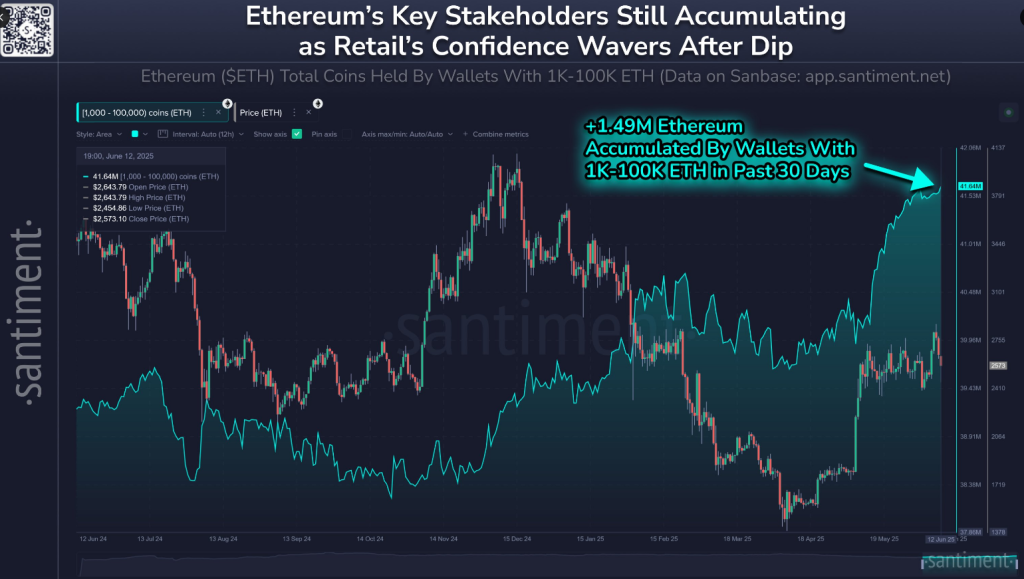

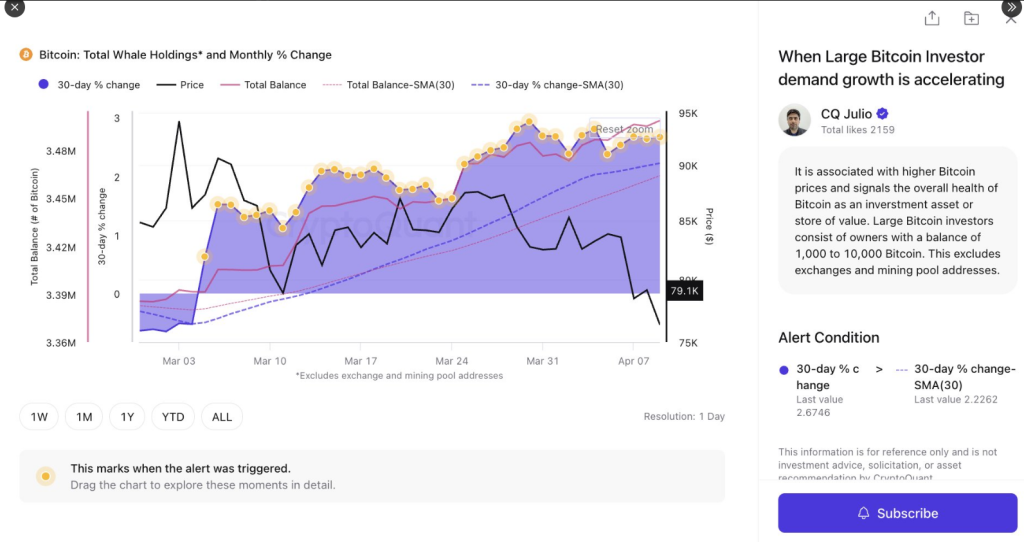

There are currently 6,392 wallets holding between 1K and 100K Ethereum. Over the past month alone, these key whale and shark wallets have rapidly added more coins as retail traders have taken profit.

There are currently 6,392 wallets holding between 1K and 100K Ethereum. Over the past month alone, these key whale and shark wallets have rapidly added more coins as retail traders have taken profit.

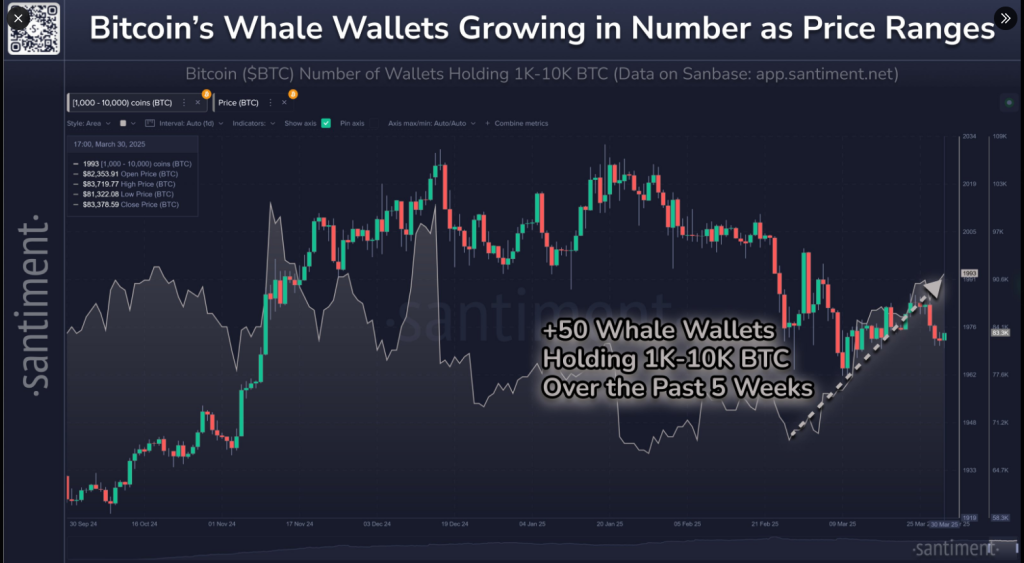

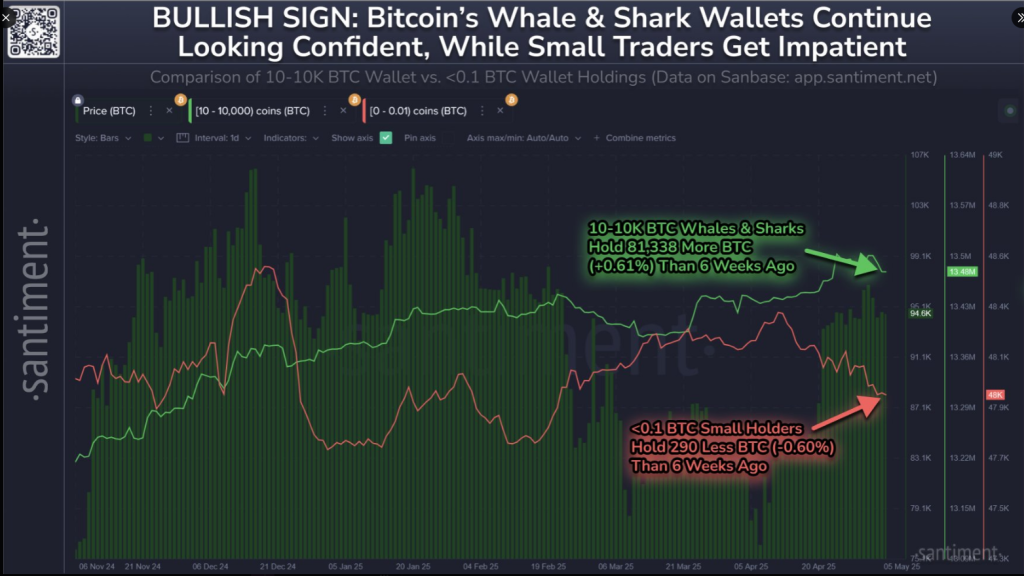

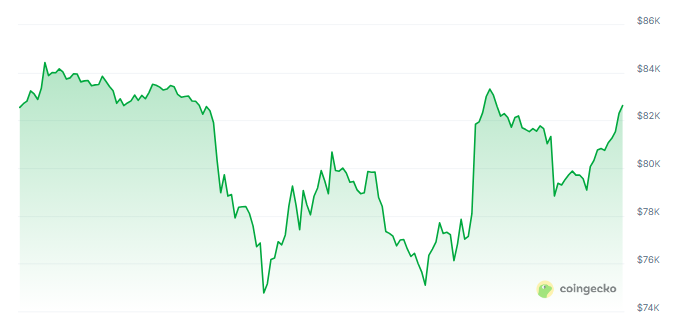

Bitcoin’s market value has fluctuated between $81K to $84K Monday. And while prices continue ranging as March draws to a close, whale wallets (specifically 1K-10K

Bitcoin’s market value has fluctuated between $81K to $84K Monday. And while prices continue ranging as March draws to a close, whale wallets (specifically 1K-10K