XRP, the cryptocurrency associated with Ripple, has been locked in a lengthy period of consolidation, trading between $0.300 and $0.600 for the past seven years.

Despite a brief surge during the 2021 bull run that saw XRP reach a three-year high of $1.9 in April, the token has since returned to its range, lacking the bullish momentum to overcome upper resistance levels.

However, some crypto analysts are now predicting a major uptrend for XRP in the coming months, potentially propelling it to new heights.

Analysts Anticipate XRP Breakout

A technical analyst using the pseudonym “U-COPY” on the social media site X (formerly Twitter) suggests that XRP could experience significant movement between May 15 and August.

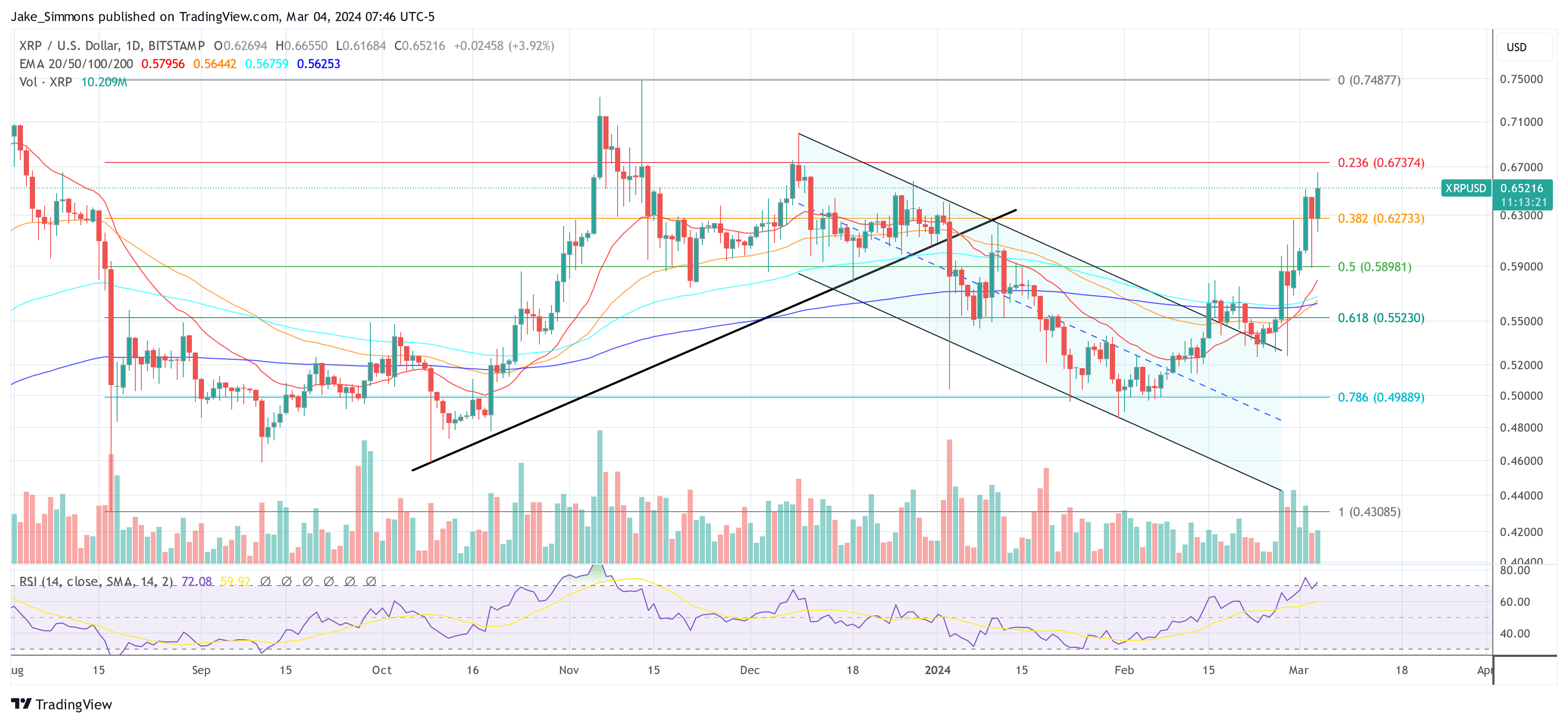

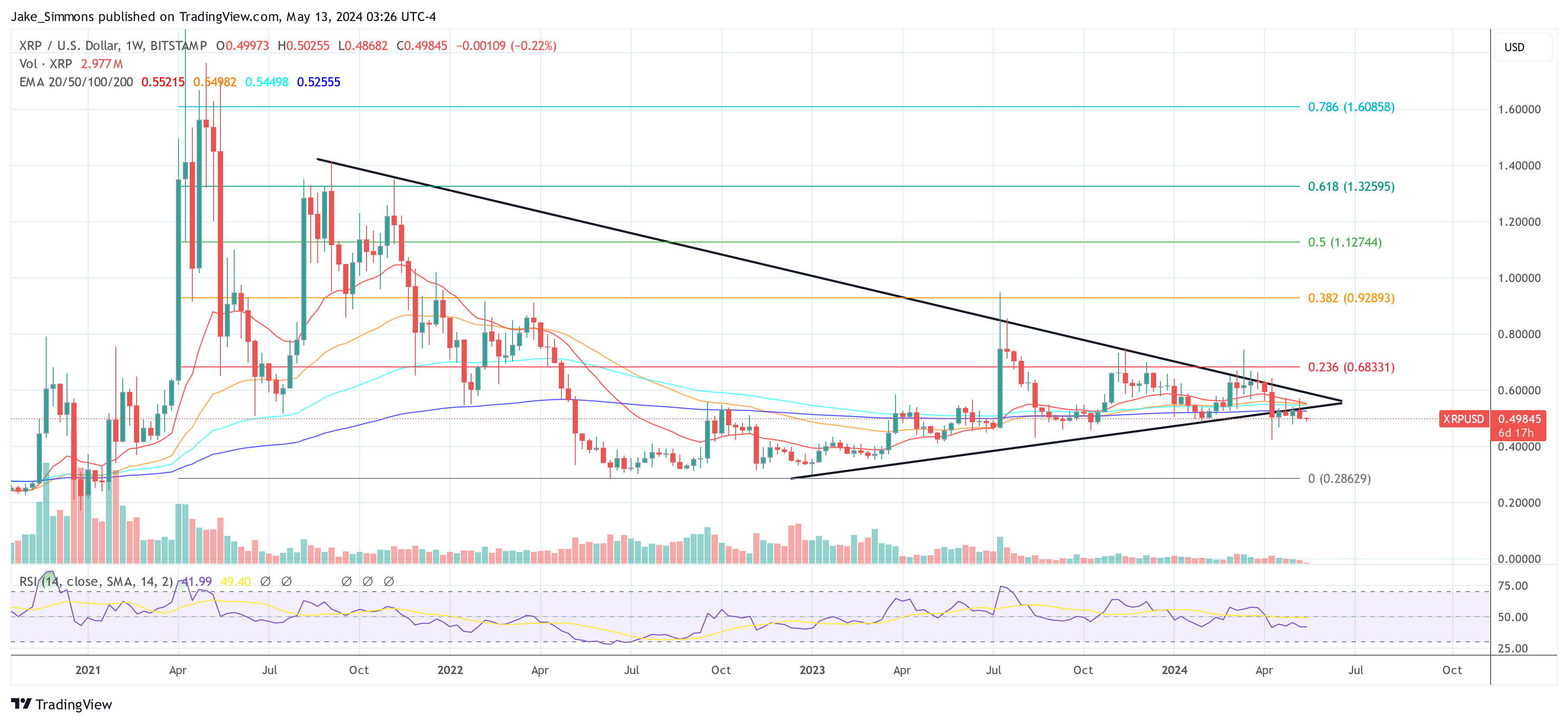

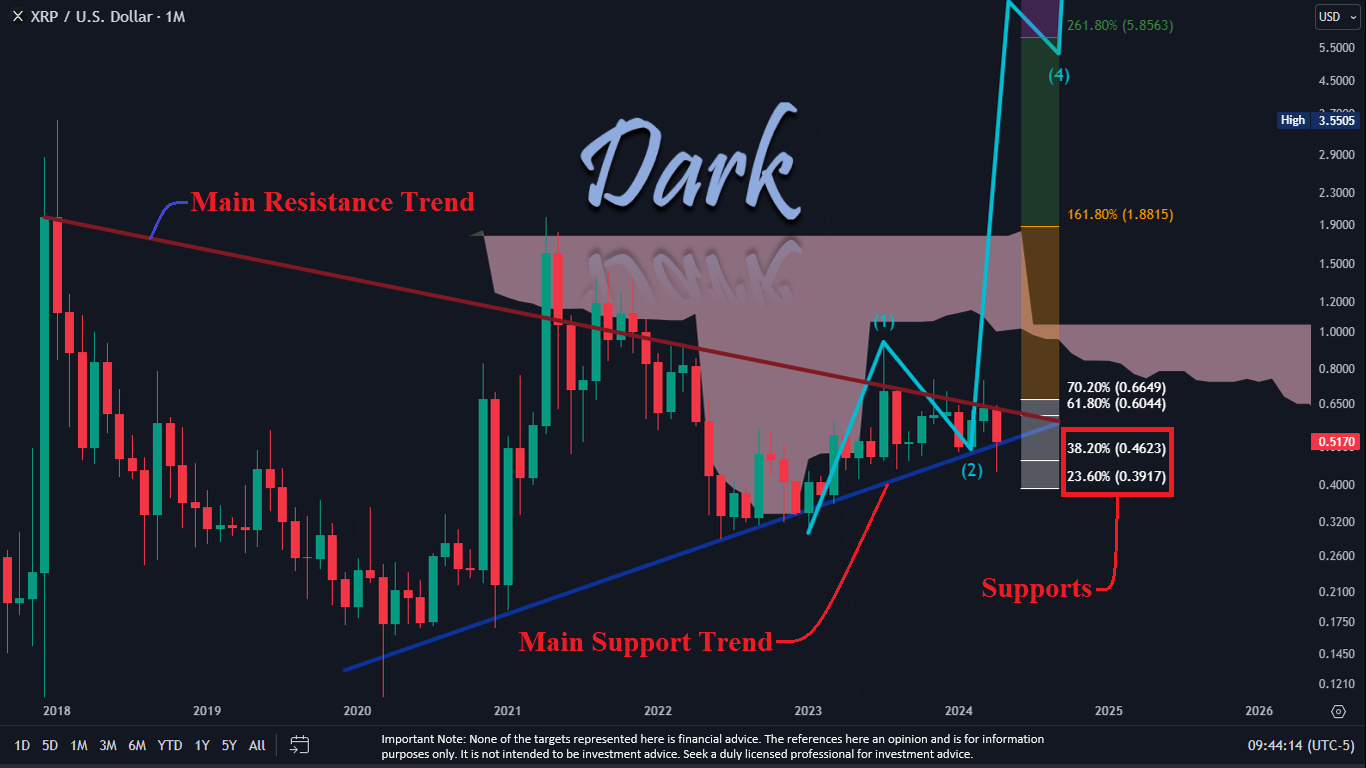

U-COPY points out that XRP has been slowly moving up from its previous low at $0.46 and is nearing the end of a long triangle formation, which has been in accumulation since 2018.

The analyst believes that XRP’s real potential will be revealed in the fully formed bull cycle, with the token possibly experiencing substantial growth by the end of the year.

Supporting this bullish outlook, another analyst, Armando Pantoja, proposes that the crypto bull run could begin in September or October 2025, with XRP potentially reaching a price of $0.75.

Pantoja further suggests that if former US President Trump wins the election and the Securities and Exchange Commission (SEC) eases its stance on cryptocurrencies, XRP could be propelled to higher levels.

This change in regulatory dynamics, combined with the ongoing legal battle between Ripple and the SEC, may increase the likelihood of XRP gaining approval for an exchange-traded fund (ETF) similar to Bitcoin.

Pantoja outlines a price range of $1-2 for an XRP ETF announcement in early 2025. If interest rates are cut multiple times during the same period, XRP could potentially reach $5-10. Ultimately, Pantoja predicts the possibility of XRP hitting $10-$20 by the fourth quarter of 2025 or the first quarter of 2026.

‘Buy the Dip’ Opportunity?

According to market intelligence platform Santiment, The XRP Ledger (XRPL) has recently witnessed a notable increase in the movement of dormant tokens, signaling a potential shift in market dynamics for the token.

Coinciding with the opening of May, the company’s Token Age Consumed metric reveals a spike in the transfer of old coins, reminiscent of a similar occurrence in April, just before a significant downturn in the market. During that period, XRP experienced a sharp decline in value, dropping by 16%.

However, in contrast to the previous event, Santiment suggests that there is a “compelling argument” that this current surge in old coin movement might be attributed to the interest of key stakeholders looking to “buy the dip.”

Furthermore, it is worth noting the growing open interest in exchanges, which has recently reached a three-week high. This uptick in open interest indicates increased active positions in XRP, potentially reflecting growing market participation and heightened trading activity.

Considering these factors together—the surge in dormant token activity, the potential buy-the-dip interest from key stakeholders, and the rising open interest on exchanges—there appears to be a shift in sentiment surrounding XRP.

At press time, the seventh-largest cryptocurrency trades at $0.5020, down over 7% in the past week alone and 1% in the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Targets: $1-$6

Targets: $1-$6  Crypto (@MikybullCrypto)

Crypto (@MikybullCrypto)