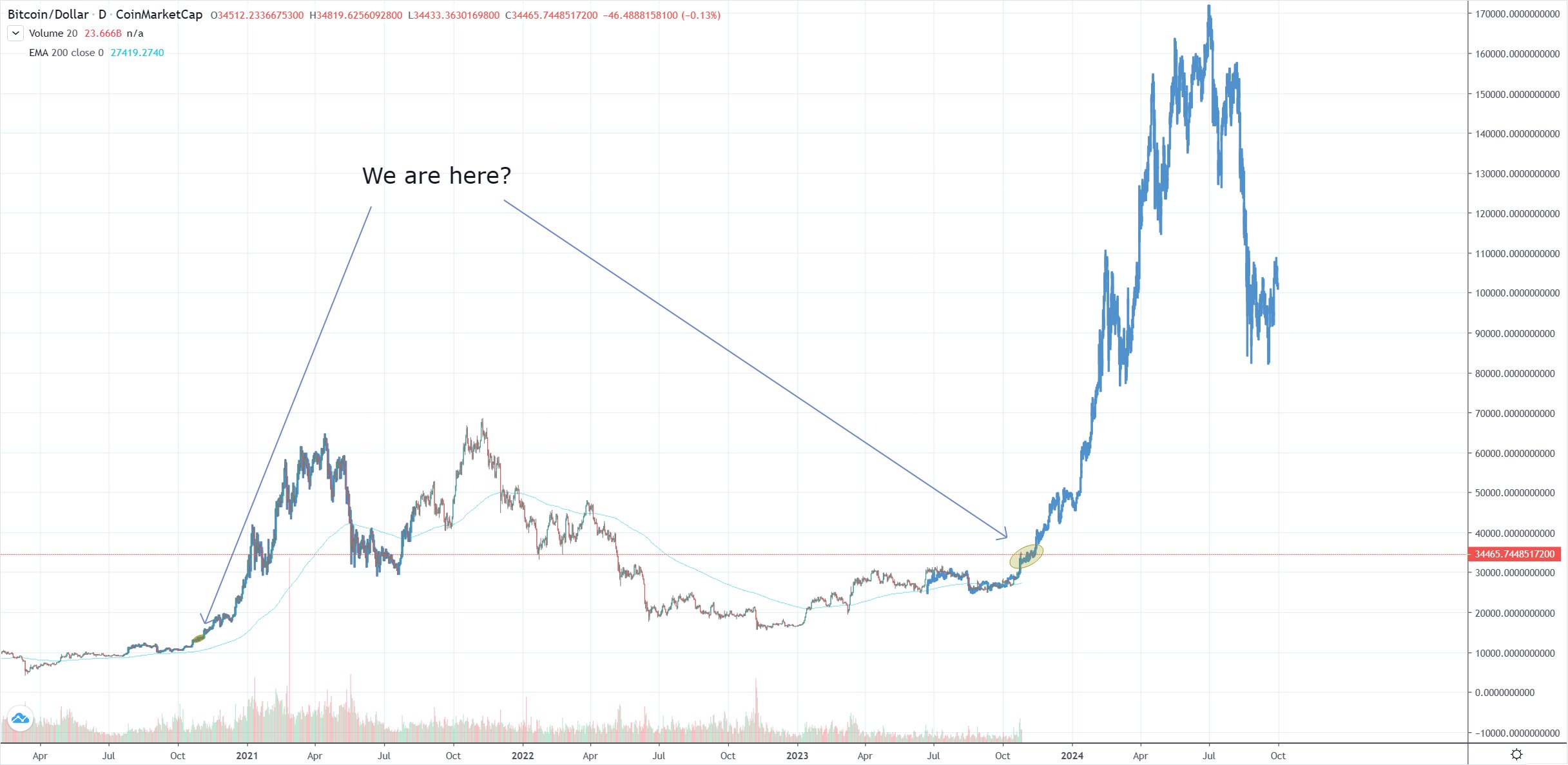

The XRP price is still in an incredibly bullish position despite the recent pullback and the general sentiment in the community matches this bullishness. One crypto analyst explains the current trend as the altcoin having entered what is referred to as a “markup phase.”

XRP Price Leaves Accumulation To Markup Phase

Crypto analyst and trade The Signalyst took to TradingView to share an interesting phase that the XRP price had entered. Using a chart, the crypto analyst outlined where the altcoin’s price had been in the past, where it is now, and where it is headed using distinct terms.

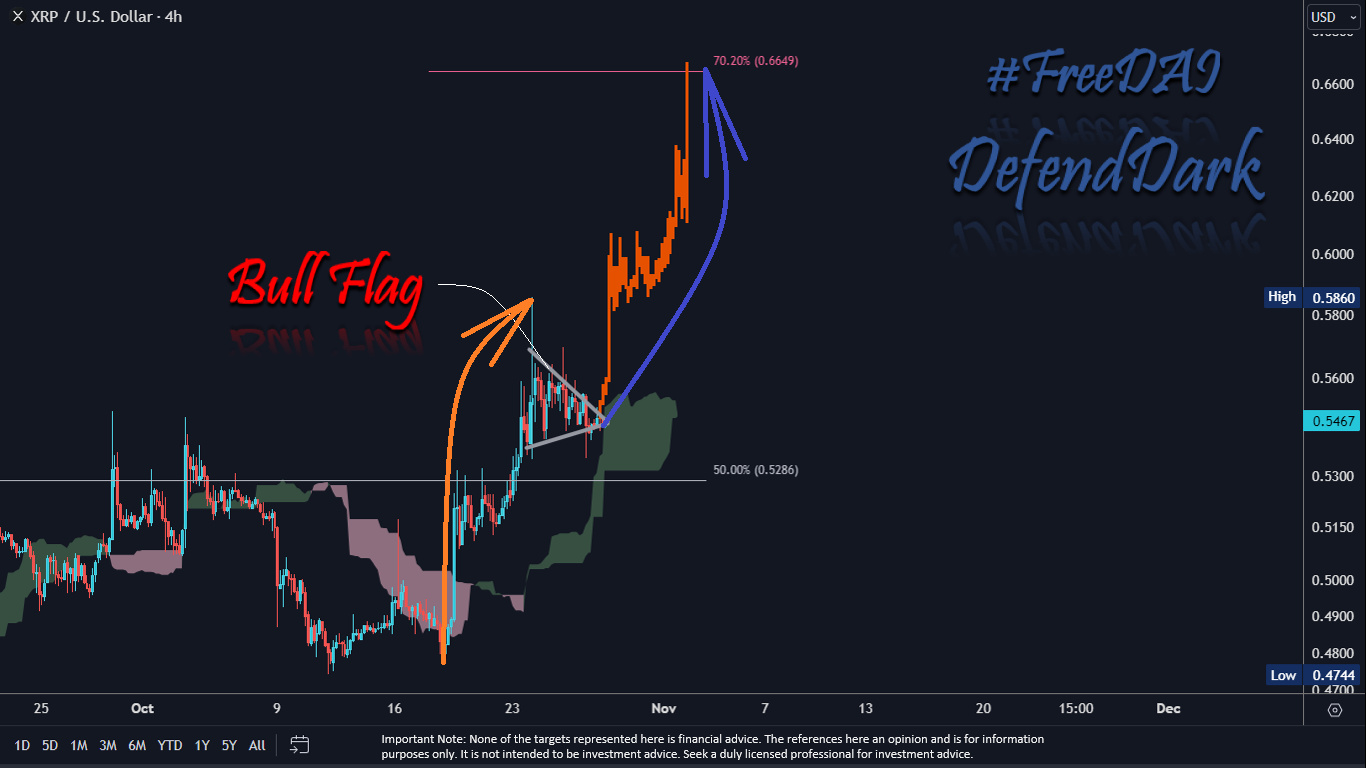

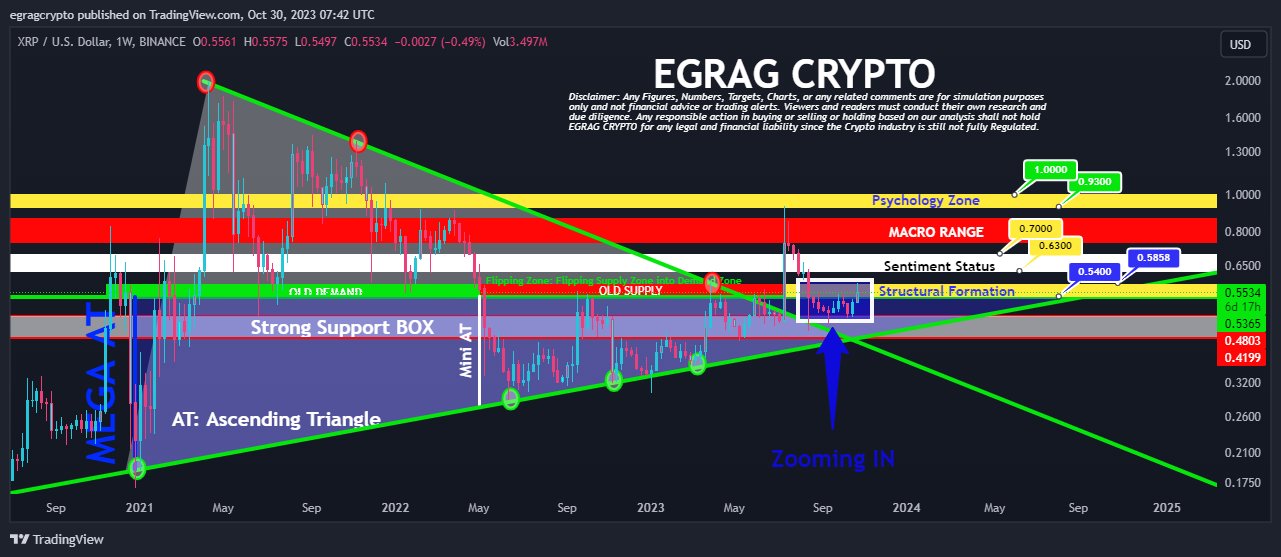

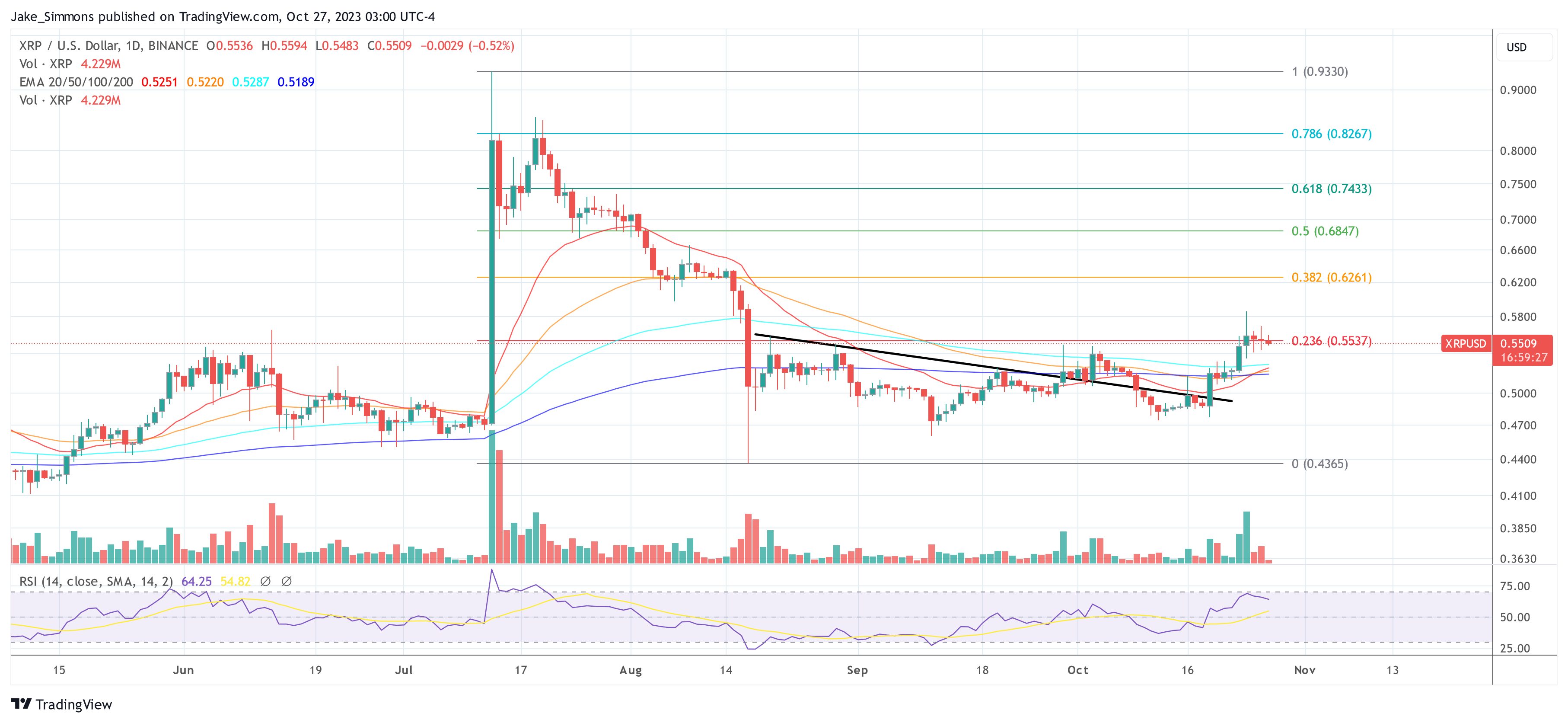

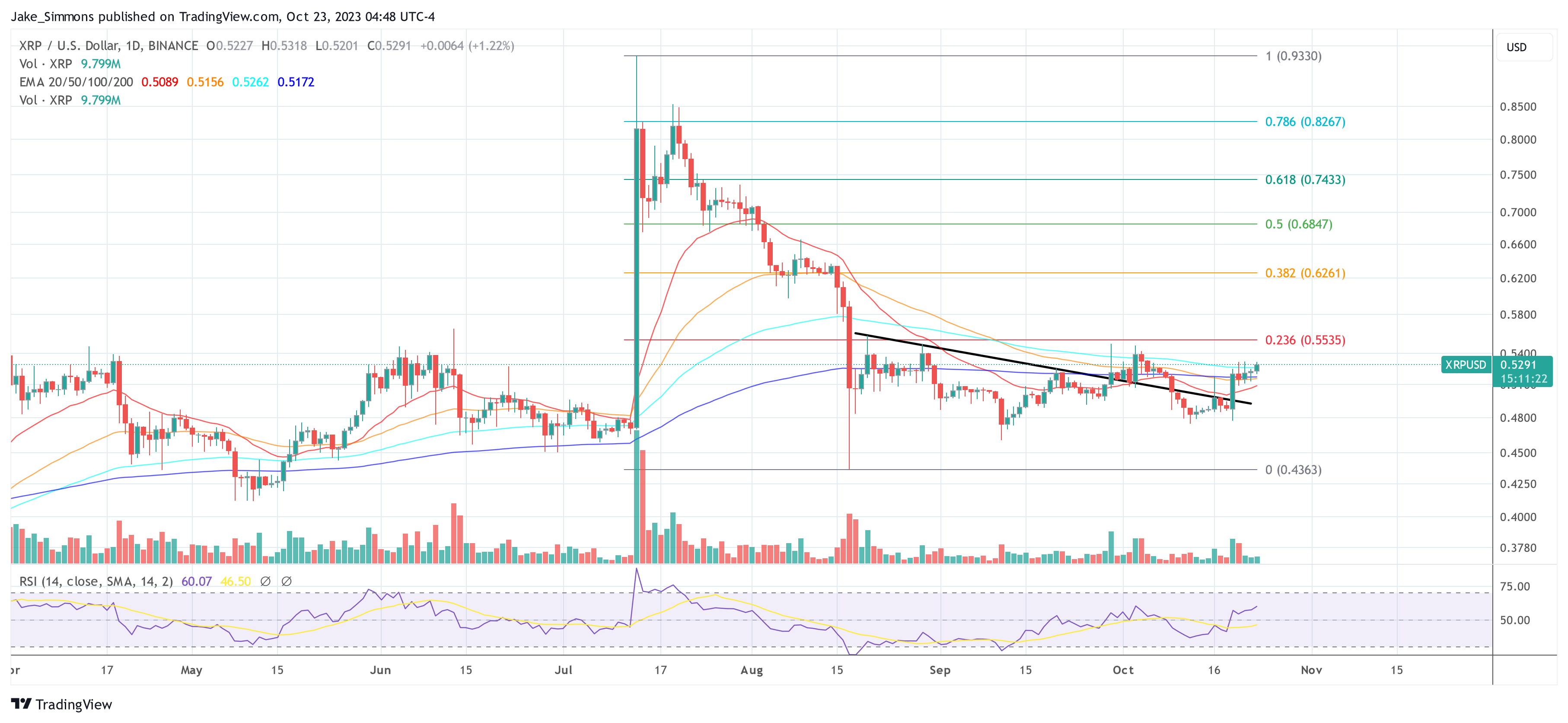

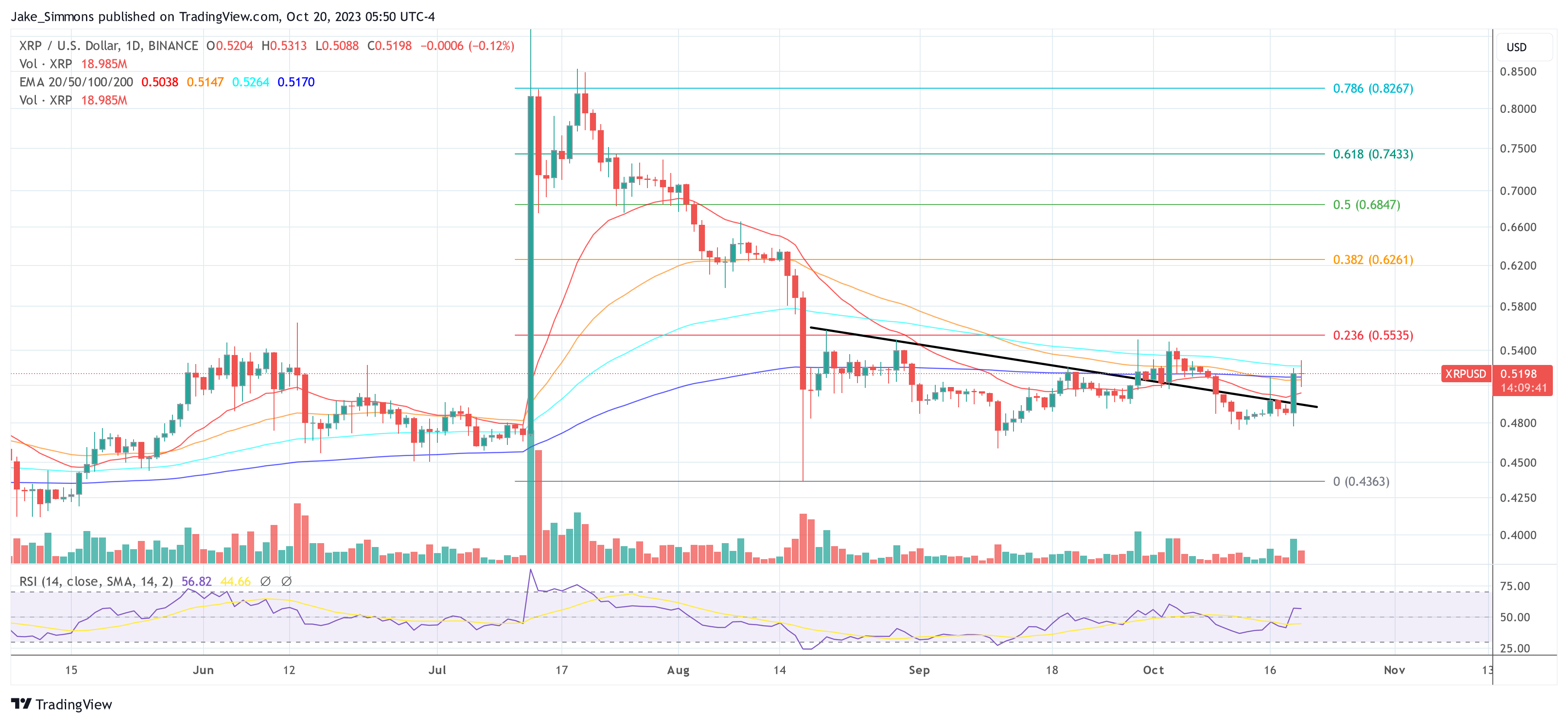

The first phase outlined in the chart is the markdown phase which took place after the price surge following Ripple’s first victory over the United States Securities and Exchange Commission (SEC) in July. This markdown phase saw the price go from as high as $0.9 to as low as $0.45 when all was said and done.

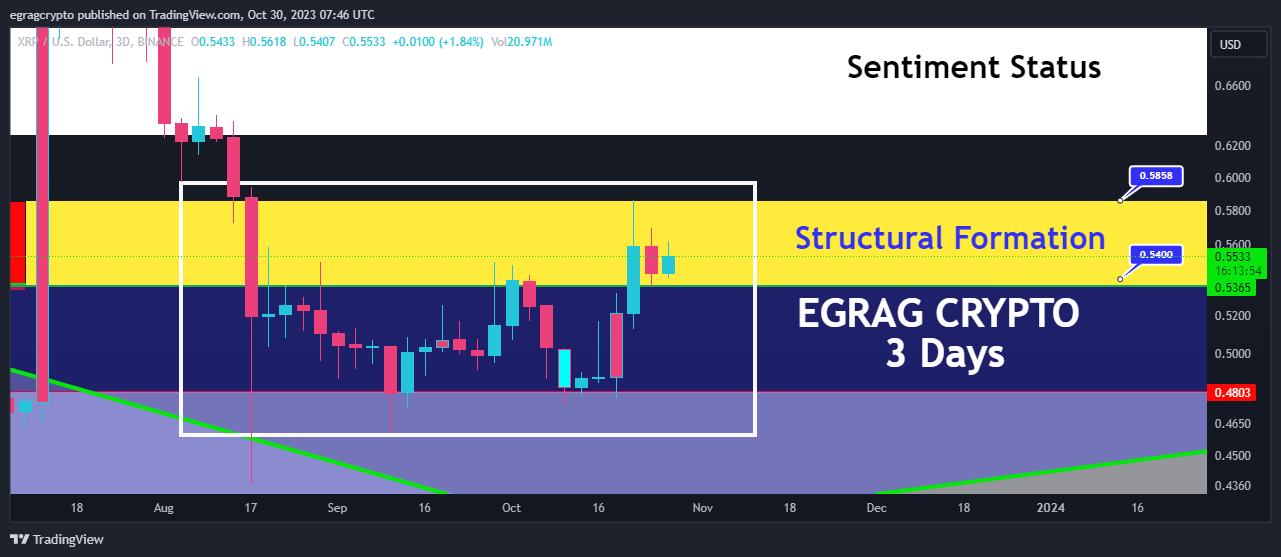

What came after the markdown phase was complete was the accumulation phase. Here, the XRP price traded in a pretty tight range, offering an opportunity for investors to buy as many coins as possible. During this phase, the price never crossed above $0.55.

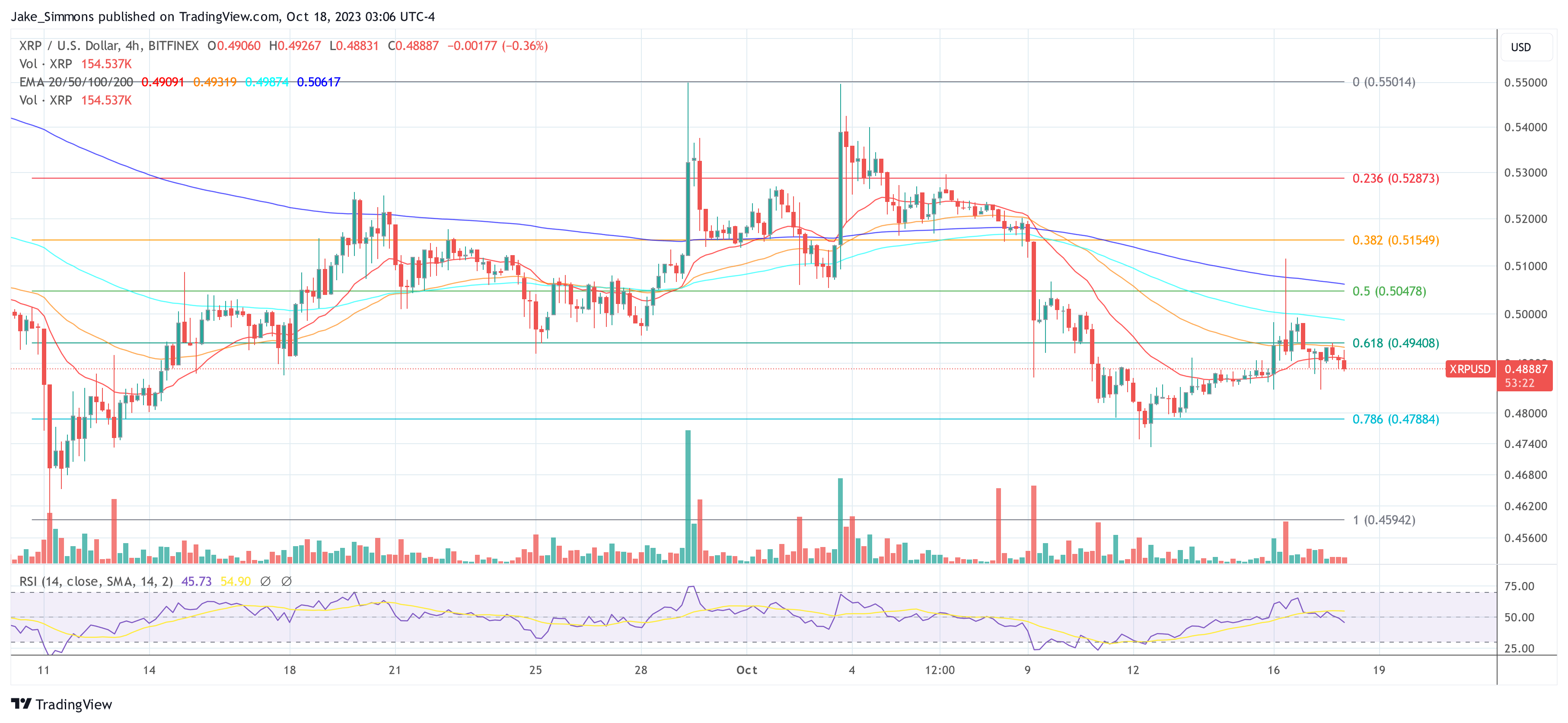

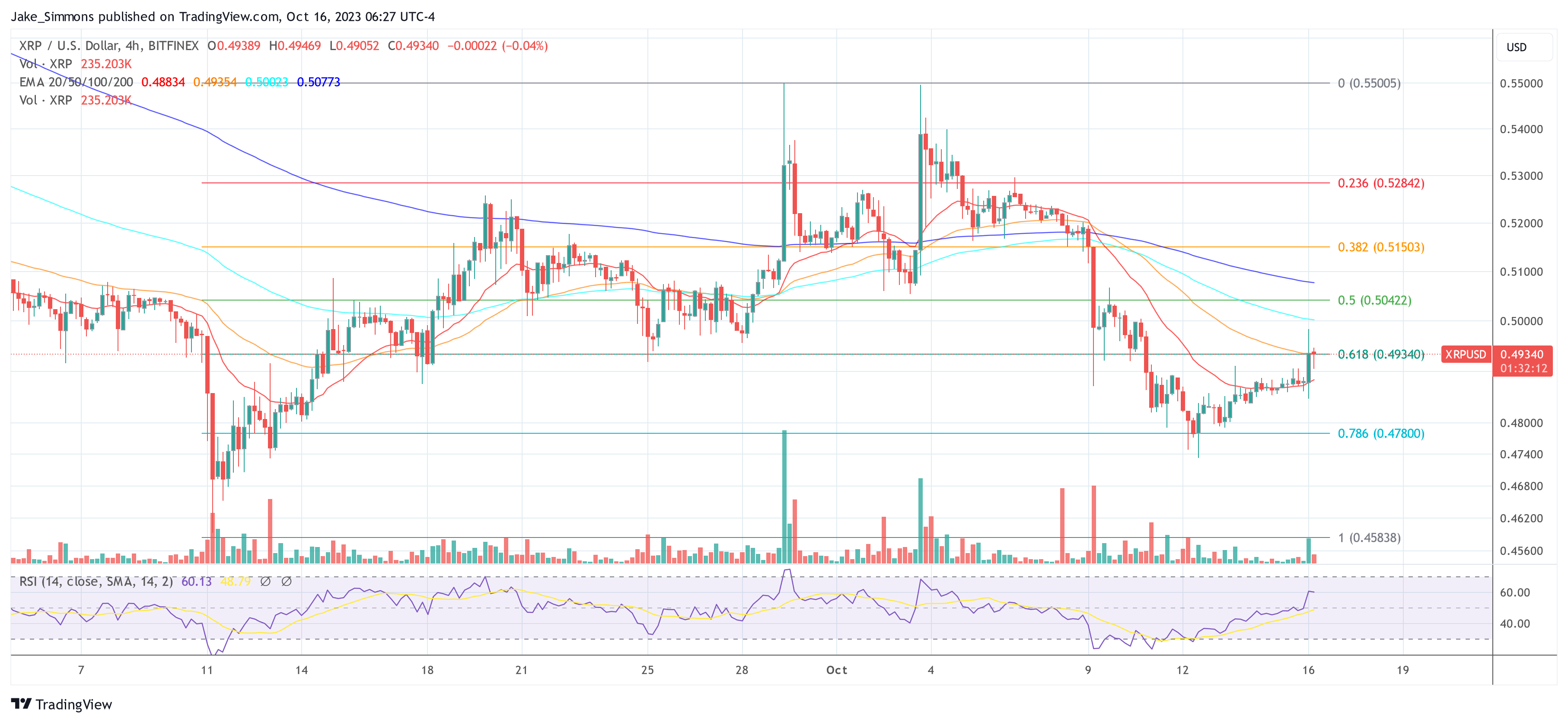

Next came the markup phase which is where the XRP price is currently residing. This markup phase is when the price starts to recover. “After breaking above the 0.55 level mentioned in my previous idea, XRP exited the accumulation phase and entered the markup phase,” the analyst said.

This markup phase is important in the fact that it possesses the strength for the XRP price to continue to grow. However, like with any rally, it faces a good measure of resistance from bears who continue to try to pull the price down.

The most important level for bulls to break in this markup phase, according to the analyst, is $0.7345, from which the price has already been rejected once on Monday. The Signalyst believes that if this level is broken, then bulls can maintain control of the price. The chart suggests a rise as high as $0.8 following a break of this resistance; an event that would cement XRP’s bull rally.

“Meanwhile, XRP could still face rejection at the resistance, which can be confirmed on lower timeframes,” the analyst warned. “In this scenario, a correction towards the 0.55 support level would be anticipated.”

Despite the drawdown, the XRP price is still showing bullishness and a high level of interest from investors. Its daily trading volume is up 32% in the last day, breaking above $3.3 billion. Its price is currently sitting at $0.69, up 1.63% and 21% on the daily and weekly charts, respectively.