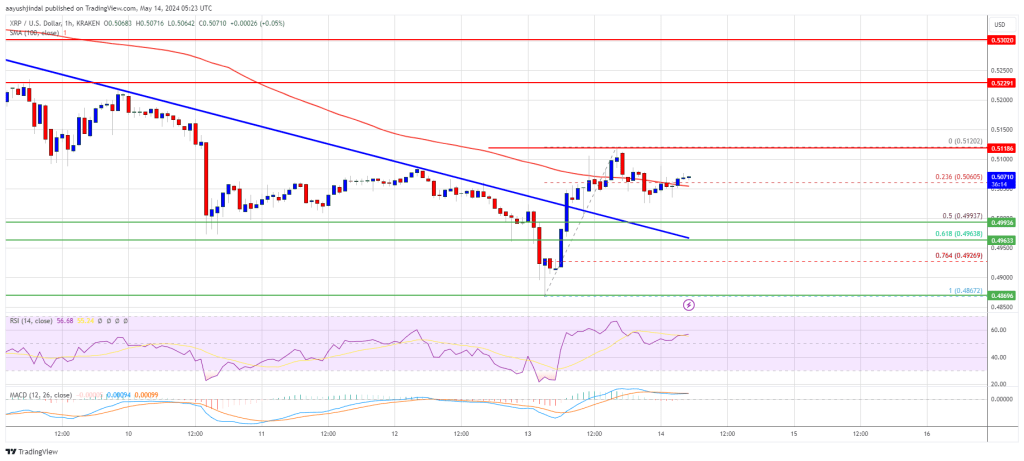

XRP price is struggling to clear the $0.5120 resistance. The price could decline again in the near term if it stays below $0.5060 and $0.5120.

- XRP is struggling to gain pace for a move above the $0.5120 level.

- The price is now trading below $0.5050 and the 100-hourly Simple Moving Average.

- There is a short-term declining channel forming with resistance at $0.5040 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair could start a decent increase if there is a close above the $0.5120 resistance.

XRP Price Stuck Near $0.50

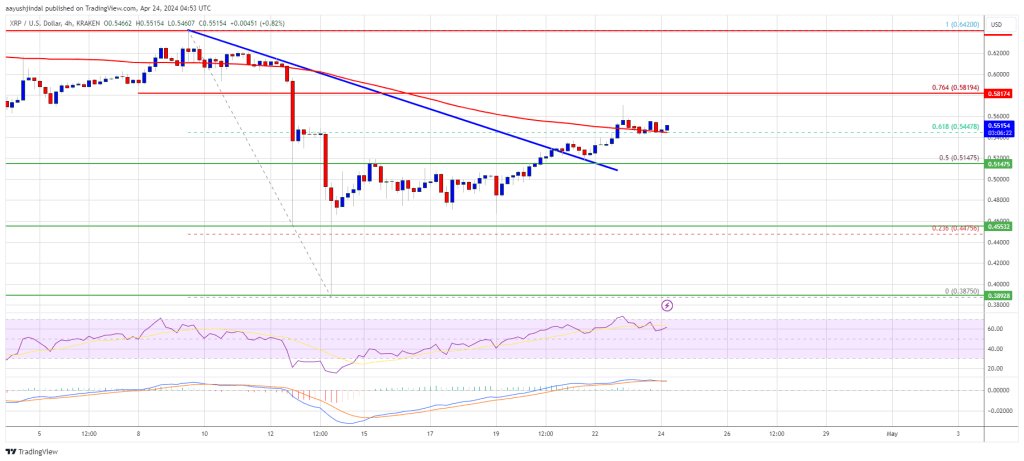

Yesterday, we discussed how XRP price started a recovery wave, like Bitcoin and Ethereum. There was a move above the $0.4950 and $0.50 resistance levels.

The price even moved above $0.5100, but the bears were active near the $0.5120 resistance. A high was formed at $0.5120 and the price is now correcting gains. There was a move below the 50% Fib retracement level of the upward move from the $0.4865 swing low to the $0.5120 high.

The price is now trading below $0.5050 and the 100-hourly Simple Moving Average. However, the bulls are active above the 61.8% Fib retracement level of the upward move from the $0.4865 swing low to the $0.5120 high.

Immediate resistance is near the $0.5040 level and the 100-hourly Simple Moving Average. There is also a short-term declining channel forming with resistance at $0.5040 on the hourly chart of the XRP/USD pair. The first key resistance is near $0.5060. A close above the $0.5060 resistance zone could send the price higher.

The next key resistance is near $0.5120. If the bulls remain in action above the $0.5120 resistance level, there could be a rally toward the $0.5250 resistance. Any more gains might send the price toward the $0.5350 resistance.

More Losses?

If XRP fails to clear the $0.5040 resistance zone, it could continue to move down. Initial support on the downside is near the $0.4965 level. The next major support is at $0.4925.

If there is a downside break and a close below the $0.4925 level, the price might accelerate lower. In the stated case, the price could even drop below the $0.4865 support zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.4965 and $0.4925.

Major Resistance Levels – $0.5040 and $0.5120.

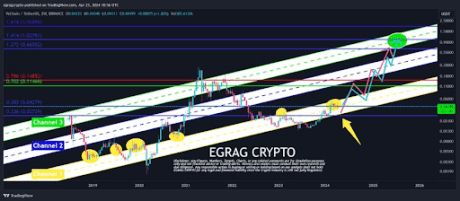

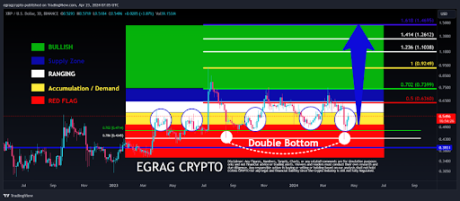

Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target.

Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target. Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.…

Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.…