The anticipated Bitcoin halving and potential ETF approvals have lit “some serious fire in the cauldron” for crypto, said Zerocap investment chief Jon de Wet.

Cryptocurrency Financial News

The anticipated Bitcoin halving and potential ETF approvals have lit “some serious fire in the cauldron” for crypto, said Zerocap investment chief Jon de Wet.

The anticipated Bitcoin halving and potential ETF approvals have lit “some serious fire in the cauldron” for crypto, said Zerocap investment chief Jon de Wet.

In a recent Bloomberg report, it has been suggested that the rise of Bitcoin price to over $42,000 is just the beginning of a new crypto super cycle that will push the world’s largest cryptocurrency to over $500,000.

According to Bloomberg, proponents of this theory argue that Bitcoin represents a new monetary order that is captivating Wall Street and fueling a “palpable sense of euphoria” within the digital asset community.

The remarkable performance of the Bitcoin price in recent months took many by surprise, as the cryptocurrency posted three consecutive monthly increases, including another 11 percent in December alone.

The enthusiasm surrounding Bitcoin’s price rally has led to optimistic predictions of further gains, often based on intuition or technical analysis.

The cryptocurrency has experienced a significant price revival in 2023, with its value surging over 150% thus far. Market observers attribute this surge to growing anticipation of a potential approval of a Bitcoin exchange-traded fund (ETF) for trading in the United States.

Per the report, the prospect of an ETF has led to jubilation within the industry. Coinbase CEO Brian Armstrong suggests that “Bitcoin may be the key to extending Western civilization.” Forecasts regarding the future price of Bitcoin have ranged from $50,000 in the immediate term to above $530,000.

Matt Maley, chief market strategist at Miller Tabak & Co., cautions about the rapidly changing sentiment in the asset class, highlighting the importance of the liquidity influx caused by the pandemic in driving Bitcoin’s strong rally in 2020 and 2021.

Maley suggests that without a similar liquidity injection, some of the optimistic predictions surrounding Bitcoin’s future value may be unrealistic.

The long-awaited launch of a Bitcoin-based ETF in the United States aims to facilitate easier access to the cryptocurrency for money managers, potentially attracting billions of dollars in new investments to the space.

Researchers at Kaiko note a noticeable shift in the market sentiment since mid-October, driven by increasing institutional interest in the potential approval of a spot BTC ETF and a more favorable macroeconomic environment.

The researchers also highlight recent inflows into crypto investment products and a seven-month high in daily spot-trading volumes in November.

Nevertheless, while excitement about a broader crypto rally often spreads across social media platforms like X (formerly known as Twitter), it is important to acknowledge Bitcoin’s historical volatility.

According to Bloomberg, the cryptocurrency has experienced multiple hype cycles in recent years, with celebrated gains followed by significant downturns.

Despite Bitcoin’s recent gains and departure from a prolonged consolidation phase, Bloomberg suggests that a significant correction may still be on the horizon. At present, Bitcoin is trading at $41,800, displaying sustained bullish momentum as it strives to reclaim the $42,000 level.

The outcome remains uncertain whether the cryptocurrency will successfully consolidate above this critical level, positioning it favorably for continued upward movement throughout the month.

Alternatively, the current yearly high level could act as a formidable resistance barrier for the Bitcoin price, further supporting Bloomberg’s thesis of a potential correction.

Featured image from Shutterstock, chart from TradingView.com

Nearly $1.8 billion flowed into crypto investment products over the last 10 weeks, which hasn’t been seen since Bitcoin futures were launched in October 2021.

Web3 gaming represents a revolutionary intersection of blockchain technology and interactive entertainment, heralding a new era in the gaming industry. This article serves as your comprehensive guide to understanding the intricacies of Web3 gaming, providing insights into the top web3 games and web3 gaming companies that are leading this digital transformation.

Whether you’re a seasoned gamer curious about the transition from traditional to Web3 gaming, or a crypto enthusiast eager to understand the synergy between gaming and blockchain, this guide has you covered. We’ll introduce you to the best web3 games that are redefining player experience and discuss the innovative mechanics that set these games apart. Additionally, our curated list of top Web3 games will serve as a valuable resource for enthusiasts and gamers alike.

Web3 gaming, at its core, is an innovative fusion of traditional gaming elements with the decentralized, secure, and transparent features of blockchain technology. Unlike traditional gaming, where the game’s data and assets are centrally controlled, Web3 gaming introduces a decentralized approach. This paradigm shift allows players to have true ownership of in-game assets, such as skins, characters, and virtual real estate, in the form of Non-Fungible Tokens (NFTs). This ownership is verifiable and transferable across different platforms, thanks to the underlying blockchain technology.

The integration of cryptocurrencies in Web3 gaming also introduces novel monetization models, including Play to Earn (P2E). In these models, players can potentially earn cryptocurrency rewards for their in-game achievements and participation, adding a layer of financial incentive that goes beyond traditional gaming experiences.

Another hallmark of Web3 gaming is the emphasis on decentralized autonomous organizations (DAOs). These player-driven governance structures enable a more democratic and transparent way of making decisions about the game’s future, including updates and rule changes. This level of player involvement is unprecedented in traditional gaming paradigms.

The Rise of Web3 Games

The rise of Web3 games can be traced back to the increasing interest in blockchain technology and the success of early blockchain-based games like “CryptoKitties,” which demonstrated the potential for integrating blockchain with gaming. This success sparked a wave of innovation, leading to more sophisticated and engaging Web3 games.

Web3 games have gradually evolved to offer complex gameplay and rich narratives, rivaling their traditional counterparts. This evolution is driven by advancements in blockchain technology, enabling faster transaction speeds, improved scalability, and enhanced user experience. As a result, these games have started to attract not just blockchain enthusiasts but also mainstream gamers.

The rise is also fueled by the increasing awareness and acceptance of cryptocurrencies and NFTs among the general public. As people become more comfortable with these concepts, the barrier to entering Web3 gaming diminishes, leading to a broader and more diverse player base.

Another factor contributing to the rise of Web3 games is the growing interest from traditional gaming studios and developers in exploring blockchain technology. This interest is leading to partnerships, investments, and development efforts aimed at creating hybrid models that blend the best of both worlds – the immersive experiences of traditional gaming with the innovative features of Web3.

The rise of Web3 games marks a significant shift in how we perceive and interact with digital content. It represents not just a new form of entertainment but also a new economy where players have a real stake and say in the gaming worlds they inhabit.

The landscape of Web3 games is rich and varied, offering a multitude of experiences that cater to different tastes and interests. These games are not just technologically advanced but also creatively diverse, ranging from simple collectibles and strategy games to complex virtual worlds with rich narratives. In this segment, we explore some of the best Web3 games that have captivated players worldwide.

Overview Of The Best Web3 Games

To understand what makes a Web3 game stand out, it’s essential to look at the best examples in the market:

Popular Web3 Game Mechs (Mechanics)

The mechanics of Web3 games are what distinguish them from traditional gaming, introducing new layers of engagement and interaction. Here are some of the most popular mechanics found in Web3 games:

True Digital Ownership: Players have real ownership of their in-game assets, thanks to blockchain technology. These assets, often NFTs, can be bought, sold, or traded on various marketplaces, providing players with tangible value for their in-game achievements.

The surge in Web3 gaming has given rise to a new breed of gaming companies that are at the forefront of blending blockchain technology with interactive entertainment. These companies are not only game developers but innovators who are reshaping the gaming landscape with their unique approaches to decentralized gaming and cryptocurrency integration.

Leading Web3 Gaming Companies

Here are some of the leading companies that are making significant strides in the Web3 gaming space:

The Role Of Crypto In Web3 Gaming

Cryptocurrency plays a pivotal role in the ecosystem of Web3 gaming, fundamentally altering how value is created, distributed, and exchanged within games. Here are key ways in which crypto is integral to Web3 gaming:

Facilitating In-Game Transactions: Cryptocurrencies provide a seamless medium for transactions within Web3 games. Whether it’s purchasing items, trading assets, or paying for services, crypto ensures fast, secure, and borderless transactions.

Web3 Game Developers: Pioneers of the Industry

Web3 game developers are at the cutting edge of integrating blockchain technology with gaming. The latest report by Footprint Analytics for October 2023 reveals a landscape of both opportunities and challenges.

Despite a significant growth in token market capitalization, developers face hurdles in user acquisition and retention. With 73.1% of games having fewer than 10 active users, it’s clear that while the industry is expanding, with a total of 2,651 games, attracting and keeping players engaged remains a key challenge.

Notably, the web3 game development landscape is geographically diverse, with the Asia-Pacific region leading the charge, hosting 40% of Web3 game developers. Notably, the United States remains a significant market, accounting for 30% of Web3 game development teams. South Korea has also emerged as a key player, contributing 27% to the Web3 gaming teams, nearly doubling its involvement from the previous year.

The Footprint Analytics report highlights an interesting development with the upcoming release of “Gas Hero” by Find Satoshi Lab, known for their successful game “StepN.” Set for a community beta in late 2023, “Gas Hero” is an MMO set in a sci-fi world, distinct from “StepN’s” focus on physical activity. It’s expected to bring a fresh narrative and immersive experience to the Web3 gaming space, using Polygon blockchain and leveraging GMT tokens.

Trends, Data, And Predictions For Web3 Gaming

The Footprint Analytics report underscores a crucial trend in the Web3 gaming industry: while the number of games is increasing, active user growth is lagging, with only a small proportion of games having more than 1,000 monthly active users. This suggests a “false boom,” raising questions about the industry’s sustainability.

Despite these challenges, the industry sees promising developments. For instance, Sega’s co-COO Shuji Utsumi expressed optimism about blockchain gaming and NFTs, marking a shift in attitude from traditional gaming giants. Furthermore, the dominance of blockchains like BNB, Ethereum, and Polygon in hosting Web3 games is evident, with new partnerships, such as Immutable’s collaboration with Amazon Web Services (AWS), aiming to provide infrastructure solutions for Web3 gaming.

The market capitalization of Web3 gaming tokens has seen a notable increase in October 2023, aligning with Bitcoin’s surge. Standout projects like Axie Infinity have shown resilience and growth, suggesting that despite the broader market conditions, there is potential for success in the Web3 gaming sector.

Still Early, But A Nascent Industry

Moreover, the Web3 gaming sector has seen significant investments, with a reported $19 billion funneled into related projects since 2018. Despite a market correction in 2022, investment in Web3 gaming stabilized in 2023, maintaining pre-bull market levels. Notably, sports, MMOs, RPGs, and action game genres have attracted the most funding.

The majority of the Web3 gaming ecosystem comprises indie-level and midsize projects, with high-budget AA & AAA titles being relatively scarce. RPG, action, strategy, and casual games dominate the genre spectrum. Interestingly, most Web3 games are free-to-play, but a significant portion requires players to hold specific NFTs to access the game.

Furthermore, blockchain networks targeting the gaming sector are expanding despite market challenges. In 2023 alone, the announcement of over 81 new blockchain networks focusing on gaming indicated a 40% year-over-year growth. Developers primarily build the majority of web3 games on general-use L1 networks like Ethereum. However, there’s a rising interest in L2 and L3 solutions, particularly in Optimism’s L2/L3 networks.

The Play to Earn (P2E) model is a revolutionary concept in Web3 gaming that intertwines gaming achievements with real-world economic incentives. This model not only enhances player engagement but also creates a new avenue for income generation through gaming.

Understanding Web3 Play To Earn Games

Play to Earn games in the Web3 space enable players to earn digital assets or cryptocurrencies as rewards for gameplay and achievements. These rewards often come in the form of NFTs or native game tokens.

The P2E model capitalizes on blockchain technology to authenticate and secure these transactions, ensuring transparent and fair distribution of rewards. This model has opened up new opportunities for players, particularly in regions with limited access to traditional financial systems, by providing a platform where their gaming skills and strategies can translate into tangible economic benefits.

Popular Play To Earn Web3 Games

Several games have successfully implemented the P2E model, gaining popularity and a dedicated player base. Notable examples include:

These games have popularized the Play-to-Earn (P2E) model and demonstrated its creative integration into various gaming genres and platforms. They offer varied and engaging experiences to players while providing economic incentives.

To get the latest updates in the world of Web3 gaming, readers should visit NewsBTC.com and Bitcoinist.com. Additionally, both websites provide up-to-date news, covering the latest developments, trends, and insights in the Web3 gaming sector.

What Is Web3 Gaming?

Web3 gaming refers to a new generation of games that integrate blockchain technology, offering decentralized gameplay, true digital ownership of in-game assets, and often incorporating Play to Earn models.

What Are The Top Web3 Games?

Top Web3 games include Axie Infinity, Decentraland, The Sandbox, Illuvium, and Big Time, each known for unique gameplay and blockchain integration.

What Are The Best Web3 Games?

The best Web3 games are subjective but popular choices are Axie Infinity, Decentraland, and The Sandbox, recognized for their engaging content and robust player communities.

What Are The Most Successful Web3 Gaming Companies?

Leading Web3 gaming companies include Sky Mavis (Axie Infinity), Animoca Brands (The Sandbox), and Dapper Labs (CryptoKitties).

What Is Web3 Gaming Crypto?

Web3 gaming crypto refers to cryptocurrencies used within Web3 games for transactions, rewards, and governance, such as AXS in Axie Infinity or SAND in The Sandbox.

What Are Web3 Games?

Web3 games, built on blockchain technology, feature elements like cryptocurrency integration, NFT-based assets, and decentralized governance.

What Are The Latest Web3 Gaming News?

You can find the latest news on websites like NewsBTC.com and Bitcoinist.com, which cover new game launches, market trends, and industry developments.

What Are The Most Popular Web3 Play to Earn Games?

Popular Play to Earn games include Axie Infinity, Decentraland, and The Sandbox, where players can earn cryptocurrency or NFTs through gameplay.

The Terra Classic (LUNC) price has been on a tear recently and over the last month, it has managed to outperform almost every cryptocurrency in the market. Its price has risen over 300% in a 30-day period, and this has brought its market cap back over $1.5 billion once more. As the coin continues to outperform, the possibilities of it returning to its previous all-time high market cap become greater.

Following the Terra collapse in 2022, the LUNC (then known as LUNA) price crashed completely, going from above $100 to less than $0. This has continued through the last year especially as the LUNC supply has swelled to over 6.5 trillion.

As the price has plunged, so has the market cap. But with the recovery in price so far, the jump in market cap has come as no surprise. However, it is still a long way from its all-time high market cap of $45 billion which was reached back in 2021.

Now, if LUNC were to return to this all-time high market cap once more, it would be a significant increase from its current price. But it will still be a long way from its ATH price of $$120. At a market cap of $40 billion, the price of the altcoin would be just around $0.007.

This would mean a more than 10x increase from its current price. However, it’ll still be very low compared to its previous price as well as the price of the new LUNA token which was launched in 2023 and is already trading above $1.

The LUNC community has implemented a burn initiative to reduce the amount of tokens in circulation. This has seen billions of tokens taken out of circulation in less than a year. Data from the LuncMetrics website shows that so far, 83.77 billion tokens have been burned since the burn initiative was introduced in 2022. However, this is only a drop in the ocean of the total token supply which numbers in the trillions.

Nevertheless, the community continues to burn tokens in a bid to drastically reduce the circulating supply. In the last seven days, a little over 5.2 billion LUNC tokens have been sent to the burn address, reducing the supply little by little.

The LUNC price is already far from returning to its past glory, but there is still a lot ahead for the coin. If it continues to perform well in the bull market, a return to the $0.01 level is a possibility. As the crypto industry grows, the likelihood of top coins crossing the $100 billion market cap becomes even more likely, signaling a better future for the altcoin.

Bitcoin hit a fresh yearly high of $42,000, pushing the market capitalization of all cryptocurrencies over $1.5 trillion for the first since May 2022.

As institutional interest in Bitcoin grows, Fidelity and BlackRock’s proposed spot Bitcoin Exchange-Traded Fund (ETF) faces an unexpected hurdle: the crypto market’s unwillingness to let go of the coin at bargain prices.

According to Mike Alfred, who claims to be a value investor and a board director, the market will “unlikely” allow BlackRock to purchase BTC below $60,000. Taking to X on December 4, Alfred said BlackRock and other Wall Street players keen on issuing spot Bitcoin ETFs would have to “buy for Boomer’s 401k plans for at least $60,000.”

This preview stems from the rapidly growing demand among institutional investors, as seen by the number of Wall Street players willing to issue complex derivatives tailored for, among other investors, “baby boomers,” most of whom are “approaching retirement.” With their substantial retirement savings, baby boomers increasingly recognize BTC’s potential as a hedge against inflation and a store of value.

Following Federal Reserve intervention during the COVID-19 pandemic, inflation rose to multi-year levels in 2021. To preserve purchasing power, the central bank began hiking interest rates. Although inflation has fallen and the economy stabilized, it remains higher than the target of 2%. The Fed continues to track this metric and may further intervene by raising rates to lower inflation. This might impact Bitcoin prices, as seen in the past months.

Nonetheless, the potential influx of boomer money into Bitcoin via a Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) approved derivatives product is a big boost for the coin. Though the SEC has yet to authorize multiple spot Bitcoin ETFs, the crypto and Bitcoin market expects the strict regulator to greenlight the first product in the next few weeks.

Accordingly, ahead of this milestone development for the Bitcoin and crypto market, Alfred thinks BlackRock, Fidelity, and other players won’t secure Bitcoin at spot rates. Instead, the market anticipates that BlackRock, one of the world’s largest digital asset managers, will make their “bi-weekly purchases at prices above $60,000.”

The coin is trading at April 2022 levels, ripping above $40,000 over the weekend as bulls step up. Looking at the BTC candlestick arrangement on the daily chart, the first clear resistance is around $48,000.

The coin trades within a bullish breakout formation following gains above $32,000. As buyers step up and investors anticipate the SEC approving the first batch of spot Bitcoin ETFs, the coin will likely continue increasing toward all-time highs of around $70,000.

If approved, this third version of the plan will go into effect on Jan. 5, 2024, and see the company add 372 MW in capacity by 2027.

According to the fiscal year 2023 report, the IRS unit investigated failures to disclose crypto holdings and report on capital gains for transactions.

A transformative wave is sweeping through the decentralized finance (DeFi) arena, as novel blockchain platforms disrupt the status quo. Standing tall among these challengers is Solana, celebrated for its exceptional throughput and scalability.

In a recent turn of events, Solana’s DeFi ecosystem has etched a momentous milestone, thrusting itself into the dynamic DeFi landscape.

The surge in Total Value Locked (TVL) to an impressive $655 million signals a watershed moment, underpinned by the escalating interest and unwavering confidence in Solana’s prowess within the DeFi sector.

This surge not only marks a numerical achievement but also underscores the burgeoning significance of Solana as a formidable player in the evolving narrative of decentralized finance.

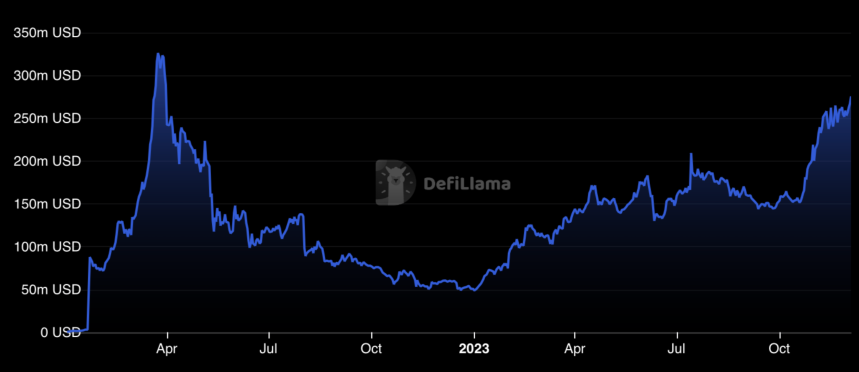

As of October 1st, DefiLlama’s statistics showed that Solana’s Total Value Locked (TVL) was around $326 million. Nevertheless, further examination revealed a significant increase in TVL by the end of October.

The TVL has soared to over $655 million as of the most recent release, demonstrating an amazing doubling from the October data. It’s not quite at its historical apex, but this increase is the highest TVL in more than a year, indicating a strong and steady growth trend.

The most recent numbers indicate a significant growth of almost 200% from Solana’s January 1st $211 million TVL. Solana’s TVL had a sharp decline following the collapse of FTX, falling from just over $10 billion in November 2021 to a low of $210 million in January 2023.

With this increase, Solana is leading the way in the expansion of decentralized finance. SOL, in particular, beat out the competition and took back Avalanche’s (AVAX) seventh rank with $678.7 million locked up and put to use in its processes.

There are a number of important reasons that have contributed to Solana’s growth and revival. The demand for Solana-based products, such Ordinals’ “SolScriptions” and other meme coins, has spurred demand and increased token minting on the Solana network.

Active involvement in liquid staking protocols such as Jito and Marinade Finance has further enhanced the network’s appeal by drawing in new users and improving liquidity.

In addition, Solana’s network saw an increase in daily addresses; as of press time, there were 158,000 daily addresses. All of these measures point to increased network traffic.

Not only is Solana’s notable expansion in the DeFi area a testament to the platform’s success, but it also serves as a barometer of the dynamic blockchain environment. It signals a change in the direction of more effective, scalable technology, upending the dominance of established platforms.

According to statistics from cryptocurrency market price tracker Coingecko, SOL was trading at $61.94 at the time of writing, up 12% over the previous seven days.

As the TVL more than doubles in recent times, attention turns to the potential impact on SOL’s valuation. The dynamic interplay between Solana’s TVL milestones and its cryptocurrency’s price sets the stage for an intriguing narrative in the crypto landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

The man who introduced the Winklevoss twins to crypto ended up in prison. He expressed no regrets to Cointelegraph.

The entire crypto market has seen a steady increase in open interest (OI) over the last few months. But the Shiba Inu open interest seems to not have followed this trend as much as others. While there has been a huge jump in the open interest of the largest cryptocurrencies in the industry, Shiba Inu’s rise has remained relatively muted, with implications for the altcoin’s price.

The Shiba Inu open interest initially started pumping back in August when the current bull run began. However, in the following months, the open interest has been considerably lower, happening at a time when open interest across other top cryptocurrencies is seeing large spikes.

Shiba Inu’s open interest crossed $43 million back in August but has had a hard time returning to this level, data from Coinglass shows. The open interest has since dropped and continues to range just below the $20 million level. Now, while this is not out of character for the altcoin, it is a deviation when it comes to following Bitcoin’s trends.

Dogecoin, SHIB’s foremost competitor, has followed the trajectory of Bitcoin, with the open interest staying low through the months of October and then exploding in the month of November. To put this in perspective, the Dogecoin open interest dropped as low as $226 million in October before exploding as high as $520 million in November.

However, the Shiba Inu open interest has struggled, maintaining a low peak of $17 million in November with a small rise to $18 million in December. This is in stark contrast to the open interest of Bitcoin and Dogecoin which have seen a flurry of activities as prices have recovered.

Another way that Shiba Inu has deviated from the rest of the crypto market is the fact that the price does not move directly proportional to the open interest. While the likes of Bitcoin and Dogecoin have shown prices moving upward as open interest has soared, SHIB’s price has remained fairly high while the open interest has remained fairly low.

This suggests that a rise in open interest is not actually one of the major factors pushing the SHIB price. So unlike others, a crash in open interest will likely not translate into a crash in price. However, Shiba Inu continues to trail the Bitcoin recovery closely, so a decline in the BTC price could sorely affect the SHIB price.

Spain and Brazil are chasing cryptocurrency stored abroad, while the U.K. wants taxes paid for crypto assets that weren’t previously declared.

Big Blue’s roadmap says it’s on pace to execute 100 million gates over 200 qubits in 2029 before a 10x improvement by 2033.

A crypto analyst has explained how the range around $2,000 could become a major Ethereum support base for years, making it not too late to buy ETH right now.

In a new post on X, analyst Ali has discussed about why Ethereum could still be worth getting into at this point. The analyst has cited data from the market intelligence platform IntoTheBlock to explain this, referring to the on-chain acquisition distribution of the cryptocurrency.

In the above graph, the dots represent the number of investors or addresses who bought their coins within the corresponding price range. Naturally, the larger the size of the dot, the more is the density of holders who bought inside the range.

It appears that out of all the price ranges that ETH has visited in its entire history, the $1,900 to $2,100 one hosts the cost basis of the largest number of holders.

ETH was just recently consolidating inside this range, and as trading occurred inside it, the investors slowly gained their cost basis there, which is why the range has now swelled so large.

Now, what relevance does this range have for Ethereum? To understand this, how investor psychology works must first be known. To any investor, their cost basis is a particular price level, as their profit-loss situation can flip when the asset’s spot price retests it.

Because of this reason, the holder might be more likely to show some kind of move when this retest takes place. If the investor had last been in profits, they might expect the same level to be profitable again, so they may just buy more.

A few investors doing such buying won’t make the market budge at all, but if a large number of investors bought inside the same tight range, the levels might just end up providing support to Ethereum should it make a retest.

The $1,900 to $2,100 buyers are obviously in profits, so this range, which hosts the cost basis of 5.85 million addresses who acquired 43.8 million ETH there, could show a major buying reaction if ETH dips towards it. Ali explains, “this range could become a significant support level for years ahead. So, it’s not too late to get in on ETH!”

In another post yesterday, the same analyst had posted the Ethereum weekly chart, noting that if ETH could secure a sustained candle close above the $2,150 mark, the asset could be set for some exciting uptrend.

As is visible from the chart, the ETH weekly price could be breaking above an ascending triangle pattern. “Targets in sight? We could be looking at ETH marching towards $2,600, and possibly even soaring to $3,500!” says Ali.

Ethereum has enjoyed some fresh bullish momentum during the past few days as it has now soared above the $2,200 mark.

Presidential candidates Asa Hutchinson, Vivek Ramaswamy and Dean Phillips will discuss blockchain and crypto ahead of the New Hampshire Primary.

Altcoins show compelling technical setups after Bitcoin price blew past $42,000 on December 4.

Cardano (ADA) has recently caught the attention of large-scale investors, also known as ‘whales.’ Crypto analyst Ali, leveraging on-chain data, has observed a significant uptick in large ADA transactions, typically over $100,000, in the past three months.

Ali noted that this growing trend suggests a heightened interest from institutional players and high-net-worth individuals in ADA. The analyst further disclosed that such whale activities have often been precursors of imminent price movements.

#Cardano | In the last three months, there’s been a significant increase in $ADA transactions over $100,000, reaching new highs consistently.

This surge points to growing interest in #ADA from institutional players and whales, which is usually a precursor to price spikes. pic.twitter.com/APczM2PGxM

— Ali (@ali_charts) December 4, 2023

Notably, while transactions can significantly impact a crypto’s market dynamics, when whales accumulate an asset, it often reduces circulating supply, creating potential upward pressure on prices.

Conversely, when they sell, it can result in a sudden increase in supply, leading to price drops. In ADA’s case, the recent whale activities have coincided with a positive price trajectory.

ADA’s market performance has mirrored the growing whale interest. In the last 24 hours alone, the crypto asset has experienced a 2.2% increase, and over 5% in the past week.

Although ADA has seen some retracement from its recently achieved peak above the $0.41 mark, it currently maintains a steady position in the $0.40 zone. This bullish trend is further supported by a surge in ADA’s trading volume, which has doubled from $250 million to over $500 million in a week.

This increase in trading activity and price aligns with the predictions of another analyst, Dan Gambardello. Gambardello has identified bullish setups in Bitcoin, Ethereum, and ADA, projecting that ADA could climb to $0.45 in the short term, with a longer-term target of $0.80-$0.85.

The analyst attributes his optimistic forecast to the growth and resilience of the Cardano ecosystem, even amid the recent broader market’s bearish trends.

GROUNDBREAKING MOMENT: Bitcoin, Cardano, Ethereum Setup For BULL MARKET https://t.co/cPfZzIVCxh

— Dan Gambardello (@cryptorecruitr) December 4, 2023

Recent data from DeFiLlama reveals a notable uptick in Cardano’s ecosystem, with its Total Value Locked (TVL) experiencing over 20% growth in the past month, currently standing at $275 million.

Although this figure is below its March 2022 peak of over $300 million, the ecosystem’s approach toward this previous high point reflects its resilience, as indicated by Gambardello amid the recent bearish market sentiments.

Gambardello’s enthusiasm for Cardano extends beyond its current market performance. The analyst believes that the Cardano ecosystem’s development during the bear cycle positions it for significant growth in the future.

Gambardello predicts that Cardano could soon account for 1% of the total crypto market capitalization. Such a milestone would be a testament to the asset’s ecosystem robustness and innovation, potentially leading to ADA’s substantial rise in the next bull run.

Notably, Gambardello isn’t the only analyst predicting a bullish future for ADA. In a recent post on X, Ali highlighted ADA’s presence in a crucial demand zone. The analyst pointed out that the price levels around $0.37 to $0.38 have seen substantial buying activity, with over 166,470 wallets acquiring ADA in this range.

#Cardano sits at a key demand zone between $0.37 and $0.38. Here, 166,470 wallets acquired 4.88 billion $ADA.

With minimal resistance ahead and solid support below, remaining above this zone could pave the way for $ADA to climb to new yearly highs. Still, watch out, as losing… pic.twitter.com/GDjhspFSVr

— Ali (@ali_charts) November 27, 2023

Ali interprets this strong buying interest as an indication of a solid support level for ADA. According to his analysis, ADA is poised for an uptrend with little resistance ahead, potentially exceeding its yearly high of $0.4518.

Despite ADA recently surpassing and seemingly respecting these key demand zones, its price has only reached a peak of $0.41 so far, not quite breaching the $0.45 mark.

However, given the surge in whale activity and the bullish sentiment enveloping the global crypto market, reaching and possibly surpassing the yearly high remains a plausible outcome.

Featured image from Unsplash, Chart from TradingView

The outspoken executive also said that Meta isn’t pursuing quantum computing because it isn’t currently useful.