The U.K. passed legislation in 2022 to make it one of the few countries in compliance with the extension of the Travel Rule to crypto.

Cryptocurrency Financial News

The U.K. passed legislation in 2022 to make it one of the few countries in compliance with the extension of the Travel Rule to crypto.

The exchange expanded its services in Canada earlier this week.

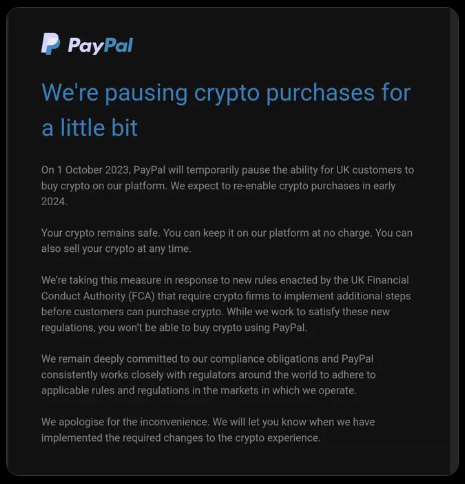

PayPal has announced a temporary suspension of cryptocurrency sales within the United Kingdom for a minimum of three months, commencing on October 1. This decision is in direct response to the recent regulatory reforms introduced by the Financial Conduct Authority, Britain’s financial regulator.

The FCA is set to implement more stringent guidelines aimed at curbing the advertising of cryptocurrencies to British consumers, which includes the mandatory inclusion of risk warnings and the discontinuation of “refer a friend” incentives.

In an email to customers, PayPal UK explained that customers who currently hold cryptocurrency in their PayPal accounts will be able to retain their holdings on the platform without incurring any fees. Furthermore, the option to sell their cryptocurrency at any time will remain available.

PayPal will ‘pause’ crypto purchases in UK

pic.twitter.com/NPkj7F61cC

— Crypto Crib (@Crypto_Crib_) August 16, 2023

However, the ability to purchase cryptocurrencies using PayPal will be temporarily suspended during the company’s efforts to ensure compliance with the new regulations set forth by the FCA.

This move comes against the backdrop of the impending enforcement of the “Travel Rule” in the UK. As of September 1, 2023, all cryptocurrency firms registered under the FCA will be obligated to adhere to the Travel Rule guidelines, a series of crucial Anti-Money Laundering and Know-Your-Customer regulations established by the Financial Action Task Force (FATF).

This mandate was introduced following governmental amendments to relevant legislation in July 2022.

PayPal, which has rapidly solidified its reputation as a crypto-friendly platform, introduced a notable addition to its offerings with the launch of its PayPal USD (PYUSD) stablecoin early this month.

The company originally unveiled its foray into the cryptocurrency realm within the United States in late 2020, positioning itself as a key player in the ever-evolving landscape of financial technology.

As the financial industry grapples with the ongoing integration of cryptocurrencies, PayPal’s response to regulatory changes highlights the evolving nature of the relationship between traditional financial platforms and the burgeoning world of digital currencies.

While the company navigates these challenges, users and industry stakeholders alike are keenly observing how this temporary pause in cryptocurrency sales will shape the future of PayPal’s engagement with the crypto market within the UK.

PayPal’s decision to temporarily suspend cryptocurrency sales in response to new FCA regulations underscores the complex interplay between regulatory developments and the cryptocurrency industry.

As the company strives to align with evolving standards, the trajectory of its cryptocurrency ventures will continue to influence the broader financial landscape.

Featured image from Francois Poirier/Shutterstock.com.

$570 million in weekly BTC options expire on Friday, and the recent macro and crypto news events have further tilted the advantage to bearish traders.

A federal judge will let the U.S. Securities and Exchange Commission file a motion that, if granted, would allow it to appeal a ruling that XRP transactions through exchanges didn’t violate securities laws.

Shiba Inu (SHIB), a dog-inspired meme coin, originally dismissed by many as just another fleeting fad, is now drawing serious attention from big players, or “whales,” in the crypto space. This attention comes amid the tokens’ recent sloppy launch of its other project, Shibarium.

Blockchain security team Beosin recently reported that the newly deployed Shibarium platform has had transactions stalled in a pending state, tying up approximately 1,003 ether, equivalent to $1.8 million in locked funds.

Transactions on #Shibarium are stuck in a pending state.

$1.7M are currently locked on ETH.Users are advised to temporarily stop using shibarium.https://t.co/io5puAibBc https://t.co/q2SXqtthoO

— Beosin Alert (@BeosinAlert) August 17, 2023

This sloppy launch has affected the SHIB token negatively seeing the tokens’ price decline by nearly 10% over the past 24 hours. However, despite this plunge whales are reportedly still making moves on Shiba Inu.

According to Santiment, a prominent blockchain data firm, there has been a noticeable increase in transaction activity by whales across several digital currencies, including SHIB and XRP.

As the crowd feels the pain, there are several assets seeing an increase in whale activity. As they attempt to capitalize on the discounted prices, read about the four projects we’re seeing some notable activity rises: $SHIB, $XRP, $SAND, & $CAKE https://t.co/SnuKebg7h1 pic.twitter.com/VWKlH95yU0

— Santiment (@santimentfeed) August 17, 2023

Specifically, for Shiba Inu, the numbers are compelling. Santiment’s data shows that there’s been a surge in transfers of SHIB valued at $1 million or higher.

According to Santiment, a possible reason for the increase in whale activity could be that these large investors are attempting to “capitalize on discount prices” of Shiba Inu and the other cryptocurrencies recording a surge in whale activity

Furthermore, this uptick in activity closely follows significant events in the Shiba Inu ecosystem, particularly the mainnet launch of Shibarium, which could be another contributing factor.

Shibarium represents a crucial advancement for the SHIB community and its broader ecosystem. And though its launch didn’t go as planned, its introduction likely plays a role in attracting these large investors and traders to SHIB, looking to capitalize on new opportunities brought about by the platform’s capabilities.

Over the past 24 hours, Shiba Inu has been in red regardless of the surging whale activity. Particularly, the dog-inspired meme coin has recorded a loss of 9.9% over this period and with a current market price of $0.0000087, at the time of writing.

This plunge is also reflected in the asset’s market capitalization which has seen a substantial loss of more than $600 million in the past day. Interestingly, despite the blood bath, Shiba Inu’s daily trading volume has remained resilient.

Over the past day, SHIB’s trading volume has hovered above $450 million and currently stands at a value of $461 million at the time of writing.

Featured image from Unsplash, Chart from TradingView

Moonstone Bank, which renamed itself Farmington State Bank, received roughly $11.5 million from FTX’s sister firm, Alameda Research, through its holding company in 2022.

This week’s episode of Market Talks discusses why 2024 could be bullish for the crypto industry and if crypto has weathered the storm.

The SEC has until August 18 to officially file its motion and the defendants will have until September 1 to respond.

Payments giant Mastercard has created a forum where crypto industry players can discuss and collaborate on central bank digital currencies, injecting its influential voice into the CBDC conversation as nations around the world consider whether to digitize their money.

PayPal has taken another step in its crypto mission following a team-up with hardware wallet provider Ledger. This time around, the payments giant is making it possible for users to purchase crypto directly without the need for extra verifications.

On August 16, Ledger and PaPal announced an integration to make buying cryptocurrencies easier. This feature will allow users to purchase crypto using PayPal directly from the Ledger Live app.

Chairman and CEO Pascal Gauthier of Ledger made a statement about integrating Ledger Live with Paypal to make crypto transactions easier.

“Both PayPal and Ledger are focused on creating secure, seamless, and fast transactions no matter where you are in the world. PayPal,” Gauthier said. “We’re combining the uncompromising security of Ledger with PayPal’s leadership in protected payments technology to help facilitate a seamless platform for user crypto transactions.”

Ledger Live’s integration with Paypal currently offers four cryptocurrencies in the US, such as Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), and Litecoin (LTC), and this will allow US residents to be able to purchase these cryptocurrencies with their verified Paypal accounts with no extra verification required.

What makes this integration so interesting is that no “withdrawal” process needs to be initiated by a user. All the crypto purchases made through Paypal via Ledger Live are immediately sent to the user’s wallet, according to the announcement.

Ledger Live’s integration with Paypal is indeed a significant step in the financial tech world, as the two giants share a similar vision of creating fast and seamless transactions on a universal scale.

Ledger is one of the most notable hardware wallet manufacturers, recording over 6 million Ledger Nano hardware wallet sales all around the world since 2016. Also, Ledger launched its Tradelink service in 2023 that will enable “off-exchange trading, enhanced security, distribution of risk, zero transaction fees, and a more efficient and faster trading” for institutional investors.

Paypal’s interest in the crypto world is by no means new. On August 7, Paypal made an announcement to launch its own Ethereum-based stablecoin called PYUSD.

However, nothing was said about PYUSD being listed as one of the coins that will be available on the Ledger Live just yet.

PYUSD’s launch has not been smooth either with regulators calling for more oversight following the launch. Last week, US congresswoman Maxine Waters called for federal oversight and enforcement of PayPal after launching the stablecoin.

PayPal also revealed plans to allow select customers to purchase cryptocurrencies such as Bitcoin and Ethereum using PYUSD. However, amid the new UK regulatory system that will come into play on October 8, Paypal plans to temporarily pause the buying of cryptocurrencies in the country from October 1 to resume crypto services in the Q1 of 2024.

Users will still be able to deposit and withdraw USDT, DAI, and RAI after the deadline, but trading will be suspended.

TK

The lending platform halted client withdrawals amid filing for bankruptcy in November 2022, but later petitioned the court for authorization to return user funds.

Bitcoin has plunged toward the $28,500 mark during the past day, which happens to be quite near a historically significant support line.

As pointed out by an analyst in a CryptoQuant post, BTC’s latest drawdown has brought it near the realized price of the short-term holders. The “realized price” here refers to a metric that’s derived from the “realized cap” model of Bitcoin.

The realized cap calculates the total valuation of the asset by assuming that the actual value of any coin in circulation is not the current spot price, but the price at which the coin was last transacted on the chain.

Since the last transfer price of any coin is likely to represent its buying price, this model accounts for the prices that each investor in the market bought their coins, and hence, the realized cap may be looked at as a measure of the total capital that holders have put into the cryptocurrency.

When this model is divided by the total number of coins in circulation, the average cost basis or acquisition price in the market is obtained. This is precisely what the realized price is.

If the Bitcoin spot price goes below this indicator, it means that the average investor has gone underwater. Similarly, breaks above the metric signify a return to profits for the majority of the market.

The realized price can also be defined for specific segments of the market. In the context of the current discussion, one part of the market is of relevance: the “short-term holders” (STHs).

Here is a chart that shows the trend in the Bitcoin realized price for this cohort:

The STHs include all investors who bought their coins within the last 155 days. The holders that pass beyond this threshold are termed “long-term holders” (LTHs).

From the chart, it’s visible that with the latest decline, the Bitcoin spot price has come very close to the STH realized price. This would suggest that these investors as a whole are about breaking even on their investment currently.

In the chart, the quant has highlighted how previous retests of this line have gone in this year so far. Interestingly, both back in March and June, the cryptocurrency found support at this metric and observed a sharp rebound.

This is a trend that has historically been seen during bullish periods. The reason behind this curious pattern may perhaps be the fact that the STHs look at their cost basis as a profitable point for accumulating more of the asset in such periods, as they believe that the price would only go up in the near future.

The extraordinary buying pressure at the line may be why the asset finds support at this level as well. This is because the opposite happens during bearish periods, as holders look to escape the market at their break-even point.

It now remains to be seen how Bitcoin’s interaction with the STH realized price will go this time around. Naturally, a successful retest would be a positive sign for the rally, as it would show that these investors haven’t yet lost their bullish conviction in the coin.

At the time of writing, Bitcoin is trading around $28,500, down 3% in the last week.

Decentral Park’s Kelly Ye provides an overview of what tokenization is and how will it affect the investment landscape.

Despite assurances, discrepancies between Cardano’s theoretical network capacity and its utility remain.

As Coinbase Inc. (COIN) scraps with the U.S. Securities and Exchange Commission (SEC) on its right to exist as an exchange, the company has achieved an unprecedented milestone in U.S. oversight by winning approval to handle customers’ buying and selling of crypto futures.

Mark Smargon, CEO of Fuse, explains how blockchain-powered payments can fix the “broken traditional payment system.”