Democrat Representative Gerald Connolly said Donald Trump is unlikely to uphold a “single provision” of the Presidential Ethics Reform Act without intervention.

Cryptocurrency Financial News

Democrat Representative Gerald Connolly said Donald Trump is unlikely to uphold a “single provision” of the Presidential Ethics Reform Act without intervention.

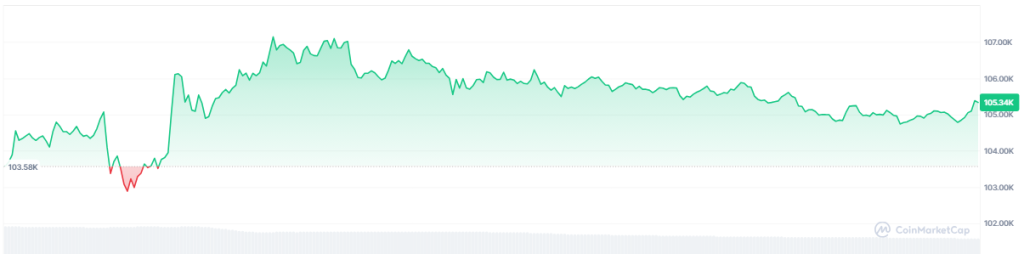

Many analysts are ruminating on the next significant milestone, as the remarkable price increase of Bitcoin has captivated the market’s attention. A research company, 10x Research, predicts thatthe alpha coin could reach $122,000 by February. Although this may appear to be an ambitious goal, it is consistent with the optimistic perspective of numerous experts who have observed Bitcoin’s capacity to surpass critical price thresholds since the approval of Bitcoin ETFs.

The momentum of Bitcoin is undeniable. In recent months, its price has fluctuated in a consistent manner, with periodic increases that have typically occurred within the $16,000–$18,000 range.

Markus Thielen of 10x Research believes that these consistent increases indicate a continuation of upward movement, which implies that $122,000 is feasible in the near future. Thielen underscores that the crypto asset’s market conduct may experience a pause upon attaining this objective, despite the optimistic outlook.

Thielen believes Bitcoin’s breakout presents a “low-risk, high-reward entry opportunity,” with Bitcoin trading at $105,727. He noted that after Donald Trump’s inauguration, BTC tested the $101,000 resistance, making it a favorable time to buy with stop-losses around $98,000.

Thielen also pointed out that Bitcoin has risen in $16,000–$18,000 increments since the launch of spot Bitcoin ETFs in the US, suggesting it could reach $122,000 by February before entering another consolidation phase.

A period of consolidation may ensue following Bitcoin’s prospective ascent to $122,000. This phase, during which its price stabilizes prior to another outburst, has been a recurring trend throughout its history. Investors should anticipate this period of sideways price action, which may present new opportunities for those who are anticipating a more favorable entry point.

Strength In Relation To The Stock Market

The optimistic forecast is also in line with the relative strength of Bitcoin in comparison to traditional markets. Despite the challenges that equities have encountered, it has demonstrated remarkable resilience.

Due to the increasing number of institutional investors who are investing in Bitcoin, the price of this digital asset is becoming less correlated with the broader financial market. This pattern has the potential to intensify the upward trajectory toward $12,000.

Meanwhile, according to current price predictions, the price of Bitcoin is predicted to rise by 24% and reach $ 130k by February 21, 2025. Technical indicators, according to CoinCodex, show the current sentiment is Bullish while the Fear & Greed Index is showing 84 (Extreme Greed).

When?

Though historical success of Bitcoin does not ensure future outcomes, the present conditions are favorable for more growth. The cornerstone for any price increases is Bitcoin’s ability to profit on positive news, such as ETF approvals, together with institutional support. The question is not whether Bitcoin will hit $122,000; rather, when.

Featured image from Getty Images, chart from TradingView

Ethereum (ETH) has been underperforming in recent weeks, with its price action leaving investors disappointed following last week’s flash crash and heightened volatility. Despite initial hopes for a recovery, ETH has struggled to regain momentum, trending downward since mid-December. This lack of bullish movement has left investors eager for a surge that could break Ethereum out of its current slump.

Adding to the anticipation, top analyst Carl Runefelt recently shared a technical analysis suggesting that Ethereum may be preparing for its next significant move. According to Runefelt, ETH is forming a 4-hour symmetrical triangle, a pattern often associated with periods of consolidation before a breakout. While the direction of the breakout remains uncertain, the formation indicates that a decisive move could be on the horizon.

As Ethereum hovers near key levels, market participants are closely monitoring the triangle’s resolution. A breakout to the upside could reignite bullish sentiment, while a breakdown may signal continued struggles for the largest altcoin. With the broader crypto market showing signs of recovery, the coming days will be crucial for Ethereum to prove its resilience and reestablish its position as a leading performer in the space. All eyes are now on ETH’s next move.

Ethereum is currently in a short-term consolidation phase, trading between key demand and supply levels as the market grapples with uncertainty. While analysts are anticipating a major move, the direction remains unclear due to heightened volatility and mixed sentiment among investors. ETH’s price action reflects a market in wait-and-see mode, with traders closely monitoring key technical levels for signs of a breakout.

Top analyst Carl Runefelt recently shared his technical analysis on X, highlighting Ethereum’s preparation for its next significant move. According to Runefelt, ETH is forming a 4-hour symmetrical triangle, a pattern that often precedes a decisive breakout. He noted that this setup comes with both bullish and bearish scenarios, depending on the direction of the breakout.

If ETH breaks above the triangle, the bullish target is set around $3,900, signaling the potential start of a new bullish phase. Conversely, a breakdown below the triangle would point to a bearish target near $2,720, indicating further downside. Runefelt emphasized the importance of monitoring this pattern as it unfolds, as the outcome could set the tone for Ethereum’s next trend.

With market sentiment still uncertain and volatility remaining high, Ethereum’s symmetrical triangle offers a clear framework for traders. Whether the breakout is upward or downward, it will likely mark the beginning of a significant move, shaping Ethereum’s trajectory in the weeks to come. For now, investors are keeping a close eye on this critical technical formation.

Ethereum is currently trading at $3,317, navigating a market dominated by massive volatility. This heightened price action has become the primary force driving speculation and uncertainty among traders. As Ethereum struggles to stabilize, holding above critical support levels is essential to maintaining a bullish structure and avoiding further downside.

The $3,300 level has emerged as a key area of support that bulls need to defend to sustain momentum. If ETH can hold this mark and push above the $3,550 resistance with strength, it could solidify a bullish outlook and potentially lead to a stronger recovery. Breaking this level would also signal renewed confidence among investors, opening the door to a more sustained upward trend.

However, the market’s uncertainty also carries the risk of a deeper correction. Losing the $3,000 psychological level could trigger additional selling pressure, leading to a dramatic drop and testing lower support zones. Such a move would challenge ETH’s resilience and likely extend its consolidation phase.

As the market waits for clearer signals, Ethereum’s ability to hold above key levels will be closely watched. The coming days are critical for determining whether ETH can maintain its structure or face further volatility and downside pressure.

Featured image from Dall-E, chart from TradingView.

Numerous cohorts of Ethereum addresses added over 330,000 ETH in the last two weeks. Is this a sign that a $5,000 ETH price is in the making?

The Silk Road creator walked free on Jan. 22 after 12 years in prison. Wallets tied to him are rumored to be worth around $47 million.

Dear CoinDesk Community,

Starting today, some readers will be asked to register for a free account to continue accessing our content.

This change is part of a pilot program to help us better understand the needs of our audience and ensure that we are delivering content that is relevant and tailored to your interests. Registration is quick, free, and we promise to keep your personal information safe.

This trial marks an important first step in understanding what users enjoy on the site and sets the stage for offering exciting new features. This includes advanced data tools, in-depth reports, protocol deep-dives, and investigative content, bringing together the best reporting and analysis CoinDesk has to offer.

If you’re prompted to register, we hope you’ll take a moment to join us. By doing so, you’re helping shape the future of CoinDesk and ensuring we continue to provide the very best coverage of the digital assets industry as it enters an expansive new phase.

Thank you for your ongoing support. We’ll keep you updated on our progress and share more about what’s ahead in the coming months.

Best regards,

Team CoinDesk

Solana rallied by 7% on Jan. 22, but a few data points suggest a move to SOL’s all-time high could take longer than expected.

According to the CME, 29.4 million crypto futures contracts were traded in 2024, valued at over $1.7 trillion in notional figures.

The complaint, filed in December 2024, alleged “antitrust injury” from Coinbase over its decision to delist wrapped Bitcoin in favor of promoting its cbBTC product.

REX Shares, a financial services company known for its innovative approach to ETFs, recently submitted filings for ETFs tied to a few cryptocurrencies, including Dogecoin. These filings mark a pivotal moment for Dogecoin amidst the current excitement in the crypto market, with the positive sentiment now at a multi-year high.

The crypto industry has been filled with excitement in the past few days leading to and after the inauguration of new US president Donald Trump. This excitement has brought alongside it an intense volatility to the price action of many cryptocurrencies.

Amidst this intense volatility, asset management firms REX Advisers and Osprey Funds have jointly submitted filings to the U.S. Securities and Exchange Commission (SEC) seeking approval to launch seven new cryptocurrency ETFs. These ETFs are designed to provide exposure to a range of digital assets, including established tokens like Solana and Ripple’s XRP, as well as meme coins such as Dogecoin and even the recently launched TRUMP coin.

ETFs are currently the rave in the crypto industry due to the success of the Spot Bitcoin ETFs that were launched in the US early last year. Their widespread success marked a turning point for institutional investment in crypto. Following their success, Spot Ethereum ETFs also entered the market, paving the way for discussions about spot ETFs for other digital assets, mostly XRP and Solana.

Interestingly, the new ETF filings by REX could be seen as an effort to capitalize on the growing interest in diverse crypto assets and to test the SEC’s evolving stance under its new crypto-friendly leadership. Bloomberg senior ETF analyst Eric Balchunas highlighted the growing interest in this space, noting that the number of crypto ETF filings with the US SEC has now reached 33, essentially doubling since Gary Gensler stepped down as the regulator’s chairman last Friday.

Specifically, the nature of the filings means that these proposed could hit the market very quickly in the next 75 days. Dogecoin, for one, is projected to benefit the most from an ETF hitting the market. This is because recent crypto market dynamics have caused Dogecoin to become the go-to cryptocurrency for retail investors since Bitcoin is increasingly becoming the choice for institutional investors.

Historically, Dogecoin has shown its ability to rally sharply on the back of positive trends, such as Elon Musk’s tweets and listings on major exchanges. If the Dogecoin ETF gains approval, it could attract substantial inflows from new investors. This, along with the community support for Dogecoin, could pave the way for a significant price surge above $1. Crypto analysts are already predicting that Dogecoin will break the $1 mark this cycle, noting various technical indicators and patterns to back this prediction.

At the time of writing, Dogecoin is trading at $0.364, up by 5.1% in the past 24 hours. Reaching $1 from the current level would represent a 175% price increase.

The release of Ross Ulbricht and the lifting of sanctions on Tornado Cash mark pivotal moments for the crypto community. It’s more than symbolic. It’s an opportunity to clearly rebrand the U.S. as a safe place to build the internet of money.

Ross’ freedom comes after over a decade of imprisonment — a journey defined by relentless advocacy, legal battles, and unwavering support from the crypto community. His release matters deeply to me because over a decade ago I launched Silk Road 2.0, his site’s successor.

His double life sentence without parole wasn’t just about the Silk Road, though. It symbolized the U.S. government’s resistance to the blockchain industry and to the idea of a financial system controlled by individuals instead of big banks.

The U.S. dollar is the world reserve currency; and, cryptocurrency has given the world democratized access to this reserve via stablecoins. Satoshi Nakamoto announced Bitcoin as a “peer-to-peer electronic cash system,” and the Silk Road was the first to actually execute that vision. Silk Road opened the door to cryptocurrency and introduced Silicon Valley (and many other groups) to bitcoin. It spawned companies like Coinbase, projects like Ethereum, and paved the way for stablecoins, which are not yet private.

Still, there is no legitimate marketplace for buying and selling things with bitcoin. Our industry’s reputation is that we’re highly speculative and scam-filled. We can’t forget that Satoshi created bitcoin for payments, not speculation.The U.S. cannot miss out on the internet-of-money. During previous administrations, global developers have become nervous to even attend conferences hosted here. This has consequences for the U.S. crypto industry. Ross’ release is a clear signal that the U.S. is no longer a scary place to innovate in cryptocurrency. His experience underscores the need for proportionate justice and serves as a reminder of the human cost of overreach in regulating innovation.

Read more: Silk Road Founder Ross Ulbricht Pardoned by President Trump

His release is an opportunity for reflection — to celebrate his freedom while remaining clear-eyed about the past. Ultimately, his harsh sentence stymied bitcoin innovation for all of us. We must ensure his case becomes a catalyst for constructive change rather than a footnote in a history of missed opportunities, a series of memecoins, or a divisive narrative that further erodes trust.

Similarly, the case of Tornado Cash founder Roman Storm — who is still in legal jeopardy — clearly shows the dangers of criminalizing innovation. Tornado Cash offers a critical function (a “mixer”) in enabling private Ethereum transactions — an essential component of conducting business competitively.

It’s important to create privacy technologies, but we also need to understand the line between legal and illegal use cases. Yes, launch the Silk Road, but don’t allow the sale of drugs on it. Launch Tornado Cash, but don’t encourage money laundering on it. The chilling effect that both cases have had on developers like me cannot be overstated. Privacy innovators in the U.S. and abroad are now second-guessing their work, fearing legal repercussions for creating tools that protect privacy.

And what do you do when you launch something decentralized that takes on a life of its own? The sanctions on Tornado Cash were deemed unlawful by the Fifth Circuit Court, yet the Department of Justice dismissed the ruling as irrelevant. Tornado Cash’s developers were allegedly aware of its misuse for money laundering but did not act decisively to address it. On a decentralized platform, should its initial developers be responsible for users’ activity? There is a clear need for America to define a “Section 230” for developers of decentralized software to not be criminally liable for what their users do on their platforms. (“Section 230” refers to a law freeing social media platforms from responsibility for content published on their networks.)

Read more:

As entrepreneur-politician Vivek Ramaswamy said, “You can’t go after the developers of code. What you actually need to do is go after individual bad actors who are breaking the laws that already exist.”

To move forward as an industry, we need to separate the tools from the misuse of those tools. Privacy technologies like Tornado Cash, Monero, and Zcash are unfairly stigmatized due to their potential use for illicit activities. But they hold transformative potential for legitimate use cases, from safeguarding personal financial data to enabling secure business transactions.

Zcash, with its optional shielded transactions, provides individuals and businesses with the ability to conduct secure, private transactions while remaining compliant with anti-money laundering (AML) and know-your-customer (KYC) regulations. Such innovations bridge the gap between cryptocurrency and traditional industries, empowering businesses to adopt crypto without exposing sensitive financial details.

Privacy tech like Zcash also addresses a fundamental flaw in bitcoin and other public ledger cryptocurrencies: the exposure of transaction data that creates competitive disadvantages and privacy risks. Soon, Zcash will be on Mayachain, allowing a decentralized way to convert between bitcoin and Zcash. It will also soon support ZSAs (shielded assets), which will enable stablecoins to be issued privately for the first time.

The new administration has proposed a national “Strategic Bitcoin Reserve” but this raises questions about privacy and decentralization. Unlike other reserves, such as gold, Bitcoin’s blockchain discloses deposits and withdrawals to the public forever. Is the Trump Administration aware of this? This level of transparency is a double-edged sword, making privacy technologies even more essential for maintaining competitive and strategic advantages.

So, where do we go from here? Bitcoin and the broader cryptocurrency industry are at a crossroads. This is a moment to refocus on the principles that drove early adoption: a perception of privacy, financial freedom and, most importantly, peer-to-peer payments.

The U.S. crypto landscape, currently a mess of regulatory uncertainty, scams, and collapses, needs reevaluation. Rather than demonizing privacy innovations, policymakers must work with developers to create clear, enforceable standards for responsible uses of “electronic cash.” This means proactive education and collaboration with regulators, more investment in privacy technologies, and development of a regulatory framework that encourages U.S. blockchain innovation.

The Silk Road founder received a commuted sentenced from US President Donald Trump on Jan. 21 after being sentenced to life in prison in 2015.

Payments-focused cryptocurrency XRP and world’s most-used blockchain Solana (SOL) prices spiked on Wednesday afternoon, after report that the Chicago Mercantile Exchange (CME) is adding futures contracts of both.

According to a post on X, CME have posted the futures page for XRP and SOL in their “staging subdomain.”

A screenshot of the website shows that the regulated futures could start trading on Feb. 10 pending regulatory approval. The website was not accessible at the time of publication. CoinDesk reached out to CME for comments.

XRP and SOL jumped as much as 3% in the minutes after the post started circulating on social media, TradingView data showed.

Read More: Solana Bull Bets Big on SOL Rallying to $400

Analysts believe US interest rates will not change, but Bitcoin price could benefit if the Federal Reserve mentions quantitative easing at the next FOMC.

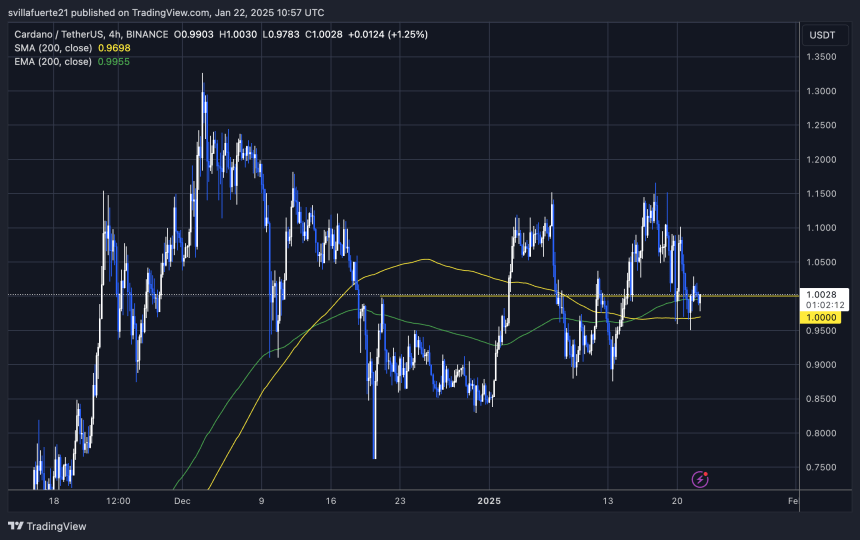

Cardano (ADA) has been a focal point of the crypto market’s volatility, experiencing sharp price swings over the past week, particularly during the weekend. In just a few days, ADA has dropped over 18%, leading to growing fear and uncertainty among investors. This significant decline has shaken confidence in Cardano’s short-term outlook, with many wondering whether the asset can regain its momentum.

Despite the market turbulence, top analyst Ali Martinez has offered a more optimistic perspective. Sharing a detailed technical analysis, Martinez suggested that Cardano is poised for a significant move upward once it overcomes a critical resistance level at $1.10. According to Martinez, breaking through this resistance could open the door for ADA to rally toward $1.50, marking a substantial recovery from its recent lows.

As investors weigh their options amid the current volatility, Martinez’s analysis provides a glimmer of hope for those looking for a bullish turnaround. With the broader market showing signs of recovery, all eyes are on Cardano’s ability to reclaim key levels and shift market sentiment. The coming days will be crucial for ADA as it attempts to shake off fear and uncertainty and position itself for a potential rally.

As the cryptocurrency market continues to grapple with heightened volatility and uncertainty, Cardano has managed to hold its ground above key demand levels. Despite recent turbulence, ADA’s ability to maintain these crucial levels has kept investors cautiously optimistic about its potential for a significant breakout. The price action indicates mounting bullish pressure, with many market participants eagerly awaiting a decisive move.

Top analyst Ali Martinez recently shared a technical analysis on X, highlighting Cardano’s promising setup. According to Martinez, ADA is poised for a rally to $1.50 if it can overcome the critical resistance level at $1.10. This level has proven to be a significant barrier, but a successful breakout would signal renewed momentum and set the stage for a sustained upward trend. Martinez’s analysis provides a beacon of hope for investors seeking confirmation of ADA’s bullish potential.

However, the outlook is not without risks. If ADA fails to hold its current demand levels, the possibility of a deeper decline looms large. Losing these levels could lead to a wave of selling pressure, testing investor confidence and delaying the anticipated breakout.

As the market watches closely, Cardano’s next moves will be critical in determining its trajectory. The coming days will reveal whether ADA can capitalize on its resilience and push through resistance or face further consolidation. For now, the balance of risk and reward keeps investors on edge as they anticipate what could be a defining moment for Cardano in the current market cycle.

Cardano (ADA) is currently trading at $1, following an 18% drop from its $1.16 local high set last Friday. The recent decline has raised concerns among investors as ADA hovers near the critical psychological level of $1. Holding this level is crucial for bulls to regain momentum and prevent further downside in the short term.

To reclaim bullish momentum, ADA must not only maintain support at the current levels but also push decisively above the $1.11 resistance in the coming days. Breaking through this level would signal renewed strength and could pave the way for a recovery toward higher targets, boosting investor confidence in the process.

However, the risk of a deeper correction remains if ADA fails to defend the $1 mark. Losing this key psychological support could trigger a wave of selling pressure, potentially resulting in a drop of up to 15% in the short term. Such a move would likely test lower support zones, challenging Cardano’s recent resilience.

Featured image from Dall-E, chart from TradingView.

Despite a rally in the US Dollar Index and cooler-than-expected Consumer Price Index data, inflationary fears persist.

Among the most vocal critics of TRUMP, the controversial and wildly popular memecoin launched by Donald Trump on the eve of his 2025 inauguration, are the very crypto enthusiasts he may have hoped to court.

The TRUMP coin, launched on Jan. 17, saw a dramatic price surge, climbing from $7 to an all-time high of $75 within 24 hours before settling at $38. While the token’s volatile trajectory has minted a few overnight millionaires, it has also drawn sharp criticism from industry insiders.

Two days after TRUMP’s debut, MELANIA, a coin endorsed by First Lady Melania Trump, entered the market. Unlike its predecessor, MELANIA has struggled, starting around $7 and plummeting below $4 after a briefly peaking at $14.

The potential for conflicts of interest has been a focal point of the backlash, with critics — including members of the U.S. senate — raising concerns that the token could enable individuals to curry favor with the president.

Anthony Scaramucci, a former White House communications director turned crypto advocate, voiced his apprehensions on X (formerly Twitter): “The most perilous aspect of Trump coin for the nation is what follows. Now, anyone globally can effectively deposit money into the bank account of the President of the United States with just a few clicks. Every favor—be it geopolitical, corporate, or personal—is now openly for sale.”

The decision to launch a memecoin has also sparked broader criticism within the crypto industry. While memecoins have become a prominent use-case for blockchain technology, many developers argue they reinforce a get-rich-quick perception that undermines the sector’s credibility.

Gabor Gurbacs, founder of digital asset firm Pointsville, posted on X: “Trump needs to dismiss his crypto advisors, from top to bottom.”

Nic Carter, a general partner at a crypto investment firm and a vocal Trump supporter, was similarly scathing: “It’s absolutely preposterous that he would do this,” he told Politico. “They’re plumbing new depths of idiocy with the memecoin launch.”

Specific concerns have been raised about the coin’s distribution. 80% of TRUMP tokens are concentrated in a small number of blockchain addresses controlled by CNC Digital, the firm that launched the coin. Such concentration is a hallmark of potential “pump-and-dump” schemes, where insiders inflate a token’s value before selling off their holdings, leaving other investors with losses.

There’s no evidence that Trump’s team plans to “dump” its tokens. Nicolas Vaiman, CEO of blockchain analytics firm Bubblemaps, noted to CoinDesk that the distribution of TRUMP tokens at least matched what was outlined on its official website. Additionally, the insider-held tokens align with prior distributions of Trump’s NFT trading cards, which were also managed by CNC Digital, meaning the tokens may be reserved for the president’s NFT holders.

The same transparency does not apply to MELANIA, however. About 89% of MELANIA tokens are controlled by insiders, according to Bubblemaps. The on-chain supply does not match an official distribution breakdown on the token’s website, which earmarked 35% of tokens for “public distribution” and “community.”

Vaiman said the First Lady’s memecoin has cast a shadow over the original TRUMP coin: “TRUMP could have been a statement from President Trump saying, ‘I endorse crypto,’” Vaiman said. “Melania launching her tokens feels like they just want to make as much money as they can on this, and then forget about it. It gives this a different flavor.”

This is not the first time the crypto community has questioned Trump’s forays into the industry. In August, Trump and his sons launched World Liberty Financial (WLFI), a platform that promised to develop a lending product. The project drew backlash for pre-selling tokens before delivering any tangible value, and critics were quick to point out the involvement of a former dating coach and memecoin promoter on the WLFI team, as well as the allocation of a percentage of presale proceeds directly to a Trump-controlled company.

The conflict-of-interest potential was also immediately apparent. Tron blockchain-founder Justin Sun recently became WLFI’s largest investor, making a $30 million purchase of the project’s tokens. In an X post on Tuesday, Donald Trump Jr. announced that World Liberty Financial would acquire some of Tron’s TRX tokens for its treasury.

A Hong Kong-based crypto billionaire, Sun was previously charged with fraud by the Securities and Exchange Commission — a department now under the control of Trump’s White House.

Bitcoin is consolidating between $100,000 and $109,588, and charts currently indicate a higher chance of an upside breakout.

NFT collection Mad Lads surged in market capitalization as the price of Solana reached a new all-time high.

Sentiment towards Ethereum’s ether (ETH) has sunk to depressed levels in recent times, but the latest maneuver of President Donald Trump-related crypto platform could spur hope for a reversal.

World Liberty Financial (WLFI), the decentralized finance (DeFi) platform linked to the Trump family, this week deposited a total of 10,000 ether (ETH) worth $33 million to liquid staking platform Lido Finance (LDO) to stake and earn rewards, blockchain data by Arkham Intelligence showed. Lido is the largest ether staking platform with $31 billion of assets posted on the platform.

The transactions came after World Liberty Finance acquired more than $110 million worth of crypto assets including ETH, wrapped bitcoin (wBTC), Tron’s TRX, AAVE, LINK and Ethena’s ENA, as CoinDesk reported.

The maneuver raises hopes that regulators will soon allow staking for spot ETH exchange-traded funds. SEC Commissioner Hester Pierce, who now leads the agency’s crypto task force, said last month in an interview with Coinage that she was open to considering staking for ETFs. Former SEC Chair Gary Gensler, known for his anti-crypto stance in the industry, stepped down on January 20 with Trump entering office.

Staking would boost appeal for the investment products, letting investors earn a steady stream of yield on their holdings and reducing product fees. U.S. spot ETH ETFs combined hold $12 billion of assets, according to SoSoValue data.

The potential regulatory approval also could jolt ETH’s price and adjacent ecosystem tokens like Lido’s LDO. Ethereum’s future has been under the microscope recently, amid sagging prices relative to competitors, leadership disputes and worries over the project’s development roadmap. ETH recently dropped to a 4-year low price against bitcoin (BTC) and ceded market share in trading activity to rapidly growing blockchains like Solana.

“I will never trade ETH again after, but watch how quickly the sentiment changes when the staked ETH ETFs come through in the next few weeks,” well-followed crypto trader Pentoshi said.

“ETH will have a multi-week giga pump at some point in 2025, around staking ETF news… If [you’re] too long ETH, that’s when you dump and switch to better performing assets,” said Alex Krüger, partner at Asgard Markets, in an X post.