Lawyers are trying to untie a complex financial web among companies that went under in the crypto winter.

Bitcoin soars in Argentina as Javier Milei wins presidential primary

Despite slumping in global crytocurrency markets, Bitcoin has jumped to new highs in Argentina after BTC-friendly presidential candidate Javier Milei won the primary vote on Aug. 13.

Polygon: New Partnership With Korean Telecom Giant Fails To Halt MATIC Slide

The Polygon (MATIC) price continues to fall. Even the recent positive news from Korea and the strong data from the NFT market cannot change this. Since the yearly high on February 13 at $1.56, the MATIC price has currently fallen 60% and is trading at just $0.6169.

Since the high, MATIC has been in a clear downtrend, which was last tested in mid-July. However, a breakout was not successful, both the trendline and the coinciding 200-day EMA have proven to be too strong a resistance. Now MATIC has also fallen below the 23.6% Fibonacci retracement level at $0.75.

If the support at $0.60 (in shorter time frames) now also falls, a plunge towards the yearly low at $0.50 could be imminent. However, if the level establishes itself as support in the next few days, a new attempt to break out of the downtrend could start.

For this, MATIC would currently have to rise above $0.71. However, validation of the breakout from the downtrend would have to come from the 23.6% Fibonacci retracement level. Only if MATIC rises above $0.75 the bulls might regain the upper hand. Then, the 200-day EMA at $0.84 would be the next major task that MATIC bulls have to master. Until then, MATIC seems poised for further downside.

Even Positive News Can’t Move Polygon Price

It is a bad omen for the MATIC bulls that even positive news cannot move the price. In the last two days Polygon has been able to report no less than two positive news. Today, Polygon Labs has inked a strategic alliance with SK Telecom (NYSE:SKM), South Korea’s foremost mobile telecom operator. This collaboration is geared towards the expansion of SKT’s Web3 ecosystem, positioning the telecom behemoth at the forefront of the burgeoning decentralized tech sector.

Polygon’s CEO, Marc Boiron, elucidated the intent behind the partnership, stating, “Polygon Labs has been developing optimal blockchain technology for Web3 popularization, and we see this collaboration with SKT as an important step in providing Web3 experiences to more consumers.”

Central to this synergy is the integration of the Polygon blockchain within SKT’s NFT marketplace, TopPort, as well as its forthcoming Web3 wallet, set for launch in 2023. The wallet promises to offer users high-speed, cost-effective transactions, augmented by Ethereum’s intrinsic security and decentralization features. Given the widespread utilization of Polygon-based solutions by global brands, this integration is likely to enhance SKT’s Web3 offerings considerably.

Both entities will be actively scouring for promising Web3 startups to nurture and support. “By combining our experience in blockchain services and Polygon Lab’s blockchain infrastructure and ecosystem, we will be able to create valuable business opportunities and boost the Web3 ecosystem,” voiced Oh Se-hyun, Vice President and Head of Web3 CO at SKT.

Moreover, Polygon’s NFT ecosystem clinched the second spot in traded volume over a month-long period, as highlighted by Polygon Labs founder Sandeep Nailwal. Interestingly, this surge can be attributed not just to high-value transactions but a flurry of micro-transactions, indicating Polygon’s accessibility and widespread use.

By number of transactions, Polygon is 3x of Ethereum mainchain, that means there is a lot of micro transactions happening. The amount of “buyers” on Polygon also is 30% higher than the mainchain. This trend clearly solidifies Polygon’s burgeoning position in the decentralized tech sector.

5 smart contract vulnerabilities: How to identify and mitigate them

Explore five critical smart contract vulnerabilities that pose risks to blockchain systems. Learn how to spot and neutralize these threats for secure and resilient DApps.

Cardano Holder Resilience Tested As ADA Fends Off Bearish Onslaught

Cardano is currently facing a stark contrast between its promising development trajectory and the significant losses incurred by ADA holders.

Recent price analysis has revealed that the losses are nearing an astonishing 90%, sending waves of concern through the cryptocurrency community. The once-active addresses have dwindled, further accentuating the unease surrounding ADA’s price trend.

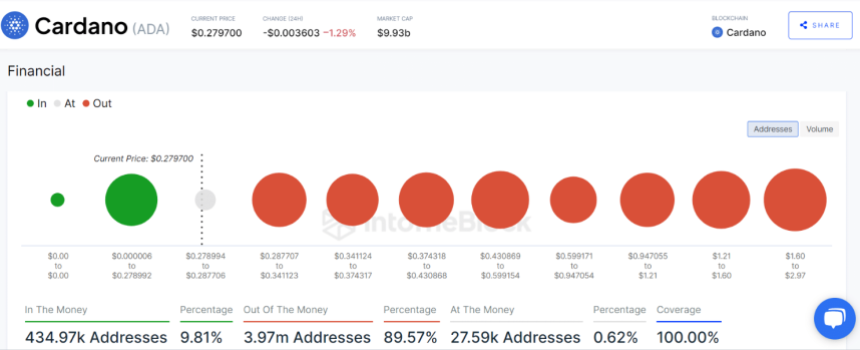

In an accompanying chart in the analysis that lays bare the current situation, it becomes evident that nearly 4 million ADA addresses find themselves in the unfortunate position of holding the cryptocurrency at a loss. This staggering figure represents approximately 89.7% of all ADA holders at the time of this report.

This unsettling statistic raises pertinent questions about the reasons behind this mass erosion of value, shedding light on potential market dynamics and investor sentiment.

Cardano Unique Funding Approach

Cardano has consistently been a pioneer in revolutionizing the blockchain landscape, consistently introducing groundbreaking developments. One such innovation is their novel approach to funding decentralized applications (dApps) – a departure from the traditional reliance on venture capital or initial coin offerings.

Cardano’s introduction of undercollateralized loans introduces a fresh paradigm that could reshape the way blockchain projects are financed and sustained, offering a glimpse into the future of decentralized funding models.

ADA’s Fluctuating Value

Despite the advancements, ADA’s recent price performance has sparked concerns. With a current value of $0.274 according to CoinGecko, the cryptocurrency has experienced a decline of 1.2% in the last 24 hours alone. A more prolonged seven-day slump paints a bleaker picture, with a decline of nearly 8%.

Navigating ADA’s Future

As Cardano’s development trajectory continues to impress with its forward-looking innovations, the prevailing challenges in ADA’s price trend and holder losses should not be underestimated.

The decline in active addresses further compounds the existing worries, potentially signaling shifts in user engagement and interest.

While the undercollateralized loan approach holds promise for the ecosystem’s future, addressing the concerns surrounding ADA’s price and holder losses remains a pressing task.

Cardano’s journey as a trailblazer in the blockchain realm is accompanied by a complex tale of contrasting fortunes. The remarkable innovations it introduces stand as a testament to its commitment to reshaping the industry.

However, the substantial losses incurred by ADA holders and the wavering price trend underscore the importance of addressing market dynamics, sentiment, and user engagement to ensure the longevity and stability of Cardano’s ecosystem.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Prime Recap

Sotheby’s and Yuga Labs respond to lawsuit from Bored Ape investors

Art broker Sotheby’s has been named in the Bored Ape investors case against NFT company Yuga Labs, which said the new allegations are without merit and “opportunistic.“

Google upgrades search engine with AI-powered enhancements

Google said that generative AI streamlines search functions, enabling individuals to discover novel perspectives and insights more effortlessly.

Fantom DEX SpiritSwap On The Verge Of Shutdown? Here’s What Has Changed

SpiritSwap, a decentralized exchange (DEX) on Fantom, will no longer be shutting down its operations in September after it received a takeover offer from Power, another Fantom-based DeFi protocol. The proposed shutdown was a result of cross-chain protocol Multichain’s collapse, which had a significant impact on the Fantom ecosystem.

On August 9, SpiritSwap announced on Discord that it is “winding down” operations and is looking for a team to take over the project after its treasury was drained in the Multichain exploit. The protocol initially planned to shut down by September 1, 2023, but it appears that won’t be happening anymore after Power’s intervention.

This would come as a relief to several SpiritSwap community members, especially those who have the native token SPIRIT locked on the protocol. According to the protocol’s website, there are currently over 410 million SPIRIT tokens locked.

Power To Deposit 200,000 USDC Into The SpiritiSwap Treasury

On August 16, the SpiritSwap community approved the proposal to hand the keys of the protocol to Power, a non-fungible token platform on Fantom. Power has now proposed to deposit 200,000 USDC into the SpiritSwap treasury.

Related Reading: Stellar Breaks Free: Unleashes New Open-Source Disbursement Platform

The team behind the NFT platform stated in the proposal that the deployment of these funds into the treasury is the first phase of ensuring that SpiritSwap survives. Meanwhile, Power claims to hold more than $1 million in liquid assets across multiple chains “ready to mobilize for use”.

In the proposal, the Power team clarified that it has also been developing its own decentralized exchange, PowerSwap. Then, it laid out plans to integrate some designs of the new DEX into SpiritSwap.

It is worth mentioning that Power was also impacted by the Multichain exploit. Fortunately, the protocol’s treasury assets were not bridged to Multichain, leading to relatively small losses.

Multichain Exploit – The Impact On Fantom

The Fantom ecosystem was the biggest victim in the Multichain exploit in July, which resulted in a total loss of over $126 million. The attack seemed to have specifically targeted the protocol’s Fantom bridge, causing a drain of more than $120 million worth of assets.

As inferred earlier, the ripple effect of the Multichain hack spread across various projects on the Fantom blockchain. As a result, the total value locked (TVL) on the network has been on a steady decline.

Fantom has seen its TVL drop by more than 61% since July 6 – the day of the Multichain exploit. As of this writing, the total value locked on the network stands at about $86.2 million, according to data from DefiLlama.

Blockchain-Harnessing AI Project Jada Receives $25M in Capital

The project’s aim is to offer AI services that aid decision-making for organizations and scale up their operations.

Bitcoin bulls risk trading range loss as BTC price nears 2-month lows

Bitcoin almost breaks down from its sideways construction in place for months, and Bitcoin bulls are struggling to prop up the market.

Bitcoin’s 2023 Bullish Trendline in Focus as Traders Search for Directional Clues

A bullish trendline is a an upward-sloping diagonal line connecting two or more higher price lows.

Bitcoin mining researchers claim new tech ups winning hash chance by 260%

U.K.-based research company Quantum Blockchain Technologies has developed algorithmic search methods that boost Bitcoin mining efficiency and reward probability.

Shibarium executive issues strong warning about exploitation risks

Shiba Inu’s marketing strategist Lucie has offered instructions to help users reduce the risk of encountering phishing links and fraudulent schemes when using Shibarium.

Shiba Inu (SHIB) Dips By 7% Following Shibarium Launch

Shibarium, an Ethereum layer 2 solution, can be termed one of the most-hyped crypto projects of 2023, expected to introduce a higher network speed and lower transaction costs to the Shiba Inu ecosystem.

After months of beta testing, Shiba Inu developers finally announced on August 16 that the Shibariun mainnet is now live. However, contrary to popular predictions, SHIB, Shiba Inu’s most prominent token, appears to have taken a nosedive upon this development.

SHIB Maintains Bearish Form As Shibarium’s Ethereum Bridge Develops Fault

So far, Shibarium’s launch has yielded a negative effect on SHIB, with the token losing 6.86% of its value in the last 24 hours based on data from CoinMarketCap. Prior to SHIB’s dip today, the token had shown an overall negative performance this week, falling from $0.00001059 on Monday to $0.000009527 on Wednesday.

Related Reading: Shiba Inu Keeps Energy Alive, Snags 26% Gain – Here’s The Inside Scoop

For now, SHIB’s loss post-Shibarium launch can be attributed to a technical issue with the much-anticipated project. According to a post by Whalechart on X, more than $1.7 million worth of ETH is presently stuck in the Shibarium bridge. This development has caused much panic among investors.

In addition, it seems these assets may be unretrievable following a message being circulated on social media that appears to be from Shiba Inu developer Shytoshi Kusama.

Meanwhile, it is worth stating SHIB is not the only Shiba Inu token under significant selling pressure, with the BONE and LEASH also declining by 15.48% and 22.59%, respectively, over the last day.

$1.7M+ worth of $ETH transferred to Shib's Layer 2 bridge, known as 'Shibarium,' is reportedly irretrievable. pic.twitter.com/lLDXsNvAx9

— Ahmad

(@Ahmadrobert_) August 17, 2023

Could Shibarium Be A Set Back To The Shiba Inu Ecosystem?

Shibarium was designed to enable the various projects of the Shiba Inu ecosystem, such as the Shib Metaverse, Shibaswap DEX, and the Shiboshi NFT Project, to operate at an increased speed while offering users lesser transaction costs.

Furthermore, all Shibarium transactions are to lead to SHIB burn, thus serving as a deflationary mechanism of the token. Due to these proposed features of the Shibarium project, it was widely expected that the layer 2 solution could bring about a higher adoption of SHIB and other Shiba Inu native tokens which in turn could boost market prices.

There were many positive signs backing this prediction, with the SHIB token notching significant gains upon any news on the progress of Shibarium in the last few months.

Related Reading: More Selling? Bankrupt Voyager Sends Millions In SHIB And ETH To Coinbase

In fact, Shibarium launched on Wednesday with 21 million wallets created, demonstrating a high level of user interest. However, the recent issue with the Ethereum bridge provides much concern for Shiba Inu investors on if the Shibarium project can live up to its potential.

Nevertheless, it may still be considered too early to call the project a failure, especially as there is no official statement from the Shiba Inu team addressing this challenge.

At the time of writing, SHIB is trading at $0.000009295, with a 0.37% gain in the last hour. Meanwhile, the token’s daily trading volume is down by 0.42%, sitting at $431.32 million.

Axie Infinity’s play-to-earn ‘scheme’ alarms Phillippine National Police

Playing crypto games can be riskier than investing in cryptocurrencies, according to the Filipino ACG, considering the ease with which gamers can lose their digital tokens and NFTs.

CME Group to launch BTC, ETH reference rates aimed at Asia’s investors

CME reported nearly half of its crypto volume year to date came from non-U.S. trading hours and around 11% from the Asia Pacific region.

Crypto Long Trades Account for 90% of Total Liquidations as Bitcoin, Ether Slump

One trading firm has a price target of as low as $24,000 in the coming months in the absence of immediate market catalysts.

Bitcoin Slides to $28.3K After Leveraged Funds Ramp Up Bearish Bets

Two-thirds of leverage funds’ positions are short, one observer said, noting the bearish bias of sophisticated traders.

SHIB, BONE, LEASH tokens dip amid rumors of $2.5M Shibarium gaffe

Shiba Inu and related-token prices plunged since Shibarium’s launch, while rumors of a significant technical error in the new Shibarium network have been swirling.

Coinbase futures approval seen as a major win amid the war on crypto

The recent approval allows Coinbase to join the ranks of major derivative exchanges in the United States, CME, and CBOE.