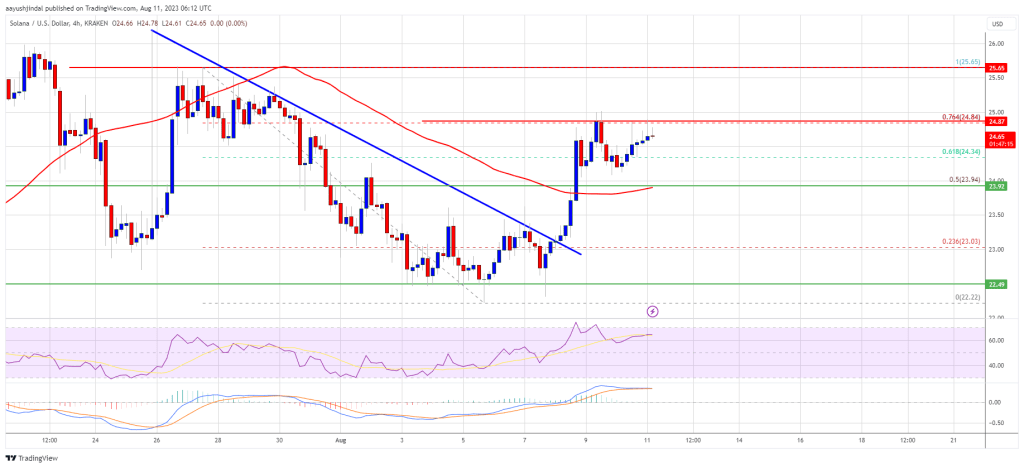

Solana is attempting a fresh increase above the $25 resistance against the US Dollar. SOL price rally toward $30 if there is a close above $25.65.

- SOL price is showing positive signs above the $23.80 level against the US Dollar.

- The price is now trading above $24 and the 100 simple moving average (4 hours).

- There was a break above a major bearish trend line with resistance near $23.10 on the 4-hour chart of the SOL/USD pair (data source from Kraken).

- The pair could continue to move up if it clears the $25.65 resistance zone.

Solana Price Starts Fresh Increase

After a steady decline, Solana’s price found support near the $22.20 zone. SOL traded as low as $22.22 and recently started a fresh increase, unlike Bitcoin and Ethereum.

The price climbed above the $23.20 and $24.00 resistance levels. There was a break above a major bearish trend line with resistance near $23.10 on the 4-hour chart of the SOL/USD pair. The pair climbed above the 50% Fib retracement level of the downward move from the $25.65 swing high to the $22.22 low.

SOL is now trading above $24 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $24.85 level. It is near the 76.4% Fib retracement level of the downward move from the $25.65 swing high to the $22.22 low.

Source: SOLUSD on TradingView.com

The first major resistance is near the $25.65 level. A clear move above the $25.65 resistance might send the price toward the $28.80 resistance. Any more gains might send the price toward the $30 level.

Are Dips Limited in SOL?

If SOL fails to clear the $25.65 resistance, it could start a fresh decline. Initial support on the downside is near the $24.00 level and the 100 SMA.

The first major support is near the $23.50 level. If there is a close below the $23.50 support, the price could decline toward the $22.50 support. In the stated case, there is a risk of more downsides toward the $21.20 support in the near term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $24.00, and $23.50.

Major Resistance Levels – $24.85, $25.65, and $30.00.