While Ethereum-based protocols have been hit with the majority of the exploit activity, BNB Smart Chain has also seen similar “copycat” exploits, according to BlockSec.

Cryptocurrency Financial News

While Ethereum-based protocols have been hit with the majority of the exploit activity, BNB Smart Chain has also seen similar “copycat” exploits, according to BlockSec.

Today marks eight years since the Ethereum Foundation first announced the rollout of its network.

An exploit of stablecoin exchange Curve Sunday could jeopardize more than $100 million in cryptocurrency. PLUS: What’s behind Russia’s mining boom?

The popularity of liquid staking tokens could usher in a new age for Ethereum and the rest of cryptocurrency — and play a key role in the new bull market.

BTC hovered comfortably over $29,300 for much of the weekend but dropped in the hours after Curve Finance tweeted that it had suffered an exploit.

A number of pools using Vyper have been exploited due to a malfunctioning reentrancy lock that potentially exposes all pools with wrapped Ether (WETH).

Curve, a stablecoin exchange at the heart of decentralized finance (DeFi) on Ethereum, has been the victim of an exploit according to a tweet from the project. Upwards of $100 million worth of cryptocurrency are at risk due to a “re-entrancy” bug in Vyper, a programming language used to power parts of the Curve system. Several stablecoin pools on the platform — used for pricing and liquidity on a number of different DeFi services — have been drained by hackers so far.

Several stable pools on Curve Finance using Vyper were exploited on July 30.

Bitcoin’s price consolidation is giving altcoin traders confidence that DOGE, MKR, OP and XDC could break out.

During a recent interview with Bloomberg Wealth, Novogratz touched on topics ranging from investing to Ripple’s case and Larry Fink.

Ethereum is currently the leader in decentralized finance, non-fungible tokens, and smart contracts, and it continues to maintain its position as the dominant cryptocurrency in the altcoin market. This has led to Ethereum having the highest rate of creation of new addresses when compared to the other blockchains. However, data suggests most of these new addresses are dumped just after a few days.

Ethereum is second to Bitcoin in terms of unique addresses. Ycharts estimates put the number of unique addresses on the Ethereum network to around 239.62 million. However, on-chain transaction data shows that if you’ve just created a new Ethereum wallet, chances are you won’t be using it for long.

According to crypto data analyst Jack Gorman, over 70% of new Ethereum wallets are used for less than 30 days before the owners stop transacting completely. While taking to a customized graph on Dune Analytics, a blockchain ecosystem analytics platform, the data analyst noted the rate of creation and abandonment of new Ethereum addresses.

The data show that Ethereum has one of the highest rates of new addresses, with 2 million new wallets per month. In the past year alone, more than 26.69 million wallets were created. However, most new addresses display minimal activity, with 66% only active for one day and 95.5% being active for less than ten days. For instance, in May 2023, 2.41 million addresses were created, with only 6.91% making transactions after 30 days.

Overall, monthly active addresses total around 4.5 million to 7 million. This means that most wallets don’t last long, and only 1.9 million are active for more than 10 days. Fewer addresses are used frequently and long-term, with only 400,000 addresses completing more than 100 transactions in the past year.

Ethereum has had one of the most impressive adoption rates in recent years. The creation of new addresses provides valuable insights into improving adoption and longevity, and the creation and abandonment of addresses can be traced to airdrop hunters. Airdrop hunters create multiple addresses with the sole aim of farming ERC-20 tokens from airdrops.

While the retention rate of new wallets is really low, Ethereum is blessed with various holders, including smart contract addresses and centralized exchanges. The Eth2 Beacon Deposit Contract has the largest address, boasting more than 27.6 million ETH and a 22.9% stake in the network.

BTC price action is “slower than ever” this weekend, but Bitcoin market participants are keenly waiting for a monthly MACD cross to confirm.

Python libraries that can interpret and explain machine learning models provide valuable insights into their predictions and ensure transparency in AI applications.

Shiba Inu, one of the well-known alternative coins on the cryptocurrency market, has seen its price rise dramatically over the past week. This increase in value can be primarily attributable to whale activities, which have significantly improved the performance of the meme coin.

Shiba Inu has distinguished itself among the many alternative cryptocurrencies with a fantastic price increase. Shiba Inu fans and investors have been closely keeping tabs on the market’s developments and have seen a rapid rise in the asset’s value.

Related Reading: Dogecoin Leaps 13% Following Elon Musk’s Cryptic Tweet – Details

Large holders have amassed enormous amounts of SHIB, as evidenced by on-chain data from the market intelligence platform Santiment. Since the beginning of June, addresses holding 10 million to 100 billion SHIB tokens (Shina Inu whales) have purchased a total of 1.11 trillion SHIB.

Whale activity refers to the involvement of large investors who hold large amounts of SHIB. Their actions, such as buying and trading the coin, contribute to the price hike and positive market sentiment surrounding the meme coin.

Additionally, Santiment data revealed that over the past two to three months, huge Shina Inu wallets belonging to the “shark” and “dolphin” categories have purchased SHIB valued at more than $9 million.

As of Friday, these significant investors held $32.49 trillion worth of SHIB securities. The group owns SHIB, worth about $266 million in total.

This increase in whale activity occurs before the launch of the layer-2 solution Shibarium, which is a significant event for the Shiba Inu ecosystem.

Shibarium’s launch has been anticipated by cryptocurrency fans, who observed a noticeable increase in buying activity in recent days. Investors and traders alike have expressed great excitement about the upcoming launch of Shibarium.

At the time of writing, SHIB was trading at $0.00000848, up 3.8% in the last 24 hours and climbing 8.0% in the previous week, data from crypto market tracker Coingecko shows.

As of this writing, Shiba Inu is ranked by CoinGecko as the 15th-largest cryptocurrency by market cap, having a value of nearly $5 billion.

![]()

Shibarium, which offers a second-layer solution to improve the network’s scalability and general efficiency, is a significant advancement for the SHIB ecosystem.

The rising demand for the SHIB coin has increased the importance of a robust infrastructure that can process a large number of transactions quickly and efficiently.

Shibarium is currently only available on the testnet. Still, its introduction has sparked great interest and is a significant factor in the increasing demand for this meme coin.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from The Daily Hodl

Blockchain technology is continually reshaping the financial industry, offering promising transformations in transaction processing. Its potential is immense, as outlined in a recent report by digital payment network Ripple in collaboration with the United States Faster Payments Council (FPC).

The report presents a robust case for blockchain’s role in expediting payment systems and the ensuing cost savings. But is the financial sector ready to embrace this emerging technology on a large scale?

The survey, which received inputs from 300 finance professionals spanning 45 countries, sheds light on the growing consensus about the advantages of blockchain. It illustrates a palpable shift in the perception of this technology across sectors including fintech, banking, retail, consumer technology, and media.

Results show that global payments leaders are dissatisfied with legacy rails for cross-border payments.

Learn why 97% believe #blockchain and #crypto will transform the way money moves in our latest whitepaper with @Faster_Payments. https://t.co/qacuAAzZrR pic.twitter.com/ForjM05Wbb

— Ripple (@Ripple) July 28, 2023

The majority of the surveyed professionals, comprising analysts, directors, and CEOs, strongly assert the potential of blockchain. Approximately 97% are confident that blockchain technology will be instrumental in expediting payment processes over the upcoming three years

This widely-held conviction underscores the positive outlook toward blockchain, indicating a readiness to welcome its disruptive capabilities.

Furthermore, the report highlights the cost-saving potential of cryptocurrencies. More than half of the respondents agreed that cryptocurrencies could significantly reduce payment costs, both domestically and internationally.

The report predicts that blockchain’s application in global transactions could save financial institutions an estimated $10 billion in cross-border payment costs by 2030, substantiated by findings from fintech analysis firm, Juniper Research.

With the rapid growth of e-commerce and businesses looking to penetrate international markets, the report anticipates a surge in cross-border payments. It estimates global cross-border payment flows could reach roughly $156 trillion by 2030, buoyed by a compound annual growth rate (CAGR) of 5%.

Despite the optimistic views, the survey revealed a divide in opinions regarding the timeline for widespread merchant adoption of digital currency payments. About 50% of the respondents were optimistic about significant merchant adoption within the next three years.

However, predictions varied for the likelihood of adoption within the next year, with the Middle East and African regions exhibiting the most confidence and Asia-Pacific the least.

Particularly, 27% of respondents from the Middle East and African regions anticipate that a majority of vendors will adopt cryptocurrency payments in the following year. While a mere 13% of the Asia-Pacific (APAC) region forecasted the same transition period.

Regardless, over the past 24 hours, XRP has shown a slight uptrend up by 0.7% with a trading price of $0.71, at the time of writing. This price action comes after the asset experienced a 4.1% decline in the past week.

Featured image from iStock, chart from TradingView

Maker (MKR), one of the prominent players in the decentralized finance (DeFi) space, has experienced a remarkable 11% price surge in the past seven days. Despite a slight drop in the last hour, the token’s performance remains impressive.

Maker’s recent price performance has been noteworthy, with a solid 11% increase over the past week. The token also recorded a 4.21% price increase in the last 24 hours, indicating strong momentum in the short term. However, a minor correction of 0.81% in the past hour highlights the market’s volatility.

Currently trading at $1,220.43 per MKR, the token remains 80.75% below its all-time high of $6,339.02. While the recent price surge is encouraging, it is essential to consider the historical context and the factors influencing the crypto market’s dynamics.

The MakerDAO community recently voted in favor of a temporary increase to the interest rate paid to holders of the protocol’s decentralized stablecoin, DAI. This proposal introduced the Enhanced Dai Savings Rate (EDSR), a mechanism to temporarily boost the Dai Savings Rate (DSR) to users during periods of low utilization.

Proposed by Maker founder Rune Christensen, the EDSR could increase the effective DSR to 8% when the utilization ranges from 0% to 20%. The mechanism is designed to decrease the DSR as utilization increases gradually.

Related Reading: Shiba Inu Reclaims 14th Spot In Market After 5% Jump

This isn’t the first time Maker has adjusted the DSR. In the past few months, the protocol has raised the DSR thrice: first to 1% in November, then to 3.3% in May, and finally incorporating a marginal increase to 3.49% in June. The latest EDSR proposal aims to incentivize DAI holders and stimulate demand for the stablecoin.

Despite the recent increase in the DSR, data from Dai Stats shows that investors have only deposited $307 million in the DSR, representing a modest 6.7% of the total supply of DAI. The amount of DAI in circulation decreased to $4.6 billion from over $6.9 billion in the previous year.

In response to the declining circulation of Maker’s dollar-pegged stablecoin, the protocol is taking proactive steps to spur demand for DAI. By enhancing the interest rate DAI holders can earn, the protocol aims to attract more users and create a favorable ecosystem for DAI utilization.

Related Reading: Tether (USDT) Market Cap Reaches New Peak, Edges Toward $84 Billion Mark

The broader stablecoin market has also experienced a downtrend, with the total market capitalization sinking to $127 billion from nearly $160 billion a year ago. The introduction of EDSR is seen as a strategic move to increase the appeal of DAI and strengthen its position in the competitive stablecoin landscape.

What’s Next For Maker (MKR)?

As Maker continues improving the DAI ecosystem, investors closely monitor its governance decisions and the market’s response to the enhanced interest rate mechanism. The success of the EDSR proposal could drive further adoption of DAI and contribute to its overall liquidity in the market.

Moreover, the broader crypto market’s performance and regulatory developments will determine Maker’s future trajectory. If the bullish sentiments continue, Maker could surpass the $1,300 resistance point but if the opposite occurs the next support levels are $1,200 and $1,180.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock, chart from TradingView

This time around, Elon Musk, the CEO of SpaceX and the world’s largest manufacturer of electric vehicles, Tesla, is creating a flurry of excitement around cryptocurrencies, maybe with a particular focus on Dogecoin, the well-known parody cryptocurrency.

The crypto community has taken note of Musk’s recent acts since they continue to demonstrate his influence in altering the market dynamics of digital currency.

The billionaire Musk, who is also the owner of the X app (formerly known as Twitter), posted on Sunday that “something special is coming soon.”

This tweet received a lot of positive feedback from the cryptocurrency community, especially from accounts with a Dogecoin theme.

Something special coming soon

— Elon Musk (@elonmusk) July 29, 2023

Based on Musk’s repeated references to this development in the past, many people, including the influencer David Gokhstein, anticipate that X will add DOGE – the largest meme coin – as a payment option.

This anticipation arises from the fact that Elon Musk has previously made a number of very quiet signals that a similar action may be planned.

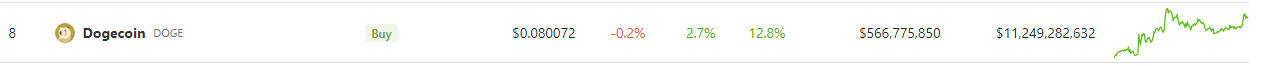

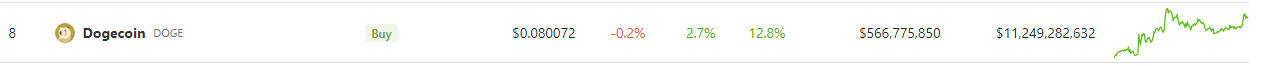

Dogecoin (DOGE) saw a stunning price increase on Friday, garnering a lot of attention in the cryptocurrency community. On that particular day, DOGE’s price noticedably increased by over 10%, breaking past the $0.07 barrier mark.

When this article was being written, DOGE was trading at $0.08, up 2.7% over the previous day. However, the meme coin really proved its worth on a weekly basis, rising in value by about 13% in response to Musk’s post.

Source: Coingecko

This positive momentum-driven upward rise in value led to a sizable increase in the market capitalisation of the asset. The cryptocurrency’s market cap increased as a result, rising by an estimated $1 billion to a new high of $10.66 billion from its previous value of $9.67 billion.

The reasons for this remarkable rise have been the subject of heated speculation among many members of the crypto community.

One of the more intriguing current theories is on the potential integration of DOGE, the disputed cryptocurrency, into the source code of Tesla’s website’s payment page.

Price Boom Soon?

As enthusiasts and investors alike anticipate the potential effects of such a development, this notion has been spreading. The mere possibility of DOGE becoming a payment option for Tesla has sparked curiosity and led to upbeat predictions for the cryptocurrency’s future.

If Elon Musk does truly integrate DOGE payments into his X app, Dogecoin will experience a solid increase in utility and acceptance, as well as a significant price boom.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Getty Images

This time around, Elon Musk, the CEO of SpaceX and the world’s largest manufacturer of electric vehicles, Tesla, is creating a flurry of excitement around cryptocurrencies, maybe with a particular focus on Dogecoin, the well-known parody cryptocurrency.

The crypto community has taken note of Musk’s recent acts since they continue to demonstrate his influence in altering the market dynamics of digital currency.

The billionaire Musk, who is also the owner of the X app (formerly known as Twitter), posted on Sunday that “something special is coming soon.”

This tweet received a lot of positive feedback from the cryptocurrency community, especially from accounts with a Dogecoin theme.

Something special coming soon

— Elon Musk (@elonmusk) July 29, 2023

Based on Musk’s repeated references to this development in the past, many people, including the influencer David Gokhstein, anticipate that X will add DOGE – the largest meme coin – as a payment option.

This anticipation arises from the fact that Elon Musk has previously made a number of very quiet signals that a similar action may be planned.

Dogecoin (DOGE) saw a stunning price increase on Friday, garnering a lot of attention in the cryptocurrency community. On that particular day, DOGE’s price noticedably increased by over 10%, breaking past the $0.07 barrier mark.

When this article was being written, DOGE was trading at $0.08, up 2.7% over the previous day. However, the meme coin really proved its worth on a weekly basis, rising in value by about 13% in response to Musk’s post.

Source: Coingecko

This positive momentum-driven upward rise in value led to a sizable increase in the market capitalisation of the asset. The cryptocurrency’s market cap increased as a result, rising by an estimated $1 billion to a new high of $10.66 billion from its previous value of $9.67 billion.

The reasons for this remarkable rise have been the subject of heated speculation among many members of the crypto community.

One of the more intriguing current theories is on the potential integration of DOGE, the disputed cryptocurrency, into the source code of Tesla’s website’s payment page.

Price Boom Soon?

As enthusiasts and investors alike anticipate the potential effects of such a development, this notion has been spreading. The mere possibility of DOGE becoming a payment option for Tesla has sparked curiosity and led to upbeat predictions for the cryptocurrency’s future.

If Elon Musk does truly integrate DOGE payments into his X app, Dogecoin will experience a solid increase in utility and acceptance, as well as a significant price boom.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Getty Images

John E. Deaton believes the unequal treatment raises concerns about the regulatory body’s effectiveness and fairness, as well as the overall framework for digital assets.

The letter revealed that on January 15, 2023, the defendant reached out to the current General Counsel of FTX U.S., who could potentially serve as a witness in the trial.