The litigation supporting claims against its commercial counterparties is set to make a difference “in excess of $1 billion” to creditors, court filings say.

Only 1,032 Addresses Control Over 60% Of All Litecoin (LTC) In Circulation

1,032 addresses control over 51.2 million Litecoin (LTC) in circulation, on-chain data from BitInfoCharts on May 15.

Litecoin Under Siege?

Records from the “Top 100 Litecoin Rich List” show that 7,355,585 LTC in circulation worth $639,814,097 are controlled by 8.78% of all registered addresses. At the same time, 26,526,499 LTC worth over $2.3 billion is managed by 111 addresses, while 17,993,930 LTC exceeding $1.5 billion are held by 918 addresses.

As of May 15, there were 72,924,127 LTC in circulation. So this concentration alone means over 60% of all LTC in circulation are controlled by 1,032 addresses. Furthermore, the network will only dispense 84,000 LTC to miners as block rewards.

Litecoin is a proof-of-work network like Bitcoin. It relies on a community of special nodes called miners to validate on-chain transactions and add them to the longest chain. For their participation, the lucky miner is rewarded 12.5 LTC per block every 2.5 minutes.

Based on the above statistics, what’s notable is that the $2.3 billion of LTC at spot rates owned by 111 addresses represents the biggest concentration compared to any other range by address count.

To illustrate, 794,934 addresses holding between 0.01 and 0.1 LTC cumulatively own 29,508 LTC. With 794,934 addresses in this range, they are the highest number of LTC owners by wallet address count.

However, considering their total holdings, these addresses are a minority since whales currently hold over 60% of the total circulating supply. Specifically, there are three whales with over 2 million LTC as of writing on May 15.

The largest LTC whale holds 2,504,667 LTC worth over $217 million. This address is active and constantly accumulates. Of note, the largest LTC whales began accumulating within the last five years from 2018.

According to on-chain data by BitInfoCharts, the last time this address deposited LTC was on May 10, 2023. Meanwhile, the last withdrawal was in early January 2023.

For instance, the second largest LTC whale, with over 2.47 million coins, started depositing coins in mid-June 2022. He withdrew a portion of LTC on February 10, 2023.

Based on the frequency of deposits and withdrawals, it is also highly likely that these addresses don’t belong to centralized crypto exchanges like Binance or Coinbase.

Will LTC Rally Ahead of Halving?

Crypto whales controlling a disproportionately large amount of coins can manipulate prices and influence trends. Still, whether this will change ahead of the Litecoin halving event is yet to be seen. The Litecoin network will slash miner rewards by half to 6.25 LTC in less than three months.

Based on historical performances, halving events, even in Litecoin, tend to support price increases. Therefore, ahead of this event estimated to be in early August 2023, LTC prices might recover as the coin becomes scarcer.

LTC prices are up 15% from May 2023 lows, changing hands at $86, according to TradingView data.

Make 500% from ChatGPT stock tips? Bard leans left, $100M AI memecoin: AI Eye

How to create a $100M memecoin with ChatGPT, $50K portfolio handed over to AI targeting 500% return, and will writers have a job in future?

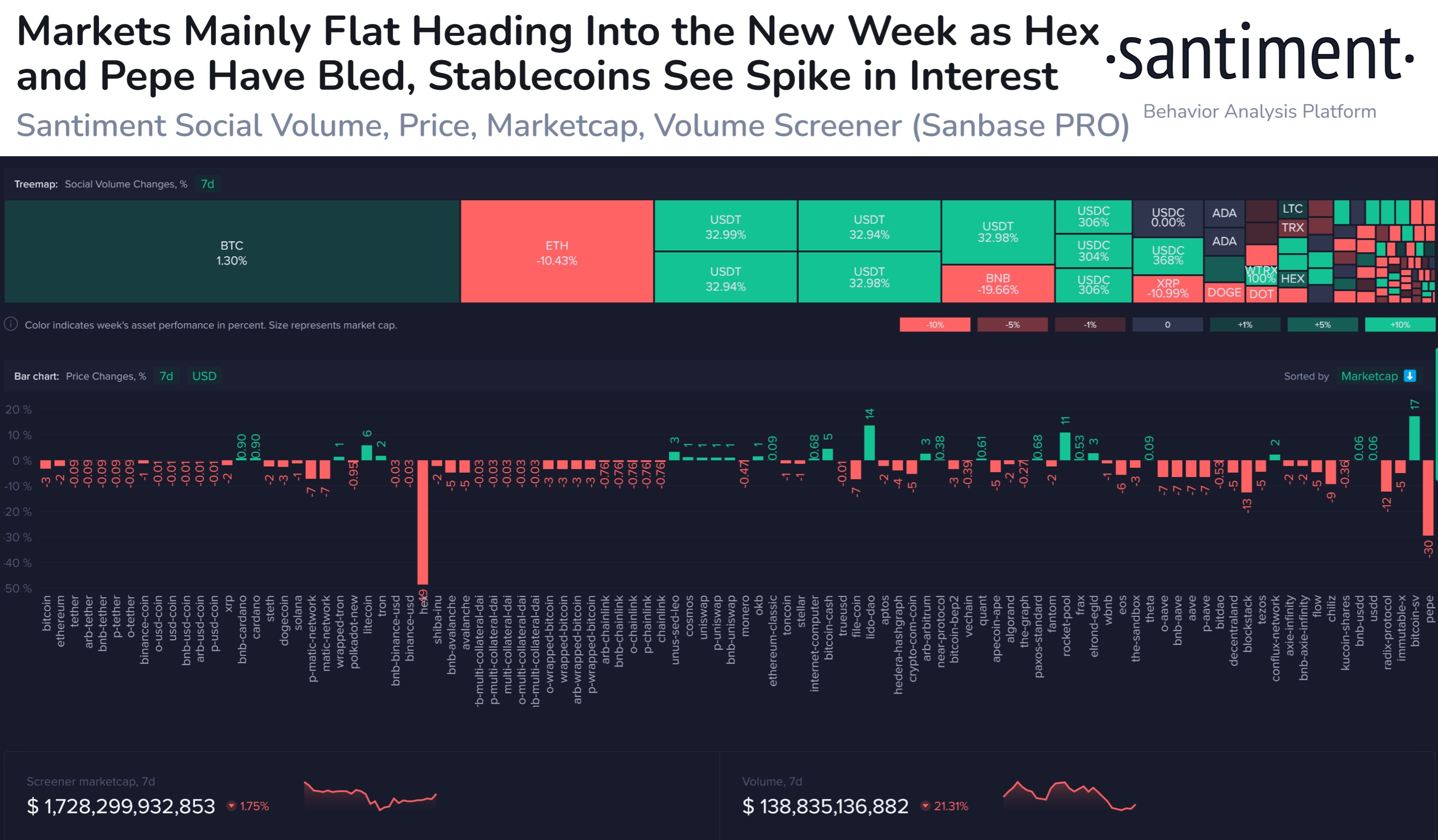

Stablecoins Interest Spikes As Traders Look To Exit Market

Data shows there has been a large spike in interest around stablecoins recently, a sign that investors of Bitcoin and other assets may be looking to exit.

Stablecoins Have Observed A Sharp Rise In Social Volume Recently

According to data from the on-chain analytics firm Santiment, there has been a major uptick in the social volume of the stablecoins recently. The “social volume” refers to an indicator that measures the total number of social media text documents that are talking about a certain topic or term.

The social media text documents here have been collected by Santiment and include a variety of sources like Reddit, Twitter, Telegram, and other internet forums.

Something to note about the metric is that it only tells us about the unique number of such posts that are mentioning the given term at least once. This means that even if a thread includes several mentions of the topic, its contribution towards the social volume will still remain only one unit.

The social volume can provide insight into the degree of attention any particular coin is getting on social media platforms. Whenever this indicator’s value goes up, it means that the general interest in the asset among investors is rising currently.

Now, here is a chart that shows the 7-day change in the social volume for the various assets in the cryptocurrency sector (including the stablecoins):

As displayed in the above graph, the social volume of a lot of the volatile assets has registered a negative 7-day change, implying that there is a lesser amount of discussion happening related to them right now as compared to a week ago.

Some of the assets like Bitcoin have seen a positive 7-day change in the metric, but the increase has only been minuscule for them, implying that their social volume is relatively unchanged.

Interestingly, while the volatile assets may have seen decreasing or sideways-moving social volumes, the stablecoins have seen a completely different trend with the metric; their social volumes have sharply surged in the past week.

USD Coin (USDC), which is the stablecoin second only to Tether (USDT) in terms of market cap, has seen an extraordinary rise of more than 300% in terms of this metric. This suggests that discussions around the coin have increased by more than 300% during the past week.

Tether itself has observed a positive 7-day change in the social volume of more than 30%, which, while much lesser than USDC’s, is still quite significant nonetheless.

Generally, investors use stables whenever they want to escape the volatility associated with the other coins in the sector. So, since the interest around these tokens has surged recently while the volatile cryptocurrencies have been seeing a red period, it would appear that holders may once again be seeking the safety of this stable form of digital assets.

BTC Price

At the time of writing, Bitcoin is trading around $27,300, down 2% in the last week.

South Korea Probes Crypto Exchanges Upbit, Bithumb on Ex-Lawmaker’s Transfers

Lawmaker Kim Nam-kuk resigned from the opposition party after his crypto transfers incited controversy.

Ripple Transaction Count Down 65%, Will This Affect XRP Prices?

The number of on-chain Ripple (XRP) transactions on the XRPL is down 65% from 2.5 million on March 19 to less than 900,000 on May 14, 2023.

XRP Transactions Crashing

As of May 14, 2023, 852,000 transactions were processed by the XRPL, a decentralized blockchain network by Ripple Labs curated for fast value transfer. This represents a 65% drop from March 19 peak when the total number of transactions on the XRPL stood at over 2.5 million.

Notably, there has been no solid technical reason, such as blockchain or node vulnerability in the XRPL, during this period to explain the contraction in transaction count.

However, what’s evident is that the crypto market has been under pressure in the last two months from March to May 2023. This might have contributed to the drop in the number of on-chain transactions.

On March 29, XRP prices peaked at around $0.58. This was 10 days after the XRP transaction count surged to the highest level on March 19. From the second half of March, however, transaction count and XRP prices have been falling.

XRP prices are down 27% to $0.42 as of writing on mid-May, down from $0.58 registered on March 29. However, whether XRP prices will continue to track lower, mirroring the number of XRPL transaction count, remains uncertain.

Overall, the number of on-chain transactions can directly influence transaction fees and prices. Moreover, it can provide insight into the level of demand for the cryptocurrency and the blockchain network. The more demand for the underlying network’s token, the higher the trading volumes, and this upsurge can influence prices.

On the XRPL, users pay fees using XRP. Therefore, the higher the demand for XRP in transaction settlement, the more upward pressure there will be for the native currency.

The contraction in the number of XRP transactions is at the back of declining prices. Nonetheless, it should be noted that the drop in XRP prices wasn’t an isolated event. Like the other crypto prices, XRP and top coins, including BTC and ETH, have been retracing from recent peaks registered in March and April 2023.

As an illustration, after surging to as high as $31,000, BTC prices have since dropped, falling to as low as $25,800 on May 12.

Meanwhile, XRP is currently trading at $0.41, down from $0.58 posted in late March 2023.

The SEC-Ripple Case

The drop in XRP transaction count can also be due to market sentiment as the community monitors the ongoing SEC-Ripple case which might end this year.

The United States Securities and Exchange Commission (SEC) sued Ripple’s executives in December 2020 for conducting an illegal initial coin offering and using XRP to raise funds, breaking federal security laws. In their assessment, the regulator says XRP is an unregistered security.

Depending on the Judge’s ruling in the coming month, the outcome of the suit may impact not only the XRP and activity on the XRPL but also influence how regulators perceive crypto in the United States.

What’s next for NFTs and Web3 in the age of the creator economy?

The advantage of Web3 is that it grants users ownership of their data. Creators will be able to treat their data as their own personal property and be paid for whatever content they create, and others consume.

US strips Ethereum dev Virgil Griffith of export privileges for 10 years

The export privilege ban comes from Griffith’s conviction and further impacts his involvement in international trade and transactions.

Bitcoin Miner Bitfarms Accelerates 6 EH/s Hashrate Target As Quarterly Loss Per Share Narrows

In Q1 2023, the bitcoin miner’s net loss per share narrowed to 1 cent, from 8 cents the previous quarter.

Dogecoin Clone Doge CEO Skyrockets Nearly 200% As Meme Coin Mania Rages On

Doge CEO, the cryptocurrency inspired by Dogecoin, has witnessed an extraordinary surge, skyrocketing nearly 200% in the face of an ongoing mania surrounding meme coins.

As investors continue to embrace the eccentricity and unpredictability of the crypto world, Doge CEO has emerged as a captivating contender in the market.

Fuelled by the same irreverent spirit that propelled Dogecoin to unexpected heights, Doge CEO has managed to capture the attention of investors searching for the next big hit in the realm of meme-inspired cryptocurrencies.

Doge CEO: Investor Optimism In The Meme Coin Revolution

The remarkable growth and upward trajectory of Doge CEO token exemplify the continued enthusiasm among retail investors for the burgeoning meme coin revolution.

In an astounding turn of events, the price of DOGECEO on CoinGecko has reached an infinitesimal value of $0.000000000007182, marking a surge of 4.9% in the last 24 hours and a staggering rally of 196.7% over the past week.

The Dogecoin clone has garnered attention from experts who consider it an opportune moment to establish significant holdings. Nevertheless, it is important to exercise caution, as the inherent volatility within the meme coin landscape warrants prudence.

The increasing popularity of the Doge CEO token demonstrates the lasting appeal of meme coins to individual investors. As these investors actively engage in the market, their strong inclination towards meme coins continues to be apparent.

With its status as a low-cap meme coin, DOGECEO has become a focal point for those seeking potentially lucrative opportunities within this market segment.

Industry experts have recognized the current climate as favorable for taking sizable positions in Doge CEO, given its growing traction and potential for significant returns.

The Meme Coin Frenzy Continues

The recent meme coin frenzy shows no signs of abating, with cryptocurrencies like PEPE soaring to unprecedented heights.

PEPE, a meme-inspired token, has become one of the most notable high-fliers this year, with staggering gains of up to 92,000% in the past month alone.

As the meme coin frenzy rages on, newer players like PEPE, Floki Inu, and BONK are stealing the spotlight from established meme coins like Dogecoin and Shiba Inu.

Investors are intrigued by the potential for astronomical gains and the allure of joining the bandwagon of the next big meme coin sensation.

However, it is important to approach these investments with caution, as the volatility and unpredictable nature of meme coins make them inherently risky.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

-Featured image from The Economic Times

Bankrupt Crypto Lender Celsius Transfers $75M of Ether to Staking Service Figment

The maneuver represents one of the largest transfers of funds for Celsius Network since it filed for bankruptcy protection in July.

First Mover Americas: Bitcoin Bounces Back From Friday Lows

The latest price moves in bitcoin (BTC) and crypto markets in context for May 15, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Bitcoin Holds Above 200-Week Average as Dollar Index Rallies Most Since February

Analysts expect the U.S. dollar to continue gaining ground in the near-term, keeping risk assets under pressure.

Irish newspaper apologizes for misleading AI-generated article

A daily newspaper in Ireland released a statement saying it was “deliberately deceived” into believing the identity of a guest writer, which turned out to be AI.

Dogecoin Sees Highest Transactions Count Ever Due DRC20 Madness

The Bitcoin Inscriptions craze is spreading to Dogecoin. The number of transactions that the Dogecoin blockchain has had to process in the last few days have risen to an all-time high, mainly due to the new DRC20 token standard.

DRC20 tokens on Dogecoin are an experimental token standard that works similarly to the minting and transfer of fungible tokens via the Ordinals protocol on the Bitcoin blockchain. Technically, this is possible because Dogecoin was created by inventor Billy Markus forking Lucky Coin, which is itself a fork of Bitcoin.

Dogecoin Transactions Surpass All-Time High By 3x

In the last 7 days, the number of transactions recorded on the Dogecoin blockchain have skyrocketed. Before the DRC20 token standard was created, the Dogecoin network recorded no more than 23,754 transactions per day throughout May, according to data from BitInfoCharts. Last Saturday, May 13, Dogecoin saw a staggering 628,209 transactions.

To put that in perspective: The highest number ever recorded before this new alltime-high was on December 20, 2013, when the network processed just 201,440 transactions. In comparison, the total number of transactions that took place on Saturday (628,209) is more than three times the historic high from 2013.

The madness first started rolling on Tuesday, May 9, when the transaction count doubled to over 40,000 and remained at that level over the next three days. On 11 May (Thursday) the Cambrian explosion occurred when the number of transactions rose above 450,000 for the first time. The sudden surge in transactions is mainly due to the registration process used to create the “Doginals” and DRC20 tokens.

#Dogecoin transactions are skyrocketing. New ATH is 3x the previous (Dec. 2013)

Why? The new DRC20 Tokens and "Doginals" pic.twitter.com/20DXWjYGTh

— Jake Simmons (@realJakeSimmons) May 15, 2023

DRC20 And Doginals Spark Controversy

In response to the emergence of DRC20 tokens, many members of the community enthusiastically began exploring and minting these tokens. However, Dogecoin core maintainer Patrick Lodder has little enthusiasm for the new trend. “Json doginals minting scams,” remarked Lodder via Twitter, adding with regard to the poor programming:

“let’s push json”

“let’s keep spaces”

“oh and let’s keep newlines”lmao morons.

When asked if there could be congestion in transaction times, similar to Bitcoin, Lodder stated:

Yes, but it currently translates to a ~5-10 block wait. This is because they overpay fees too (10.3x recommended min fee) so you’ll get to get priority over these at 11x min fee (0.11 DOGE/kB). Ah, so higher cost per as well. hmm.

But Lodder rejected the necessity of a fork, saying that DRC20 tokens simply increase fees “a little bit”. In addition, the Dogecoin core maintainer also disagreed with the need for a “spam filter” (as has been discussed for Bitcoin) and shared a tip: “Just raise your fees a little now, and if you don’t like this, you can simply raise your dust limit so that you don’t relay these transactions – saves bandwidth.”

At press time, the DOGE price stood at $0.07271.

South Korean lawmaker leaves political party amid crypto investment controversy

A lawmaker allegedly sold over $4 million in cryptocurrency prior to the country’s enforcement of the “Travel Rule” from the Financial Action Task Force.

Are ZK-proofs the answer to Bitcoin’s Ordinal and BRC-20 problem?

Zero-knowledge proofs could be a viable means to address recent network congestion and high fees on the Bitcoin blockchain.

Ribbon Finance’s Decentralized Exchange Aevo Unveils Altcoin Options Trading

Users will be able to trade options tied to coins like LDO, PEPE, SUI, ARB, LTC, APT, and others, which was previously possible only through an over-the-counter desk. .

PEPE Outperforms Bitcoin In Social Media Buzz, Triggers Bullish Run For Frog Coin

Pepecoin (PEPE) has recently gained significant attention on social media platforms, outperforming Bitcoin in terms of buzz and hype.

As the cryptocurrency market continues to evolve rapidly, the power of social media in driving prices and market sentiment cannot be underestimated.

With Pepecoin generating a surge of interest and excitement among investors and traders, the question now arises: could this trigger a renewed bullish run for PEPE?

Pepecoin, named after the popular Pepe the Frog meme, has emerged as a promising new player in the cryptocurrency space. Its community-driven approach and unique branding have attracted a loyal following, which has helped it gain traction on social media platforms like Twitter and Reddit.

Pepecoin (PEPE) Emerges As A Social Media Darling

Pepecoin (PEPE) has taken the cryptocurrency world by storm, surpassing Bitcoin and other popular digital assets in terms of social media buzz. This newfound attention has triggered a surge in discussions and mentions of PEPE on various social media platforms, as tweeted by LunarCrush, a leading social analytics platform.

TRENDING

$pepe is now leading social engagement activity, even higher than #bitcoin at the moment.

This metric indicates extremely heavy community participation in social posts, measured by likes, retweets, comments, bookmarks, influential account participation, and more.… pic.twitter.com/5omzcenzKN

— LunarCrush (@LunarCrush) May 13, 2023

The platform’s data reveals that PEPE has emerged as the frontrunner in social engagement activity, outperforming even Bitcoin and Shiba Inu (SHIB) in this metric. While Bitcoin claimed the second spot, Shiba Inu lagged behind in seventh place.

With millions of users actively discussing and sharing information about digital assets, social media platforms have become breeding grounds for hype and speculation.

LunarCrush’s data indicates that PEPE has managed to capture the attention and enthusiasm of crypto enthusiasts, generating a significant level of social engagement. This surge in online activity suggests that investors and traders are closely monitoring PEPE and may be considering it as a potential investment opportunity.

PEPE Price Struggles To Move Up Despite High Social Engagement Activity

Despite the high levels of social engagement and buzz surrounding Pepecoin, the cryptocurrency has seen a dip in its price over the past few days. CoinGecko reports that as of this writing, PEPE’s price stands at $0.00000175, which marks an 8.7% decrease in the past 24 hours.

Moreover, over the past week, the cryptocurrency has seen a significant decline of 29.0%, highlighting a bearish trend that may have shaken the confidence of some investors.

The decline in PEPE’s price is particularly noteworthy given the recent surge in social media activity surrounding the coin. While it is too early to say what the future holds for Pepecoin, the current bearish trend may signal a correction after the initial hype surrounding the coin.

-Featured image from Today’s Parent

G-7 Finance Ministers Discuss Crypto Regulation Ahead of Japan Summit Next Week

Representatives for the seven advanced economies signaled a commitment to following norms set by standard-setters FSB and IMF on crypto and central bank digital currencies.