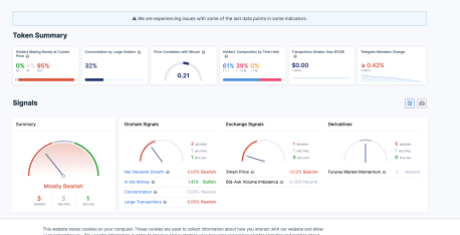

Crypto analyst Ali Martinez has noted Cardano (ADA) is open to an unprecedented rally. Price activity suggests that Cardano is moving into a state of consolidation, which coincides with a moderate decline in the general cryptocurrency market.

Nevertheless, the analyst is of the opinion that Cardano’s current consolidation is similar to one it had prior to a 2980% increase. If previous events are any indicator, we could see Cardano mirror this move and spike past its all-time high.

Recent Cardano Price Action

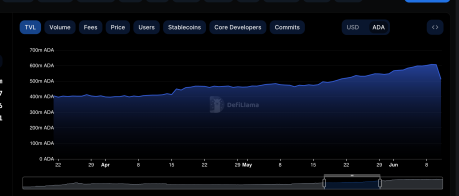

Cardano is still up by 48.47% in a 30-day timeframe, but it has lost 7.21% of its market value in the past 24 hours and is currently trading at $0.372. According to chart analysis by Ali Martinez, the current consolidation looks similar to the 2018-2020 consolidation phase without considering the COVID-19 crash.

Following the conclusion of this phase, Cardano witnessed price surges in the first quarter of 2021, one of which was a price surge of nearly 100% in seven days in early February 2021. This marked the beginning of a prolonged bullish run that drove Cardano’s price up by more than 2980% and brought it to its current all-time high of $3.10 in September 2021.

#Cardano‘s current consolidation trend eerily mirrors the 2018-2020 phase without the COVID-19 crash!

If so, $ADA could break through the $0.45 resistance around the first week of December. The upswing could send #ADA to $0.75 by late December.

Looking to trade this setup? Head… pic.twitter.com/u3KzOsZj2F

— Ali (@ali_charts) November 16, 2023

If analyst Ali Martinez is right, Cardano is on the cusp of a massive breakout that could send the price of ADA skyrocketing in the same manner. A look through his price chart shared on social media estimates the price of Cardano surging past the $6.5 level, a surge of more than 1,600%.

The journey to this price level is certainly not going to be a smooth one. ADA is going to face major resistance at the $0.45 level, which it has to break through to start with. This won’t be easy, as the coin has already tried and failed to break through this barrier in April. It did go over to reach $0.4533 on April 16, but it fell 15% to 0.383 by April 22nd.

According to the analyst, if a strong price spike were to occur now, ADA could break past $0.45 by the first week of December. If Cardano breaks $0.45, the next stop would be $0.75 by late December, a 66% increase from current levels.

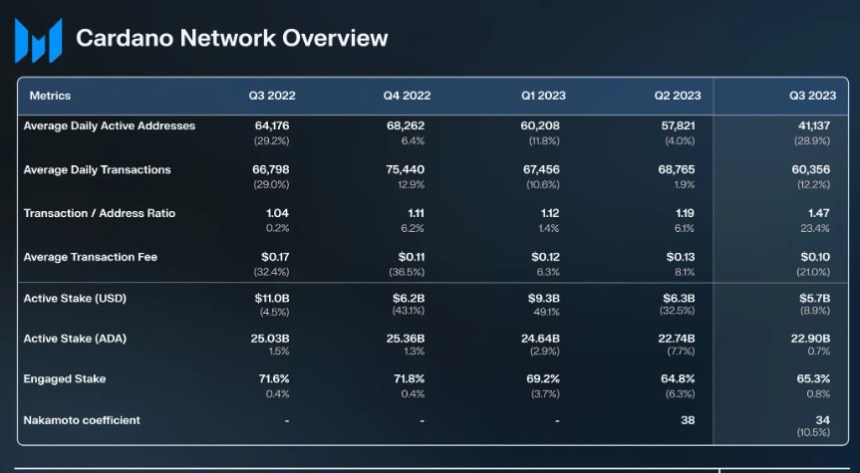

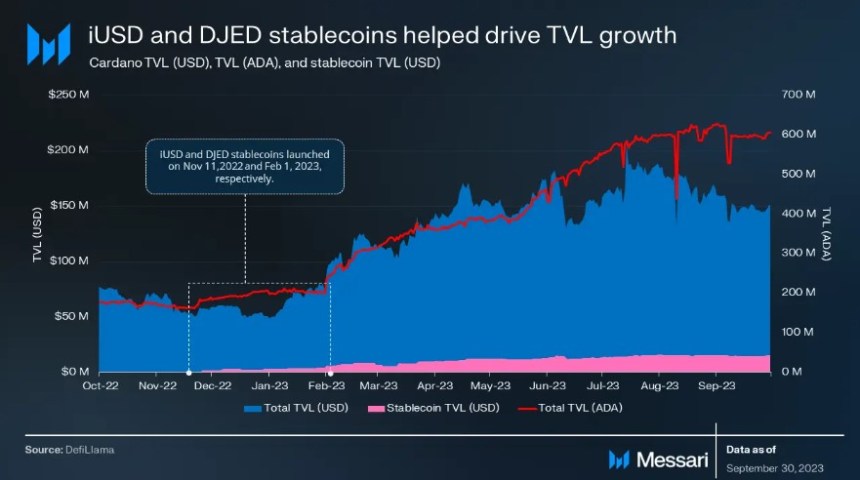

According to Coinmarketcap’s Fear & Greed Index, the crypto market is now at a greed level of 71. For Cardano to mimic the 2021 bull run, the overall crypto market sentiment would need to maintain this very strong bullish and greed level. Interest in altcoins would have to pick up, and Cardano’s progress on key milestones like smart contracts and DeFi would need to drive hype.

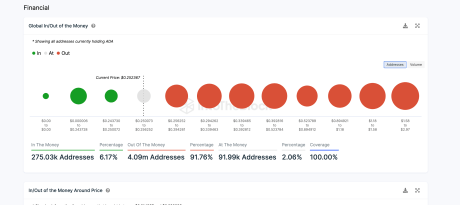

Ada has a max supply of 45,000,000,000 tokens with approximately 35,045,020,830 of those tokens in…

Ada has a max supply of 45,000,000,000 tokens with approximately 35,045,020,830 of those tokens in…