Coinbase’s stock price has surged since the company’s first-quarter earnings report. Will its Base offering be enough for investors to sustain the momentum?

Cryptocurrency Financial News

Coinbase’s stock price has surged since the company’s first-quarter earnings report. Will its Base offering be enough for investors to sustain the momentum?

Early Friday, Friend.Tech airdropped its native token, FRIEND, while debuting version 2 of the platform.

Crypto users have continued to send funds to the apparent honeypot scam, even with many warnings they won’t be able to transfer any of it.

The next era of Web3 will be defined by the ability of projects to attract and retain users, says Kelly Ye of Decentral Park Capital. Coinbase’s Ethereum Layer 2 is showing the way forward.

Renowned crypto analyst Lark Davis recently shared insights into the world of altcoin and decentralized finance (DeFi), offering high-risk, high-reward options and established projects.

During a live stream, Davis discussed his current portfolio holdings, while emphasizing the volatility inherent in these markets.

During his discussion, Davis advised against investing in Bitcoin SV (BSV), expressing doubts about Craig Wright’s claim to be Satoshi Nakamoto. He emphasized the importance of doing thorough research before investing in cryptocurrencies.

Additionally, he mentioned Bitcoin Cash (BCH) as a potential candidate for the next ETF approval in the US due to its slight variations from Bitcoin.

Regarding altcoins and DeFi, Davis highlighted different projects in his portfolio, including “Puff, Benji, and Foxy,” which he categorized as “high-risk, high-reward ventures.” Davis also mentioned DeFi projects like “Jup and Arrow,” which are known for their governance features and staking rewards.

Furthermore, Davis discussed projects with considerable potential for growth, such as Solana, Trader Joe, and Mantle. However, he emphasized these investments’ volatile nature and recommended that viewers approach them cautiously.

In addition to Davis’s insights, Solana has recently become the fourth-largest cryptocurrency by market capitalization, surpassing XRP and Dogecoin. With a market cap of $68.7 billion and a price of $154.66 at the time of writing, Solana’s rise reflects growing interest in the project.

Meanwhile, analysts offer contrasting views on the future of altcoins. Altcoin Sherpa suggests that these alternative tokens may stagnate for 1-4 months, needing time to consolidate after a significant run.

It’s quite possible that altcoins are done for the next 1-4 months. There are certainly going to be outliers but I think that the majority need time to chill out and consolidate after such a big run.

The scary thing is that many alts didn’t even run that hard over the last few… pic.twitter.com/sGke8PT5yw

— Altcoin Sherpa (@AltcoinSherpa) April 16, 2024

However, Crypto Jelle presents an opposite outlook, suggesting that altcoins could rally massively in the coming months.

Crypto Jelle points to historical patterns, noting that altcoins typically consolidate after breaking out from a resistance zone before entering a new bull run. If history repeats itself, altcoins could demonstrate significant growth potential shortly.

It’s about time for #Altcoins to remind everyone what they’re capable of.

Looks primed to go on a massive rally in the coming months.

I’m ready. pic.twitter.com/qru4GksczF

— Jelle (@CryptoJelleNL) April 12, 2024

Featured image from Unspalsh, Chart from TradingView

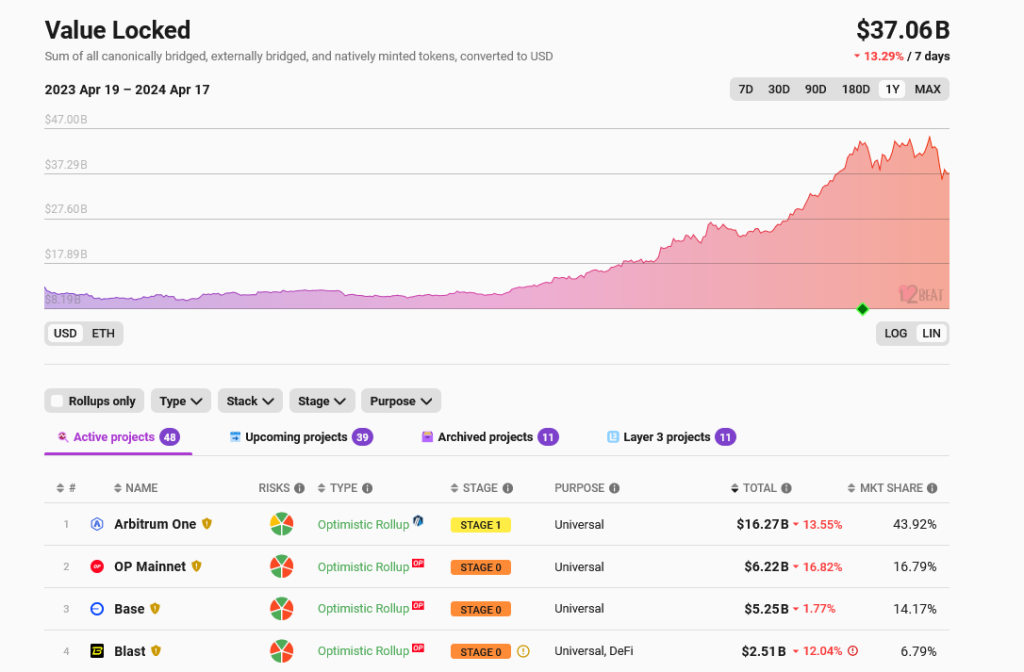

Arbitrum, the largest Ethereum layer-2 scaling solution by total value locked (TVL), is taking steps towards decentralization. In an update on April 16, Offchain Labs–Arbitrum developers–said they have deployed the permissionless version of their fraud proofs, dubbed Bounded Liquidity Delay (BOLD), to testnet.

Ethereum layer-2 solutions have been gaining prominence over the years. According to L2Beat data on April 17, these platforms control over $37 billion of assets. Protocol developers and users can send transactions cheaply through Arbitrum, Optimism, Base, and other alternatives.

However, while they are popular and command billions in TVL, most of these platforms’ fraud proofs are being developed. Typically, when users transact all chains, all transactions must be confirmed by a web of miners or validators, depending on the consensus mechanism.

This differs in layer-2 options, which must reroute transactions and process them off-chain. There is no way of proving whether queued transactions are valid before being batched and confirmed on-chain.

The fraud proofs, such as those presented by Arbitrum and other optimistic rollup solutions, are designed to address a critical issue in layer-2 solutions. Specifically, once live and integrated into Arbitrum, BOLD will serve as a safety net, ensuring the validity of transactions processed off-chain. This mechanism is crucial in maintaining the integrity of transactions while enabling efficient off-chain processing.

In compliance with blockchain principles, BOLD will be decentralized. As such, the community will run nodes, which differs from the current setup. As it is, transaction validation in Arbitrum is centralized, and only a few validators are tasked with this.

With BOLD in the testnet, Arbitrum is opening up its rails so that anyone can participate in network security and validate withdrawals back to Ethereum. This move will be critical in building a more decentralized ecosystem and making the platform more robust.

Arbitrum becomes the first Ethereum layer-2 to launch its fraud proofs in testnet. In a post on X, Ryan Watts of Optimism also notified the community that plans are underway to create a decentralized fraud-proof system for the second-most largest layer-2 by TVL.

Even with this major milestone, ARB prices are stable and under pressure.

Related Reading: Crypto Analyst Says Don’t Buy Altcoins Just Yet – Here’s Why

The token is down 50% from March 2024 highs at spot rates and remains under immense selling pressure. If buyers reverse the April 12 and 13 sell-off, the token might recover strongly, racing towards $1.5.

CFG, the protocol’s native token, spiked as much as 14% after the announcement before paring gains and outperformed other DeFi tokens.

In an analysis shared with his nearly 100,000 followers on X (formerly Twitter), the crypto analyst known by the pseudonym Xremlin (@0x_gremlin) has pinpointed Base as the burgeoning hub for memecoin enthusiasts and investors. This proclamation follows a season of unprecedented gains in the Solana memecoin market, with tokens like BOME, WIF, and SLERF achieving returns ranging from 300x to 1000x.

Xremlin’s insight into the crypto market dynamics suggests a potential replication of these astronomical returns on Base, underlined by a tweet stating, “Meme traders on Solana printed millions this season: BOME: 800x, WIF: 1000x, SLERF: 300x. BASE season is just revving up, and might have a similar rally.”

Meme traders on Solana printed millions this season:$BOME: 800x │ $WIF: 1000x │ $SLERF: 300x$BASE season is just revving up, and might have a similar rally.

List of memes on Base with 10-500x potential⭣ pic.twitter.com/wAs5hde0N9

— Xremlin (@0x_gremlin) March 21, 2024

The transition of focus towards Base is attributed by the analyst to its association with Coinbase and an upcoming product launch aimed at simplifying on-chain trading. Xremlin elaborates, “Why Base? Coinbase has a large user base in the US, but trading on-chain can be too complex for normies. Soon, Coinbase will launch a product that enables its CEX users [100M+] to trade on Base without requiring seed phrases or private keys.”

This move is anticipated to significantly lower the entry barriers for new investors, potentially catalyzing a memecoin rally on the Base platform.

However, amidst the excitement, Xremlin issues a word of caution to their followers: “Remember: Investing in memes is high risk. Only bet what you can afford to lose. Projects might rug, slow rug, or suddenly tank by 50%-70% when the hype fades.” This cautionary advice reflects the inherent volatility and risk associated with memecoin investments, where the line between significant gains and losses can be remarkably thin.

Xremlin’s curated list of Base memecoins is not only varied but also rich with potential, highlighting projects inspired by cultural references, pets of notable figures, and even caricatures of industry leaders. Here’s a closer look at the analyst’s picks:

Xremlin further emphasizes the importance of community and research in navigating the memecoin market: “For those interested in researching Base memes, I recommend joining the /base channel on Warpcaster. Community insight is invaluable, and collective due diligence can help mitigate risks associated with memecoin investments.”

At press time, TOSHI traded at $0.000321653, up 210% in the last three weeks.

The Ethereum layer-2 chain’s status page warns users of high fees and slowdowns as traders flock to new Base meme coins.

A version of the new proof system, which will help secure withdrawals from Optimism and other networks based on its tech, will be deployed to Ethereum’s Sepolia test network on Tuesday.

The indexing layer is also expanding to Avalanche and Celo.

The upgrade allows layer 2 solutions to store data in “blobs” instead of the expensive call data.

Leading figures behind layer-2 teams told CoinDesk how Ethereum’s upcoming Dencun upgrade will affect their networks.

The smart wallet will be an addition to Coinbase Wallet SDK, and the embedded wallets feature will be powered by “wallet as a service.”

AERO, the native token of liquidity protocol Aerodrome Finance, jumped by 77% on Tuesday after it was selected by the Base Ecosystem Fund, which is led by CB Ventures.

Uniswap (UNI), one of the largest decentralized cryptocurrency exchanges (DEX) by trading volume, has made an important announcement regarding deploying its v2 protocol on six additional chains.

The chains on which the v2 protocol has been deployed include Arbitrum (ARB), Polygon (MATIC), Optimism (OP), Base, Binance Smart Chain (BSC), and Avalanche (AVAX).

According to a recent post on X (formerly Twitter) by Uniswap Labs, the software product developer working on the protocol, the decision to deploy the v2 protocol on more chains is primarily driven by the desire to simplify the experience for Liquidity Providers (LPs).

While the protocol’s v3 offers advanced features tailored for active liquidity providers, the development team believes the v2 protocol offers a more “straightforward approach.”

By default, v2 pools cover the entire price range, reducing the need for upfront decisions and minimizing the active involvement of liquidity providers. This simplification streamlines the process and makes it more accessible to a broader range of users, according to the announcement.

Another benefit of using the v2 protocol on multiple chains, according to Uniswap Labs, is its cost efficiency. Creating pools on v2 is more gas efficient than other versions, resulting in lower gas costs to add liquidity.

This cost reduction can be translated into savings for users, making swaps on the platform “incredibly affordable.” In addition, the use of v2 on Layer 2 scaling solutions significantly reduces the risk of frontrunning and manipulative practices known as Miner Extractable Value (MEV).

Ultimately, by offering an official v2 deployment directly accessible through the Uniswap interface, the developers suggest that users can be assured of a safe and secure environment for their swaps.

Despite the recent developments that could attract investors’ attention and drive broader adoption of the Uniswap protocol, the exchange’s native token, UNI, is currently undergoing a significant correction in line with the overall market trend.

Currently, UNI is trading at $7.22, representing a 4.4% price drop in the past 24 hours and a 1.1% decline in the last trading hour. However, it’s worth noting that UNI has been one of the better-performing tokens in the market, with price increases of 14.7% and 16.8% in the past fourteen and thirty days, respectively.

Furthermore, according to data from Token Terminal, the Uniswap ecosystem continues to exhibit substantial growth in key metrics.

The fully diluted market capitalization of Uniswap stands at $7.56 billion, reflecting the total value of all tokens if they were fully in circulation. This figure has experienced a notable increase of 18.4% over the past month.

In contrast, the circulating market capitalization, which considers the currently circulating tokens, is valued at $6.94 billion, indicating a 19.9% increase over the same period.

Despite the overall surge in market capitalization, the trading volume of the UNI token has experienced a significant decline of 69.3% over the past 30 days, amounting to $2.79 billion.

The total value locked (TVL), a measure of the value of assets locked within Uniswap’s smart contracts, has also experienced a 14.4% increase, reaching $4.76 billion.

Featured image from Shutterstock, chart from TradingView.com

Foobar, a code builder, criticizes Ethereum, accusing its developers of neglecting crucial improvements. Because of this shift, projects, including meme coin issuers, are adopting alternative protocols, including layer-2s and modern blockchains like Solana, which boast more features, mostly higher scalability.

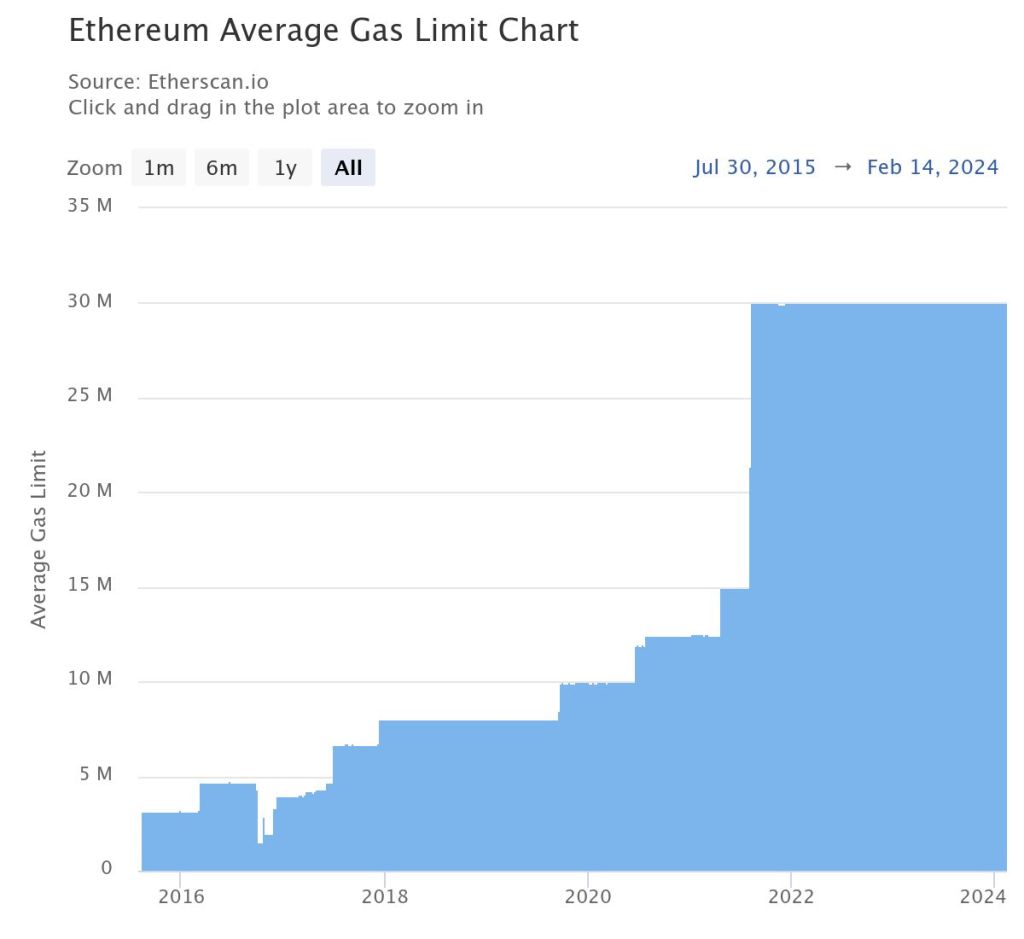

Taking to X, the developer claims that there have been no major mainnet improvements chiefly because such upgrades are being blocked by core and client developers. Specifically, Foobar cites the long-standing delays for features like Trie State Storage Optimizations (TSTORE) and Externally Owned Account (EOA) batch transactions. The developer also noted the lack of block gas limit increase since 2021.

The developer adds that the absence of main net updates and opcode improvements leading to the implementation of these proposals could be why decentralized apps (apps) launching on Ethereum are “bleeding tremendous value” due to high fees and limitations.

TSTORE and EOA batch transactions are proposals that, if they see the light of day, could see Ethereum scale better. Specifically, proposers of TSTORE forwarded a solution to address storage bloat to improve performance. On the other hand, EOA will enable the bundling of transactions from the same sender, reducing gas fees.

Meanwhile, Etherscan data shows that the block gas limit has been capped at around 30 million since August 9, 2021. Subsequently, Ethereum throughput remains low, and gas fees are higher, considering the high on-chain activity.

The failure of clients to integrate these proposals, the developer continues, makes Ethereum unusable for “any interesting app requiring moderate complexity.” Subsequently, many projects are migrating to layer-2s like Base, Arbitrum, Optimism, or entirely different blockchains like Solana and Avalanche due to limitations on the Ethereum mainnet.

As of mid-February 2024, more meme coin developers, reading from the popularity of emerging projects, are deploying from high throughput and low-fee platforms like Solana, Avalanche, and even Base. Meme coins like Bonk, Honk, and even the successful Bald on Base are examples.

Meanwhile, meme coin projects on Ethereum, like Pepe Coin (PEPE), appear to be losing market share as Shiba Inu, for example, launched Shibarium to offer its users lower transaction fees.

Foobar thinks the lack of improvements on the Ethereum mainnet is why Uniswap v4 has yet to launch. The new iteration of Uniswap, a popular decentralized exchange (DEX) powering Ethereum token swapping, is yet to release its latest version.

Based on existing documentation, v4 will include new features and functionalities, including Hooks. Supporters claim this tool will make the DEX more flexible, drawing more users once it goes live.

The foundational infrastructure of the Base Network brings about yet another Ethereum Layer 2 network, distinguished by its scalability and empowerment through the notable association with Coinbase. Coinbase is recognized globally as one of the most trusted cryptocurrency exchanges and companies, Coinbase effectively manages a diverse portfolio of crypto assets, solidifying its status as a cornerstone within the digital currency realm.

Positioned as a pivotal solution to address the persistent challenge of high transaction costs within the Ethereum network, the Base Chain stands quite firmly to revolutionize transaction fees, delivering a cost-effective alternative within the secure Ethereum environment. The assurance of a safe and reliable ecosystem is heightened by the affiliation with Coinbase, an industry titan renowned for its unwavering commitment and 10-year-long track record of great service.

The current centralized phase of the Coinbase company, with its owners and Devs known to the public, establishes a solid foundation for users to place their trust in the Base chain. With over a decade of extensive experience in the cryptocurrency space, Coinbase has consistently demonstrated its expertise by developing and launching numerous successful crypto products.

This wealth of experience instills confidence in the Base Chain as it navigates its initial stages of centralization, with a strategic vision to progressively evolve into a decentralized entity over time.

For those embarking on their journey within the Base Chain ecosystem, it is imperative to keep certain key considerations in mind. Firstly, the association with Coinbase serves as a testament to the network’s reliability and credibility. Additionally, users can anticipate ongoing enhancements and decentralization initiatives as the Base Chain matures, aligning with the broader ethos of blockchain technology.

In summary, the Base Network, fortified by its affiliation with Coinbase, emerges as a promising Ethereum Layer 2 solution, poised to alleviate the burden of high transaction costs while providing a secure and gradually decentralized environment.

Related Reading: How To Buy, Sell, And Trade Tokens On The Avalanche Network

Related Reading: How To Buy, Sell, And Trade Tokens on The Polygon Network

Select an EVM-Compatible Wallet

To be able to make any transactions on the Base network, you need to have an EVM-Compatible Wallet. Click here to see a list of wallet options you can select from but I would recommend you use MetaMask, it is one of the most popular Ethereum Virtual Machine (EVM)-compatible wallets and also one of the most used wallets for Base Network transactions.

If you are using a PC, install the Metamask wallet extension by clicking on “Add to Chrome” to add the extension to your Chrome browser, as shown below:

Once installed, open your MetaMask, set up your account, and make sure to keep your secret phrase very safe, I would advise that you write it down on a shit of paper, away from the internet where it can’t be hacked.

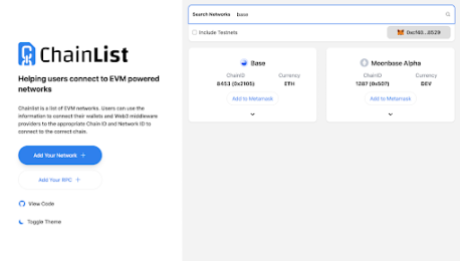

Add The BASE Network To Your MetaMask

To add the Base Network to your MetaMask, search for Chainlist on your browser, open it, connect your MetaMask wallet, search for Base, and add it to MetaMask by clicking on “Add to Metamask”, click on “Approve” and lastly click on “Switch Network” on your Metamask.

Acquire Base ETH

To make any transaction on the Base Network, you need Base ETH. Get your Base ETH from these cryptocurrency exchanges such as Binance, OKX, or KuCoin. Buy ETH on these platforms, go to the withdraw section, making sure to choose the BASE network as your transfer Network, which automatically converts your ETH to Base ETH as it gets to the ETH wallet destination.

Related Reading: How To Buy, Sell, and Trade Tokens On The Arbitrum Network

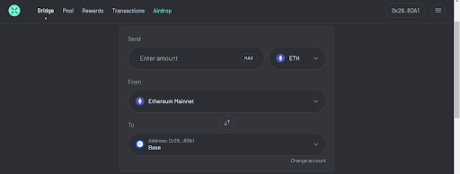

Alternatively, if you already have native ETH in your Metamask wallet, you can use the BASE bridge to bridge from the Ethereum Mainnet to the Base Network.

If you wish to bridge your ETH to Base ETH from other Ethereum Layer 2 solutions, I would recommend secondary bridging platforms featured on the BASE Bridge platform. These platforms facilitate a smooth transition to the Base Network from various Ethereum Layer 2 environments, as shown below.

Example Of Bridging to Base ETH From Other Ethereum Layer 2s

ACROSS PROTOCOL is the first secondary bridging platform featured on the BASE Bridge platform as shown above, all you need to do is connect your Metamask wallet and select the amount of ETH you want to bridge to Base ETH and Bridge.

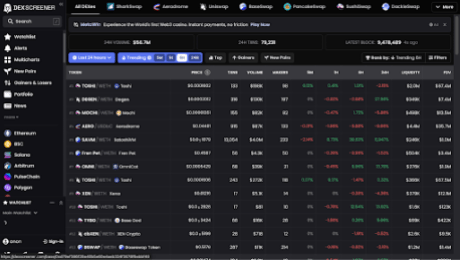

After Acquiring your Base ETH, you need to do your research and know which token you want to buy on the Base Network on Coingecko before heading over to Dexscreener to check for the token, Dexscreener serves as a valuable tool for checking available tokens on the EVM chain, including the Base Network.

By selecting the Base network on Dexscreener, you can access a comprehensive chart of available Base tokens. Note that not all tokens are supported on every DeFi DEX, search for the token you would like to trade and select it. After selecting, look out for the Green Box section selected in the image to identify which DeFi platforms support the token you wish to trade.

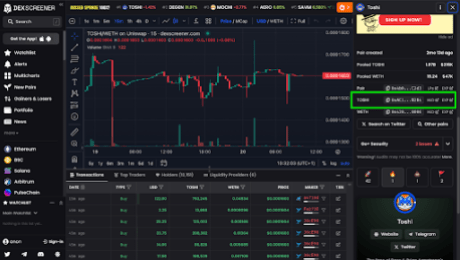

Obtaining Token Contract Address

Scroll down on the Dexscreener to find the token contract address or go back to Coingecko and copy the contract address. This address is crucial when trading on DeFi platforms.

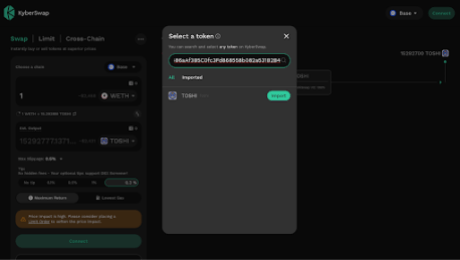

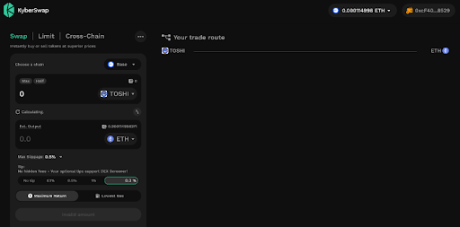

Copy the contract address, and when you enter it in the swap section of a DeFi platform like Uniswap, it will reveal the token. If the token is not available on Uniswap, the Dexscreener will redirect you to another supported DeFi where you can trade the token like KyberSwap.

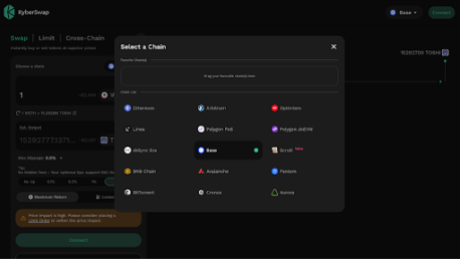

Connect your wallet to KyberSwap, click on the denominator token, and paste the contract address of the Base token in the search box. Before initiating any trade on DeFi, confirm that the network on the DeFi is on, in this case, the Base Network, ensuring the token’s availability on the Base Network. If it’s not initially on the Base Network, go to “Select a chain”, and select the Base network to ensure compatibility.

Choose the desired pair of Base tokens and ETH (or other base pairs), specify the amount you want to swap, and execute the trade.

Related Reading: How To Buy, Sell, And Trade Tokens On The BSC Network

Reverse Trading For Base Network ETH

If you wish to trade from a BASE token to Base ETH, simply reverse the order. Place the Base token at the top and the ETH at the bottom, then proceed with the swap. This allows you to exchange your Base token for ETH within the Base Network.

By following these steps, you can confidently navigate the trading process on the Base Network, leveraging the features of DeFi platforms and Dexscreener to make informed decisions and execute trades seamlessly.

The Base Network is another Ethereum Layer 2 network which is also affiliated with Coinbase, which is one of the most trusted cryptocurrency exchanges and companies in the crypto space with over 100 million users and processing $80 billion worth of crypto assets. Base Network has a lot of features which I have pointed out in the article already, although the Base Network does not have its Native token yet, it is still trusted and reliable due to its affiliation with Coinbase.

Manta Pacific is the native layer 2 of the Manta Network.